Key Insights

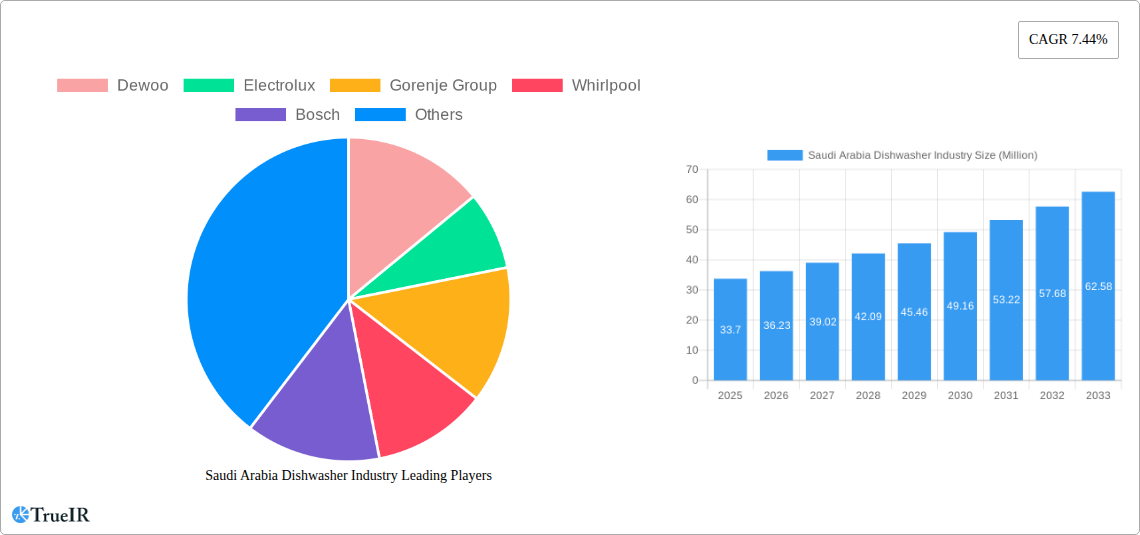

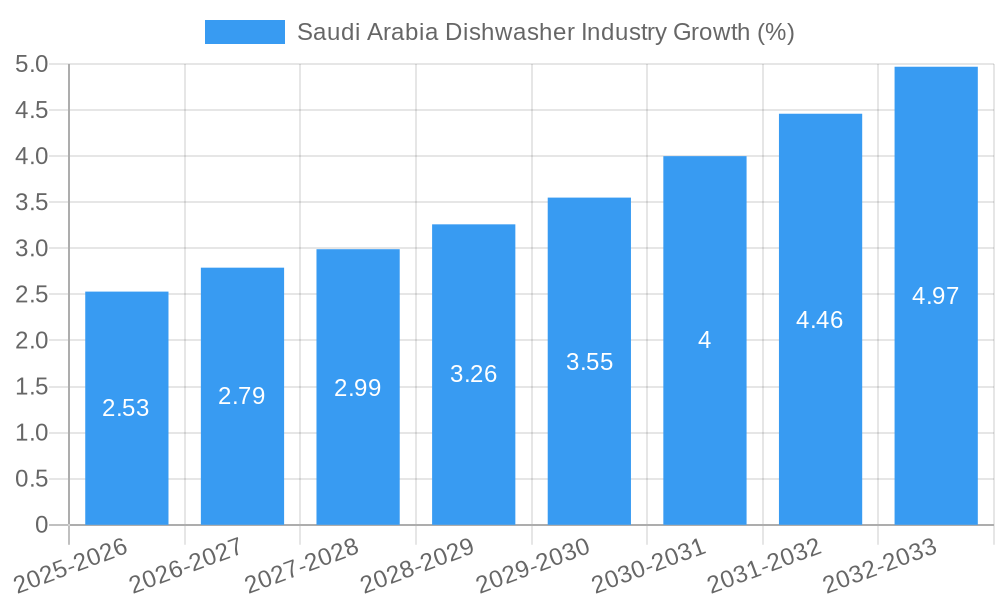

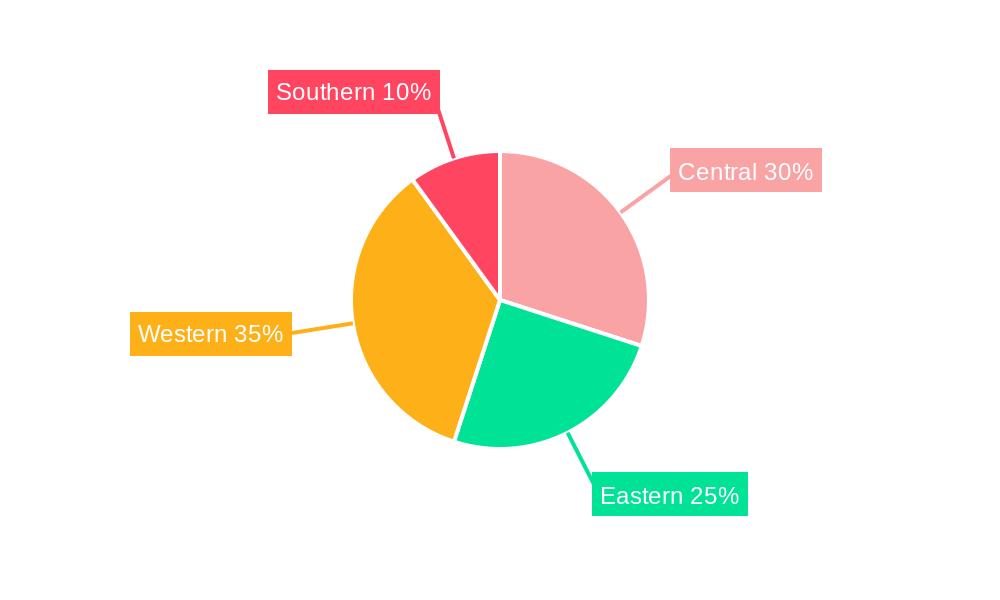

The Saudi Arabian dishwasher market, valued at $33.70 million in 2025, is projected to experience robust growth, driven by rising disposable incomes, increasing urbanization, and a shift towards modern kitchen appliances. The 7.44% CAGR indicates a significant expansion over the forecast period (2025-2033). Key growth drivers include the increasing adoption of convenience appliances in both residential and commercial settings (restaurants, hotels). The preference for built-in dishwashers over freestanding models is expected to contribute to market segmentation. While online distribution channels are growing, offline sales through traditional retailers and appliance stores still dominate the market. Major players like Whirlpool, Bosch, LG Electronics, and Midea compete intensely, focusing on product innovation, energy efficiency, and attractive pricing strategies to capture market share. The market's regional distribution across Saudi Arabia (Central, Eastern, Western, Southern regions) reflects varying levels of economic development and appliance penetration, with higher demand expected in urban centers. Potential restraints include fluctuating oil prices which can influence consumer spending, and competition from other kitchen appliance categories.

The forecast suggests a steady increase in market value throughout the forecast period, with higher growth potentially observed in the earlier years as adoption increases. The commercial segment is likely to show faster growth than the residential segment driven by expansion in the hospitality and food service sectors. Further segmentation within the types of dishwashers, based on features (e.g., capacity, energy efficiency ratings), could provide a more granular understanding of market dynamics and preferences. Companies are expected to invest in marketing campaigns highlighting the benefits of dishwashers, such as time saving and improved hygiene. The market’s future growth heavily relies on sustaining economic growth and continued modernization of households and businesses across Saudi Arabia.

Saudi Arabia Dishwasher Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Saudi Arabia dishwasher industry, covering market size, segmentation, competitive landscape, growth drivers, and future outlook from 2019 to 2033. The report is essential for manufacturers, distributors, investors, and anyone seeking to understand this dynamic market. With a base year of 2025 and a forecast period of 2025-2033, this in-depth analysis leverages high-impact keywords to ensure maximum search visibility and industry relevance. The total market value in 2025 is estimated at SAR xx Million.

Saudi Arabia Dishwasher Industry Market Structure & Competitive Landscape

The Saudi Arabia dishwasher market exhibits a moderately concentrated structure, with a few major international players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately competitive landscape. Key innovation drivers include the increasing demand for energy-efficient appliances, smart features, and improved cleaning technology. Government regulations focusing on energy efficiency and water conservation influence product design and manufacturing. While there are no significant direct substitutes for dishwashers, other cleaning methods like manual washing remain prevalent, particularly in smaller households. The market is primarily segmented by application (residential and commercial) and type (free-standing and built-in). Mergers and acquisitions (M&A) activity has been relatively low in recent years, with only xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, HHI estimated at xx.

- Innovation Drivers: Energy efficiency, smart features, improved cleaning technology.

- Regulatory Impacts: Energy efficiency standards, water conservation regulations.

- Product Substitutes: Manual washing.

- End-User Segmentation: Residential and Commercial sectors.

- M&A Trends: Low activity, xx deals between 2019-2024.

Saudi Arabia Dishwasher Industry Market Trends & Opportunities

The Saudi Arabian dishwasher market is experiencing robust growth, driven by rising disposable incomes, urbanization, and changing lifestyles. The market size is projected to reach SAR xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of smart features and improved cleaning technologies, are reshaping consumer preferences. Increased awareness of hygiene and convenience is further fueling demand. The online distribution channel is gaining traction, though offline channels still dominate. Competitive dynamics are marked by intense price competition and ongoing product innovation, particularly among leading brands like Whirlpool and LG Electronics. The market penetration rate for dishwashers in Saudi Arabia is currently estimated at xx%, with significant room for growth, particularly in smaller cities and rural areas.

Dominant Markets & Segments in Saudi Arabia Dishwasher Industry

The residential segment currently dominates the Saudi Arabia dishwasher market, accounting for approximately xx% of total sales. Among the types of dishwashers, free-standing models hold a larger market share, primarily due to their affordability and suitability for a wider range of kitchen configurations. The offline distribution channel is prevalent, reflecting strong consumer preference for in-person product evaluation and purchase.

- Key Growth Drivers for Residential Segment: Rising disposable incomes, increased urbanization, changing lifestyles, and growing preference for convenience.

- Key Growth Drivers for Free-Standing Dishwashers: Affordability, suitability for various kitchen layouts.

- Key Growth Drivers for Offline Distribution: Strong preference for in-person product evaluation and purchase.

Saudi Arabia Dishwasher Industry Product Analysis

The Saudi Arabia dishwasher market showcases a diverse range of products, from basic free-standing models to advanced built-in units with smart features. Technological advancements are focused on improving energy efficiency, water conservation, cleaning performance, and ease of use. Product innovation is driven by the need to cater to diverse consumer preferences and price points, fostering competition and driving market growth. The market shows a clear trend toward energy-efficient, space-saving, and technologically advanced models.

Key Drivers, Barriers & Challenges in Saudi Arabia Dishwasher Industry

Key Drivers:

- Rising disposable incomes and increasing urbanization are driving demand for convenience appliances.

- Government initiatives promoting energy efficiency are influencing product development.

- The growing hospitality sector fuels demand in the commercial segment.

Key Challenges:

- Competition from established international brands creates price pressure.

- Supply chain disruptions can impact product availability and pricing.

- Stricter energy efficiency regulations may increase production costs.

Growth Drivers in the Saudi Arabia Dishwasher Industry Market

The Saudi Arabian dishwasher market is primarily fueled by rising disposable incomes and increased urbanization. Government initiatives focusing on energy efficiency and improved living standards further stimulate demand. The growth of the hospitality sector, driving demand for commercial dishwashers, presents an additional catalyst for market expansion.

Challenges Impacting Saudi Arabia Dishwasher Industry Growth

Significant challenges include intense competition from multinational brands, leading to price pressures. Supply chain disruptions, particularly prevalent in recent years, can affect product availability and increase costs. Furthermore, stricter regulatory requirements related to energy efficiency might increase manufacturing costs and hinder the growth of low-cost options.

Key Players Shaping the Saudi Arabia Dishwasher Industry Market

- Dewoo

- Electrolux

- Gorenje Group

- Whirlpool

- Bosch

- Toshiba

- Mastergas

- Midea

- LG Electronics

- Arsiton

Significant Saudi Arabia Dishwasher Industry Industry Milestones

- March 2021: Samsung introduced new kitchen appliances range under the Baker Series microwaves. While not directly related to dishwashers, this signifies activity within the broader kitchen appliance market.

- February 2nd, 2022: LG Electronics showcased its 2022 lineup of commercial and residential HVAC solutions at the AHR Expo in Las Vegas. While not directly related to dishwashers, this highlights LG's commitment to the broader appliance market and its technological capabilities, impacting consumer perception and market competitiveness indirectly.

Future Outlook for Saudi Arabia Dishwasher Industry Market

The Saudi Arabia dishwasher market is poised for sustained growth, driven by continued urbanization, rising incomes, and increasing awareness of hygiene and convenience. Strategic opportunities exist for players focusing on energy efficiency, smart features, and innovative product design. Market expansion is expected across both residential and commercial sectors, with the online distribution channel playing an increasingly important role. The market's future growth will be contingent on navigating supply chain challenges, adapting to evolving consumer preferences, and complying with increasingly stringent regulations.

Saudi Arabia Dishwasher Industry Segmentation

-

1. Types

- 1.1. Free Standing Dishwasher

- 1.2. Built-in Dishwasher

-

2. Applications

- 2.1. Residential

- 2.2. Commercial

-

3. Dsitribution Channel

- 3.1. Offline

- 3.2. Online

Saudi Arabia Dishwasher Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Dishwasher Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Rising Disposable Income & Urbanization is Augmenting Dishwasher's Sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Free Standing Dishwasher

- 5.1.2. Built-in Dishwasher

- 5.2. Market Analysis, Insights and Forecast - by Applications

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Dsitribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Central Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Dishwasher Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Dewoo

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electrolux

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Gorenje Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Whirlpool

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Bosch

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Toshiba

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mastergas

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Midea

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 LG Electronics

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Arsiton

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Dewoo

List of Figures

- Figure 1: Saudi Arabia Dishwasher Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Dishwasher Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Types 2019 & 2032

- Table 4: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Types 2019 & 2032

- Table 5: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 6: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Applications 2019 & 2032

- Table 7: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Dsitribution Channel 2019 & 2032

- Table 8: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Dsitribution Channel 2019 & 2032

- Table 9: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Central Saudi Arabia Dishwasher Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Central Saudi Arabia Dishwasher Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Eastern Saudi Arabia Dishwasher Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Eastern Saudi Arabia Dishwasher Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Western Saudi Arabia Dishwasher Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Western Saudi Arabia Dishwasher Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Southern Saudi Arabia Dishwasher Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southern Saudi Arabia Dishwasher Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Types 2019 & 2032

- Table 22: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Types 2019 & 2032

- Table 23: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Applications 2019 & 2032

- Table 24: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Applications 2019 & 2032

- Table 25: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Dsitribution Channel 2019 & 2032

- Table 26: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Dsitribution Channel 2019 & 2032

- Table 27: Saudi Arabia Dishwasher Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Saudi Arabia Dishwasher Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Dishwasher Industry?

The projected CAGR is approximately 7.44%.

2. Which companies are prominent players in the Saudi Arabia Dishwasher Industry?

Key companies in the market include Dewoo, Electrolux, Gorenje Group, Whirlpool, Bosch, Toshiba, Mastergas, Midea, LG Electronics, Arsiton.

3. What are the main segments of the Saudi Arabia Dishwasher Industry?

The market segments include Types, Applications, Dsitribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Rising Disposable Income & Urbanization is Augmenting Dishwasher's Sales.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

On Feb 2nd 2022, LG Electronics (LG) showcased its robust 2022 lineup of commercial, light commercial and residential HVAC solutions - including industry-leading Variable Refrigerant Flow (VRF) technology, latest energy efficient heat pump systems, indoor air quality solutions and flexible building automation and connectivity products - at the 2022 AHR Expo in Las Vegas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Dishwasher Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Dishwasher Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Dishwasher Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Dishwasher Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence