Key Insights

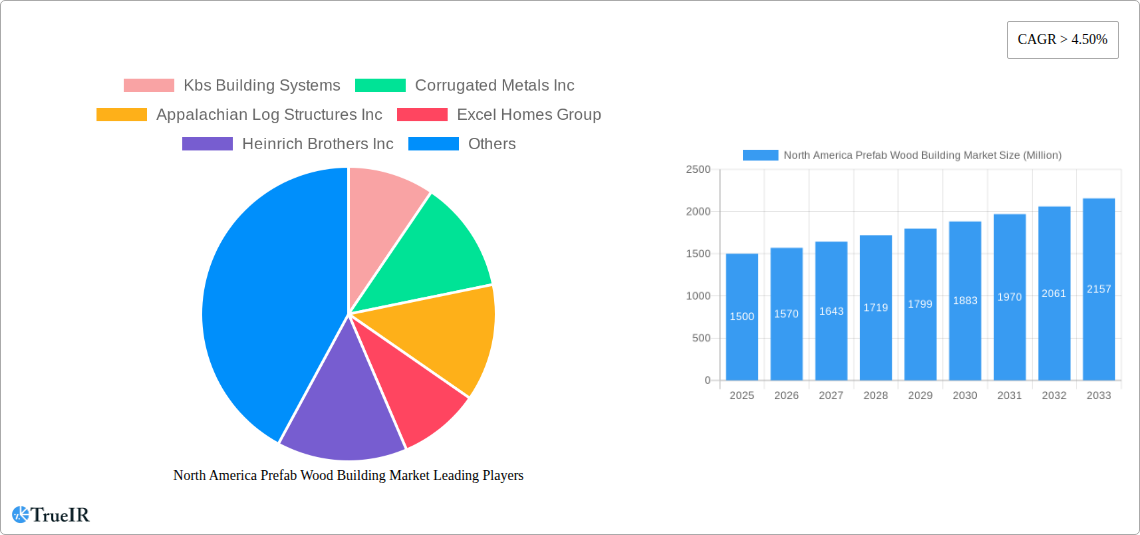

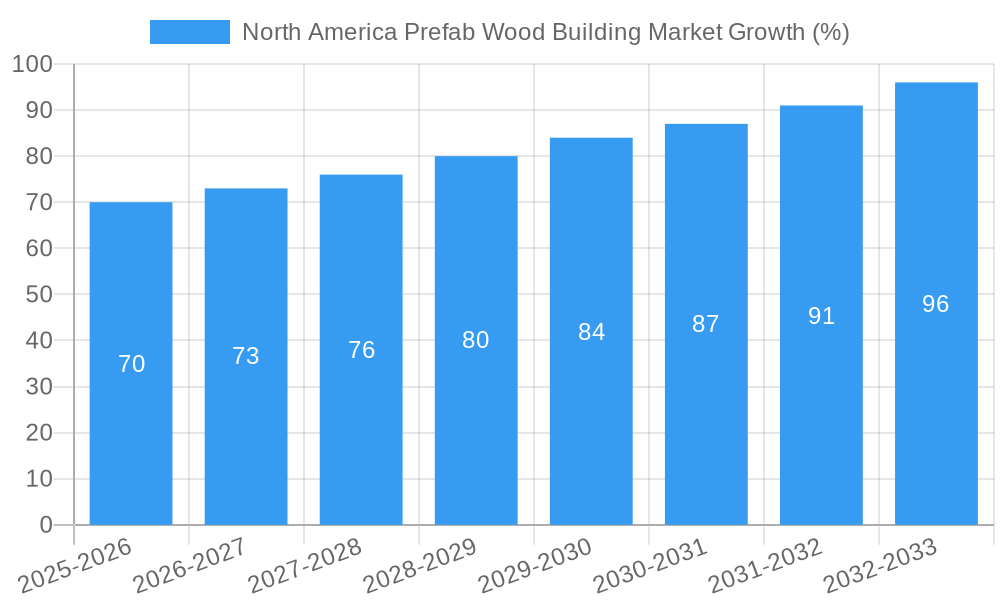

The North American prefab wood building market is experiencing robust growth, driven by increasing demand for sustainable and efficient construction solutions. With a current market size exceeding $XX million (estimated based on provided CAGR and market trends), the market is projected to maintain a compound annual growth rate (CAGR) of over 4.50% from 2025 to 2033. Several factors contribute to this expansion. The rising adoption of sustainable building practices, coupled with the inherent eco-friendliness of wood, is a significant driver. Furthermore, the prefabrication process offers substantial advantages in terms of reduced construction time, improved quality control, and lower labor costs, making it an attractive option for both residential and commercial projects. The increasing urbanization and the need for faster housing solutions are also fueling market demand. Segment-wise, Cross-laminated timber (CLT) panels are gaining traction due to their superior strength and versatility, while the multi-family residential sector is expected to witness significant growth, driven by the rising population and increasing demand for affordable housing. Growth is also being observed across various regions within North America, with the United States expected to dominate the market, followed by Canada and Mexico. However, challenges such as the fluctuating price of lumber and the need for skilled labor to assemble prefab structures could potentially restrain market growth to some extent.

The market's competitive landscape is fragmented, with several key players like Kbs Building Systems, Corrugated Metals Inc, and Clayton Homes Inc. These companies are focusing on innovation and product diversification to cater to the evolving needs of the market. The ongoing focus on improving the energy efficiency of buildings and the integration of smart technologies in prefab wood structures further enhances the attractiveness of this market. Future growth will depend on continuous technological advancements, government support for sustainable building initiatives, and the efficient management of supply chain complexities to address potential material cost volatility. Over the forecast period, the market is poised for significant expansion, presenting attractive opportunities for both established players and new entrants. The rising adoption of advanced manufacturing techniques and digitalization in the construction industry will further contribute to the market's expansion.

North America Prefab Wood Building Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Prefab Wood Building Market, offering valuable insights for industry stakeholders, investors, and researchers. The study covers the period from 2019 to 2033, with a focus on the forecast period from 2025 to 2033, using 2025 as the base year. The report delves into market size, segmentation, competitive landscape, and future growth projections, utilizing robust data and analysis to provide a clear and actionable understanding of this dynamic market. Key players such as Kbs Building Systems, Corrugated Metals Inc, Appalachian Log Structures Inc, Excel Homes Group, Heinrich Brothers Inc, Clayton Homes Inc, Speed Space, R P Crawford Co Inc, Guerdon Modular Buildings, and Alta-Fab Structures are profiled, among others.

North America Prefab Wood Building Market Structure & Competitive Landscape

The North American prefab wood building market is characterized by a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Several large players dominate significant market shares, while numerous smaller companies compete in niche segments. The market's competitive intensity is driven by factors such as product differentiation, technological innovation, and pricing strategies.

Innovation Drivers: The market witnesses continuous innovation in panel systems (CLT, NLT, DLT, GLT), construction techniques, and design aesthetics. Sustainability concerns are fueling the adoption of eco-friendly materials and construction methods.

Regulatory Impacts: Building codes and regulations influence design, material selection, and construction processes, impacting both costs and market penetration. Government incentives for sustainable building practices also play a significant role.

Product Substitutes: Traditional construction methods pose a primary competitive challenge, although prefab wood's advantages in speed, cost-effectiveness, and sustainability are gradually increasing its appeal. Other substitutes include steel and concrete prefab structures.

End-User Segmentation: The market is segmented into Single Family Residential, Multi-family Residential, Office, Hospitality, and Others, each with unique growth trajectories and requirements.

M&A Trends: The past five years have seen xx mergers and acquisitions (M&A) deals in the North American prefab wood building market, with an average deal value of xx Million. Consolidation is expected to continue as larger companies seek to expand their market share and geographical reach. The Volumetric Building Companies' acquisition of a Pennsylvania manufacturing facility in August 2022 exemplifies this trend.

North America Prefab Wood Building Market Market Trends & Opportunities

The North American prefab wood building market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This growth is fueled by several key factors:

- Increasing demand for affordable and sustainable housing: The rising cost of traditional construction is driving demand for more cost-effective and environmentally friendly alternatives.

- Technological advancements: Innovations in design, materials, and manufacturing processes are improving the quality, efficiency, and speed of prefab construction.

- Growing adoption of sustainable building practices: Environmental awareness and government regulations are promoting the use of sustainable materials like wood.

- Shorter construction timelines: Prefab construction significantly reduces project completion times compared to traditional methods.

- Improved design flexibility: Prefab designs are becoming increasingly customizable and aesthetically pleasing.

Market penetration rates vary across segments and regions, with the single-family residential segment showing the highest penetration, followed by multi-family residential. Technological shifts, such as the increasing use of advanced software for design and manufacturing, are further streamlining the process and enhancing efficiency. Consumer preferences are leaning towards sustainable, customizable, and aesthetically pleasing homes, which prefab wood construction can successfully fulfill. The competitive landscape is dynamic, with established players expanding their product lines and entering new segments, while new entrants are leveraging innovative technologies to gain market share.

Dominant Markets & Segments in North America Prefab Wood Building Market

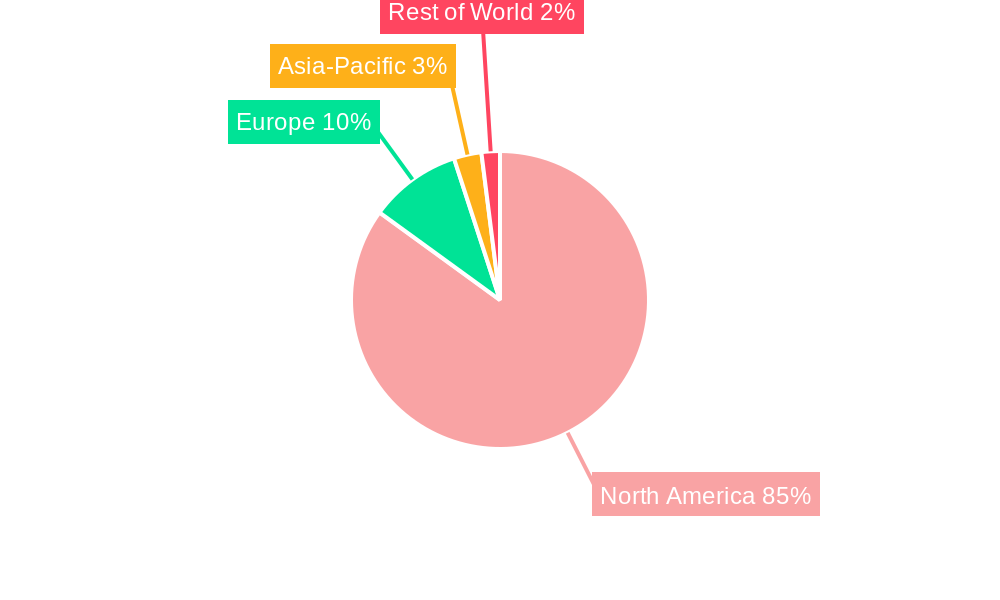

The United States represents the largest market for prefab wood buildings in North America, driven by its vast housing market and substantial construction activity. However, Canada is experiencing significant growth due to increasing government investments in infrastructure and affordable housing initiatives. Mexico's market is showing moderate growth. The Rest of North America segment shows limited activity at present.

By Panel Systems: The Cross-laminated timber (CLT) segment holds the largest market share, fueled by its superior strength and structural properties. Glue-laminated timber (GLT) columns and beams are also experiencing significant growth, driven by their versatility and cost-effectiveness.

By Application: The Single Family Residential segment commands the largest market share due to the high demand for affordable housing. Multi-family Residential is a rapidly growing segment, driven by increasing urbanization and population density.

Key Growth Drivers:

- Favorable government policies and incentives: Initiatives promoting sustainable construction and affordable housing boost the market.

- Robust infrastructure development: Investments in transportation and other infrastructure create demand for new buildings.

- Technological advancements: Innovations in panel systems and construction methods enhance efficiency and affordability.

- Growing awareness of environmental sustainability: Demand for eco-friendly building materials is increasing.

North America Prefab Wood Building Market Product Analysis

Prefab wood buildings offer a range of advantages, including faster construction times, reduced labor costs, and improved sustainability compared to traditional methods. Technological advancements in panel systems, like CLT and NLT, enhance structural performance and design flexibility. Innovations in modular design and prefabrication techniques are leading to more customizable and aesthetically appealing structures, thus improving market fit.

Key Drivers, Barriers & Challenges in North America Prefab Wood Building Market

Key Drivers:

- Increased demand for affordable housing coupled with rising labor costs in traditional construction.

- Growing awareness of sustainability and environmental benefits of wood construction.

- Government incentives and policies promoting sustainable building practices.

- Advancements in prefabrication technology and design software.

Key Challenges:

- Supply chain disruptions impacting the availability and cost of raw materials. This has resulted in a xx% increase in material costs since 2020.

- Stringent building codes and regulations increasing design and construction complexities and potentially increasing costs.

- Competition from traditional construction methods and other prefab building materials.

- Skilled labor shortages hindering the efficient execution of prefabrication projects.

Growth Drivers in the North America Prefab Wood Building Market Market

The market is primarily driven by increasing demand for sustainable and affordable housing, supportive government policies, and continuous advancements in prefabrication technologies. These factors are expected to fuel strong growth in the coming years. Government initiatives promoting green building practices and affordable housing schemes are playing a significant role.

Challenges Impacting North America Prefab Wood Building Market Growth

Challenges include supply chain disruptions, the increasing cost of raw materials, stringent building regulations that can limit design flexibility, and competition from traditional construction and other prefab materials like steel.

Key Players Shaping the North America Prefab Wood Building Market Market

- Kbs Building Systems

- Corrugated Metals Inc

- Appalachian Log Structures Inc

- Excel Homes Group

- Heinrich Brothers Inc

- Clayton Homes Inc

- Speed Space

- R P Crawford Co Inc

- Guerdon Modular Buildings

- Alta-Fab Structures

Significant North America Prefab Wood Building Market Industry Milestones

- November 2022: Installation of a 40m2 prefabricated steel and wood tiny house in Canada by Lloyoll Prefabs, highlighting the growing market for smaller, sustainable prefab homes.

- August 2022: Volumetric Building Companies' acquisition of a manufacturing facility, signifying the ongoing consolidation and expansion within the industry.

Future Outlook for North America Prefab Wood Building Market Market

The North American prefab wood building market is poised for continued growth, driven by ongoing demand for sustainable and affordable housing solutions. Strategic partnerships, technological innovations, and expansion into new market segments will be key to success. The market presents significant opportunities for companies capable of navigating supply chain challenges and adapting to evolving consumer preferences.

North America Prefab Wood Building Market Segmentation

-

1. Panel Systems

- 1.1. Cross-laminated timber (CLT) panels

- 1.2. Nail-laminated timber (NLT) panels

- 1.3. Dowel-laminated timber (DLT) panels

- 1.4. Glue-laminated timber (GLT) columns and beams

-

2. Application

- 2.1. Single Family Residential

- 2.2. Multi-family Residential

- 2.3. Office

- 2.4. Hospitality

- 2.5. Others

North America Prefab Wood Building Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Prefab Wood Building Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Increasing Government Initiative is assisting Canada's Prefab growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Prefab Wood Building Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 5.1.1. Cross-laminated timber (CLT) panels

- 5.1.2. Nail-laminated timber (NLT) panels

- 5.1.3. Dowel-laminated timber (DLT) panels

- 5.1.4. Glue-laminated timber (GLT) columns and beams

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Single Family Residential

- 5.2.2. Multi-family Residential

- 5.2.3. Office

- 5.2.4. Hospitality

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Panel Systems

- 6. United States North America Prefab Wood Building Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Prefab Wood Building Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Prefab Wood Building Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Prefab Wood Building Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kbs Building Systems

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Corrugated Metals Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Appalachian Log Structures Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Excel Homes Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Heinrich Brothers Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Clayton Homes Inc **List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Speed Space

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 R P Crawford Co Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Guerdon Modular Buildings

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Alta-Fab Structures

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kbs Building Systems

List of Figures

- Figure 1: North America Prefab Wood Building Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Prefab Wood Building Market Share (%) by Company 2024

List of Tables

- Table 1: North America Prefab Wood Building Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Prefab Wood Building Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 3: North America Prefab Wood Building Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Prefab Wood Building Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Prefab Wood Building Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Prefab Wood Building Market Revenue Million Forecast, by Panel Systems 2019 & 2032

- Table 11: North America Prefab Wood Building Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: North America Prefab Wood Building Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Prefab Wood Building Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Prefab Wood Building Market?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the North America Prefab Wood Building Market?

Key companies in the market include Kbs Building Systems, Corrugated Metals Inc, Appalachian Log Structures Inc, Excel Homes Group, Heinrich Brothers Inc, Clayton Homes Inc **List Not Exhaustive, Speed Space, R P Crawford Co Inc, Guerdon Modular Buildings, Alta-Fab Structures.

3. What are the main segments of the North America Prefab Wood Building Market?

The market segments include Panel Systems, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Increasing Government Initiative is assisting Canada's Prefab growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

November 2022 - In Canada, a 40m2 tiny prefabricated steel and wood house has been installed for vacations and short stays. It was designed by Lloyoll Prefabs, a manufacturer of Premium Modular Homes brought to the site on a truck and set on a concrete slab. The open floor layout makes the most of every square inch, with a kitchen, bathroom, master bedroom, and loft bedroom with two more beds. It has a little ecological imprint, and its large apertures provide a better connection to the outside world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Prefab Wood Building Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Prefab Wood Building Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Prefab Wood Building Market?

To stay informed about further developments, trends, and reports in the North America Prefab Wood Building Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence