Key Insights

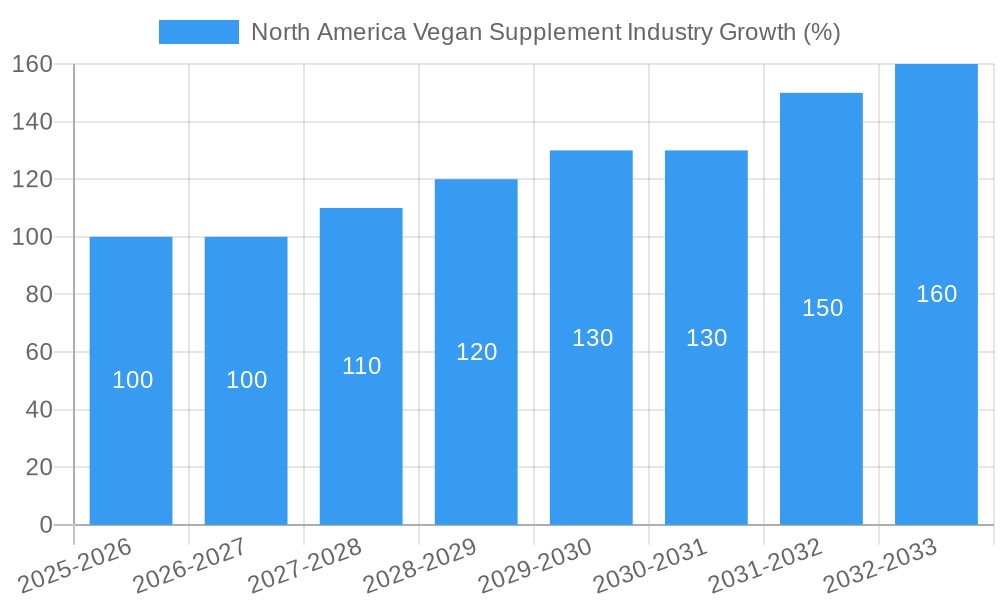

The North American vegan supplement market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing prevalence of veganism and vegetarian diets within North America, driven by health consciousness, environmental concerns, and ethical considerations, is a significant factor. Furthermore, growing awareness of the nutritional gaps often associated with plant-based diets is prompting consumers to seek supplementation to ensure adequate intake of essential vitamins, proteins, omega-3 fatty acids, and other nutrients. The rise of online retail channels has also facilitated access to a wider range of vegan supplements, boosting market accessibility and contributing to growth. Key segments within the market include protein supplements, vitamin supplements, omega-3 supplements, and other specialized vegan supplements. Distribution primarily occurs through pharmacies, supermarkets, online platforms, and other retail channels. Leading players such as Nestlé, NOW Health Group, and Canopy Growth (Biosteel) are leveraging innovation and brand recognition to capture market share, while smaller companies focus on niche segments and specialized formulations.

The market's growth is, however, subject to certain restraints. Price sensitivity among consumers, particularly with premium products, can hinder expansion. Furthermore, stringent regulatory frameworks regarding supplement labeling and efficacy can pose challenges for manufacturers. Maintaining product quality, ensuring authenticity, and addressing consumer concerns about potential side effects are also vital for sustained market growth. The competitive landscape is characterized by both established players and emerging brands, leading to intensified competition and a need for constant innovation to stay ahead. Geographic distribution within North America shows significant concentration in the United States, with Canada and Mexico representing notable but smaller markets. Future growth will likely be shaped by emerging trends such as personalized nutrition, the development of functional foods incorporating vegan supplements, and the ongoing evolution of consumer preferences within the health and wellness sector.

This comprehensive report provides a detailed analysis of the North America vegan supplement market, covering the period from 2019 to 2033. It offers invaluable insights into market size, growth drivers, competitive dynamics, and future trends, making it an essential resource for industry stakeholders, investors, and researchers. The report leverages extensive data analysis and expert insights to forecast significant growth, presenting a clear picture of opportunities and challenges within this rapidly expanding sector.

North America Vegan Supplement Industry Market Structure & Competitive Landscape

The North American vegan supplement market is characterized by a moderately fragmented structure, with several key players and numerous smaller niche brands competing for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. However, larger players like Nestlé S.A. exert significant influence due to their extensive distribution networks and established brand recognition. Innovation plays a crucial role, with companies continuously developing new formulations and delivery methods to cater to evolving consumer preferences. Regulatory oversight, primarily at the federal and state levels in the US, and provincial levels in Canada, shapes product development and labeling requirements. Product substitutes, such as whole foods and alternative health practices, exert a degree of competitive pressure. The market also sees considerable end-user segmentation, targeting specific demographics with tailored product offerings, including athletes, health-conscious individuals, and those with specific dietary needs. M&A activity has been moderate in recent years, with xx mergers and acquisitions recorded between 2019 and 2024, primarily focused on expanding product portfolios and distribution channels.

- Market Concentration: Moderate fragmentation; HHI (2024): xx

- Innovation Drivers: New formulations, delivery methods (e.g., gummies, powders), sustainable sourcing.

- Regulatory Impacts: FDA guidelines (US), Health Canada regulations (Canada), impacting labeling and ingredient claims.

- Product Substitutes: Whole foods, alternative health practices.

- End-User Segmentation: Athletes, health-conscious individuals, specific dietary needs (e.g., allergies).

- M&A Trends: Moderate activity (xx deals 2019-2024); focus on portfolio expansion and distribution.

North America Vegan Supplement Industry Market Trends & Opportunities

The North American vegan supplement market is experiencing robust growth, driven by increasing consumer awareness of health and wellness, rising adoption of vegan and plant-based lifestyles, and the growing demand for convenient and effective nutritional solutions. The market size reached approximately $xx Million in 2024 and is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching $xx Million by 2033. Technological advancements, such as improved extraction techniques and novel delivery systems, are enhancing product efficacy and consumer appeal. Consumer preferences are shifting towards clean label products, with a focus on natural ingredients and transparency. Competitive dynamics are intense, with established players facing challenges from emerging brands offering innovative and specialized products. Market penetration rates vary across segments and regions, with online channels experiencing the fastest growth.

Dominant Markets & Segments in North America Vegan Supplement Industry

The United States holds the largest share of the North American vegan supplement market, commanding approximately [Insert Updated Percentage]% of the total market value in 2024. This leadership stems from a substantial and expanding vegan/vegetarian population, a strong emphasis on health and wellness, and a well-developed retail infrastructure. The protein supplement segment generates the highest revenue, followed closely by vitamins and omega-3 supplements (derived primarily from algae). Online sales channels are experiencing the most rapid growth, reflecting the increasing popularity and convenience of e-commerce.

- Key Growth Drivers (United States): Expanding vegan/vegetarian population, rising health consciousness, robust retail infrastructure (including specialty stores and large retailers), strong online presence and direct-to-consumer marketing.

- Key Growth Drivers (Canada): Growing health awareness, supportive government initiatives promoting plant-based diets and sustainable food systems, increasing consumer demand for transparency and ethically sourced ingredients.

- Key Growth Drivers (Mexico): Rising disposable incomes, increasing awareness of the health benefits of plant-based nutrition and supplementation, growing popularity of veganism and flexitarian diets, expanding access to health and wellness information.

- Leading Segment (by Type): Protein supplements (including powders, bars, and ready-to-drink beverages)

- Leading Segment (by Distribution Channel): Online channels (e-commerce websites, online marketplaces, subscription services)

North America Vegan Supplement Industry Product Analysis

The vegan supplement market is characterized by continuous innovation, with advancements such as enhanced bioavailability through technologies like liposomal encapsulation and the development of novel ingredient delivery systems. Companies are prioritizing improved absorption rates and enhanced palatability to cater to consumer preferences for both efficacy and enjoyable product experiences. The market encompasses a diverse range of products, including protein powders, comprehensive vitamin and mineral complexes, omega-3 fatty acid supplements from algae, and specialized formulations targeting specific health goals, such as immune support, cognitive enhancement, gut health, and sports performance. Competitive differentiation is achieved through product innovation, sustainable and high-quality ingredient sourcing, and targeted marketing strategies that resonate with the values and priorities of the vegan and health-conscious consumer.

Key Drivers, Barriers & Challenges in North America Vegan Supplement Industry

Key Drivers:

The expanding vegan and vegetarian population, heightened consumer awareness of health and wellness, growing demand for convenient and effective nutritional solutions, and ongoing technological advancements in supplement formulation and delivery are key drivers of market expansion. Government regulations promoting public health and wellness, along with increased consumer trust in certified organic and ethically sourced products, also contribute to market growth.

Challenges:

Regulatory complexities concerning product labeling, ingredient claims, and health-related statements present significant hurdles. Supply chain vulnerabilities, particularly regarding the sourcing of key raw materials, lead to production constraints and fluctuating costs. Intense competition from both established and emerging players necessitates continuous innovation and strategic marketing to capture market share. Consumer skepticism regarding supplement efficacy and potential adverse effects can also impact market growth. The [Insert Updated Percentage]% increase in raw material costs in 2024 directly impacted profit margins across the industry.

Growth Drivers in the North America Vegan Supplement Industry Market

The expanding vegan/vegetarian population coupled with rising health consciousness fuels significant demand. Technological breakthroughs enhance product absorption and efficacy, while increased e-commerce penetration broadens market access.

Challenges Impacting North America Vegan Supplement Industry Growth

Regulatory hurdles related to product labeling and health claims continue to pose significant challenges. Supply chain disruptions and price volatility for key ingredients create production uncertainties. The competitive landscape demands continuous product innovation, effective marketing strategies, and robust brand building to stand out in a crowded market. Furthermore, educating consumers about the benefits and safety of vegan supplements is crucial to mitigate skepticism and boost market adoption.

Key Players Shaping the North America Vegan Supplement Industry Market

- Nestlé S.A.

- NOW Health Group Inc

- Canopy Growth Corporation (Biosteel Sports Nutrition Inc)

- Ora Organic

- Wonder Laboratories

- Future Kind

- FORGE Supplements

- Country Life LLC

- Blueroot Health

- Life Extension

- BrainMD Health

- [Add other relevant key players]

Significant North America Vegan Supplement Industry Industry Milestones

- September 2021: Life Extension launched a new plant-based multivitamin.

- April 2022: Blueroot Health's Vital Nutrients launched Ultra Pure Vegan Omega SPM+.

- August 2022: BrainMD Health launched an EPA/DHA vegan omega-3 supplement.

Future Outlook for North America Vegan Supplement Industry Market

The North American vegan supplement market is poised for continued expansion, fueled by sustained growth in the vegan population, rising health awareness, and ongoing product innovation. Strategic opportunities exist in developing sustainable and ethically sourced products, catering to specific niche markets, and leveraging digital marketing channels to reach a broader consumer base. The market's potential is significant, with substantial room for growth across various segments and geographical regions.

North America Vegan Supplement Industry Segmentation

-

1. Type

- 1.1. Protein

- 1.2. Vitamins

- 1.3. Omega Supplements

- 1.4. Other Vegan Supplements

-

2. Distribution Channel

- 2.1. Pharmacies & Drug Stores

- 2.2. Supermarkets & Hypermarkets

- 2.3. Online Channels

- 2.4. Others

- 2.5. Convenience Food

- 2.6. Other Distribution Channels

North America Vegan Supplement Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Vegan Supplement Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Veganism in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vegan Supplement Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Protein

- 5.1.2. Vitamins

- 5.1.3. Omega Supplements

- 5.1.4. Other Vegan Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Pharmacies & Drug Stores

- 5.2.2. Supermarkets & Hypermarkets

- 5.2.3. Online Channels

- 5.2.4. Others

- 5.2.5. Convenience Food

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Vegan Supplement Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Vegan Supplement Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Vegan Supplement Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Vegan Supplement Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nestlé S A

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NOW Health Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Canopy Growth Corporation (Biosteel Sports Nutrition Inc )

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ora Organic

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Wonder Laboratories

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Future Kind

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 FORGE Supplements

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Country Life LLC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Blueroot Health*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Life Extension

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BrainMD Health

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Nestlé S A

List of Figures

- Figure 1: North America Vegan Supplement Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Vegan Supplement Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Vegan Supplement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Vegan Supplement Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Vegan Supplement Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Vegan Supplement Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Vegan Supplement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Vegan Supplement Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: North America Vegan Supplement Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: North America Vegan Supplement Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Vegan Supplement Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vegan Supplement Industry?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the North America Vegan Supplement Industry?

Key companies in the market include Nestlé S A, NOW Health Group Inc, Canopy Growth Corporation (Biosteel Sports Nutrition Inc ), Ora Organic, Wonder Laboratories, Future Kind, FORGE Supplements, Country Life LLC, Blueroot Health*List Not Exhaustive, Life Extension, BrainMD Health.

3. What are the main segments of the North America Vegan Supplement Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Veganism in the Region.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2022: BrainMD Health, a leader in premium-quality, science-based nutraceuticals, launched an EPA/DHA vegan omega-3 supplement. The product was made using sustainable and certified marine algae.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vegan Supplement Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vegan Supplement Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vegan Supplement Industry?

To stay informed about further developments, trends, and reports in the North America Vegan Supplement Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence