Key Insights

The Middle East and Africa video surveillance market is experiencing robust growth, projected to reach a substantial market size. While the provided data states a 2025 market value of 4.32 million (likely a typo and representing billions), a more realistic figure, considering the significant infrastructure development and security concerns across the region, points towards a multi-billion dollar market. The Compound Annual Growth Rate (CAGR) of 5.80% indicates consistent expansion over the forecast period (2025-2033). This growth is driven by several key factors. Increasing urbanization and population density necessitate enhanced security measures, fueling demand for advanced surveillance solutions. Furthermore, the rising adoption of smart city initiatives, coupled with growing government investments in public safety and critical infrastructure protection, are significantly boosting market demand. The increasing prevalence of cyber threats and the need for robust cybersecurity solutions integrated with video surveillance systems also contribute to market expansion. Key market segments include government, commercial, and residential sectors, each presenting unique opportunities for growth. Competitive forces are shaping the market, with established players like Axis Communications, Bosch, Honeywell, and Samsung competing alongside emerging players offering innovative solutions.

However, certain restraining factors influence market growth. High initial investment costs for advanced systems can pose a barrier to entry for smaller businesses and individuals. Additionally, concerns regarding data privacy and ethical implications associated with widespread surveillance need careful consideration and robust regulatory frameworks. Despite these challenges, the long-term outlook for the Middle East and Africa video surveillance market remains positive, driven by technological advancements, rising security concerns, and the increasing adoption of connected security solutions. The market is expected to witness the adoption of cutting-edge technologies such as AI-powered video analytics, cloud-based surveillance, and IoT integration. This integration is transforming the traditional surveillance landscape, facilitating better threat detection, response capabilities, and overall operational efficiency.

Middle East & Africa Video Surveillance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa video surveillance market, offering valuable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market size, growth drivers, challenges, key players, and future outlook. The report leverages extensive data and qualitative analysis to provide a complete picture of this dynamic market, encompassing crucial segments and technological advancements.

Middle East and Africa Video Surveillance Market Structure & Competitive Landscape

The Middle East and Africa video surveillance market exhibits a moderately consolidated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players like Axis Communications AB, Bosch Security Systems Incorporated, and Honeywell Security Group hold significant market share, driving innovation and shaping competitive dynamics. The market is characterized by intense competition, with companies focusing on product differentiation, technological advancements, and strategic partnerships.

- Market Concentration: The HHI suggests a moderately competitive landscape, with several major players and numerous smaller participants.

- Innovation Drivers: The demand for advanced features like AI-powered analytics, cloud-based solutions, and improved video quality fuels innovation.

- Regulatory Impacts: Government initiatives promoting public safety and infrastructure development significantly influence market growth. Varying data privacy regulations across different countries within the region also play a role.

- Product Substitutes: While traditional CCTV systems remain prevalent, the market witnesses increasing adoption of IP-based systems and cloud solutions, impacting market segmentation.

- End-User Segmentation: Key end-users include government agencies, commercial establishments (retail, banking, etc.), critical infrastructure providers, and residential sectors.

- M&A Trends: The market has witnessed xx mergers and acquisitions in the historical period (2019-2024), indicating a trend of consolidation among players. The total value of these deals is estimated at xx Million.

Middle East and Africa Video Surveillance Market Trends & Opportunities

The Middle East and Africa video surveillance market is experiencing robust growth, driven by increasing urbanization, rising security concerns, and the adoption of advanced technologies. The market size is projected to reach xx Million by 2025, with a CAGR of xx% from 2025 to 2033. Technological shifts toward AI-powered video analytics, cloud-based solutions, and IoT integration are shaping market trends. Consumer preference is shifting toward higher resolution, more feature-rich, and user-friendly systems. The competitive landscape is marked by both established players and emerging technology providers, leading to intensified competition and innovation.

Market penetration rates for IP-based surveillance systems are steadily rising, with an estimated xx% penetration in 2025. The adoption of cloud-based video management systems (VMS) is also gaining momentum, particularly in sectors prioritizing remote monitoring and scalability. Increasing government spending on security infrastructure projects, particularly in rapidly developing nations, is a key market driver. The demand for advanced analytics capabilities, including facial recognition and object detection, is driving further market segmentation.

Dominant Markets & Segments in Middle East and Africa Video Surveillance Market

The United Arab Emirates (UAE) and South Africa are currently the dominant markets in the Middle East and Africa video surveillance sector.

- UAE Growth Drivers:

- Significant investments in smart city initiatives and infrastructure projects.

- Stringent security regulations and a high level of government spending on security solutions.

- Adoption of advanced technologies such as AI and IoT in surveillance systems.

- South Africa Growth Drivers:

- Rising crime rates and the need for enhanced security measures.

- Increased investment in public safety and security infrastructure.

- Growing adoption of surveillance solutions in commercial and residential sectors.

Other key markets include Saudi Arabia, Nigeria, and Kenya, experiencing considerable growth driven by similar factors, though at varying paces. The market is segmented by product type (CCTV, IP cameras, video analytics software), application (retail, banking, transportation, residential), and technology (analog, IP, cloud). The IP-based segment holds a substantial share and is expected to grow significantly due to its flexibility and advanced features. The growth of cloud-based VMS solutions further expands market segmentation.

Middle East and Africa Video Surveillance Market Product Analysis

Technological advancements in video surveillance are driving product innovation, focusing on higher resolution imaging, enhanced analytics capabilities (AI-driven object detection, facial recognition, and behavioral analysis), and seamless integration with IoT ecosystems. Products are tailored to specific applications, emphasizing ease of use and cost-effectiveness. Competitive advantages are built through superior image quality, advanced analytics, robust cybersecurity features, and strong after-sales service. The market is witnessing a rise in demand for AI-powered video analytics solutions, driving growth in this specific segment.

Key Drivers, Barriers & Challenges in Middle East and Africa Video Surveillance Market

Key Drivers:

- Increasing urbanization and population growth, leading to a heightened need for security.

- Rising crime rates and security concerns across various sectors.

- Government initiatives promoting smart cities and enhancing public safety infrastructure.

- Technological advancements in video analytics and cloud-based solutions.

Challenges:

- High initial investment costs for advanced systems, limiting affordability in certain sectors.

- Concerns about data privacy and security, necessitating robust cybersecurity measures.

- Regulatory complexities and varying standards across different countries.

- Supply chain disruptions potentially impacting the availability of components and finished goods. These disruptions, experienced in the past with an estimated xx% impact on market growth in 2024, must be mitigated through diversification and strategic sourcing.

Growth Drivers in the Middle East and Africa Video Surveillance Market

Key drivers include rapid urbanization, increasing security concerns, substantial government investments in infrastructure, and the adoption of advanced technologies like AI and cloud computing. The rising adoption of smart city initiatives and the expanding need for robust security solutions across various sectors – from critical infrastructure to residential areas – significantly propel market growth.

Challenges Impacting Middle East and Africa Video Surveillance Market Growth

Challenges include high initial costs for advanced systems, particularly in developing regions, data privacy and security concerns, and regulatory inconsistencies across various countries. Supply chain vulnerabilities and fluctuations in currency exchange rates further complicate market dynamics.

Key Players Shaping the Middle East and Africa Video Surveillance Market

- Axis Communications AB

- Bosch Security Systems Incorporated

- Honeywell Security Group

- Samsung Group

- Panasonic Corporation

- FLIR Systems Inc

- Schneider Electric SE

- Fujifilm Corporation

- Eagle Eye Networks

- Johnson Controls

- Dahua Technology India Pvt Ltd

- Motorola Solutions Inc

- Veesion

- Ava Security

- Mobotix

Significant Middle East and Africa Video Surveillance Market Industry Milestones

- October 2023: FUJIFILM launched the FUJINON SX1600 long-range surveillance camera system at Milipol Paris, showcasing advanced features like 40x zoom and improved image stabilization. This launch signifies a push towards high-performance, long-range surveillance solutions within the market.

- March 2024: Hikvision's technology partnership with Can'nX integrates Hikvision's AI-enabled devices with the KNX home and building automation protocol, enhancing building management efficiency and security. This collaboration demonstrates a strategic move towards integrated building management systems within the video surveillance sector.

Future Outlook for Middle East and Africa Video Surveillance Market

The Middle East and Africa video surveillance market is poised for sustained growth, driven by ongoing urbanization, increased security concerns, and the continuous adoption of innovative technologies. Strategic opportunities lie in expanding the market for advanced analytics solutions, cloud-based VMS, and integrated security systems. The market's potential is significant, with continued expansion in both established and emerging markets across the region.

Middle East And Africa Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Camera

- 1.1.1.3. Hybrid

- 1.1.2. Storage

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management Software

- 1.3. Services (VSaaS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Industrial

- 2.5. Defense

- 2.6. Residential

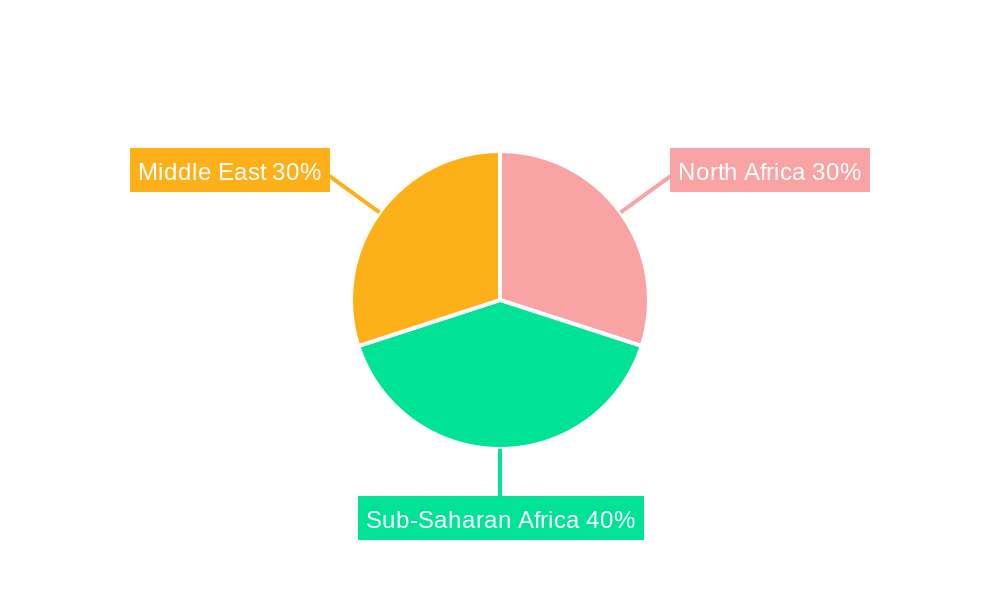

Middle East And Africa Video Surveillance Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East And Africa Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.3. Market Restrains

- 3.3.1. Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics

- 3.4. Market Trends

- 3.4.1. Rising Geopolitical Unrest in the Region Driving the Importance of Proper Surveillance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East And Africa Video Surveillance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Camera

- 5.1.1.1.3. Hybrid

- 5.1.1.2. Storage

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management Software

- 5.1.3. Services (VSaaS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Industrial

- 5.2.5. Defense

- 5.2.6. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Axis Communications AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bosch Security Systems Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell Security Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FLIR Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Fujifilm Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Eagle Eye Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Johnson Controls

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dahua Technology India Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Motorola Solutions Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Veesion

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ava Security

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mobotix*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Axis Communications AB

List of Figures

- Figure 1: Middle East And Africa Video Surveillance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East And Africa Video Surveillance Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 13: Middle East And Africa Video Surveillance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East And Africa Video Surveillance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Saudi Arabia Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: United Arab Emirates Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Israel Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Qatar Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Qatar Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Kuwait Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Kuwait Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Oman Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Bahrain Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bahrain Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Jordan Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Jordan Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Lebanon Middle East And Africa Video Surveillance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Lebanon Middle East And Africa Video Surveillance Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East And Africa Video Surveillance Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Middle East And Africa Video Surveillance Market?

Key companies in the market include Axis Communications AB, Bosch Security Systems Incorporated, Honeywell Security Group, Samsung Group, Panasonic Corporation, FLIR Systems Inc, Schneider Electric SE, Fujifilm Corporation, Eagle Eye Networks, Johnson Controls, Dahua Technology India Pvt Ltd, Motorola Solutions Inc, Veesion, Ava Security, Mobotix*List Not Exhaustive.

3. What are the main segments of the Middle East And Africa Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

6. What are the notable trends driving market growth?

Rising Geopolitical Unrest in the Region Driving the Importance of Proper Surveillance.

7. Are there any restraints impacting market growth?

Emergence of Video Surveillance-as-a-Service; Increasing Demand for Video Analytics.

8. Can you provide examples of recent developments in the market?

March 2024: Hikvision announced a technology partnership with Can'nX, enabling Hikvision technologies to be integrated with the KNX protocol, the global standard for home and building automation. Owing to the collaboration, integrators can enhance their building automation solutions by integrating Hikvision AI-enabled devices, such as cameras, into building systems, surging the efficiency of building management and improving overall security.October 2023: FUJIFILM introduced the FUJINON SX1600 camera system for long-range surveillance applications for the first time in a European show at the Milipol homeland security and safety show held in ParisNord Villepinte from November 14 to 17, 2023, at booth 4F055. The SX1600 is a state-of-the-art long-range camera system incorporating a 40x-zoom FUJINON lens that covers a focal length range from the wide-angle 40 mm to 1600 mm telephoto and has been further equipped with a newly developed image stabilization system and fast and accurate autofocus to capture a distant subject clearly and instantaneously.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East And Africa Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East And Africa Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East And Africa Video Surveillance Market?

To stay informed about further developments, trends, and reports in the Middle East And Africa Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence