Key Insights

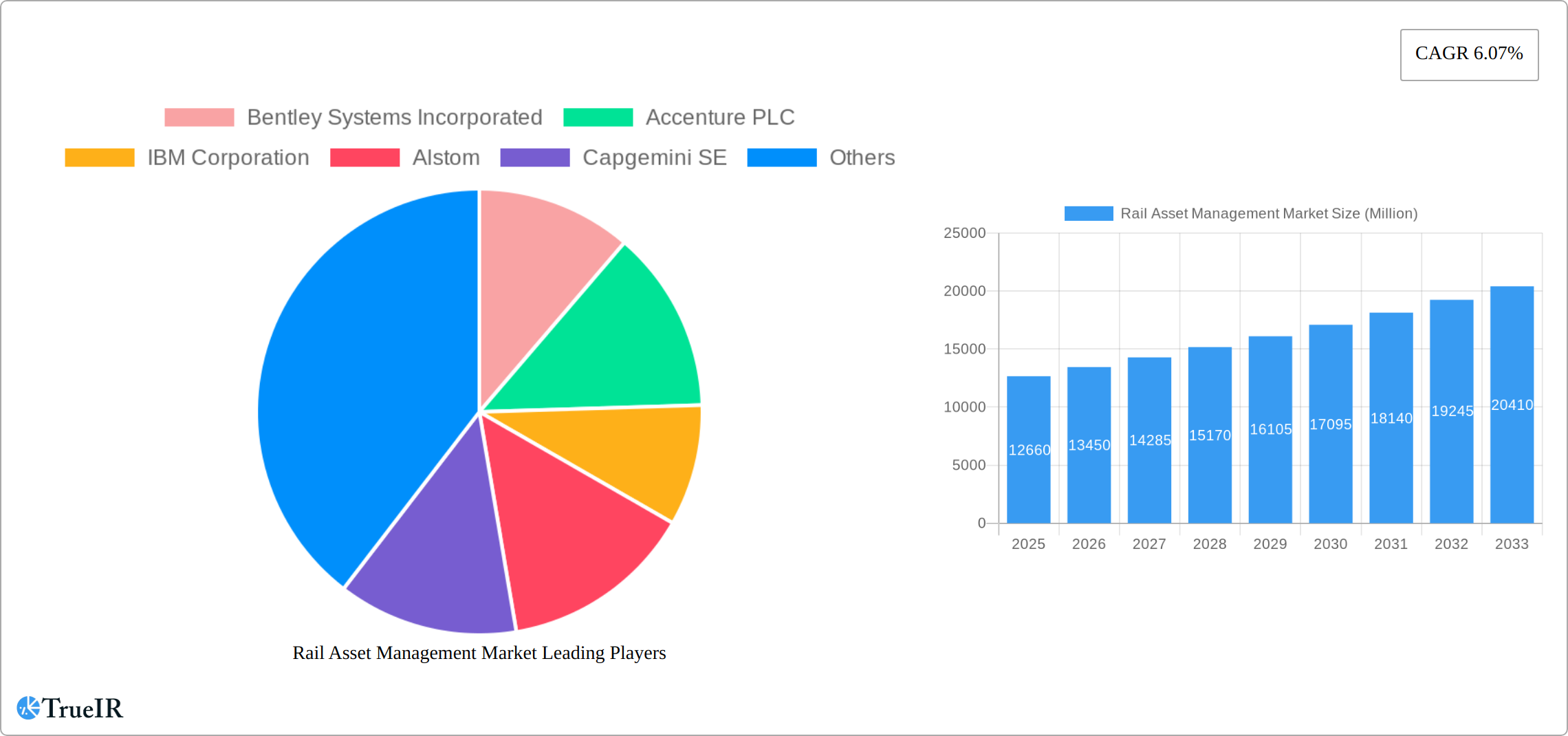

The global Rail Asset Management market, valued at $12.66 billion in 2025, is projected to experience robust growth, driven by increasing investments in railway infrastructure modernization and the rising adoption of digital technologies for improved efficiency and safety. A Compound Annual Growth Rate (CAGR) of 6.07% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated value exceeding $20 billion by 2033. Key drivers include the growing need for predictive maintenance to reduce operational costs and minimize disruptions, the increasing complexity of railway systems demanding sophisticated management solutions, and stringent government regulations promoting safety and asset optimization. The market is segmented by deployment (on-premises and cloud) and application (rolling stock and infrastructure). Cloud-based solutions are gaining traction due to their scalability, accessibility, and cost-effectiveness. Within applications, the rolling stock segment is expected to show higher growth due to the need for real-time monitoring and predictive maintenance of critical components. Geographically, North America and Europe currently hold significant market shares due to advanced infrastructure and early adoption of digital technologies; however, Asia-Pacific is poised for substantial growth driven by rapid infrastructure development in countries like China and India. Competition is fierce, with established players like Bentley Systems, Accenture, IBM, and Siemens alongside specialized rail technology providers driving innovation and market penetration.

The strategic focus among market players is shifting towards integrated solutions that combine data analytics, IoT sensors, and AI-powered predictive modeling to optimize asset performance and lifecycle management. This trend is further fueled by the need for improved interoperability across different railway systems and the increasing demand for data-driven insights to make informed decisions regarding maintenance, upgrades, and capital investments. The adoption of digital twins is also expected to play a significant role in the market's future growth, enabling virtual representations of railway assets for effective simulation and optimization. While the initial investment in digital transformation can be substantial, the long-term benefits of reduced downtime, improved safety, and optimized resource allocation will continue to drive market expansion. This combined with ongoing technological advancements, and the growing adoption of sustainable practices within the railway industry, promises continued expansion of the Rail Asset Management market in the coming years.

Rail Asset Management Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Rail Asset Management Market, offering invaluable insights for stakeholders across the industry. With a meticulous examination of market trends, competitive dynamics, and future projections, this report is an essential resource for informed decision-making. The study period covers 2019-2033, with a base year of 2025 and a forecast period spanning 2025-2033. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Rail Asset Management Market Market Structure & Competitive Landscape

The Rail Asset Management market exhibits a moderately concentrated structure, with several major players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Key innovation drivers include the adoption of advanced analytics, IoT sensors, and AI-powered predictive maintenance solutions. Stringent safety regulations and increasing governmental oversight significantly impact market dynamics. Product substitutes, while limited, include traditional manual inspection methods. End-users span diverse segments including national railway operators, private railway companies, and infrastructure management firms. M&A activity within the sector has been relatively consistent, with an estimated xx Million in deal value in 2024.

- Market Concentration: Moderately Concentrated (HHI: xx)

- Innovation Drivers: Advanced analytics, IoT, AI-powered predictive maintenance

- Regulatory Impacts: Stringent safety regulations, increasing governmental oversight

- Product Substitutes: Limited, primarily manual inspection methods

- End-User Segmentation: National railway operators, private companies, infrastructure managers

- M&A Trends: Consistent activity, approximately xx Million in deal value in 2024

Rail Asset Management Market Market Trends & Opportunities

The global Rail Asset Management market is experiencing robust growth, driven by substantial investments in railway infrastructure modernization and a widespread adoption of digital technologies. Market projections indicate significant expansion, reaching [Insert Projected Market Value] by 2025 and [Insert Projected Market Value] by 2033, fueled by a robust compound annual growth rate (CAGR) of [Insert CAGR]. This expansion is primarily propelled by several key factors: a decisive shift towards predictive maintenance strategies, leveraging advanced data analytics to optimize asset utilization, and a growing preference for scalable and accessible cloud-based solutions. The market penetration rate of digital asset management solutions is steadily increasing, with projections indicating a [Insert Percentage]% penetration rate by 2033. The competitive landscape is dynamic, characterized by strategic partnerships, continuous technological advancements, and a strong focus on delivering comprehensive and integrated solutions that address the multifaceted needs of rail operators.

Dominant Markets & Segments in Rail Asset Management Market

The North American region currently holds a dominant position in the Rail Asset Management market, driven by substantial investments in infrastructure upgrades and modernization initiatives. Europe follows closely, with significant growth potential stemming from the ongoing expansion of high-speed rail networks and the implementation of smart rail solutions.

- Leading Region: North America

- Key Growth Drivers (North America): Significant infrastructure investments, modernization initiatives, government support for digital transformation

- Key Growth Drivers (Europe): Expansion of high-speed rail networks, implementation of smart rail technologies, increasing focus on sustainability

- By Deployment: Cloud-based solutions are experiencing faster growth than on-premises deployments, owing to their scalability and cost-effectiveness.

- By Application: Infrastructure asset management constitutes a larger market segment than rolling stock, due to the extensive scope of infrastructure networks and the critical need for proactive maintenance.

Rail Asset Management Market Product Analysis

The market is witnessing rapid innovation in rail asset management products, with a strong focus on developing integrated platforms that leverage advanced analytics, AI, and IoT capabilities. These solutions provide predictive maintenance functionalities, optimized resource allocation, and enhanced operational efficiency, resulting in improved safety and cost savings. The competitive advantage lies in offering comprehensive, user-friendly, and scalable solutions tailored to the specific needs of diverse rail operators and infrastructure managers.

Key Drivers, Barriers & Challenges in Rail Asset Management Market

Key Drivers:

- Increased global investments in railway infrastructure modernization and expansion.

- Rising adoption of digital technologies to enhance operational efficiency, safety, and asset lifecycle management.

- Stringent government regulations and industry standards promoting asset optimization and sustainable practices.

- Growing demand for improved passenger and freight transportation capacity and reliability.

Challenges:

- Integration complexities arising from the need to seamlessly integrate legacy systems with newer, advanced technologies.

- High initial capital expenditure required for implementing sophisticated asset management solutions.

- Significant cybersecurity concerns related to the protection of sensitive operational and asset data.

- Supply chain disruptions and volatility in component costs, leading to project delays and increased overall costs (estimated impact of [Insert Percentage]% on project costs in 2024).

- Shortage of skilled professionals capable of implementing and managing advanced rail asset management systems.

Growth Drivers in the Rail Asset Management Market Market

Technological advancements, particularly in areas like AI, IoT, and data analytics, are significantly contributing to market growth. Government initiatives aimed at upgrading railway infrastructure and fostering digital transformation also play a key role. The increasing focus on safety and operational efficiency further fuels the demand for effective rail asset management solutions.

Challenges Impacting Rail Asset Management Market Growth

Navigating regulatory complexities and ensuring stringent compliance with evolving industry standards presents significant hurdles to market expansion. Furthermore, supply chain disruptions and fluctuating component costs continue to impact project timelines and budgets. The competitive landscape, characterized by both established players and new entrants, adds another layer of complexity, necessitating continuous innovation and adaptation to maintain a competitive edge.

Key Players Shaping the Rail Asset Management Market Market

- Bentley Systems Incorporated

- Accenture PLC

- IBM Corporation

- Alstom

- Capgemini SE

- Hitachi Ltd

- Cisco Systems Inc

- Siemens AG

- Huawei Technologies Co

- Trimble Inc

- ZEDAS Gmb

- SNC-Lavalin Group Inc

- SAP SE

- Wabtec Corporation

Significant Rail Asset Management Market Industry Milestones

- April 2023: Alstom secured a contract with the Pomeranian Metropolitan Railway for comprehensive maintenance services of rail traffic control equipment, highlighting the growing demand for outsourced asset management solutions.

- April 2023: The contract renewal between GWR, Eversholt Rail, and Hitachi Rail underscores the success of predictive maintenance strategies in improving train reliability and operational efficiency. The 94% improvement in fleet dependability demonstrates the significant return on investment from advanced asset management solutions.

Future Outlook for Rail Asset Management Market Market

The Rail Asset Management market is poised for sustained growth, driven by continuous infrastructure development, the accelerating adoption of advanced digital technologies, and a growing emphasis on predictive maintenance and operational efficiency. Strategic collaborations and partnerships between technology providers and rail operators are expected to further shape the market landscape. Emerging technologies such as AI, machine learning, and blockchain hold significant potential for innovation, opening new avenues for market expansion and the creation of substantial value for stakeholders.

Rail Asset Management Market Segmentation

-

1. Deployment

- 1.1. On-Premises

- 1.2. Cloud

-

2. Application

- 2.1. Rolling Stock

- 2.2. Infrastructure

Rail Asset Management Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Rail Asset Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Effective Rail Operations; Increase in Government Initiatives and Public-Private Partnership Model; Rapid Urbanization in Developing and Underdeveloped Countries

- 3.3. Market Restrains

- 3.3.1. High Initial Investment in Creating Supporting Infrastructure and Automation

- 3.4. Market Trends

- 3.4.1. Growing Demand for Effective Rail Operations to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-Premises

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Rolling Stock

- 5.2.2. Infrastructure

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-Premises

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Rolling Stock

- 6.2.2. Infrastructure

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-Premises

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Rolling Stock

- 7.2.2. Infrastructure

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-Premises

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Rolling Stock

- 8.2.2. Infrastructure

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Australia and New Zealand Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-Premises

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Rolling Stock

- 9.2.2. Infrastructure

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. On-Premises

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Rolling Stock

- 10.2.2. Infrastructure

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Middle East and Africa Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 11.1.1. On-Premises

- 11.1.2. Cloud

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Rolling Stock

- 11.2.2. Infrastructure

- 11.1. Market Analysis, Insights and Forecast - by Deployment

- 12. North America Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 France

- 13.1.3 Germany

- 14. Asia Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 India

- 14.1.3 Japan

- 15. Australia and New Zealand Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Latin America Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Middle East and Africa Rail Asset Management Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1.

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Bentley Systems Incorporated

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Accenture PLC

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 IBM Corporation

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Alstom

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Capgemini SE

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Hitachi Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Cisco Systems Inc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Siemens AG

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Huawei Technologies Co

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Trimble Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 ZEDAS Gmb

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 SNC-Lavalin Group Inc

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 SAP SE

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Wabtec Corporation

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Bentley Systems Incorporated

List of Figures

- Figure 1: Global Rail Asset Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Middle East and Africa Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Middle East and Africa Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 17: North America Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 21: Europe Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 22: Europe Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Asia Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Asia Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Asia Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Asia Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 33: Australia and New Zealand Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 34: Australia and New Zealand Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 35: Australia and New Zealand Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 36: Australia and New Zealand Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Latin America Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Latin America Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 41: Latin America Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 42: Latin America Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Rail Asset Management Market Revenue (Million), by Deployment 2024 & 2032

- Figure 45: Middle East and Africa Rail Asset Management Market Revenue Share (%), by Deployment 2024 & 2032

- Figure 46: Middle East and Africa Rail Asset Management Market Revenue (Million), by Application 2024 & 2032

- Figure 47: Middle East and Africa Rail Asset Management Market Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East and Africa Rail Asset Management Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Rail Asset Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rail Asset Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 3: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Rail Asset Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: France Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: China Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Japan Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 23: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United States Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Canada Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 28: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: France Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 34: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Rail Asset Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 40: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 43: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 44: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Global Rail Asset Management Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 46: Global Rail Asset Management Market Revenue Million Forecast, by Application 2019 & 2032

- Table 47: Global Rail Asset Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Asset Management Market?

The projected CAGR is approximately 6.07%.

2. Which companies are prominent players in the Rail Asset Management Market?

Key companies in the market include Bentley Systems Incorporated, Accenture PLC, IBM Corporation, Alstom, Capgemini SE, Hitachi Ltd, Cisco Systems Inc, Siemens AG, Huawei Technologies Co, Trimble Inc, ZEDAS Gmb, SNC-Lavalin Group Inc, SAP SE, Wabtec Corporation.

3. What are the main segments of the Rail Asset Management Market?

The market segments include Deployment, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Effective Rail Operations; Increase in Government Initiatives and Public-Private Partnership Model; Rapid Urbanization in Developing and Underdeveloped Countries.

6. What are the notable trends driving market growth?

Growing Demand for Effective Rail Operations to Drive the Market.

7. Are there any restraints impacting market growth?

High Initial Investment in Creating Supporting Infrastructure and Automation.

8. Can you provide examples of recent developments in the market?

April 2023: Alstom, a provider of smart and sustainable mobility, signed a contract with the Pomeranian Metropolitan Railway, a Pomeranian railway infrastructure management company, to provide full maintenance services, including repairs and periodic inspections of rail traffic control equipment manufactured at the Alstom ZWUS site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Asset Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Asset Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Asset Management Market?

To stay informed about further developments, trends, and reports in the Rail Asset Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence