Key Insights

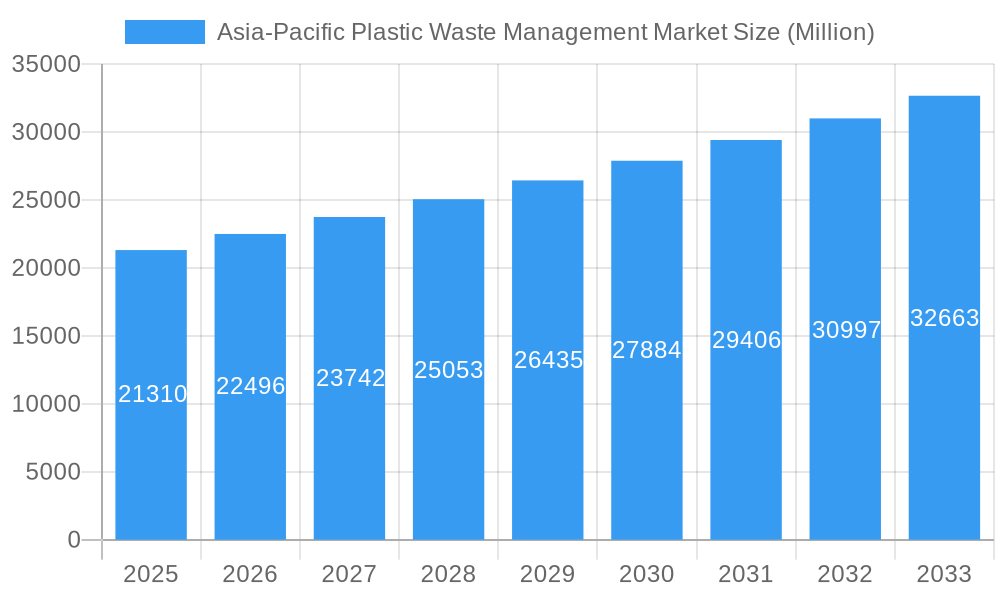

The Asia-Pacific plastic waste management market, valued at $21.31 billion in 2025, is projected to experience robust growth, driven by increasing environmental concerns, stringent government regulations, and a rising awareness of the detrimental effects of plastic pollution. The market's 5.45% CAGR from 2019 to 2033 indicates a significant expansion over the forecast period (2025-2033). Key drivers include the escalating generation of plastic waste due to rapid urbanization and economic growth across the region, coupled with a growing demand for sustainable waste management solutions. Emerging trends such as advancements in plastic recycling technologies (chemical recycling, advanced sorting), the rise of the circular economy model, and increasing investments in waste-to-energy projects are further accelerating market growth. However, challenges remain, including the high cost of implementing advanced waste management technologies, inconsistent waste collection infrastructure in some areas, and a lack of public awareness in certain regions. Despite these restraints, the market's positive trajectory is largely attributable to proactive government policies promoting recycling and waste reduction initiatives, coupled with the increasing involvement of both private and public sector companies in developing innovative solutions.

Asia-Pacific Plastic Waste Management Market Market Size (In Billion)

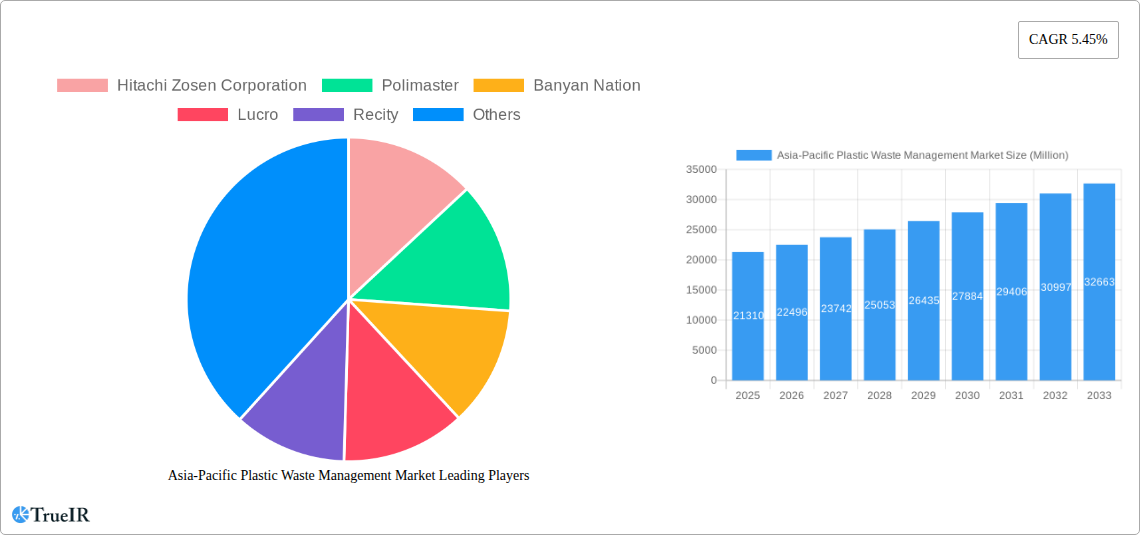

The competitive landscape is marked by a mix of multinational corporations like SUEZ and Waste Management Inc., alongside regional players and specialized technology providers such as Agilyx and Banyan Nation. These companies are focusing on developing technologically advanced solutions, strategic partnerships, and geographical expansion to capitalize on the burgeoning market opportunities. The market segmentation (while not explicitly provided) likely includes various waste management services (collection, processing, recycling, disposal), different types of plastic waste (PET, HDPE, LDPE, etc.), and technological solutions (mechanical recycling, chemical recycling, pyrolysis, etc.). Further analysis would reveal specific segment performance and potential areas for future growth. The substantial untapped potential for plastic waste management in numerous countries within the Asia-Pacific region presents significant growth opportunities for companies investing in this sector.

Asia-Pacific Plastic Waste Management Market Company Market Share

Asia-Pacific Plastic Waste Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific plastic waste management market, offering invaluable insights for investors, industry professionals, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data and expert analysis to illuminate current market dynamics and predict future growth trajectories. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Asia-Pacific Plastic Waste Management Market Structure & Competitive Landscape

The Asia-Pacific plastic waste management market exhibits a moderately concentrated structure, with a few large multinational players alongside numerous regional operators. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include advancements in waste-to-energy technologies, chemical recycling, and AI-powered waste sorting systems. Stringent government regulations, particularly concerning plastic bans and extended producer responsibility (EPR) schemes, significantly influence market dynamics. Product substitutes, such as biodegradable plastics and alternative packaging materials, pose a growing competitive threat. End-user segments encompass municipalities, industries, and private businesses, with municipalities currently holding the largest market share. Mergers and acquisitions (M&A) activity has been significant in recent years, with an estimated xx Million in M&A volume between 2019 and 2024, primarily driven by consolidation and expansion efforts by larger players.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Waste-to-energy, chemical recycling, AI-powered sorting.

- Regulatory Impacts: Stringent plastic bans and EPR schemes.

- Product Substitutes: Biodegradable plastics, alternative packaging.

- End-User Segmentation: Municipalities (largest share), industries, private businesses.

- M&A Trends: Significant activity (xx Million between 2019-2024), driven by consolidation.

Asia-Pacific Plastic Waste Management Market Trends & Opportunities

The Asia-Pacific plastic waste management market is experiencing robust growth, driven by increasing environmental awareness, stricter regulations, and rising urbanization. Market size is projected to increase from xx Million in 2025 to xx Million by 2033. Technological advancements are transforming waste management practices, with smart bins, automated sorting facilities, and advanced recycling technologies gaining traction. Consumer preferences are shifting towards sustainable and eco-friendly products, creating demand for efficient waste management solutions. The competitive landscape is dynamic, with both established players and innovative startups vying for market share. Market penetration of advanced recycling technologies is currently low but is anticipated to grow significantly in the coming years. Significant opportunities exist in developing sustainable waste management infrastructure in underserved regions and implementing circular economy models to reduce plastic waste.

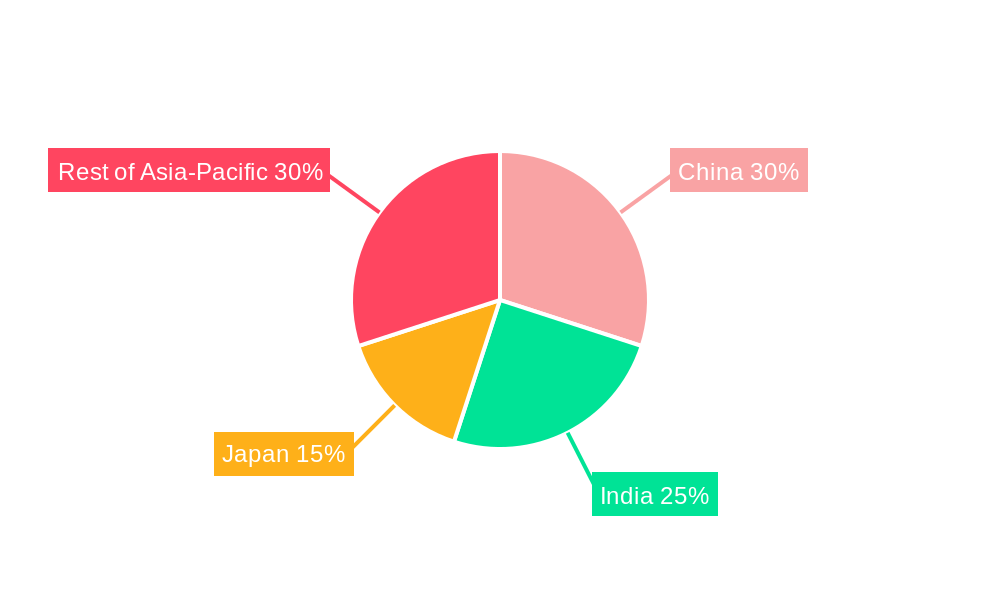

Dominant Markets & Segments in Asia-Pacific Plastic Waste Management Market

China and India currently dominate the Asia-Pacific plastic waste management market, owing to their large populations and substantial waste generation volumes. However, other rapidly developing economies like Indonesia, Thailand, and Vietnam are also witnessing strong growth. The municipal solid waste (MSW) segment holds the largest market share, followed by the industrial waste segment.

Key Growth Drivers in China:

- Massive waste generation from urbanization and industrialization.

- Government initiatives promoting waste-to-energy and recycling.

- Significant investments in waste management infrastructure.

Key Growth Drivers in India:

- Rising awareness of plastic pollution and environmental concerns.

- Government policies focusing on plastic waste reduction.

- Increasing private sector participation in waste management.

Other High-Growth Markets: Indonesia, Thailand, Vietnam (driven by increasing urbanization and government support).

Asia-Pacific Plastic Waste Management Market Product Analysis

The market offers a diverse range of products and services, encompassing waste collection and transportation, material recovery facilities (MRFs), recycling technologies (mechanical, chemical, and biological), waste-to-energy plants, and landfill management. Recent technological advancements include the development of advanced sorting systems using AI and robotics, improved chemical recycling processes to handle complex plastics, and innovative solutions for plastic waste-to-fuel conversion. These innovations enhance efficiency, reduce costs, and improve the quality of recycled materials, contributing significantly to market growth.

Key Drivers, Barriers & Challenges in Asia-Pacific Plastic Waste Management Market

Key Drivers: Stringent government regulations promoting plastic waste reduction, increasing environmental awareness, growing urbanization and industrialization leading to higher waste generation, and technological advancements in waste management solutions. For example, the recent World Bank loan to Shaanxi Province underscores the substantial government investment in tackling the problem.

Key Challenges: Lack of adequate waste management infrastructure in many regions, particularly in rural areas, limited public awareness and participation in recycling programs, high costs associated with implementing advanced recycling technologies, and logistical challenges related to waste collection and transportation, especially in densely populated areas. These issues, along with inconsistent waste management policies across the region, create significant hurdles for market growth. The uneven development across different countries can also lead to unequal access to effective waste management solutions.

Growth Drivers in the Asia-Pacific Plastic Waste Management Market Market

The market is driven by escalating environmental concerns, supportive government policies (such as the World Bank's initiative in Shaanxi Province), increasing urbanization leading to higher waste generation, and technological advancements offering more efficient and cost-effective waste management solutions. Furthermore, growing consumer demand for sustainable products and a rise in corporate social responsibility (CSR) initiatives are fueling market growth.

Challenges Impacting Asia-Pacific Plastic Waste Management Market Growth

Significant challenges include the lack of comprehensive waste management infrastructure in many parts of the region, inconsistent regulatory frameworks across countries, high capital costs associated with adopting advanced technologies, and limited public awareness and participation in waste recycling and segregation programs. These factors constrain market expansion and create uneven growth patterns across the region.

Key Players Shaping the Asia-Pacific Plastic Waste Management Market Market

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co Ltd

Significant Asia-Pacific Plastic Waste Management Market Industry Milestones

- April 2024: Launch of "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions" initiative targeting Bangkok, Vientiane, Battambang, and Can Tho. This signifies a proactive approach to tackling regional plastic pollution.

- March 2023: World Bank approves USD 250 Million loan for plastic pollution reduction in Shaanxi Province, China. This substantial investment highlights the commitment to improved waste management practices at a national level.

Future Outlook for Asia-Pacific Plastic Waste Management Market Market

The Asia-Pacific plastic waste management market is poised for continued expansion, driven by a confluence of factors including strengthening government regulations, increasing environmental awareness, technological innovation, and rising private sector investment. Strategic opportunities lie in leveraging advanced technologies, developing sustainable infrastructure, and fostering public-private partnerships to address the region's plastic waste challenge effectively. The market's future growth will significantly depend on successful implementation of circular economy models and the integration of innovative waste management technologies across the region.

Asia-Pacific Plastic Waste Management Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Terephthalate (PET)

- 1.5. Other Polymers

-

2. Source

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Other Sources (Construction, Healthcare, etc.)

-

3. Treatment

- 3.1. Recycling

- 3.2. Chemical Treatment

- 3.3. Landfill

- 3.4. Other Treatments

Asia-Pacific Plastic Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Waste Management Market Regional Market Share

Geographic Coverage of Asia-Pacific Plastic Waste Management Market

Asia-Pacific Plastic Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.3. Market Restrains

- 3.3.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Terephthalate (PET)

- 5.1.5. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Other Sources (Construction, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Treatment

- 5.3.1. Recycling

- 5.3.2. Chemical Treatment

- 5.3.3. Landfill

- 5.3.4. Other Treatments

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polimaster

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banyan Nation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUEZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Management Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agilyx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GreenTech Environmental Co Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hitachi Zosen Corporation

List of Figures

- Figure 1: Asia-Pacific Plastic Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Plastic Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 2: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 3: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 6: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 7: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 10: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 11: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 14: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 15: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Waste Management Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Plastic Waste Management Market?

Key companies in the market include Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, GreenTech Environmental Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Plastic Waste Management Market?

The market segments include Polymer, Source, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

6. What are the notable trends driving market growth?

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific.

7. Are there any restraints impacting market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

8. Can you provide examples of recent developments in the market?

April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence