Key Insights

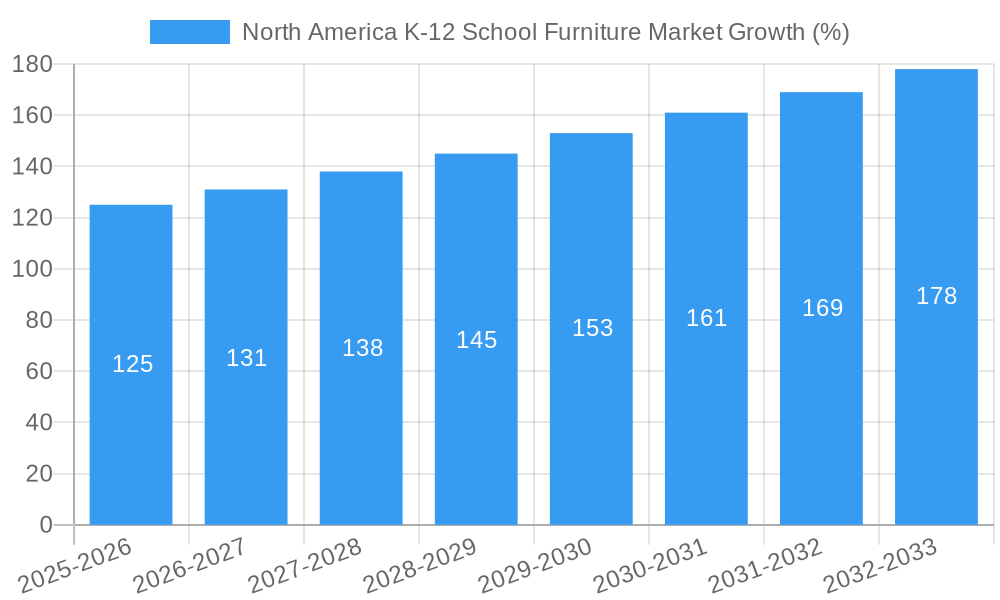

The North America K-12 school furniture market is experiencing robust growth, driven by increasing enrollment in K-12 schools and a rising focus on creating ergonomic and conducive learning environments. The market, estimated at $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. Key growth drivers include government initiatives promoting infrastructure upgrades in schools, increasing disposable income leading to higher investments in education, and a growing demand for durable and adaptable furniture solutions to cater to diverse learning styles. The market is segmented by end-user (classroom, cafeteria, library, office), geography (United States, Canada, and Rest of North America), material (wood, metal, plastic, other), and product type (desks and chairs, storage). The US dominates the market due to its large K-12 student population and higher spending on education infrastructure compared to Canada and the rest of North America. The preference for durable and sustainable materials like wood and metal, alongside the growing adoption of technologically advanced furniture integrating storage and charging capabilities, are shaping market trends. While challenges such as fluctuating raw material prices and economic uncertainties might pose some restraints, the overall market outlook remains positive, fueled by the ongoing need for comfortable and functional furniture to enhance the educational experience.

Significant players in the market, including Fleet Wood Furniture, Knoll Inc., Virco Manufacturing Corporation, HNI Corporation, Haworth Inc., Steelcase Inc., and others, are focusing on innovation and expansion to capitalize on the growth opportunities. These companies are leveraging advanced manufacturing techniques, integrating smart technologies, and investing in research and development to create high-quality, durable, and ergonomic furniture solutions. The increasing demand for customized furniture tailored to specific school requirements is also creating niche opportunities for smaller players. Competition is intense, based on factors like pricing, product quality, design, and after-sales services. The market's future growth is inextricably linked to government spending on education, economic conditions, and the evolving needs of modern educational institutions. The continued focus on improving the learning environment through well-designed furniture is expected to drive the market's sustained expansion over the forecast period.

North America K-12 School Furniture Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America K-12 school furniture market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology to forecast market trends and opportunities from 2025 to 2033, while analyzing historical data from 2019 to 2024. The market is segmented by end-user (classroom, cafeteria, library, office), country (United States, Canada, Rest of North America), material (wood, metal, plastic, other materials), and product (desk and chairs, storage). Key players like Fleet Wood Furniture, Knoll Inc, Virco Manufacturing Corporation, HNI Corporation, Haworth Inc, Steelcase Inc, VS America Inc, Krueger International Inc, Herman Miller Inc, Agati Inc, and Hertz Furniture Systems LLC are profiled, though this list is not exhaustive. The report projects a market size of xx Million in 2025 and a CAGR of xx% from 2025-2033.

North America K-12 School Furniture Market Structure & Competitive Landscape

The North America K-12 school furniture market exhibits a moderately consolidated structure. The top five players hold an estimated xx% market share in 2025, indicating a relatively competitive landscape. Innovation in materials, design, and ergonomics is a key driver, with companies continuously seeking to enhance product functionality and aesthetics to meet evolving educational needs. Government regulations regarding safety and accessibility significantly impact market dynamics. Furthermore, the market experiences competition from substitute products, such as repurposed furniture or alternative seating solutions. M&A activity has been moderate in recent years, with an estimated xx number of transactions between 2019 and 2024. Future market concentration is expected to remain relatively stable, with potential for strategic partnerships and acquisitions driving consolidation in specific segments.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Innovation Drivers: Ergonomic designs, sustainable materials, technological integration (e.g., smart desks).

- Regulatory Impacts: Safety standards, accessibility requirements influence product development and demand.

- Product Substitutes: Repurposed furniture, alternative seating arrangements, modular systems pose competition.

- End-User Segmentation: Classroom furniture dominates, followed by cafeteria and library segments.

- M&A Trends: Moderate activity observed between 2019-2024 with approximately xx transactions, indicating potential for future consolidation.

North America K-12 School Furniture Market Trends & Opportunities

The North America K-12 school furniture market is projected to experience significant growth, driven by several key factors. Increasing school enrollments, particularly in certain regions, contribute to heightened demand for new furniture. Technological advancements, such as the integration of smart technology into furniture, create new market opportunities. A growing emphasis on creating healthier and more comfortable learning environments fuels the demand for ergonomic and sustainable furniture options. Consumer preferences are shifting towards adaptable and modular furniture solutions, allowing for flexible classroom arrangements. Intense competition among established and emerging players drives innovation and keeps prices competitive. This robust market growth is projected to continue, with a CAGR of xx% from 2025-2033. Market penetration rates for newer technologies like smart furniture are expected to rise to xx% by 2033.

Dominant Markets & Segments in North America K-12 School Furniture Market

The United States represents the largest market within North America, driven by its extensive school system and higher spending on educational infrastructure. The classroom segment dominates due to the sheer volume of classrooms requiring furniture.

- Leading Region: United States

- Key Growth Drivers (United States):

- Significant investment in school infrastructure renovation and expansion.

- Strong government funding for education.

- Growing school enrollment in certain regions.

- Classroom Segment Dominance: High demand due to the large number of classrooms.

- Other Significant Segments: Cafeteria and library segments demonstrate consistent growth.

Canada and the Rest of North America present considerable, albeit smaller, opportunities. Growth in these regions is linked to government education spending and infrastructural developments.

North America K-12 School Furniture Market Product Analysis

The North American K-12 school furniture market is a dynamic sector offering a wide array of products designed to meet the diverse needs of modern education. The market encompasses traditional offerings like desks and chairs, alongside innovative solutions such as height-adjustable desks, modular furniture systems, and technologically integrated smart furniture. These advancements reflect a growing focus on enhancing student comfort, promoting adaptable learning environments, and fostering greater student engagement. Key features driving product differentiation include durability, ergonomic design, aesthetic appeal, compliance with stringent safety regulations, and alignment with specific educational requirements. The market is increasingly driven by a demand for sustainable and environmentally friendly materials and manufacturing processes.

Key Drivers, Barriers & Challenges in North America K-12 School Furniture Market

Key Drivers: Several factors fuel the growth of the North American K-12 school furniture market. These include: rising school enrollments necessitating increased furniture provision; government funding initiatives aimed at improving school infrastructure; a heightened demand for ergonomic and sustainable furniture that promotes student health and well-being; and ongoing technological advancements that continue to shape innovative furniture designs and functionalities.

Challenges: The market faces significant challenges, including: fluctuating raw material prices leading to unpredictable manufacturing costs; supply chain disruptions causing delays and impacting production output; intense competition among established and emerging manufacturers; and stringent safety and environmental regulations that add complexity and expense to product development and compliance. The supply chain disruptions experienced in 2022-2023, for example, resulted in a substantial (quantify with percentage if possible, e.g., 15-20%) increase in production costs, significantly impacting market profitability for many players.

Growth Drivers in the North America K-12 School Furniture Market

Government initiatives promoting school infrastructure upgrades and the increasing focus on creating healthier and more stimulating learning environments significantly boost market growth. Technological advancements, such as the integration of smart technology, and rising demand for ergonomic and sustainable furniture are also key drivers.

Challenges Impacting North America K-12 School Furniture Market Growth

The North American K-12 school furniture market's growth trajectory is significantly influenced by several persistent challenges. Supply chain vulnerabilities and the volatility of raw material prices pose major obstacles, impacting both production costs and timely delivery. Furthermore, navigating stringent regulatory compliance requirements and competing effectively within a fiercely competitive market landscape place considerable pressure on manufacturers' profitability and expansion strategies. Successfully addressing these challenges will require strategic adaptation and innovative solutions from market participants.

Key Players Shaping the North America K-12 School Furniture Market

- Fleetwood Furniture

- Knoll Inc

- Virco Manufacturing Corporation

- HNI Corporation

- Haworth Inc

- Steelcase Inc

- VS America Inc

- Krueger International Inc

- Herman Miller Inc

- Agati Inc

- Hertz Furniture Systems LLC

Significant North America K-12 School Furniture Market Industry Milestones

- February 2023: Steelcase named among the world's leading brands on the Fortune 2023 World's Most Admired Companies list for the 17th year, reinforcing its strong brand reputation and market leadership.

- January 2023: Steelcase Health's partnership with KwickScreen expands its offerings in the healthcare sector, potentially influencing future product development and market expansion into adjacent segments.

Future Outlook for North America K-12 School Furniture Market

The North America K-12 school furniture market is projected to experience continued growth, driven by several key factors. These include: sustained investment in school infrastructure modernization and improvement; evolving educational philosophies that prioritize student well-being and the integration of technology into the learning environment; and a growing preference for sustainable and ergonomically designed furniture solutions that support student health and learning outcomes. Companies seeking to capitalize on this market potential will need to prioritize strategic partnerships, product innovation, and effective adaptation to market challenges, including navigating supply chain complexities and addressing environmental concerns.

North America K-12 School Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Desk and Chairs

- 2.2. Storage

-

3. End User

- 3.1. Classroom

- 3.2. Cafeteria

- 3.3. Library

- 3.4. Office

North America K-12 School Furniture Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America K-12 School Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Convenient Kitchen Appliances

- 3.3. Market Restrains

- 3.3.1. Preference for Traditional Manual Methods of Food Preparation

- 3.4. Market Trends

- 3.4.1. Wood Furniture is Dominating the Market in United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America K-12 School Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Desk and Chairs

- 5.2.2. Storage

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Classroom

- 5.3.2. Cafeteria

- 5.3.3. Library

- 5.3.4. Office

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America K-12 School Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America K-12 School Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America K-12 School Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America K-12 School Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Fleet Wood Furniture

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Knoll Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Virco Manufacturing Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 HNI Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Haworth Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Steelcase Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VS America Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Krueger International Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Herman Miller Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agati Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hertz Furniture Systems LLC**List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Fleet Wood Furniture

List of Figures

- Figure 1: North America K-12 School Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America K-12 School Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: North America K-12 School Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America K-12 School Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 3: North America K-12 School Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: North America K-12 School Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America K-12 School Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America K-12 School Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America K-12 School Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: North America K-12 School Furniture Market Revenue Million Forecast, by Product 2019 & 2032

- Table 13: North America K-12 School Furniture Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America K-12 School Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America K-12 School Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America K-12 School Furniture Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the North America K-12 School Furniture Market?

Key companies in the market include Fleet Wood Furniture, Knoll Inc, Virco Manufacturing Corporation, HNI Corporation, Haworth Inc, Steelcase Inc, VS America Inc, Krueger International Inc, Herman Miller Inc, Agati Inc, Hertz Furniture Systems LLC**List Not Exhaustive.

3. What are the main segments of the North America K-12 School Furniture Market?

The market segments include Material, Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Convenient Kitchen Appliances.

6. What are the notable trends driving market growth?

Wood Furniture is Dominating the Market in United States.

7. Are there any restraints impacting market growth?

Preference for Traditional Manual Methods of Food Preparation.

8. Can you provide examples of recent developments in the market?

February 2023: Steelcase has been named among the world's leading brands on the Fortune 2023 World's Most Admired Companies list for the 17th year, recognized as fourth in the Home Equipment and Furnishings category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America K-12 School Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America K-12 School Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America K-12 School Furniture Market?

To stay informed about further developments, trends, and reports in the North America K-12 School Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence