Key Insights

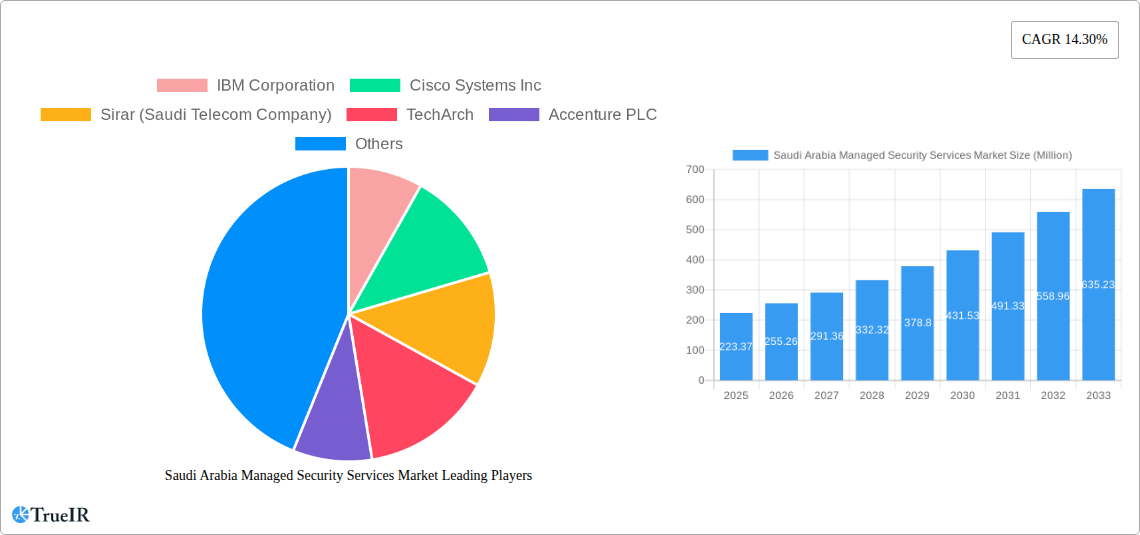

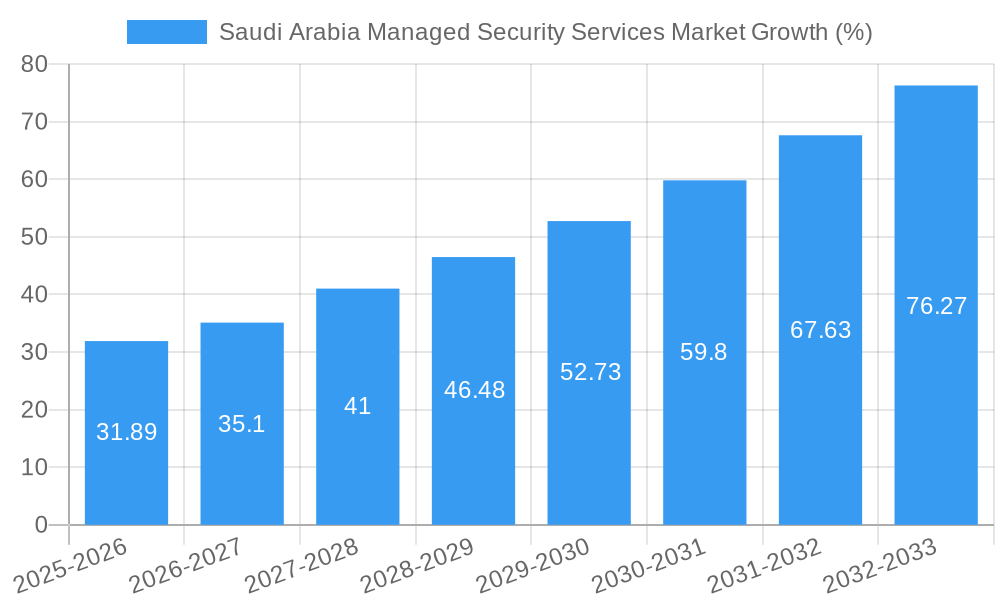

The Saudi Arabia Managed Security Services Market is experiencing robust growth, projected to reach \$223.37 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.30% from 2025 to 2033. This expansion is fueled by several key factors. The Kingdom's ongoing digital transformation initiatives, coupled with increasing government investments in cybersecurity infrastructure, are driving significant demand for sophisticated managed security services. Moreover, the rising adoption of cloud technologies and the expanding attack surface created by interconnected systems necessitate proactive security measures. The prevalence of cyber threats targeting critical infrastructure and businesses further underscores the need for robust managed security solutions. Key players in this market, including IBM, Cisco, and local providers like Saudi Telecom Company (STC), are actively contributing to this growth by offering a range of services from threat detection and response to vulnerability management and security awareness training. The market is segmented by service type (e.g., security information and event management (SIEM), intrusion detection/prevention systems (IDS/IPS), vulnerability management), deployment model (cloud, on-premise), and end-user industry (BFSI, government, healthcare).

This market's growth trajectory is expected to continue, driven by several emerging trends. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in security operations centers (SOCs) promises to enhance threat detection and response capabilities. The rise of managed detection and response (MDR) services, offering proactive threat hunting and remediation, is further accelerating market expansion. However, challenges such as a shortage of skilled cybersecurity professionals and the high cost of implementation could potentially impede growth. Overcoming these hurdles through investment in training and development programs, alongside the adoption of cost-effective solutions, will be crucial for sustained market expansion. The competitive landscape is dynamic, with both international and local players vying for market share. Strategic partnerships and mergers & acquisitions are likely to shape the market in the coming years.

Saudi Arabia Managed Security Services Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Saudi Arabia Managed Security Services Market, offering invaluable insights for businesses, investors, and industry stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report leverages extensive market research, incorporating quantitative and qualitative data to paint a comprehensive picture of this rapidly evolving market. Expected market size in 2025 is estimated at xx Million.

Saudi Arabia Managed Security Services Market Market Structure & Competitive Landscape

The Saudi Arabia Managed Security Services market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated to be around xx, indicating a moderately competitive landscape. However, the market is characterized by significant innovation, driven by the increasing sophistication of cyber threats and the Kingdom's digital transformation initiatives. Regulatory changes, such as the National Cybersecurity Strategy, significantly impact market dynamics. Product substitutes, including in-house security solutions, exist but are often less cost-effective for many organizations. End-user segmentation includes government, BFSI, healthcare, telecom, and others. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, driven primarily by the need for enhanced capabilities and market consolidation.

- Market Concentration: Moderately concentrated (HHI: xx)

- Innovation Drivers: Sophisticated cyber threats, digital transformation initiatives

- Regulatory Impacts: National Cybersecurity Strategy, data protection laws

- Product Substitutes: In-house security solutions, open-source tools

- End-User Segmentation: Government, BFSI, Healthcare, Telecom, Others

- M&A Trends: Approximately xx deals between 2019 and 2024

Saudi Arabia Managed Security Services Market Market Trends & Opportunities

The Saudi Arabia Managed Security Services market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) projected at xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising cybersecurity awareness, increasing adoption of cloud technologies, and government initiatives promoting digitalization. Market penetration rate for managed security services is estimated to be xx% in 2025, expected to increase to xx% by 2033. Technological advancements, such as AI-powered security solutions and advanced threat detection technologies, are driving market transformation. Consumer preferences are shifting towards comprehensive, managed security solutions that provide greater protection and peace of mind. The competitive landscape is dynamic, with both established players and new entrants vying for market share. This leads to innovation and enhanced service offerings, benefiting consumers. Opportunities exist in specialized security areas like cloud security, IoT security, and industrial control systems (ICS) security.

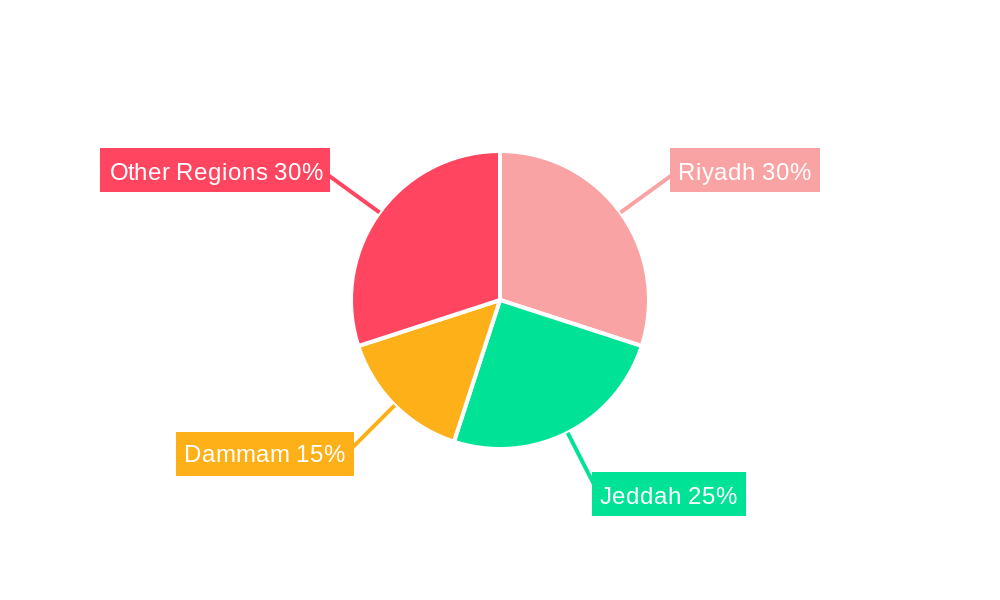

Dominant Markets & Segments in Saudi Arabia Managed Security Services Market

The Riyadh region dominates the Saudi Arabia Managed Security Services market, driven by the concentration of businesses, government agencies, and IT infrastructure. Other major cities such as Jeddah and Dammam also represent significant markets.

- Key Growth Drivers for Riyadh:

- Concentrated business and government presence

- Robust IT infrastructure

- Higher cybersecurity awareness among businesses

- Government initiatives promoting digitalization

The BFSI (Banking, Financial Services, and Insurance) sector is the leading segment, driven by strict regulatory compliance requirements and the sensitivity of financial data. The government sector also constitutes a significant segment, due to the critical infrastructure under its control. The healthcare sector is experiencing rapid growth due to increasing adoption of digital health solutions.

Saudi Arabia Managed Security Services Market Product Analysis

The Saudi Arabia Managed Security Services market offers a wide array of products, encompassing security information and event management (SIEM), security operations center (SOC) as a service, endpoint detection and response (EDR), vulnerability management, and managed firewall services. These services leverage advanced technologies like AI and machine learning to enhance threat detection and response capabilities. The competitive advantage lies in offering comprehensive, integrated solutions tailored to specific industry needs and compliance requirements. The market increasingly favors solutions that are scalable, flexible, and easily integrated with existing infrastructure.

Key Drivers, Barriers & Challenges in Saudi Arabia Managed Security Services Market

Key Drivers: The increasing prevalence of cyber threats, government mandates promoting cybersecurity, and rapid growth of digital infrastructure significantly drive market growth. Government initiatives like Vision 2030 further stimulate the demand for robust cybersecurity solutions.

Challenges: Regulatory complexities, limited skilled cybersecurity professionals, and a reliance on foreign expertise pose challenges to market expansion. Supply chain disruptions and intense competition also constrain the market's growth trajectory. The lack of standardization and interoperability among security solutions also presents a hurdle.

Growth Drivers in the Saudi Arabia Managed Security Services Market Market

The increasing digitalization of Saudi Arabia’s economy, coupled with stringent government regulations and a growing awareness of cyber threats, fuels market expansion. Government investments in cybersecurity infrastructure and talent development provide a strong foundation for market growth. The increasing adoption of cloud services and IoT devices creates new avenues for managed security service providers.

Challenges Impacting Saudi Arabia Managed Security Services Market Growth

The shortage of skilled cybersecurity professionals and the high cost of implementing advanced security solutions pose significant barriers. Competition from international players and potential supply chain vulnerabilities related to global events also present challenges. Regulatory complexities and a lack of standardized security practices create a fragmented landscape.

Key Players Shaping the Saudi Arabia Managed Security Services Market Market

- IBM Corporation

- Cisco Systems Inc

- Sirar (Saudi Telecom Company)

- TechArch

- Accenture PLC

- Capgemini SE

- SecurityHQ

- SecureWorks Corp

- Arabic Computer Systems (ACS)

- Eviden (Atos SE)

- Saudi Information Technology Company (SITE) (Public Investment Fund)

- Saudi Business Machines Ltd

- Innovative Solutions

- IT Security Training & Solutions I(TS)

- Cipher

- List Not Exhaustive

Significant Saudi Arabia Managed Security Services Market Industry Milestones

- March 2024: Saudi Information Technology Company (SITE) and SITE Ventures invested over SAR 500 Million in AhnLab Inc. to deploy and localize cybersecurity technologies in Saudi Arabia and the MENA region. This signifies a major push towards national cybersecurity capabilities.

- March 2024: Emircom opened its EiSoC in Riyadh and received certification for Cisco's XDR Managed Services, expanding its service offerings and boosting the market’s capacity for advanced threat response.

Future Outlook for Saudi Arabia Managed Security Services Market Market

The Saudi Arabia Managed Security Services market is poised for continued growth, driven by ongoing digital transformation, robust government support, and the increasing sophistication of cyber threats. Strategic opportunities exist for providers offering specialized solutions for key sectors like BFSI, healthcare, and government. The market's potential is substantial, with considerable room for expansion and innovation in the coming years. The anticipated growth is underpinned by a strengthening regulatory framework, increased private sector investment, and a growing pool of skilled professionals.

Saudi Arabia Managed Security Services Market Segmentation

-

1. Service

- 1.1. Managed Detection and Response (MDR)

- 1.2. Security Information and Event Management (SIEM)

- 1.3. Managed Identity and Access Management (IAM)

- 1.4. Vulnerability Management

- 1.5. Other Services

-

2. Size of Enterprises

- 2.1. Large Enterprises

- 2.2. Small and Medium-sized Enterprises (SMEs)

-

3. End-user Industry

- 3.1. IT and Telecom

- 3.2. BFSI

- 3.3. Retail and E-commerce

- 3.4. Construction and Real Estate

- 3.5. Government and Defense

- 3.6. Energy, Oil, and Gas

- 3.7. Other End-user Industries

Saudi Arabia Managed Security Services Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Managed Security Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Cybercrime

- 3.2.2 Digital Disruption

- 3.2.3 and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs

- 3.3. Market Restrains

- 3.3.1 Rising Cybercrime

- 3.3.2 Digital Disruption

- 3.3.3 and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs

- 3.4. Market Trends

- 3.4.1. Managed Detection and Response (MDR) Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Managed Security Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Managed Detection and Response (MDR)

- 5.1.2. Security Information and Event Management (SIEM)

- 5.1.3. Managed Identity and Access Management (IAM)

- 5.1.4. Vulnerability Management

- 5.1.5. Other Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprises

- 5.2.1. Large Enterprises

- 5.2.2. Small and Medium-sized Enterprises (SMEs)

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.2. BFSI

- 5.3.3. Retail and E-commerce

- 5.3.4. Construction and Real Estate

- 5.3.5. Government and Defense

- 5.3.6. Energy, Oil, and Gas

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cisco Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sirar (Saudi Telecom Company)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TechArch

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Capgemini SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SecurityHQ

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SecureWorks Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Arabic Computer Systems (ACS)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eviden (Atos SE)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Information Technology Company (SITE) (Public Investment Fund)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Saudi Business Machines Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Innovative Solutions

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 IT Security Training & Solutions I(TS)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cipher*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Saudi Arabia Managed Security Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Managed Security Services Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Service 2019 & 2032

- Table 5: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 6: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Size of Enterprises 2019 & 2032

- Table 7: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Saudi Arabia Managed Security Services Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Service 2019 & 2032

- Table 12: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Service 2019 & 2032

- Table 13: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Size of Enterprises 2019 & 2032

- Table 14: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Size of Enterprises 2019 & 2032

- Table 15: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Saudi Arabia Managed Security Services Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Saudi Arabia Managed Security Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Saudi Arabia Managed Security Services Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Managed Security Services Market?

The projected CAGR is approximately 14.30%.

2. Which companies are prominent players in the Saudi Arabia Managed Security Services Market?

Key companies in the market include IBM Corporation, Cisco Systems Inc, Sirar (Saudi Telecom Company), TechArch, Accenture PLC, Capgemini SE, SecurityHQ, SecureWorks Corp, Arabic Computer Systems (ACS), Eviden (Atos SE), Saudi Information Technology Company (SITE) (Public Investment Fund), Saudi Business Machines Ltd, Innovative Solutions, IT Security Training & Solutions I(TS), Cipher*List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Managed Security Services Market?

The market segments include Service, Size of Enterprises, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 223.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Cybercrime. Digital Disruption. and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs.

6. What are the notable trends driving market growth?

Managed Detection and Response (MDR) Witness Major Growth.

7. Are there any restraints impacting market growth?

Rising Cybercrime. Digital Disruption. and Increased Compliance Demands; Growing Adoption of Cloud-based Technologies and Work-from-anywhere Initiatives; Increasing Sophistication of Attacks and Impact on Critical Infrastructure; Rapid Rise in Data Flow Considering the Customer-centric Approach of Industries; Advantage of Organizations Focus on Core Operations Through Seamless Service by MSSPs.

8. Can you provide examples of recent developments in the market?

March 2024: Saudi Information Technology Company (SITE), a Public Investment Fund (PIF) entity and the national provider of cybersecurity, along with its subsidiary SITE Ventures, forged a dual investment exceeding SAR 500 million with AhnLab Inc., a cybersecurity firm based in South Korea, to collaborate with SITE and SITE Ventures. The aim is to deploy and localize various cybersecurity technologies in the Kingdom of Saudi Arabia and all throughout the broader Middle East & North Africa region.March 2024: Emircom announced the opening of its fully equipped Emircom Intelligent Security Operations Center (EiSoC) in Riyadh, Saudi Arabia, and received certification to deliver Cisco's Extended Detection and Response (XDR) Managed Services. This expansion reflects Emircom's commitment to enhancing cybersecurity defenses and provides a comprehensive suite of services aimed at protecting organizations' information systems from evolving threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Managed Security Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Managed Security Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Managed Security Services Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Managed Security Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence