Key Insights

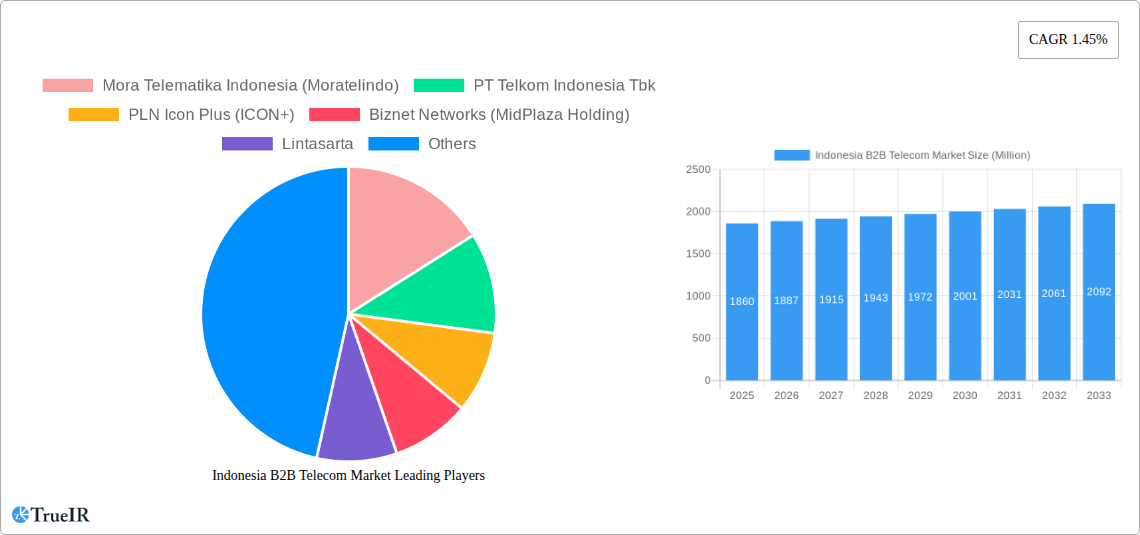

The Indonesia B2B telecom market, valued at $1.86 billion in 2025, is projected to experience steady growth, driven by increasing digitalization across various industries and rising demand for robust connectivity solutions. The 1.45% CAGR indicates a consistent expansion, albeit moderate, reflecting a maturing market. Key drivers include the government's ongoing digital infrastructure development initiatives, the expanding adoption of cloud services and IoT applications by businesses, and the growing need for secure and reliable communication networks. The market is witnessing a shift towards advanced technologies like 5G and fiber optic solutions, enabling higher bandwidth and improved service reliability. Competition among major players like Moratelindo, Telkom Indonesia, and XL Axiata, along with smaller players like Biznet Networks and Lintasarta, is fierce, leading to price competitiveness and service innovation. While potential restraints include the ongoing need for infrastructure development in less-connected areas and the inherent challenges of maintaining network security, the overall market outlook remains positive, fueled by sustained economic growth and the continuous need for digital transformation within Indonesian businesses. The segmentation of the market likely reflects varied service offerings, such as voice, data, and managed services, each experiencing varying growth rates based on specific industry demands.

Indonesia B2B Telecom Market Market Size (In Billion)

The forecast period (2025-2033) suggests a continued expansion, with projected growth likely influenced by factors such as government policy, technological advancements, and economic conditions. Growth might be slightly higher in certain segments, like those catering to emerging technologies or specific industry verticals (e.g., finance, manufacturing). The competitive landscape will continue to evolve, potentially involving mergers and acquisitions or strategic partnerships to gain market share and expand service offerings. Monitoring factors such as regulatory changes, cybersecurity threats, and the broader economic climate is crucial for businesses operating within this dynamic market.

Indonesia B2B Telecom Market Company Market Share

Indonesia B2B Telecom Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the Indonesian B2B telecommunications market, offering invaluable insights for businesses, investors, and stakeholders. With a comprehensive analysis spanning from 2019 to 2033 (Study Period), including a base year of 2025 and a forecast period of 2025-2033, this report leverages robust data and expert analysis to illuminate the market's structure, trends, opportunities, and challenges. Expect detailed breakdowns of market size, CAGR, key players like Telkom Indonesia and Indosat Ooredoo Hutchison, and emerging market segments, all presented with data-driven clarity and actionable insights.

Indonesia B2B Telecom Market Structure & Competitive Landscape

The Indonesian B2B telecom market exhibits a moderately concentrated structure, with a few dominant players and several smaller, specialized providers. The market's Herfindahl-Hirschman Index (HHI) in 2024 was estimated at xx, indicating a moderately consolidated landscape. Key players such as PT Telkom Indonesia Tbk and Indosat Ooredoo Hutchison hold significant market share, driving much of the innovation and shaping the competitive landscape. Regulatory changes from the Indonesian government, particularly concerning data privacy and infrastructure development, significantly influence market dynamics. The market is also characterized by ongoing M&A activity, with xx Million USD worth of deals recorded between 2019 and 2024. These activities are driven by the desire to expand market reach, gain access to new technologies, and consolidate market share.

- Market Concentration: Moderately concentrated, with a few dominant players. HHI (2024): xx

- Innovation Drivers: Technological advancements (5G, cloud computing), government initiatives (digital transformation), and growing business needs.

- Regulatory Impacts: Significant influence on pricing, infrastructure development, and data privacy.

- Product Substitutes: VoIP services, satellite communication, and alternative data transfer solutions pose some competitive pressure.

- End-User Segmentation: The market caters to various sectors, including finance, manufacturing, healthcare, and government, each with specific needs.

- M&A Trends: Consolidation through acquisitions and mergers to enhance market position and expand service offerings.

Indonesia B2B Telecom Market Trends & Opportunities

The Indonesian B2B telecom market is experiencing robust growth, driven by increasing digital adoption across businesses. The market size reached xx Million USD in 2024 and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by the increasing demand for high-speed internet, cloud-based services, and advanced communication solutions across various business sectors. The market penetration rate for fiber optic connectivity is currently at xx%, with significant potential for further expansion. Key technological shifts, such as the rollout of 5G and the adoption of Software-Defined Networking (SDN), are creating new opportunities for market players. However, this growth is not without its challenges. Competition remains fierce, with established players and new entrants vying for market share. The government's regulatory framework and infrastructure development plans significantly influence the market's trajectory.

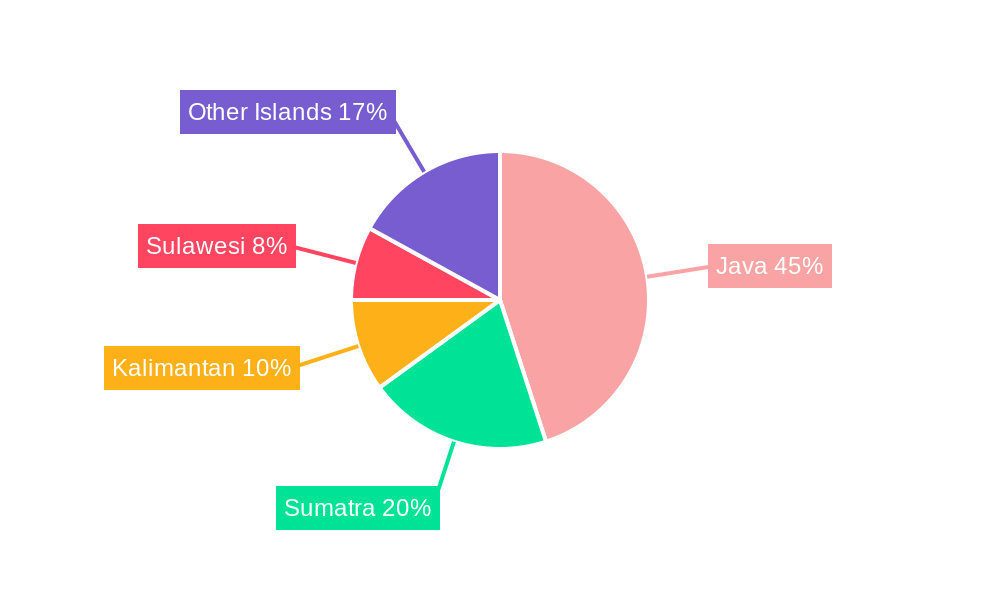

Dominant Markets & Segments in Indonesia B2B Telecom Market

The Jakarta metropolitan area remains the dominant market segment due to its high concentration of businesses and advanced infrastructure. Other key regions include major cities like Surabaya, Bandung, and Medan. The enterprise segment is the fastest-growing, driven by the increasing demand for high-bandwidth solutions to support business operations and digital transformation initiatives.

- Key Growth Drivers in Jakarta:

- Advanced digital infrastructure

- High concentration of businesses

- Government initiatives promoting digital economy.

- Key Growth Drivers in Enterprise Segment:

- Increased digital adoption

- Demand for high-bandwidth solutions

- Cloud computing adoption

The dominance of Jakarta and the strong growth of the enterprise segment are primarily attributed to Indonesia's ongoing economic development and the government's emphasis on digital transformation. This is further reinforced by continued investments in infrastructure and supportive regulatory environments. However, challenges remain in expanding coverage to underserved areas.

Indonesia B2B Telecom Market Product Analysis

The market offers a diverse range of products, including leased lines, MPLS VPNs, internet access, cloud-based services, and managed services. Technological advancements such as 5G, SDN, and NFV are driving innovation and enabling the development of more sophisticated and efficient solutions tailored to specific business requirements. These advancements enhance data speeds, improve reliability, and offer greater flexibility, aligning perfectly with evolving business needs. This leads to increased market competitiveness and pushes service providers to continuously innovate and enhance their offerings.

Key Drivers, Barriers & Challenges in Indonesia B2B Telecom Market

Key Drivers:

- Increasing digitalization across businesses

- Government initiatives promoting digital economy

- Expansion of 4G and 5G networks

- Growing demand for cloud-based services

Challenges:

- Uneven infrastructure development across the country, particularly in rural areas. This limits market reach and accessibility for some businesses, negatively impacting growth potential by xx%.

- Regulatory complexities and bureaucratic hurdles, creating delays and increasing costs. This adds an estimated xx% to operating expenses for some companies.

- Intense competition from existing players and new entrants, necessitating constant innovation and competitive pricing strategies.

Growth Drivers in the Indonesia B2B Telecom Market Market

The Indonesian B2B telecom market's growth is propelled by several key factors. The rising digital adoption across businesses necessitates reliable and high-speed connectivity. Government initiatives promoting a digital economy, coupled with investments in expanding 4G and 5G networks, further accelerate this growth. The increasing demand for cloud-based services and managed solutions also contributes significantly. Furthermore, robust economic growth fuels the demand for advanced communication solutions.

Challenges Impacting Indonesia B2B Telecom Market Growth

The market faces challenges stemming from uneven infrastructure development, particularly in remote areas, limiting market reach. Regulatory complexities and bureaucratic hurdles create obstacles and increase operational costs. Intense competition from both established players and new entrants necessitates consistent innovation and competitive pricing, impacting profitability.

Key Players Shaping the Indonesia B2B Telecom Market Market

Significant Indonesia B2B Telecom Market Industry Milestones

- January 2024: PT Telkom Indonesia and Indosat Ooredoo Hutchison announced a strategic alliance to bolster Indonesia's digital infrastructure by creating an interconnected Internet Exchange (IX) ecosystem.

- April 2024: Epsilon Telecommunications partnered with Moratelindo to enhance connectivity for Indonesian businesses via remote peering, improving content and application performance.

Future Outlook for Indonesia B2B Telecom Market Market

The Indonesian B2B telecom market exhibits strong growth potential, driven by continued digitalization, government support, and infrastructure expansion. Opportunities exist in providing advanced solutions, expanding coverage to underserved areas, and capitalizing on the growing demand for cloud-based services. The market's trajectory is positive, with further consolidation expected among key players and continued innovation shaping the competitive landscape.

Indonesia B2B Telecom Market Segmentation

-

1. Connectivity Type

- 1.1. Mobile Connectivity

- 1.2. Fixed Co

-

2. Size of Enterprises

- 2.1. Small and Medium-sized Enterprises (SMEs)

- 2.2. Large Enterprises

Indonesia B2B Telecom Market Segmentation By Geography

- 1. Indonesia

Indonesia B2B Telecom Market Regional Market Share

Geographic Coverage of Indonesia B2B Telecom Market

Indonesia B2B Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Introduction of SD-WAN and Cloud/Data Center Services; Growth in Use of Connected Devices; Rising Digital Transformation in the Industries

- 3.3. Market Restrains

- 3.3.1. Introduction of SD-WAN and Cloud/Data Center Services; Growth in Use of Connected Devices; Rising Digital Transformation in the Industries

- 3.4. Market Trends

- 3.4.1. Connected Devices to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia B2B Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.1.1. Mobile Connectivity

- 5.1.2. Fixed Co

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Small and Medium-sized Enterprises (SMEs)

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Connectivity Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mora Telematika Indonesia (Moratelindo)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Telkom Indonesia Tbk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PLN Icon Plus (ICON+)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Biznet Networks (MidPlaza Holding)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lintasarta

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Cyberindo Aditama (CBN)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT XL Axiata Tbk (acquired PT Link Net Tbk)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Telekomunikasi Selular (Telkomsel)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Indosat Ooredoo Hutchison

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Smartfren Telecom Tbk

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mora Telematika Indonesia (Moratelindo)

List of Figures

- Figure 1: Indonesia B2B Telecom Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia B2B Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia B2B Telecom Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 2: Indonesia B2B Telecom Market Volume Billion Forecast, by Connectivity Type 2020 & 2033

- Table 3: Indonesia B2B Telecom Market Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 4: Indonesia B2B Telecom Market Volume Billion Forecast, by Size of Enterprises 2020 & 2033

- Table 5: Indonesia B2B Telecom Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia B2B Telecom Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia B2B Telecom Market Revenue Million Forecast, by Connectivity Type 2020 & 2033

- Table 8: Indonesia B2B Telecom Market Volume Billion Forecast, by Connectivity Type 2020 & 2033

- Table 9: Indonesia B2B Telecom Market Revenue Million Forecast, by Size of Enterprises 2020 & 2033

- Table 10: Indonesia B2B Telecom Market Volume Billion Forecast, by Size of Enterprises 2020 & 2033

- Table 11: Indonesia B2B Telecom Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia B2B Telecom Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia B2B Telecom Market?

The projected CAGR is approximately 1.45%.

2. Which companies are prominent players in the Indonesia B2B Telecom Market?

Key companies in the market include Mora Telematika Indonesia (Moratelindo), PT Telkom Indonesia Tbk, PLN Icon Plus (ICON+), Biznet Networks (MidPlaza Holding), Lintasarta, PT Cyberindo Aditama (CBN), PT XL Axiata Tbk (acquired PT Link Net Tbk), PT Telekomunikasi Selular (Telkomsel), Indosat Ooredoo Hutchison, PT Smartfren Telecom Tbk.

3. What are the main segments of the Indonesia B2B Telecom Market?

The market segments include Connectivity Type , Size of Enterprises .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Introduction of SD-WAN and Cloud/Data Center Services; Growth in Use of Connected Devices; Rising Digital Transformation in the Industries.

6. What are the notable trends driving market growth?

Connected Devices to Drive the Market.

7. Are there any restraints impacting market growth?

Introduction of SD-WAN and Cloud/Data Center Services; Growth in Use of Connected Devices; Rising Digital Transformation in the Industries.

8. Can you provide examples of recent developments in the market?

April 2024 - Epsilon Telecommunications (Epsilon), a prominent global interconnectivity provider, joined forces with Moratelindo, a key player in Indonesia's telecommunications infrastructure. Their collaboration is poised to transform connectivity for Indonesian businesses. The primary goal is to link Indonesian enterprises, carriers, and service providers to a worldwide network of internet exchanges (IXs) via remote peering. This move is designed to boost content and application performance, all while sidestepping the necessity for extra infrastructure investments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia B2B Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia B2B Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia B2B Telecom Market?

To stay informed about further developments, trends, and reports in the Indonesia B2B Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence