Key Insights

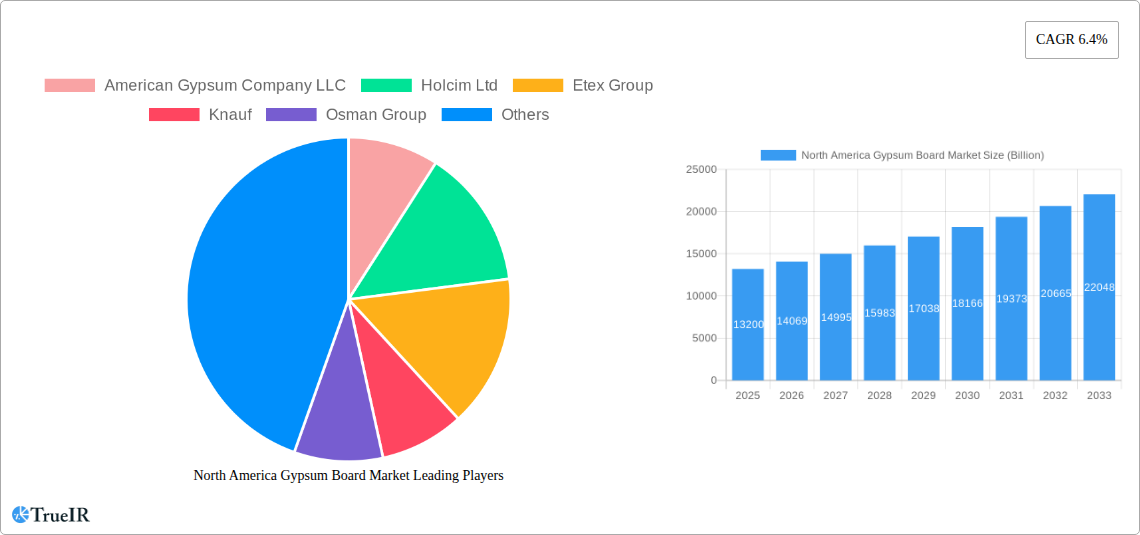

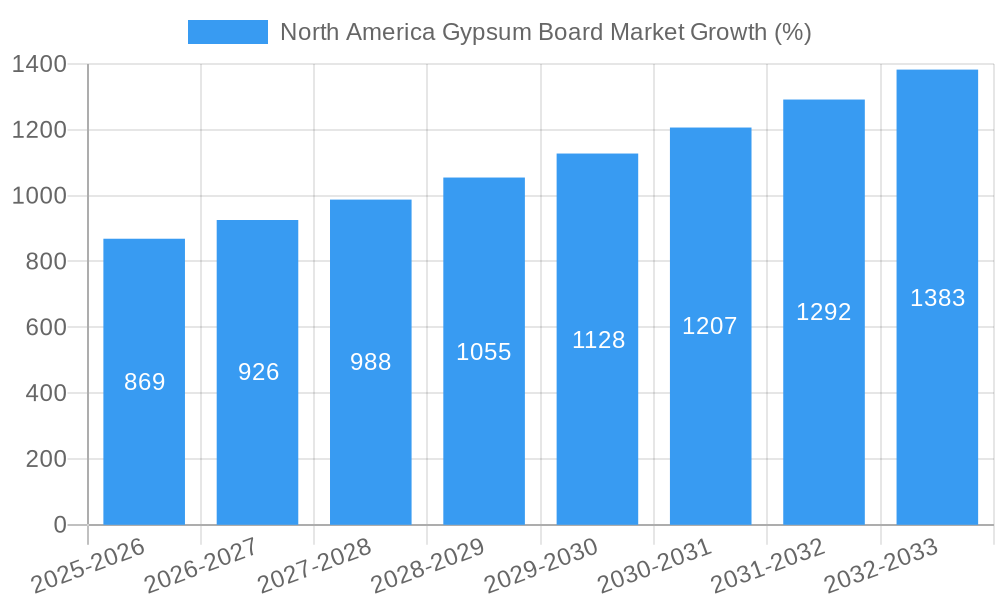

The North American gypsum board market, valued at $13.2 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning construction sector, particularly in the residential and commercial segments, is a significant driver. Increasing urbanization and population growth across the US, Canada, and Mexico are fueling demand for new housing and commercial buildings, directly impacting gypsum board consumption. Furthermore, the rising preference for sustainable building materials and the inherent fire-resistant and moisture-resistant properties of gypsum board are contributing to its increased adoption. Government initiatives promoting energy-efficient buildings also indirectly bolster demand. Market segmentation reveals strong performance across various types of gypsum boards, including wall boards, ceiling boards, and pre-decorated boards, reflecting diverse architectural and design preferences. The industrial and institutional sectors also contribute substantially to the market's growth trajectory, showcasing the versatility of gypsum board in diverse applications.

However, challenges exist within the market. Fluctuations in raw material prices, particularly gypsum, can impact profitability. Supply chain disruptions, potentially caused by geopolitical events or natural disasters, pose a risk to market stability. Competition among established players like American Gypsum Company LLC, Holcim Ltd, and Saint Gobain, alongside the emergence of regional players, necessitates continuous innovation and cost optimization strategies. Environmental concerns surrounding manufacturing processes are also driving the need for more sustainable and eco-friendly production methods. Nonetheless, the overall outlook for the North American gypsum board market remains positive, with continued growth expected throughout the forecast period due to consistent demand from expanding construction activities and a preference for versatile, cost-effective building materials. The market's resilience and growth potential make it an attractive investment opportunity for both established and emerging players.

North America Gypsum Board Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the North America gypsum board market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive market research to deliver a comprehensive understanding of market size, segmentation, competitive dynamics, and future growth potential. The market is expected to reach xx Billion by 2033, exhibiting a CAGR of xx% during the forecast period.

This report is essential for businesses involved in manufacturing, distribution, and utilization of gypsum board products in North America. It provides crucial information for strategic planning, investment decisions, and understanding the competitive landscape.

North America Gypsum Board Market Structure & Competitive Landscape

The North America gypsum board market is characterized by a moderately concentrated structure. Top players, including American Gypsum Company LLC, Holcim Ltd, Etex Group, Knauf, Osman Group, Volma, Pabco Building Products LLC, VANS Gypsum Pvt Ltd, Georgia-pacific LLC, Saint Gobain, and National Gypsum Services Company, collectively hold a significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately consolidated market.

- Innovation Drivers: Continuous product innovation, focusing on enhanced fire resistance, moisture resistance, and sound insulation, are major drivers. The development of lightweight and eco-friendly gypsum boards is also gaining traction.

- Regulatory Impacts: Building codes and environmental regulations significantly impact the market, driving demand for sustainable and energy-efficient products.

- Product Substitutes: While gypsum board dominates, alternative materials like fiber cement boards and metal studs compete in specific applications. However, gypsum board's cost-effectiveness and versatility maintain its leading position.

- End-User Segmentation: The market is segmented into residential, commercial, institutional, and industrial sectors. The residential sector currently accounts for the largest share, driven by ongoing construction and renovation activities.

- M&A Trends: The past five years have witnessed xx M&A deals, primarily focused on expanding production capacity and geographical reach. This consolidation trend is expected to continue, driving further market concentration.

North America Gypsum Board Market Market Trends & Opportunities

The North America gypsum board market is experiencing significant growth, driven by factors such as increasing construction activity, rising disposable incomes, and government initiatives promoting affordable housing. The market size was valued at xx Billion in 2024 and is projected to reach xx Billion by 2033. This growth reflects strong demand across all end-user segments. Technological advancements, such as the development of lightweight and eco-friendly gypsum boards, are further fueling market expansion. The market penetration rate for sustainable gypsum boards is currently at xx% and is anticipated to increase significantly in the forecast period. Consumer preferences are increasingly shifting towards eco-friendly and high-performance building materials, opening up opportunities for manufacturers to introduce innovative, sustainable products. The rising popularity of green building practices further strengthens the demand for environmentally conscious gypsum boards. Competitive dynamics are intense, with major players focusing on product differentiation, cost optimization, and strategic partnerships to maintain market share. The market exhibits a moderately competitive landscape, with a few key players dominating while numerous smaller players compete in niche segments. The rising popularity of prefabricated building systems also presents significant opportunities for gypsum board manufacturers.

Dominant Markets & Segments in North America Gypsum Board Market

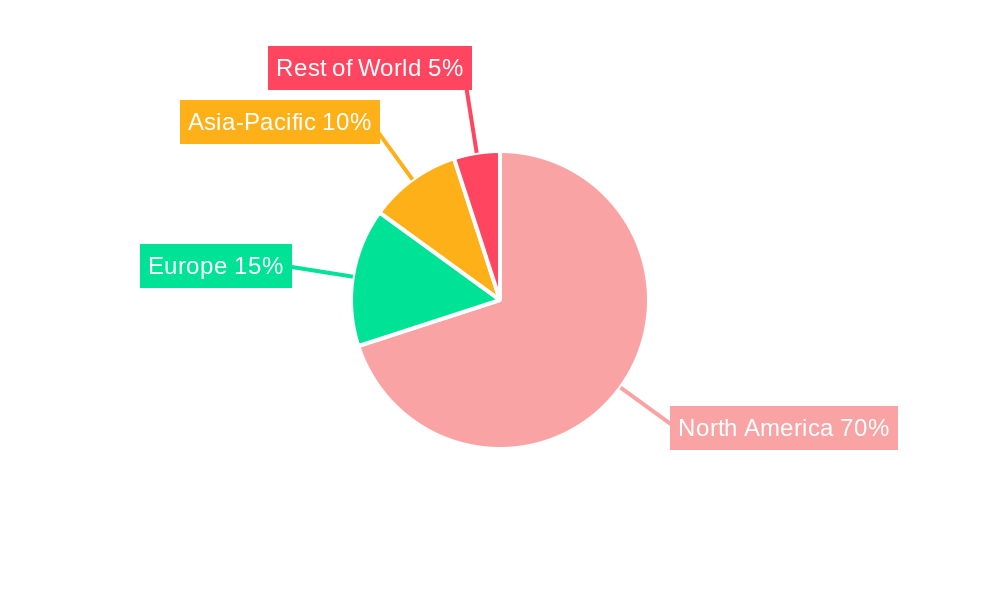

The US dominates the North America gypsum board market, accounting for approximately xx% of the total market value. Strong construction activity and a large residential sector are key factors contributing to this dominance. Within the product segment, wall boards hold the largest market share, followed by ceiling boards and pre-decorated boards. The residential sector remains the largest end-user segment, driven by robust housing starts and renovation projects. However, the commercial and industrial sectors are also experiencing healthy growth.

Key Growth Drivers in the US Market:

- Robust residential construction activity fueled by population growth and favorable mortgage rates.

- Increasing investments in non-residential construction, particularly in the commercial and industrial sectors.

- Government initiatives to improve infrastructure and stimulate economic growth.

- Growing adoption of sustainable building practices.

Key Growth Drivers in Canada:

- Government investment in infrastructure projects.

- Growing demand for residential housing, particularly in urban centers.

- Increasing adoption of energy-efficient building technologies.

North America Gypsum Board Market Product Analysis

Gypsum board product innovations focus on enhancing performance characteristics like fire resistance, moisture resistance, and sound insulation. Lightweight options are becoming increasingly popular, driven by sustainability concerns and construction efficiency needs. Competitive advantages are achieved through product differentiation, superior quality, cost-effectiveness, and efficient supply chain management. Technological advancements in manufacturing processes lead to improved product quality and reduced environmental impact. The market features a wide range of products catering to various applications, from standard wallboards to specialized fire-resistant and moisture-resistant boards.

Key Drivers, Barriers & Challenges in North America Gypsum Board Market

Key Drivers: Strong construction activity, particularly in the residential sector, is the primary driver. Government initiatives to promote affordable housing and infrastructure development further boost market demand. Rising disposable incomes and urbanization contribute to a growing need for new construction and renovations. Technological advancements resulting in improved product features and efficiency also drive growth.

Challenges: Fluctuations in raw material prices, particularly gypsum and paper, pose a significant challenge. Increasing energy costs impact manufacturing expenses. Intense competition among manufacturers necessitates continuous innovation and cost optimization to maintain profitability. Supply chain disruptions, especially in the wake of global events, can significantly impact production and delivery timelines. Regulatory changes and environmental concerns necessitate compliance with increasingly stringent standards, increasing operational costs.

Growth Drivers in the North America Gypsum Board Market Market

Growth in the North America gypsum board market is primarily driven by the robust construction sector, particularly in the residential market. Government investments in infrastructure projects, coupled with a growing population and urbanization trends, contribute to this growth. Technological advancements in product design, improving performance and sustainability, also play a role. Regulations emphasizing energy-efficient buildings further boost the demand for advanced gypsum boards.

Challenges Impacting North America Gypsum Board Market Growth

The market faces challenges from fluctuating raw material prices, impacting production costs. Supply chain disruptions can cause delays and shortages, affecting production and sales. Intense competition necessitates continuous innovation and cost-optimization strategies. Stricter environmental regulations and growing concerns about sustainable building practices introduce new challenges and compliance costs for manufacturers.

Key Players Shaping the North America Gypsum Board Market Market

- American Gypsum Company LLC

- Holcim Ltd

- Etex Group

- Knauf

- Osman Group

- Volma

- Pabco Building Products LLC

- VANS Gypsum Pvt Ltd

- Georgia-pacific LLC

- Saint Gobain

- National Gypsum Services Company

Significant North America Gypsum Board Market Industry Milestones

- March 2022: Saint-Gobain invested roughly CAD 4 million (USD 2.93 million) to install heat recovery equipment at its Canadian gypsum wallboard production facility, reducing energy consumption and carbon emissions. This showcases a commitment to sustainability, influencing market perception and potentially boosting demand for environmentally conscious products.

- October 2022: Saint-Gobain's CertainTeed Gypsum launched a circular economy project, reclaiming discarded gypsum wallboard for reuse. This initiative positions the company as a leader in sustainable practices, potentially influencing consumer choices and setting a precedent for industry-wide adoption of circular economy principles.

Future Outlook for North America Gypsum Board Market Market

The North America gypsum board market is poised for continued growth, driven by sustained construction activity and a focus on sustainable building practices. Opportunities exist for manufacturers to innovate with lightweight, eco-friendly, and high-performance products. Strategic partnerships and investments in efficient manufacturing processes will be crucial for maintaining competitiveness. The increasing adoption of prefabricated building systems also presents a significant growth opportunity. The market's future is bright, with continued expansion driven by the underlying economic and demographic factors.

North America Gypsum Board Market Segmentation

-

1. Type

- 1.1. Wall Board

- 1.2. Ceiling Board

- 1.3. Pre-decorated Board

-

2. End-User Industry

- 2.1. Residential Sector

- 2.2. Institutional Sector

- 2.3. Industrial Sector

- 2.4. Commercial Sector

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Gypsum Board Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Gypsum Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Residential Construction; Rising Repair Activities

- 3.3. Market Restrains

- 3.3.1. Gypsum Boards are Prone to Water Damage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Application in Residential Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Board

- 5.1.2. Ceiling Board

- 5.1.3. Pre-decorated Board

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Residential Sector

- 5.2.2. Institutional Sector

- 5.2.3. Industrial Sector

- 5.2.4. Commercial Sector

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wall Board

- 6.1.2. Ceiling Board

- 6.1.3. Pre-decorated Board

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Residential Sector

- 6.2.2. Institutional Sector

- 6.2.3. Industrial Sector

- 6.2.4. Commercial Sector

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wall Board

- 7.1.2. Ceiling Board

- 7.1.3. Pre-decorated Board

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Residential Sector

- 7.2.2. Institutional Sector

- 7.2.3. Industrial Sector

- 7.2.4. Commercial Sector

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wall Board

- 8.1.2. Ceiling Board

- 8.1.3. Pre-decorated Board

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Residential Sector

- 8.2.2. Institutional Sector

- 8.2.3. Industrial Sector

- 8.2.4. Commercial Sector

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Gypsum Board Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 American Gypsum Company LLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Holcim Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Etex Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Knauf

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Osman Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Volma

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pabco Building Products LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 VANS Gypsum Pvt Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Georgia-pacific LLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Saint Gobain

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 National Gypsum Services Company

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 American Gypsum Company LLC

List of Figures

- Figure 1: North America Gypsum Board Market Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: North America Gypsum Board Market Share (%) by Company 2024

List of Tables

- Table 1: North America Gypsum Board Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: North America Gypsum Board Market Volume Square Meters Forecast, by Region 2019 & 2032

- Table 3: North America Gypsum Board Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 4: North America Gypsum Board Market Volume Square Meters Forecast, by Type 2019 & 2032

- Table 5: North America Gypsum Board Market Revenue Billion Forecast, by End-User Industry 2019 & 2032

- Table 6: North America Gypsum Board Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 7: North America Gypsum Board Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 8: North America Gypsum Board Market Volume Square Meters Forecast, by Geography 2019 & 2032

- Table 9: North America Gypsum Board Market Revenue Billion Forecast, by Region 2019 & 2032

- Table 10: North America Gypsum Board Market Volume Square Meters Forecast, by Region 2019 & 2032

- Table 11: North America Gypsum Board Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: North America Gypsum Board Market Volume Square Meters Forecast, by Country 2019 & 2032

- Table 13: United States North America Gypsum Board Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: United States North America Gypsum Board Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 15: Canada North America Gypsum Board Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Gypsum Board Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Gypsum Board Market Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Mexico North America Gypsum Board Market Volume (Square Meters) Forecast, by Application 2019 & 2032

- Table 19: North America Gypsum Board Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 20: North America Gypsum Board Market Volume Square Meters Forecast, by Type 2019 & 2032

- Table 21: North America Gypsum Board Market Revenue Billion Forecast, by End-User Industry 2019 & 2032

- Table 22: North America Gypsum Board Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 23: North America Gypsum Board Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 24: North America Gypsum Board Market Volume Square Meters Forecast, by Geography 2019 & 2032

- Table 25: North America Gypsum Board Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 26: North America Gypsum Board Market Volume Square Meters Forecast, by Country 2019 & 2032

- Table 27: North America Gypsum Board Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 28: North America Gypsum Board Market Volume Square Meters Forecast, by Type 2019 & 2032

- Table 29: North America Gypsum Board Market Revenue Billion Forecast, by End-User Industry 2019 & 2032

- Table 30: North America Gypsum Board Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 31: North America Gypsum Board Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 32: North America Gypsum Board Market Volume Square Meters Forecast, by Geography 2019 & 2032

- Table 33: North America Gypsum Board Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 34: North America Gypsum Board Market Volume Square Meters Forecast, by Country 2019 & 2032

- Table 35: North America Gypsum Board Market Revenue Billion Forecast, by Type 2019 & 2032

- Table 36: North America Gypsum Board Market Volume Square Meters Forecast, by Type 2019 & 2032

- Table 37: North America Gypsum Board Market Revenue Billion Forecast, by End-User Industry 2019 & 2032

- Table 38: North America Gypsum Board Market Volume Square Meters Forecast, by End-User Industry 2019 & 2032

- Table 39: North America Gypsum Board Market Revenue Billion Forecast, by Geography 2019 & 2032

- Table 40: North America Gypsum Board Market Volume Square Meters Forecast, by Geography 2019 & 2032

- Table 41: North America Gypsum Board Market Revenue Billion Forecast, by Country 2019 & 2032

- Table 42: North America Gypsum Board Market Volume Square Meters Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Gypsum Board Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the North America Gypsum Board Market?

Key companies in the market include American Gypsum Company LLC, Holcim Ltd, Etex Group, Knauf, Osman Group, Volma, Pabco Building Products LLC, VANS Gypsum Pvt Ltd, Georgia-pacific LLC, Saint Gobain, National Gypsum Services Company.

3. What are the main segments of the North America Gypsum Board Market?

The market segments include Type, End-User Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.2 Billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Residential Construction; Rising Repair Activities.

6. What are the notable trends driving market growth?

Increasing Application in Residential Sector.

7. Are there any restraints impacting market growth?

Gypsum Boards are Prone to Water Damage; Other Restraints.

8. Can you provide examples of recent developments in the market?

October 2022: Saint-Gobain North America, through its building goods subsidiary business unit CertainTeed Gypsum, started a circular economy project in partnership with three New York partner firms. At its Buchanan, New York factory, the firm began reclaiming discarded gypsum wallboard and reusing it as feedstock for the new product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion and volume, measured in Square Meters.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Gypsum Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Gypsum Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Gypsum Board Market?

To stay informed about further developments, trends, and reports in the North America Gypsum Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence