Key Insights

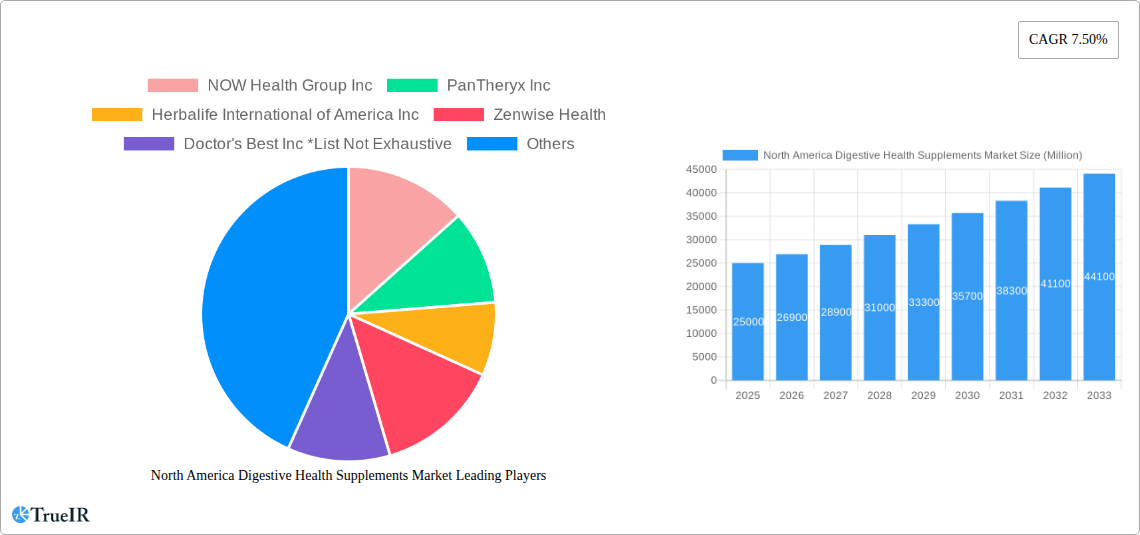

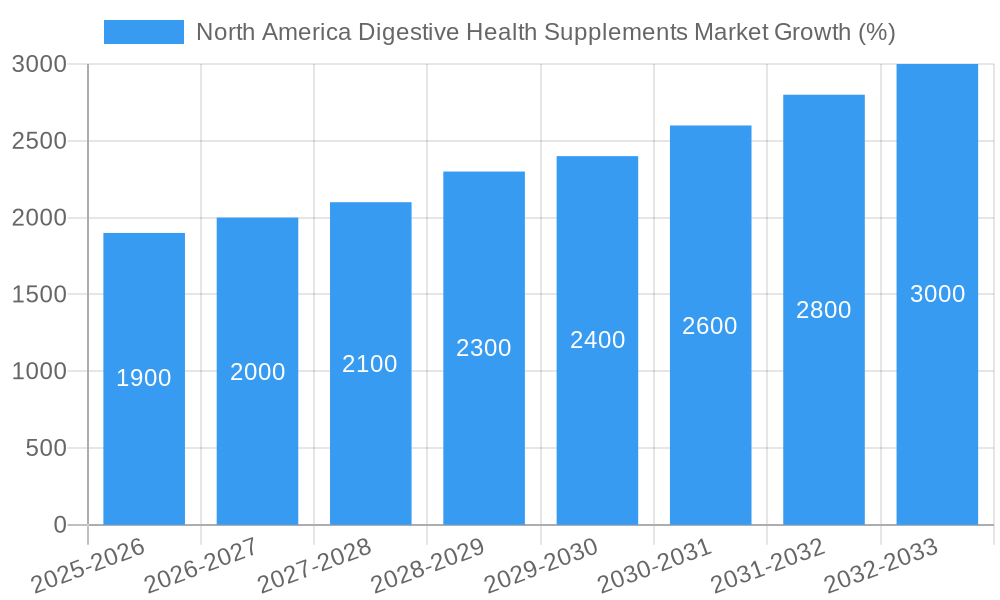

The North American digestive health supplements market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.5% from 2025 to 2033. This expansion is fueled by several key factors. Increasing awareness of gut health's crucial role in overall well-being, coupled with rising prevalence of digestive disorders like irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD), are driving consumer demand. Furthermore, the growing popularity of functional foods and beverages, incorporating probiotics and prebiotics, contributes significantly to market growth. The convenience and accessibility offered by online retail channels also play a crucial role in expanding market reach. Within the market segmentation, probiotics and prebiotics dominate, reflecting the heightened consumer interest in natural solutions for digestive health. Supermarkets and hypermarkets remain the primary distribution channels, although online retailers are rapidly gaining traction, driven by ease of purchase and wider product availability. Competition among established players like NOW Health Group, Herbalife, and Bayer, alongside emerging brands, fosters innovation and diverse product offerings. However, concerns about the efficacy and regulation of certain supplements, alongside potential side effects, present challenges to market expansion.

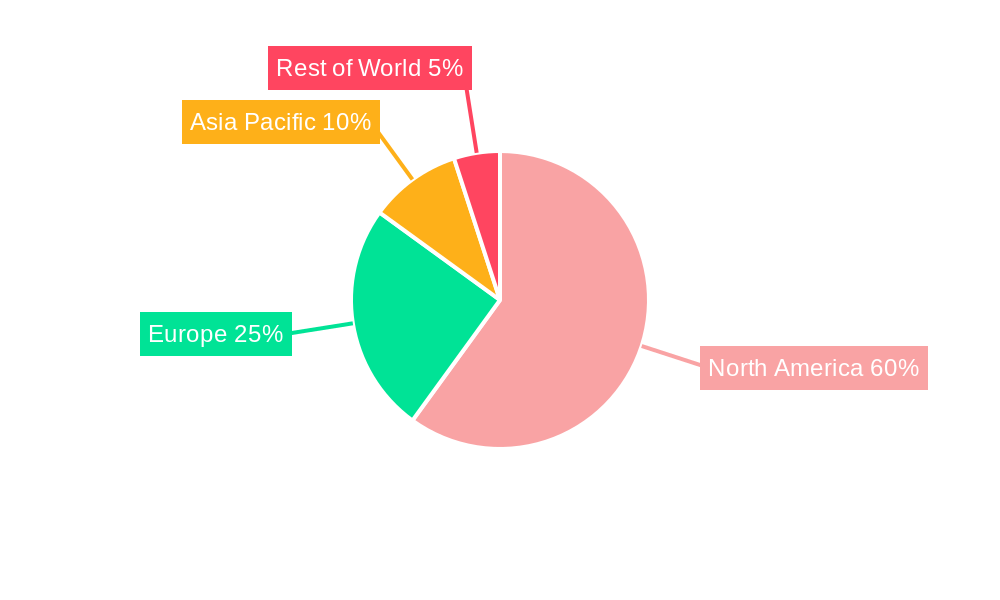

The projected market value for 2033, calculated using the provided CAGR, indicates substantial growth potential. While specific regional breakdowns beyond North America are absent, the significant presence of major players suggests substantial international market share, potentially including Europe and Asia. Future growth is anticipated to be further propelled by advancements in supplement formulation and research highlighting the gut-brain connection. The market will likely see increasing diversification in product formats, catering to consumer preferences and encompassing a wider range of target demographics, including specific age groups and health conditions. Continued focus on consumer education regarding appropriate supplement usage, combined with stringent quality control measures within the industry, will contribute to establishing market stability and further fueling growth.

North America Digestive Health Supplements Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America digestive health supplements market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this research delves into market size, segmentation, competitive dynamics, and future growth projections. The report leverages extensive data analysis and expert insights to present a clear and actionable understanding of this rapidly evolving market.

North America Digestive Health Supplements Market Structure & Competitive Landscape

The North America digestive health supplements market is characterized by a moderately concentrated landscape, with both large multinational corporations and smaller specialized companies competing for market share. The Herfindahl-Hirschman Index (HHI) for 2024 was estimated at xx, indicating a moderately consolidated market. Innovation plays a crucial role, with companies continually developing new products incorporating advanced formulations and delivery systems (e.g., targeted probiotics, prebiotic blends). Regulatory changes, particularly those concerning labeling and claims, significantly impact market dynamics. The presence of substitute products, including traditional remedies and functional foods, adds to competitive pressures.

The market is segmented by end-user demographics, focusing on age groups (e.g., young adults and senior citizens) and health conditions (e.g., Irritable Bowel Syndrome (IBS), Inflammatory Bowel Disease (IBD)). Mergers and acquisitions (M&A) activity in the sector has been moderate, with xx deals recorded between 2019 and 2024, primarily driven by companies seeking to expand their product portfolios and geographical reach. Key M&A trends include the acquisition of smaller, specialized companies by larger players to incorporate innovative technologies or expand distribution channels.

- Market Concentration: Moderately concentrated, HHI (2024) estimated at xx.

- Innovation Drivers: Advanced formulations, novel delivery systems, targeted probiotics.

- Regulatory Impacts: Stringent labeling regulations, increasing scrutiny of health claims.

- Product Substitutes: Traditional remedies, functional foods.

- End-User Segmentation: Age groups (e.g., young adults, seniors), health conditions (e.g., IBS, IBD).

- M&A Trends: Moderate activity (xx deals 2019-2024), driven by portfolio expansion and geographical reach.

North America Digestive Health Supplements Market Trends & Opportunities

The North America digestive health supplements market is experiencing significant growth, driven by increasing consumer awareness of gut health's importance and the rising prevalence of digestive disorders. The market size was valued at xx Million in 2024, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as personalized probiotics and advanced prebiotic formulations, are transforming the market. Consumer preferences are shifting towards natural and organic products, with a growing demand for transparency and traceable ingredients.

Competitive dynamics are intense, with both established players and emerging companies vying for market share through product innovation, effective marketing, and strategic partnerships. Market penetration rates vary significantly across different segments and geographic regions. Probiotic supplements currently hold the largest market share, but the demand for prebiotics and enzyme supplements is growing rapidly.

Dominant Markets & Segments in North America Digestive Health Supplements Market

Within North America, the United States currently holds the largest market share for digestive health supplements, driven by high consumer spending on health and wellness products and a large and ageing population. However, Canada and Mexico are showing considerable growth potential.

By type, the probiotics segment dominates, owing to its established efficacy in improving gut health. However, the prebiotics segment is exhibiting faster growth due to increasing awareness of their synergistic role with probiotics. Online retailers are witnessing strong growth, driven by increased e-commerce penetration and the convenience it offers to consumers.

- Key Growth Drivers (US): High consumer spending on health and wellness, large ageing population.

- Key Growth Drivers (Canada & Mexico): Rising disposable incomes, increasing health awareness.

- Probiotics: High market share, established efficacy, strong growth potential.

- Prebiotics: Fastest-growing segment, increasing awareness of synergistic benefits.

- Enzymes: Moderate growth, driven by demand for improved digestion.

- Online Retailers: Strong growth, driven by e-commerce penetration and convenience.

North America Digestive Health Supplements Market Product Analysis

The digestive health supplement market features diverse product innovations, including targeted probiotic strains for specific health conditions, prebiotic blends optimized for gut microbiome modulation, and enzyme formulations designed to enhance nutrient absorption. These innovations cater to specific consumer needs and preferences, while leveraging advancements in microbiome science. The competitive advantage lies in developing products with proven efficacy, strong branding, and effective marketing strategies, highlighting the scientific evidence supporting their benefits.

Key Drivers, Barriers & Challenges in North America Digestive Health Supplements Market

Key Drivers: Increasing prevalence of digestive disorders, rising consumer awareness of gut health, technological advancements in probiotic and prebiotic research, growing demand for natural and organic products, supportive regulatory environment (in some regions).

Challenges: Intense competition, stringent regulatory requirements, concerns regarding product efficacy and safety, fluctuations in raw material prices, and supply chain disruptions can impact market growth. The stringent regulatory requirements and the potential for inconsistencies in product quality present significant challenges.

Growth Drivers in the North America Digestive Health Supplements Market Market

The market's growth is fueled by increasing consumer awareness of gut health's importance, the rising prevalence of digestive issues, and technological advancements in supplement formulations. Government initiatives promoting healthier lifestyles and the expanding e-commerce sector further contribute to market expansion.

Challenges Impacting North America Digestive Health Supplements Market Growth

Stringent regulatory approvals, fluctuating raw material costs, and supply chain disruptions hinder market growth. Competition from established and emerging players also presents a significant challenge. Furthermore, maintaining consumer trust through consistent product quality and efficacy is paramount.

Key Players Shaping the North America Digestive Health Supplements Market Market

- NOW Health Group Inc

- PanTheryx Inc

- Herbalife International of America Inc

- Zenwise Health

- Doctor's Best Inc

- Bayer AG

- GlaxoSmithKline Plc

- The Nature's Bounty Co (Puritan's Pride Inc )

- Koninklijke DSM NV

- General Nutrition Centers Inc

Significant North America Digestive Health Supplements Market Industry Milestones

- September 2021: FrieslandCampina Ingredients and Lallemand Health Solutions launch PRO-Digest Health Shot and PRO-Digest Bowel Support.

- September 2021: Wedderspoon launches Manuka Honey Digestive Gummies (Tropical & Berry).

- August 2022: Megalabs USA launches Glutapak R, a probiotic glutamine supplement.

Future Outlook for North America Digestive Health Supplements Market Market

The North America digestive health supplements market is poised for continued growth, driven by increasing consumer awareness, product innovation, and favorable regulatory landscapes in certain sectors. Strategic partnerships, expansion into new markets, and personalized supplement offerings will be key to success. The market's future hinges on addressing consumer concerns regarding product quality, efficacy, and safety while embracing technological advancements that enhance product innovation and personalization.

North America Digestive Health Supplements Market Segmentation

-

1. Type

- 1.1. Prebiotics

- 1.2. Probiotics

- 1.3. Enzymes

- 1.4. Other Types

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies and Drugstores

- 2.3. Online Retailers

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Digestive Health Supplements Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Digestive Health Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Rise in Awareness about Digestive Health

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Prebiotics

- 5.1.2. Probiotics

- 5.1.3. Enzymes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies and Drugstores

- 5.2.3. Online Retailers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Prebiotics

- 6.1.2. Probiotics

- 6.1.3. Enzymes

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Pharmacies and Drugstores

- 6.2.3. Online Retailers

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Prebiotics

- 7.1.2. Probiotics

- 7.1.3. Enzymes

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Pharmacies and Drugstores

- 7.2.3. Online Retailers

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Prebiotics

- 8.1.2. Probiotics

- 8.1.3. Enzymes

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Pharmacies and Drugstores

- 8.2.3. Online Retailers

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Prebiotics

- 9.1.2. Probiotics

- 9.1.3. Enzymes

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Pharmacies and Drugstores

- 9.2.3. Online Retailers

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. United States North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Digestive Health Supplements Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 NOW Health Group Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 PanTheryx Inc

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Herbalife International of America Inc

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Zenwise Health

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Doctor's Best Inc *List Not Exhaustive

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Bayer AG

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 GlaxoSmithKline Plc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 The Nature's Bounty Co (Puritan's Pride Inc )

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Koninklijke DSM NV

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 General Nutrition Centers Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 NOW Health Group Inc

List of Figures

- Figure 1: North America Digestive Health Supplements Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Digestive Health Supplements Market Share (%) by Company 2024

List of Tables

- Table 1: North America Digestive Health Supplements Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Digestive Health Supplements Market Volume k tons Forecast, by Region 2019 & 2032

- Table 3: North America Digestive Health Supplements Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2019 & 2032

- Table 5: North America Digestive Health Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 6: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2019 & 2032

- Table 7: North America Digestive Health Supplements Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2019 & 2032

- Table 9: North America Digestive Health Supplements Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America Digestive Health Supplements Market Volume k tons Forecast, by Region 2019 & 2032

- Table 11: North America Digestive Health Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2019 & 2032

- Table 13: United States North America Digestive Health Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States North America Digestive Health Supplements Market Volume (k tons) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Digestive Health Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Digestive Health Supplements Market Volume (k tons) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Digestive Health Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Digestive Health Supplements Market Volume (k tons) Forecast, by Application 2019 & 2032

- Table 19: Rest of North America North America Digestive Health Supplements Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of North America North America Digestive Health Supplements Market Volume (k tons) Forecast, by Application 2019 & 2032

- Table 21: North America Digestive Health Supplements Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2019 & 2032

- Table 23: North America Digestive Health Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 24: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2019 & 2032

- Table 25: North America Digestive Health Supplements Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2019 & 2032

- Table 27: North America Digestive Health Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2019 & 2032

- Table 29: North America Digestive Health Supplements Market Revenue Million Forecast, by Type 2019 & 2032

- Table 30: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2019 & 2032

- Table 31: North America Digestive Health Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 32: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2019 & 2032

- Table 33: North America Digestive Health Supplements Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2019 & 2032

- Table 35: North America Digestive Health Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2019 & 2032

- Table 37: North America Digestive Health Supplements Market Revenue Million Forecast, by Type 2019 & 2032

- Table 38: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2019 & 2032

- Table 39: North America Digestive Health Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 40: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2019 & 2032

- Table 41: North America Digestive Health Supplements Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 42: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2019 & 2032

- Table 43: North America Digestive Health Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2019 & 2032

- Table 45: North America Digestive Health Supplements Market Revenue Million Forecast, by Type 2019 & 2032

- Table 46: North America Digestive Health Supplements Market Volume k tons Forecast, by Type 2019 & 2032

- Table 47: North America Digestive Health Supplements Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 48: North America Digestive Health Supplements Market Volume k tons Forecast, by Distibution Channel 2019 & 2032

- Table 49: North America Digestive Health Supplements Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Digestive Health Supplements Market Volume k tons Forecast, by Geography 2019 & 2032

- Table 51: North America Digestive Health Supplements Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Digestive Health Supplements Market Volume k tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Digestive Health Supplements Market?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the North America Digestive Health Supplements Market?

Key companies in the market include NOW Health Group Inc, PanTheryx Inc, Herbalife International of America Inc, Zenwise Health, Doctor's Best Inc *List Not Exhaustive, Bayer AG, GlaxoSmithKline Plc, The Nature's Bounty Co (Puritan's Pride Inc ), Koninklijke DSM NV, General Nutrition Centers Inc.

3. What are the main segments of the North America Digestive Health Supplements Market?

The market segments include Type, Distibution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Rise in Awareness about Digestive Health.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

In August 2022, Megalabs USA, a subsidiary of Megalabs Inc., that manufactures, markets, and distributes pharmaceutical products and nutritional supplements throughout the Americas, launched Glutapak R, a probiotic glutamine supplement for gut health and intestinal healing.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in k tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Digestive Health Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Digestive Health Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Digestive Health Supplements Market?

To stay informed about further developments, trends, and reports in the North America Digestive Health Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence