Key Insights

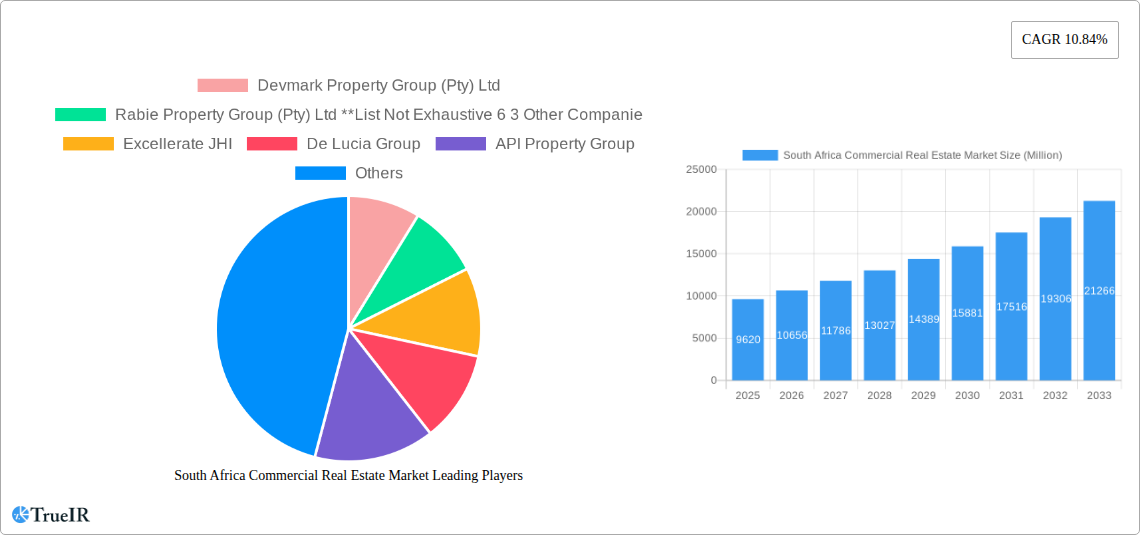

The South African commercial real estate market, valued at $9.62 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.84% from 2025 to 2033. This expansion is fueled by several key drivers. Increased urbanization and population growth in major cities like Johannesburg, Cape Town, and Durban are creating consistent demand for office, retail, and industrial spaces. Furthermore, the burgeoning tourism sector and associated hospitality investments contribute significantly to market growth. The logistics sector, benefiting from expanding e-commerce and improved infrastructure, is another significant contributor. However, the market faces constraints such as economic volatility, fluctuating interest rates, and potential infrastructural limitations in certain regions. Segmentation reveals that the office sector currently holds the largest market share, followed by retail, industrial and logistics, and hospitality, reflecting the country's economic structure and development priorities. Key players like Growthpoint Properties, Amdec Group, and others are actively shaping the market landscape through development, acquisition, and management activities. The market's future hinges on the successful management of these driving forces and constraints, promising consistent growth opportunities despite inherent market risks.

The forecast period (2025-2033) anticipates a significant increase in market value, driven by sustained demand and strategic investments across various property types. While the "Other Key Cities" segment currently contributes a smaller share, its potential for growth is considerable, particularly with the development of new infrastructure and expansion of business activities beyond the major metropolitan areas. The industrial and logistics sector is expected to witness particularly strong growth given South Africa's strategic location as a gateway to the African continent and its expanding trade relationships. Competitive pressures among leading companies will drive innovation and efficiency in property management and development, shaping a dynamic and evolving market landscape. However, careful monitoring of macroeconomic conditions and addressing regulatory challenges will remain critical for sustaining sustainable growth and attracting further investments in the sector.

South Africa Commercial Real Estate Market Report: 2019-2033

A comprehensive analysis of market trends, key players, and future opportunities in South Africa's dynamic commercial real estate sector. This in-depth report provides a detailed overview of the South African commercial real estate market, covering the period 2019-2033, with a focus on 2025. We delve into market structure, competitive dynamics, key segments, and future growth prospects, offering invaluable insights for investors, developers, and industry professionals. The report leverages extensive data analysis and incorporates recent industry developments to provide a robust and up-to-date perspective.

South Africa Commercial Real Estate Market Structure & Competitive Landscape

This section analyzes the South African commercial real estate market's competitive landscape, examining market concentration, innovation, regulatory influences, and M&A activity. The study period covers 2019-2024, with projections extending to 2033.

Market Concentration: The South African commercial real estate market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. Leading players like Growthpoint Properties and other major firms hold significant market share, but a fragmented landscape of smaller companies also exists.

Innovation Drivers: Technological advancements, such as PropTech solutions for property management and data analytics, are driving innovation. The increasing demand for sustainable and smart buildings also fuels innovation.

Regulatory Impacts: Government regulations, including zoning laws and building codes, significantly influence market activity. Changes in tax policies and environmental regulations can impact investment decisions.

Product Substitutes: The rise of co-working spaces and flexible office solutions presents a growing substitute for traditional office leasing, particularly impacting the office segment. E-commerce's growth is also affecting retail real estate.

End-User Segmentation: The market is segmented by end-users such as corporate tenants, small and medium-sized enterprises (SMEs), and government agencies. Each segment exhibits unique needs and preferences, affecting market dynamics.

M&A Trends: The volume of mergers and acquisitions (M&A) in the South African commercial real estate sector reached xx Million in 2024. Consolidation is expected to continue, driven by the pursuit of economies of scale and market dominance. The largest deals in recent years involved players like Growthpoint Properties and other key firms.

The market is further shaped by the evolving needs of tenants, particularly the increased adoption of hybrid work models, leading to shifts in demand for flexible office spaces and a heightened focus on sustainability and technology integration within commercial properties.

South Africa Commercial Real Estate Market Trends & Opportunities

This section explores key market trends, growth drivers, and emerging opportunities within the South African commercial real estate market. The report incorporates quantitative metrics such as Compound Annual Growth Rate (CAGR) and market penetration rates to provide a comprehensive understanding.

The South African commercial real estate market experienced significant growth during the historical period (2019-2024), with a CAGR of xx%. This growth was primarily driven by factors such as increased urbanization, economic expansion, and significant investments in infrastructure development. However, economic fluctuations and shifts in consumer behavior have impacted market dynamics. For example, the COVID-19 pandemic accelerated the adoption of remote working, influencing demand patterns in the office sector.

Looking ahead, the projected CAGR for 2025-2033 is estimated at xx%. This growth is expected to be driven by the increasing demand for flexible workspace, technological advancements, and the expanding middle class. The market is witnessing growing adoption of PropTech solutions improving efficiency and transparency. However, challenges remain, including economic uncertainty and infrastructure limitations in certain areas, potentially impacting growth rates and investment decisions. The market penetration rate for smart building technologies is projected to reach xx% by 2033, representing a significant increase from the current level.

Dominant Markets & Segments in South Africa Commercial Real Estate Market

This section identifies the leading segments and regions within the South African commercial real estate market.

By Type: The office segment holds a substantial market share, although the demand for flexible workspaces is rapidly changing its dynamics. The industrial and logistics sector is experiencing robust growth due to the expansion of e-commerce and related activities. Retail remains significant but faces challenges from online competition. The hospitality segment displays growth potential tied to tourism and business travel.

By Key City: Johannesburg remains the dominant market due to its status as the economic hub. Cape Town also holds a significant share, driven by strong economic growth and tourism. Durban and Port Elizabeth contribute meaningfully, while other key cities exhibit varied growth rates according to their local economic activity.

Key Growth Drivers:

- Johannesburg: Strong economic activity, established infrastructure, and a large corporate presence.

- Cape Town: Tourism, technology sector growth, and a favorable business environment.

- Durban: Port activity, industrial development, and a growing population.

- Office Segment: Demand for flexible workspaces and ongoing corporate expansion.

- Industrial and Logistics: E-commerce growth and improved infrastructure.

Despite the dominance of these sectors and regions, significant variations exist in growth rates and investment opportunities across different cities and property types. These variations are influenced by factors such as local economic conditions, infrastructure development, and government policies. Further analysis is required to fully understand this dynamic landscape.

South Africa Commercial Real Estate Market Product Analysis

The South African commercial real estate market is witnessing significant product innovations, driven largely by technological advancements. Smart building technologies, including energy-efficient systems and advanced security features, are becoming increasingly popular, enhancing the value proposition for both owners and tenants. The integration of PropTech solutions, such as property management software and virtual tours, improves operational efficiency and transparency. This focus on technology and sustainability differentiates products and caters to the evolving needs of a modern workforce and environmentally conscious investors. The market fit for these innovations is strong, aligning with global trends and creating a competitive edge for developers adopting them.

Key Drivers, Barriers & Challenges in South Africa Commercial Real Estate Market

Key Drivers:

Strong economic growth, particularly in certain sectors, fuels demand for commercial real estate. Government infrastructure investments, such as transportation upgrades, enhance property values and attractiveness. The rise of e-commerce is driving growth in the industrial and logistics sector. Technological advancements provide opportunities for efficiency and sustainability.

Challenges & Restraints:

Economic volatility and uncertainty impact investor confidence and development activity. Infrastructure deficiencies in some areas constrain growth. High property taxes and regulatory complexities can impede market activity. Competition among developers and rising construction costs impact profitability. The estimated impact of these challenges on the market's overall growth is currently estimated at xx Million in lost potential revenue annually.

Growth Drivers in the South Africa Commercial Real Estate Market Market

The growth of the South African commercial real estate market is primarily fueled by factors such as sustained economic growth (when present), investment in infrastructure, and the increasing demand for modern, sustainable buildings. Government policies promoting economic development and attracting foreign investment are also contributing to market expansion. Technological advancements continue to reshape the industry, with PropTech solutions driving efficiency and innovation.

Challenges Impacting South Africa Commercial Real Estate Market Growth

The market faces several challenges, including economic uncertainty and fluctuations which affect investment decisions. Infrastructure limitations in certain regions restrict development potential. Stringent regulations and bureaucratic processes can slow down project approvals. Competition among developers and rising construction costs put pressure on margins. These factors present significant hurdles to sustained market growth.

Key Players Shaping the South Africa Commercial Real Estate Market Market

- Devmark Property Group (Pty) Ltd

- Rabie Property Group (Pty) Ltd

- Excellerate JHI

- De Lucia Group

- API Property Group

- PAM Golding Properties

- Chas Everitt Property Group

- Growthpoint Properties

- Legaro Property Development

- Amdec Group

Significant South Africa Commercial Real Estate Market Industry Milestones

- November 2023: WeWork South Africa accelerates expansion plans, reflecting increased demand for flexible office spaces driven by the hybrid work model. This signals a shift in tenant preferences and potential growth opportunities for flexible workspace providers.

- September 2023: Instant Group's acquisition of PSA expands its African reach. This highlights the consolidation trend within the flexible workspace sector and its growing importance in the broader commercial real estate market.

Future Outlook for South Africa Commercial Real Estate Market Market

The South African commercial real estate market is poised for continued growth, driven by ongoing urbanization, infrastructure development, and the increasing adoption of technological advancements. Strategic opportunities exist in the development of sustainable and smart buildings, along with the expansion of flexible workspaces to cater to evolving workplace trends. However, macroeconomic conditions and regulatory factors will continue to influence market dynamics. The overall market potential is significant, but successful navigation of existing challenges will be crucial for sustained growth.

South Africa Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Office

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Hospitality

-

2. Key City

- 2.1. Johannesburg

- 2.2. Cape Town

- 2.3. Durban

- 2.4. Port Elizabeth

- 2.5. Other Key Cities

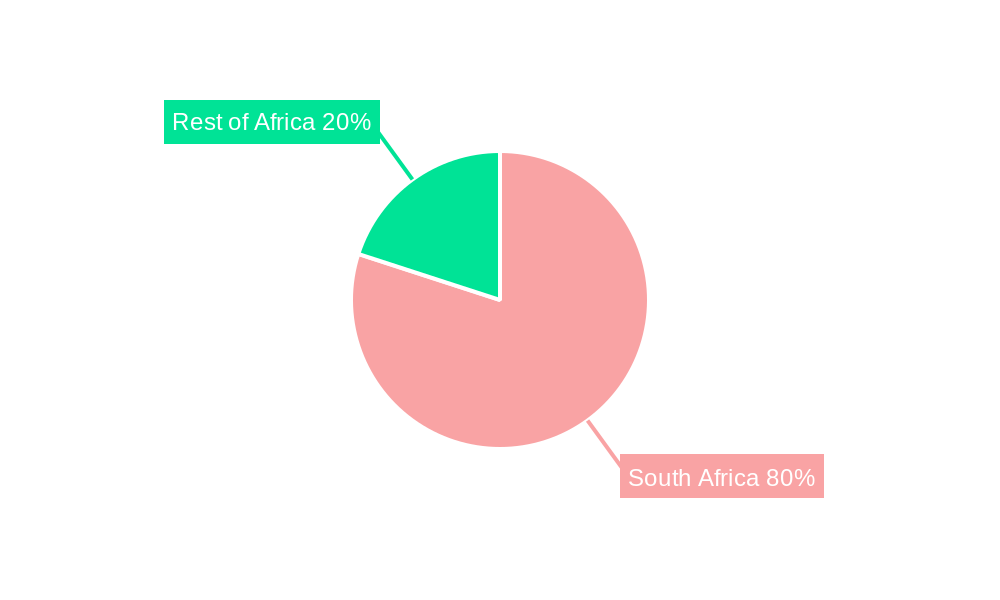

South Africa Commercial Real Estate Market Segmentation By Geography

- 1. South Africa

South Africa Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Urbanization and Population growth4.; Foreign direct investments

- 3.3. Market Restrains

- 3.3.1. 4.; Economic uncertainity4.; Regulatory environment

- 3.4. Market Trends

- 3.4.1. Increasing office space demand in South Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Office

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key City

- 5.2.1. Johannesburg

- 5.2.2. Cape Town

- 5.2.3. Durban

- 5.2.4. Port Elizabeth

- 5.2.5. Other Key Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Devmark Property Group (Pty) Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Rabie Property Group (Pty) Ltd **List Not Exhaustive 6 3 Other Companie

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Excellerate JHI

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 De Lucia Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 API Property Group

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PAM Golding Properties

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Chas Everitt Property Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Growthpoint Properties

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Legaro Property Development

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Amdec Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Devmark Property Group (Pty) Ltd

List of Figures

- Figure 1: South Africa Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Africa Commercial Real Estate Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 4: South Africa Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Commercial Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: South Africa Commercial Real Estate Market Revenue Million Forecast, by Key City 2019 & 2032

- Table 14: South Africa Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Commercial Real Estate Market?

The projected CAGR is approximately 10.84%.

2. Which companies are prominent players in the South Africa Commercial Real Estate Market?

Key companies in the market include Devmark Property Group (Pty) Ltd, Rabie Property Group (Pty) Ltd **List Not Exhaustive 6 3 Other Companie, Excellerate JHI, De Lucia Group, API Property Group, PAM Golding Properties, Chas Everitt Property Group, Growthpoint Properties, Legaro Property Development, Amdec Group.

3. What are the main segments of the South Africa Commercial Real Estate Market?

The market segments include Type, Key City.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.62 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Urbanization and Population growth4.; Foreign direct investments.

6. What are the notable trends driving market growth?

Increasing office space demand in South Africa.

7. Are there any restraints impacting market growth?

4.; Economic uncertainity4.; Regulatory environment.

8. Can you provide examples of recent developments in the market?

November 2023: WeWork South Africa is accelerating its expansion plans as the rise in popularity of hybrid work sees a boost in demand for flexible office spaces.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the South Africa Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence