Key Insights

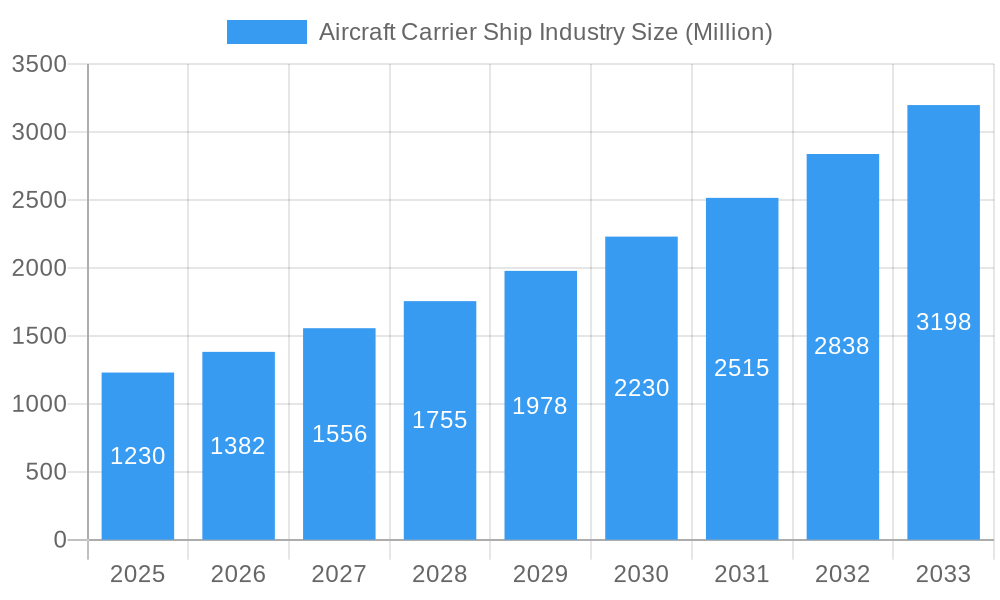

The Aircraft Carrier Ship industry, valued at $1.23 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 12.75% from 2025 to 2033. This expansion is driven by several key factors. Geopolitical instability and rising international tensions are prompting nations to bolster their naval capabilities, leading to increased demand for these sophisticated vessels. Technological advancements, particularly in areas like nuclear propulsion and advanced flight deck systems (CATOBAR, STOBAR, STOVL), are enhancing the operational efficiency and combat readiness of aircraft carriers, further fueling market growth. The increasing integration of unmanned aerial vehicles (UAVs) and other advanced sensor technologies into carrier operations also contributes significantly to the market's expansion. Significant investments in naval modernization programs by major global powers, such as the United States, China, and others, represent another major contributing factor. While budgetary constraints and the high cost of development and maintenance can act as potential restraints, the strategic importance of aircraft carriers in projecting power and ensuring maritime security is expected to outweigh these challenges, ensuring sustained growth in the foreseeable future.

Aircraft Carrier Ship Industry Market Size (In Billion)

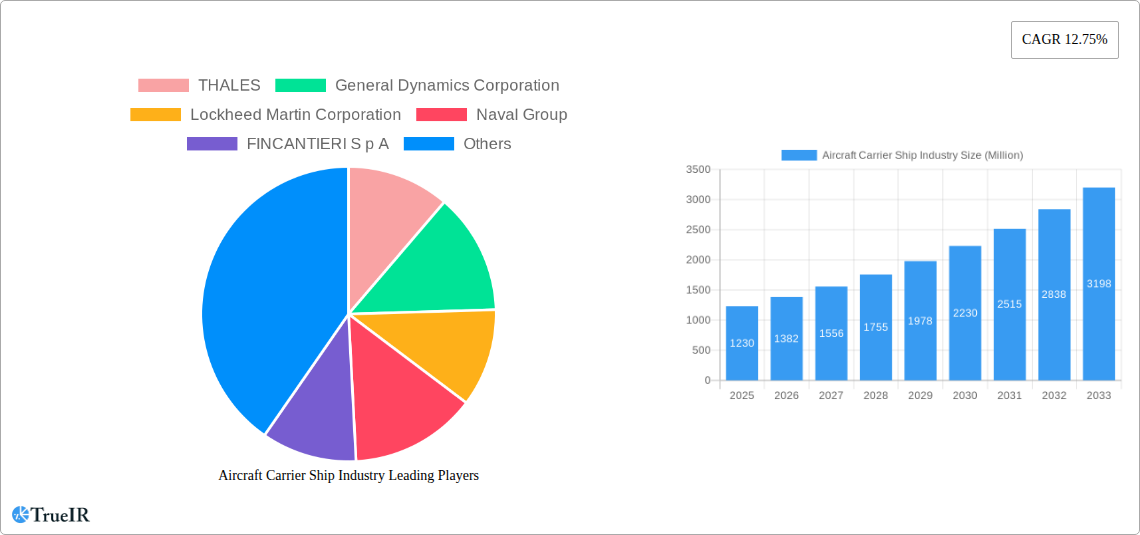

Segment-wise, the market is diverse, encompassing various vessel types (Amphibious Assault Ships, Helicopter Carriers, Fleet Carriers) and power sources (Conventional and Nuclear). The choice of technology is heavily influenced by a nation's strategic priorities and technological capabilities. Similarly, the adoption of different launch and recovery systems (CATOBAR, STOBAR, STOVL) reflects varied operational doctrines and technological maturity. Key players such as Thales, General Dynamics, Lockheed Martin, Naval Group, Fincantieri, Navantia, Leonardo, BAE Systems, Northrop Grumman, and Huntington Ingalls Industries are at the forefront of innovation and competition in this dynamic market, continuously developing and upgrading their offerings to meet the evolving needs of their clients. The Asia-Pacific region, especially countries like India, China, and South Korea, is expected to witness significant growth owing to their substantial naval modernization efforts.

Aircraft Carrier Ship Industry Company Market Share

Aircraft Carrier Ship Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Aircraft Carrier Ship Industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research and data analysis to project a xx Million market value by 2033, exhibiting a CAGR of xx% during the forecast period.

Aircraft Carrier Ship Industry Market Structure & Competitive Landscape

The Aircraft Carrier Ship Industry is characterized by a moderately concentrated market structure, with a few major players dominating global production and sales. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with continuous advancements in propulsion systems, launch and recovery technologies, and onboard capabilities pushing the boundaries of naval warfare. Stringent regulatory frameworks concerning safety, environmental impact, and national security significantly shape industry practices. While there are no direct substitutes for aircraft carriers, the industry faces indirect competition from other naval platforms like amphibious assault ships and submarines. End-user segmentation primarily comprises national navies worldwide. M&A activity in the sector has been relatively subdued in recent years, with a total transaction volume of approximately xx Million USD between 2019-2024, primarily driven by strategic acquisitions for technology consolidation or geographic expansion.

- Top 5 Players Market Share (2024): xx%

- Major M&A Activities (2019-2024): xx transactions, primarily involving technology integration and geographical expansion.

- Key Regulatory Impacts: Stringent safety standards, environmental regulations (waste management, emissions), and export control policies.

Aircraft Carrier Ship Industry Market Trends & Opportunities

The global aircraft carrier ship market is experiencing robust growth, driven by escalating geopolitical tensions, advancements in naval technology, and increasing defense budgets. The market size reached xx Million in 2024 and is projected to reach xx Million by 2033. This growth is fueled by the rising demand for enhanced naval capabilities and the continuous modernization of existing fleets. Technological advancements, such as the development of electromagnetic catapults (EMALS) and advanced sensor systems, are transforming the industry, leading to more efficient and effective aircraft carrier operations. Growing interest in hybrid and electric propulsion systems is also expected to impact market growth positively. Competitive dynamics are shaped by a combination of factors including technological prowess, production capacity, and government support. The industry is witnessing increasing competition among established players, as well as the emergence of new entrants in select market segments. Market penetration rates are highest in developed nations, with developing countries showing growing demand for more cost-effective conventional powered carriers.

Dominant Markets & Segments in Aircraft Carrier Ship Industry

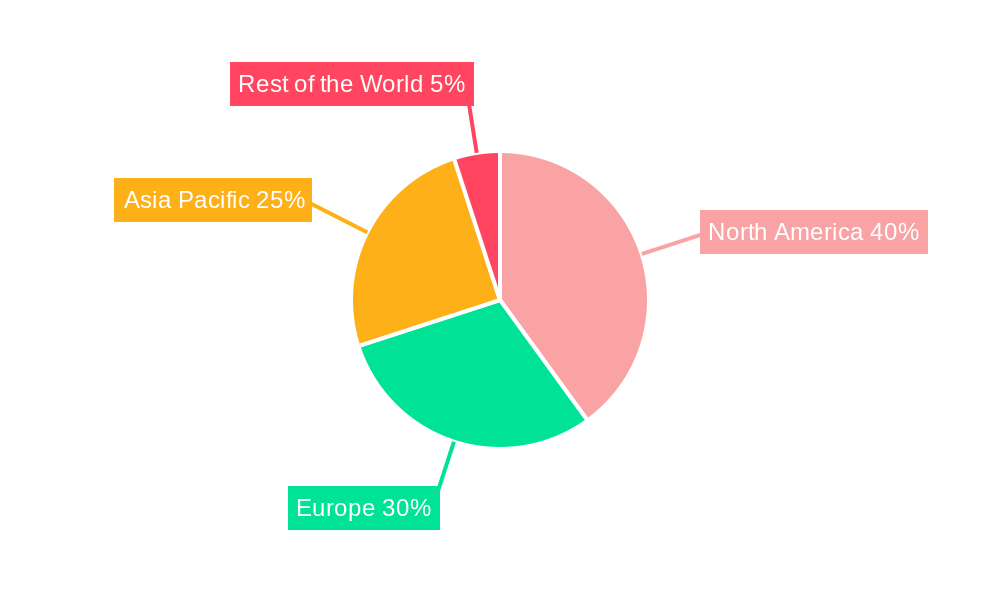

The US remains the dominant market for aircraft carriers, both in terms of fleet size and technological leadership. Asia-Pacific, however, is expected to witness the highest growth rate during the forecast period, driven by substantial investments in naval modernization by countries like China and India.

- Dominant Type: Fleet Carriers, accounting for xx% of the global market in 2024.

- Dominant Technology: Nuclear-powered carriers hold a significant share due to their extended operational range and endurance, but conventional power is experiencing increasing adoption due to cost effectiveness.

- Dominant Configuration: CATOBAR remains the dominant configuration, despite the increasing interest in STOBAR and STOVL designs for their cost effectiveness and operational flexibility.

Key Growth Drivers:

- Significant increases in defense spending, particularly in the Asia-Pacific region.

- Technological advancements leading to greater operational efficiency and effectiveness.

- Geopolitical instability and the need for stronger naval capabilities.

Aircraft Carrier Ship Industry Product Analysis

Technological advancements are driving product innovation in the aircraft carrier ship industry. The integration of electromagnetic launch systems (EMALS), advanced sensor systems, and improved aircraft handling capabilities are enhancing the combat effectiveness and operational efficiency of modern carriers. These innovations are aligning with the needs of modern navies, increasing the demand for technologically superior vessels. The competitive advantages in this market lie in possessing cutting-edge technology, efficient production capabilities, and the ability to secure lucrative government contracts.

Key Drivers, Barriers & Challenges in Aircraft Carrier Ship Industry

Key Drivers:

- Increasing geopolitical tensions and the need for enhanced naval power projection.

- Advancements in shipbuilding technology, leading to more efficient and effective carriers.

- Growing defense budgets in several key regions, particularly in Asia-Pacific.

Key Challenges and Restraints:

- High capital costs associated with the design, construction, and maintenance of aircraft carriers.

- Supply chain disruptions and the need for specialized materials and expertise.

- Stringent regulatory compliance and environmental concerns.

Growth Drivers in the Aircraft Carrier Ship Industry Market

The aircraft carrier ship industry's growth is primarily driven by the increasing need for enhanced naval capabilities in the face of geopolitical instability. Technological advancements, such as EMALS and advanced sensor technologies, further contribute to this growth. Furthermore, considerable defense budget increases by several nations, notably in the Asia-Pacific region, are fueling the demand for new aircraft carriers.

Challenges Impacting Aircraft Carrier Ship Industry Growth

High capital expenditure, complex logistical requirements, and stringent regulatory compliance pose significant challenges to the aircraft carrier ship industry. These hurdles impact project timelines and increase overall costs, slowing down market expansion. Furthermore, the industry's dependence on a specialized supply chain makes it vulnerable to disruptions and price fluctuations in essential raw materials.

Key Players Shaping the Aircraft Carrier Ship Industry Market

- THALES

- General Dynamics Corporation

- Lockheed Martin Corporation

- Naval Group

- FINCANTIERI S p A

- NAVANTIA S A

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

- HUNTINGTON INGALLS INDUSTRIES INC

Significant Aircraft Carrier Ship Industry Industry Milestones

- June 2022: China launched its third advanced aircraft carrier, Fujian, featuring an advanced electromagnetic catapult system. This signifies a major technological leap in the Asian aircraft carrier landscape and intensifies competition in the global market.

- March 2023: The US Navy announced a plan to extend the service life of the USS Nimitz, indicating a continued reliance on existing assets while also signifying the high costs and logistical challenges of building new nuclear-powered carriers.

Future Outlook for Aircraft Carrier Ship Industry Market

The future of the aircraft carrier ship industry appears promising, driven by ongoing technological innovations and increased defense spending globally. Strategic partnerships, investments in research and development, and the adoption of sustainable shipbuilding practices will shape the industry's growth trajectory. The Asia-Pacific region is poised for significant expansion, with several nations actively modernizing their naval fleets. The continued demand for superior naval capabilities and the development of more efficient and effective carrier designs will ensure the industry's sustained growth in the coming years.

Aircraft Carrier Ship Industry Segmentation

-

1. Type

- 1.1. Amphibious Assault Ship

- 1.2. Helicopter Carrier

- 1.3. Fleet Carrier

-

2. Technology

- 2.1. Conventional Powered

- 2.2. Nuclear Powered

-

3. Configuration

- 3.1. Catapult

- 3.2. Short Take-off but Arrested Recovery (STOBAR)

- 3.3. Short Take-off but Vertical Recovery (STOVL)

Aircraft Carrier Ship Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. South Korea

- 3.4. Japan

- 3.5. Rest of Asia Pacific

- 4. Rest of the World

Aircraft Carrier Ship Industry Regional Market Share

Geographic Coverage of Aircraft Carrier Ship Industry

Aircraft Carrier Ship Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Nuclear Powered Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Amphibious Assault Ship

- 5.1.2. Helicopter Carrier

- 5.1.3. Fleet Carrier

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Conventional Powered

- 5.2.2. Nuclear Powered

- 5.3. Market Analysis, Insights and Forecast - by Configuration

- 5.3.1. Catapult

- 5.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 5.3.3. Short Take-off but Vertical Recovery (STOVL)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Amphibious Assault Ship

- 6.1.2. Helicopter Carrier

- 6.1.3. Fleet Carrier

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Conventional Powered

- 6.2.2. Nuclear Powered

- 6.3. Market Analysis, Insights and Forecast - by Configuration

- 6.3.1. Catapult

- 6.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 6.3.3. Short Take-off but Vertical Recovery (STOVL)

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Amphibious Assault Ship

- 7.1.2. Helicopter Carrier

- 7.1.3. Fleet Carrier

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Conventional Powered

- 7.2.2. Nuclear Powered

- 7.3. Market Analysis, Insights and Forecast - by Configuration

- 7.3.1. Catapult

- 7.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 7.3.3. Short Take-off but Vertical Recovery (STOVL)

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Amphibious Assault Ship

- 8.1.2. Helicopter Carrier

- 8.1.3. Fleet Carrier

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Conventional Powered

- 8.2.2. Nuclear Powered

- 8.3. Market Analysis, Insights and Forecast - by Configuration

- 8.3.1. Catapult

- 8.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 8.3.3. Short Take-off but Vertical Recovery (STOVL)

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Aircraft Carrier Ship Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Amphibious Assault Ship

- 9.1.2. Helicopter Carrier

- 9.1.3. Fleet Carrier

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Conventional Powered

- 9.2.2. Nuclear Powered

- 9.3. Market Analysis, Insights and Forecast - by Configuration

- 9.3.1. Catapult

- 9.3.2. Short Take-off but Arrested Recovery (STOBAR)

- 9.3.3. Short Take-off but Vertical Recovery (STOVL)

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 THALES

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 General Dynamics Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lockheed Martin Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Naval Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 FINCANTIERI S p A

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NAVANTIA S A

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Leonardo S p A

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 BAE Systems plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Northrop Grumman Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 HUNTINGTON INGALLS INDUSTRIES INC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 THALES

List of Figures

- Figure 1: Global Aircraft Carrier Ship Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 7: North America Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 8: North America Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 15: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 16: Europe Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 23: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 24: Asia Pacific Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Configuration 2025 & 2033

- Figure 31: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Configuration 2025 & 2033

- Figure 32: Rest of the World Aircraft Carrier Ship Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Aircraft Carrier Ship Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 4: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 8: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 14: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 23: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Aircraft Carrier Ship Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 30: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 31: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Configuration 2020 & 2033

- Table 32: Global Aircraft Carrier Ship Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Carrier Ship Industry?

The projected CAGR is approximately 12.75%.

2. Which companies are prominent players in the Aircraft Carrier Ship Industry?

Key companies in the market include THALES, General Dynamics Corporation, Lockheed Martin Corporation, Naval Group, FINCANTIERI S p A, NAVANTIA S A, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, HUNTINGTON INGALLS INDUSTRIES INC.

3. What are the main segments of the Aircraft Carrier Ship Industry?

The market segments include Type, Technology, Configuration.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Nuclear Powered Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2023: The US Navy announced its plan to extend Nimitz as part of a five-and-a-half-month maintenance availability that will carry the carrier into May 2026.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Carrier Ship Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Carrier Ship Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Carrier Ship Industry?

To stay informed about further developments, trends, and reports in the Aircraft Carrier Ship Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence