Key Insights

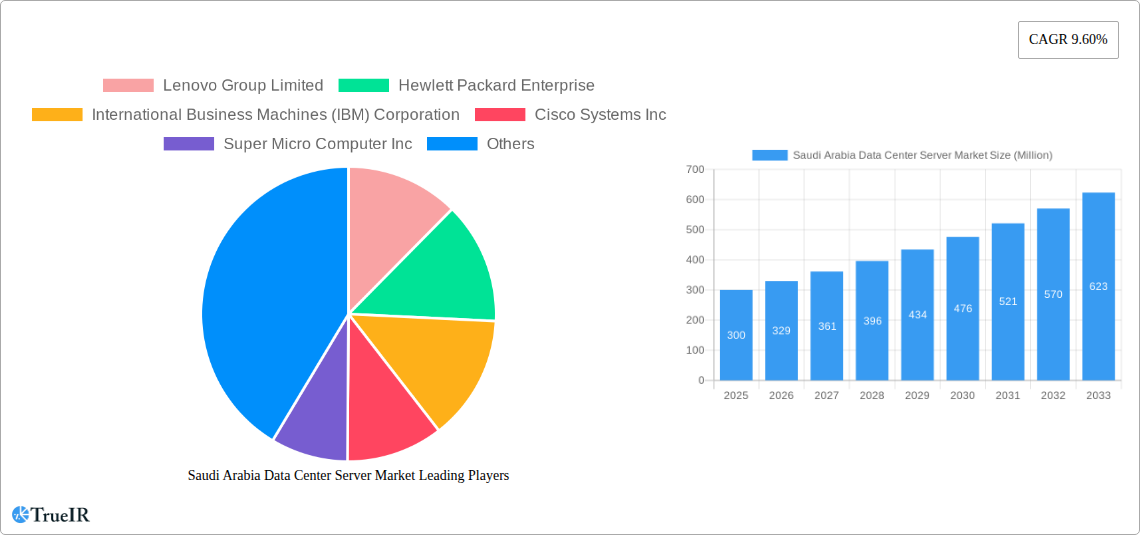

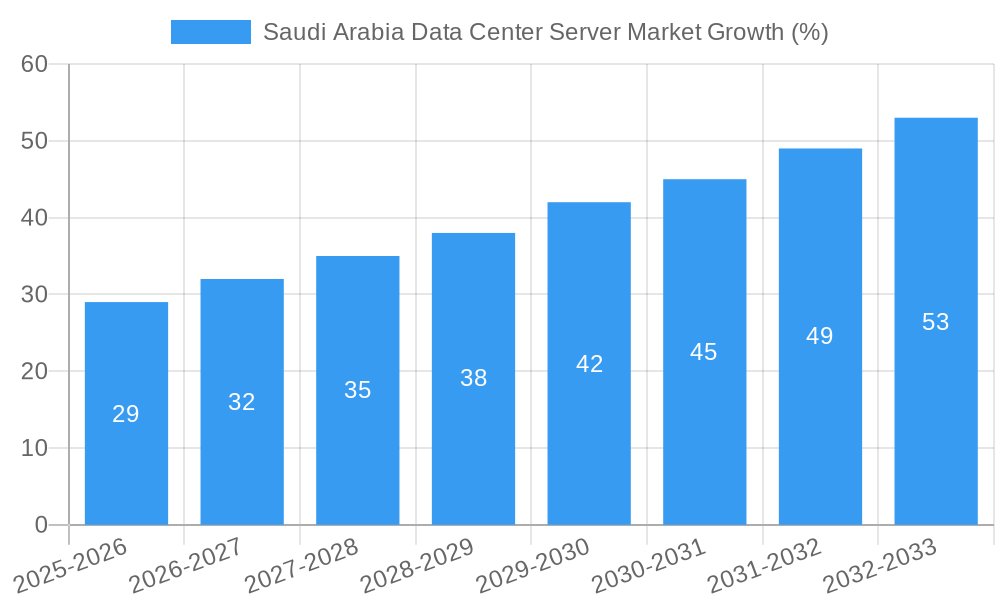

The Saudi Arabian data center server market is experiencing robust growth, driven by the Kingdom's Vision 2030 initiative, which emphasizes digital transformation and diversification of the economy. This ambitious plan necessitates significant investments in infrastructure, including a substantial expansion of data centers to support burgeoning e-commerce, cloud computing adoption, and the growth of various digital services across sectors like BFSI (Banking, Financial Services, and Insurance), government services, and the media & entertainment industry. The market's Compound Annual Growth Rate (CAGR) of 9.60% from 2019-2033 signifies a consistent upward trajectory. The increasing demand for high-performance computing, big data analytics, and improved data security further fuels this expansion. Leading vendors like Lenovo, Hewlett Packard Enterprise, IBM, and Dell are actively vying for market share, offering a range of server form factors – blade, rack, and tower – tailored to diverse customer requirements. Regional variations exist, with potential for accelerated growth in areas experiencing rapid infrastructural development. The continued focus on cloud infrastructure and the emergence of edge computing are expected to present further opportunities for market expansion within the forecast period.

While the market enjoys strong growth momentum, certain challenges remain. The relatively high cost of deploying and maintaining data center infrastructure could pose a barrier for some smaller businesses. Furthermore, ensuring data security and privacy in a rapidly evolving digital landscape is paramount and requires ongoing investment. The successful navigation of these challenges and the continued government support for technological advancements will be crucial in shaping the future trajectory of the Saudi Arabian data center server market. The diverse segmentations of the market, catering to various end-users' specific needs, create opportunities for specialized solutions and sustained market expansion. This combination of strong drivers and managed challenges creates a positive outlook for the Saudi Arabian data center server market in the coming years.

Saudi Arabia Data Center Server Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia data center server market, encompassing historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033). It delves into market size, segmentation, competitive landscape, growth drivers, challenges, and key industry milestones, offering valuable insights for stakeholders across the value chain. The report leverages extensive market research, incorporating quantitative data and qualitative analysis to provide a clear picture of this dynamic market. The report utilizes high-volume keywords like "Saudi Arabia data center market," "server market," "data center server," "blade server," "rack server," and "AI server," to ensure optimal visibility in search engine results. Market values are expressed in Millions.

Saudi Arabia Data Center Server Market Structure & Competitive Landscape

The Saudi Arabia data center server market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Lenovo, Hewlett Packard Enterprise, IBM, Cisco, Super Micro, Dell, Quanta Computer, Kingston Technology, Inspur, and Huawei, account for a significant market share, engaging in intense competition driven by innovation and product differentiation. The market is influenced by several factors:

- Innovation Drivers: Constant advancements in processor technology, memory capacity, and storage solutions are driving market growth. The increasing adoption of AI and cloud computing fuels demand for high-performance servers.

- Regulatory Impacts: Government initiatives promoting digital transformation and Vision 2030 are fostering data center infrastructure development, creating a favorable environment for server vendors. Specific regulatory frameworks related to data security and localization may influence market dynamics.

- Product Substitutes: While traditional servers dominate, the emergence of edge computing and serverless architectures presents some degree of substitution, though these are currently niche segments.

- End-User Segmentation: The IT & Telecommunication sector leads the market, followed by BFSI, Government, Media & Entertainment, and other end-users. Specific growth in each segment depends on digital transformation projects and investment in IT infrastructure.

- M&A Trends: The number of mergers and acquisitions in the Saudi Arabian data center server market in the period 2019-2024 was estimated at xx, reflecting consolidation and strategic expansion efforts by major players. These transactions are driven by the desire to expand market share and gain access to new technologies and markets.

Saudi Arabia Data Center Server Market Trends & Opportunities

The Saudi Arabia data center server market is projected to experience significant growth during the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by several factors:

The market size in 2025 is estimated at xx Million. Rising digitalization across various sectors is driving demand for advanced computing infrastructure. Government initiatives promoting the development of the digital economy, especially under Vision 2030, are creating a favorable regulatory landscape. The increasing adoption of cloud computing, big data analytics, and artificial intelligence is also fueling demand for high-performance servers. Competition is fierce among established players, driving innovation and price optimization. Market penetration rates for advanced server technologies (e.g., those supporting AI/ML workloads) are increasing steadily. Furthermore, the development of local manufacturing capabilities and supply chain diversification strategies could also stimulate growth.

Dominant Markets & Segments in Saudi Arabia Data Center Server Market

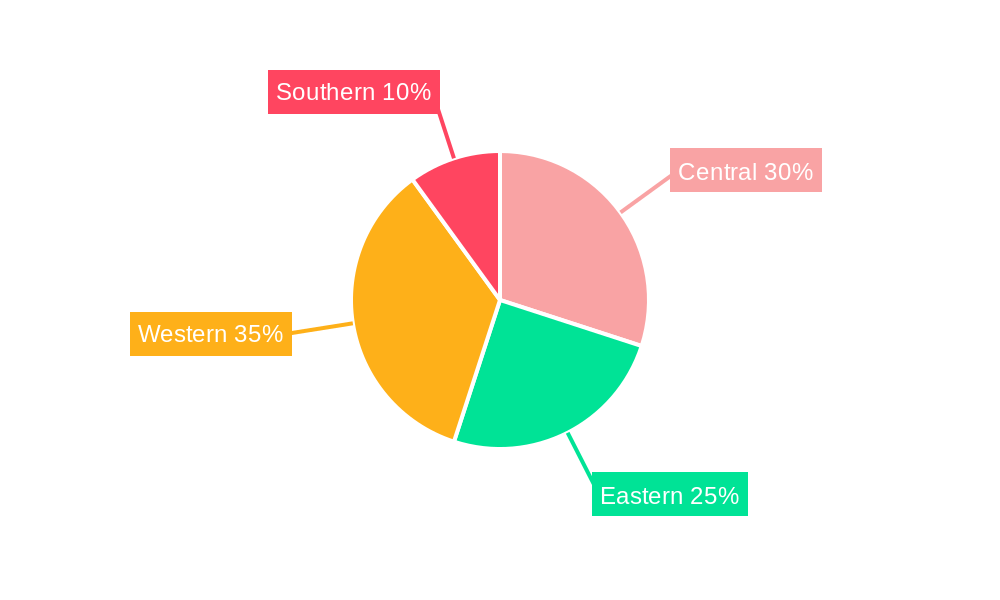

The Riyadh region dominates the Saudi Arabia data center server market due to its concentration of data centers and IT infrastructure. Within the segmentation analysis:

Form Factor:

- Rack Servers: Hold the largest market share due to their versatility, scalability, and cost-effectiveness. Growth is driven by the widespread adoption of cloud computing and data center virtualization.

- Blade Servers: Experience moderate growth, driven by their space-saving features and high density in data centers seeking optimal space utilization.

- Tower Servers: Represent a smaller segment, mainly catering to smaller businesses and enterprises with limited space requirements.

End-User:

- IT & Telecommunication: Represents the largest end-user segment, with significant demand for servers to support network infrastructure, cloud services, and data management. Growth drivers include expansion of 5G networks and increasing adoption of cloud-based services.

- BFSI (Banking, Financial Services, and Insurance): This segment shows strong growth due to increasing investment in digital banking and financial technology. Regulatory requirements for data security and compliance also drive demand.

- Government: Government initiatives to digitize public services and enhance cybersecurity contribute significantly to server demand. Large-scale infrastructure projects are increasing growth within this sector.

Growth in these segments is driven by increased government investment, private sector adoption of cloud computing, and the ongoing digital transformation of the Saudi Arabian economy.

Saudi Arabia Data Center Server Market Product Analysis

Recent product innovations focus on energy efficiency, increased processing power, and enhanced security features. Advancements in CPU and GPU technology are delivering performance improvements and the integration of AI-specific hardware is becoming increasingly prevalent. The market emphasizes servers offering high scalability and flexibility to meet diverse business needs. Companies are also offering services like managed services to differentiate themselves.

Key Drivers, Barriers & Challenges in Saudi Arabia Data Center Server Market

Key Drivers:

- Government Initiatives: Vision 2030's digital transformation initiatives are a significant driver.

- Technological Advancements: AI, cloud computing, and big data analytics push demand for high-performance servers.

- Economic Growth: The expanding Saudi Arabian economy supports increased IT investment.

Challenges:

- Supply Chain Disruptions: Global supply chain issues can impact server availability and pricing. The impact is estimated at xx Million in lost revenue in 2024.

- Regulatory Compliance: Meeting data localization and security regulations adds complexity for vendors.

- Competition: Intense competition among established players puts pressure on pricing and margins.

Growth Drivers in the Saudi Arabia Data Center Server Market Market

Government initiatives such as Vision 2030, coupled with the booming private sector investment in digital infrastructure, are key drivers. The escalating adoption of cloud technologies and the rising demand for high-performance computing resources for AI and big data applications fuel considerable growth. Furthermore, a supportive regulatory environment and the nation's economic diversification strategies enhance the expansion of this sector.

Challenges Impacting Saudi Arabia Data Center Server Market Growth

Supply chain vulnerabilities and global economic uncertainties could hinder market expansion. The relatively high cost of setting up data centers and procuring advanced servers might limit widespread adoption, especially in smaller enterprises. Also, complying with stringent data security and localization regulations adds to the complexity and cost of doing business in the market.

Key Players Shaping the Saudi Arabia Data Center Server Market Market

- Lenovo Group Limited

- Hewlett Packard Enterprise

- International Business Machines (IBM) Corporation

- Cisco Systems Inc

- Super Micro Computer Inc

- Dell Inc

- Quanta Computer Inc

- Kingston Technology Company Inc

- Inspur Group

- Huawei Technologies Co Ltd

Significant Saudi Arabia Data Center Server Market Industry Milestones

- May 2023: Cisco announced its Intersight platform with UCS X-Series servers can reduce data center energy consumption by up to 52% at a 4:1 server consolidation ratio. This highlights the growing focus on energy efficiency.

- March 2023: Supermicro launched the SYS-751GE-TNRT-NV1 server with a standalone liquid cooling system for AI applications, demonstrating the increasing demand for high-performance computing solutions in the AI sector.

Future Outlook for Saudi Arabia Data Center Server Market Market

The Saudi Arabia data center server market is poised for sustained growth, driven by continued digital transformation, government investments, and technological advancements. Strategic opportunities exist for companies focusing on energy-efficient solutions, AI-optimized hardware, and robust cybersecurity features. The market is expected to witness increased adoption of cloud computing and edge computing technologies, resulting in a substantial expansion of server deployment in the coming years.

Saudi Arabia Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Saudi Arabia Data Center Server Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Smartpone Users; Fiber Connectivity Network Expansion

- 3.3. Market Restrains

- 3.3.1. Increasing number of Data Security Breaches

- 3.4. Market Trends

- 3.4.1. Blade Servers To Grow At A Faster Pace In Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Central Saudi Arabia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Data Center Server Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Lenovo Group Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hewlett Packard Enterprise

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 International Business Machines (IBM) Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Cisco Systems Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Super Micro Computer Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Dell Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Quanta Computer Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kingston Technology Company Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Inspur Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Huawei Technologies Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lenovo Group Limited

List of Figures

- Figure 1: Saudi Arabia Data Center Server Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Data Center Server Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 3: Saudi Arabia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Central Saudi Arabia Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Saudi Arabia Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Saudi Arabia Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southern Saudi Arabia Data Center Server Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Form Factor 2019 & 2032

- Table 11: Saudi Arabia Data Center Server Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 12: Saudi Arabia Data Center Server Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Data Center Server Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Saudi Arabia Data Center Server Market?

Key companies in the market include Lenovo Group Limited, Hewlett Packard Enterprise, International Business Machines (IBM) Corporation, Cisco Systems Inc, Super Micro Computer Inc, Dell Inc, Quanta Computer Inc, Kingston Technology Company Inc, Inspur Group, Huawei Technologies Co Ltd.

3. What are the main segments of the Saudi Arabia Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Smartpone Users; Fiber Connectivity Network Expansion.

6. What are the notable trends driving market growth?

Blade Servers To Grow At A Faster Pace In Coming Years.

7. Are there any restraints impacting market growth?

Increasing number of Data Security Breaches.

8. Can you provide examples of recent developments in the market?

May 2023: By combining the Intersight infrastructure management platform with Unified Computing System (UCS) X-Series servers, Cisco says it can reduce data center energy consumption by up to 52 percent at a four-to-one (4:1) server consolidation ratio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Data Center Server Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence