Key Insights

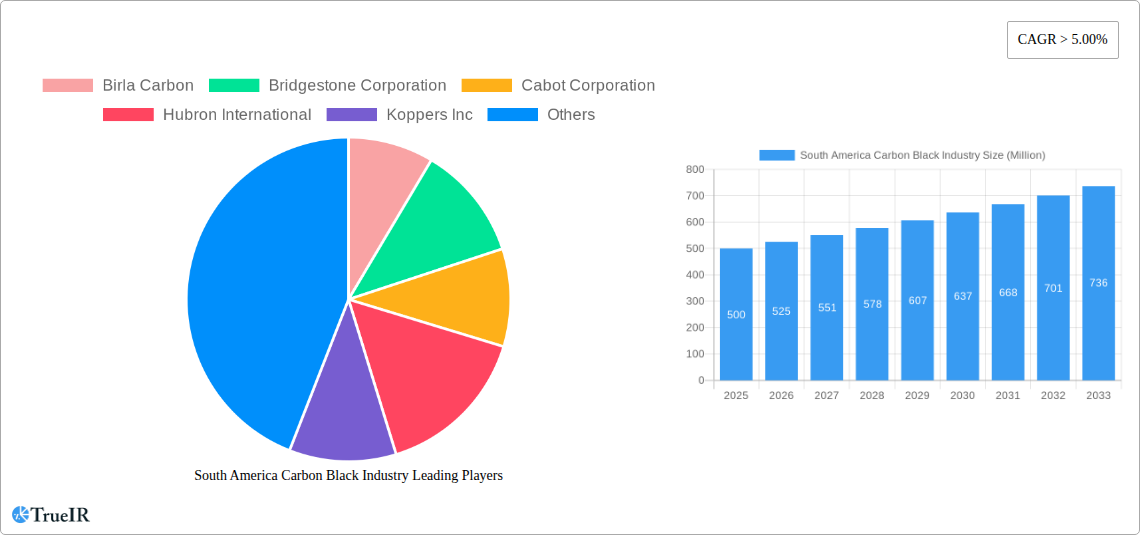

The South American carbon black market is poised for substantial growth, driven by key industrial sectors and regional development. With a projected Compound Annual Growth Rate (CAGR) of 6.3%, the market is expected to expand significantly from its current size of 21.6 billion in the base year 2025. Demand is primarily fueled by the burgeoning tire and rubber industries, with Brazil and Argentina leading the expansion. Increased automotive production and ongoing infrastructure development across the continent further bolster the need for high-quality carbon black. A growing emphasis on sustainable manufacturing is also shaping the market, encouraging environmentally conscious production methods and the adoption of recycled materials. While facing challenges such as raw material price volatility and supply chain complexities, the overall market outlook remains robust. Key market segments include applications such as tires, inks, and plastics, alongside product types like furnace black and channel black. Geographically, Brazil, Argentina, and Colombia are prominent markets. Major industry players, including Birla Carbon, Bridgestone Corporation, and Cabot Corporation, are actively engaged, contributing to the market's dynamic nature. Supportive government initiatives aimed at bolstering the automotive sector and infrastructure improvements across South America are also significant growth enablers.

South America Carbon Black Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained expansion, propelled by increasing urbanization and industrialization throughout South America. Technological advancements in carbon black production, enhancing product performance and minimizing environmental impact, will further accelerate market growth. However, economic fluctuations and evolving regulatory landscapes present potential challenges requiring strategic navigation. Intense competition among established leaders and the emergence of new participants will also influence market dynamics. A thorough examination of these factors offers a realistic appraisal of opportunities and inherent risks within the South American carbon black market, indicating a promising future characterized by continuous innovation and expansion.

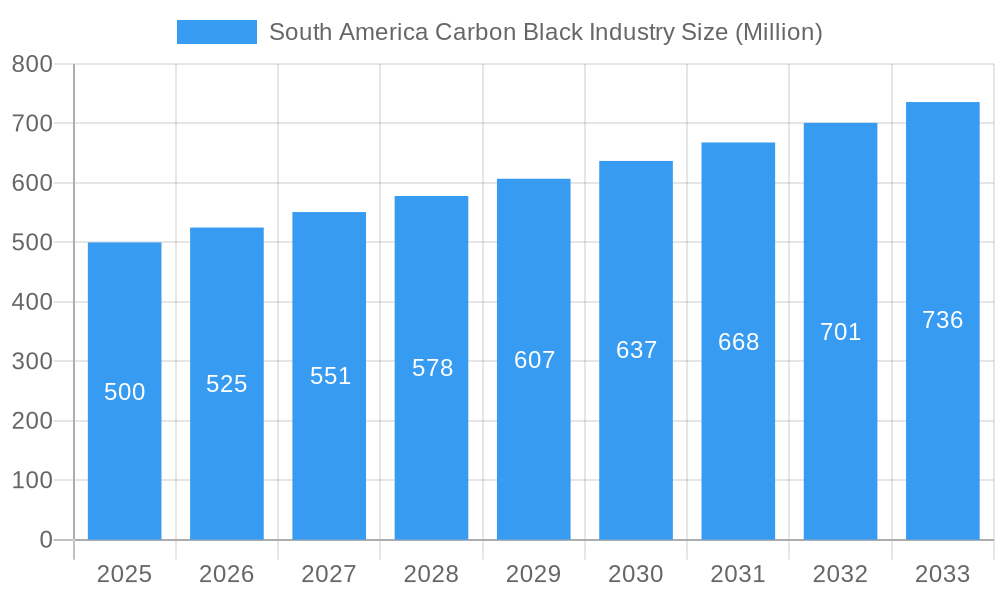

South America Carbon Black Industry Company Market Share

South America Carbon Black Industry: Market Analysis, Trends & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the South America carbon black industry, offering invaluable insights for investors, manufacturers, and industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers critical data and forecasts on market size, segmentation, competitive dynamics, and future growth potential. The report leverages extensive primary and secondary research, employing robust analytical models to ensure accuracy and reliability. Discover key trends, challenges, and opportunities shaping the future of this dynamic market.

South America Carbon Black Industry Market Structure & Competitive Landscape

The South American carbon black market is characterized by a moderately concentrated structure, with a few prominent multinational players holding significant market share. The estimated Herfindahl-Hirschman Index (HHI) for 2024 suggests a moderately consolidated landscape. Key global entities such as Birla Carbon, Bridgestone Corporation, Cabot Corporation, Hubron International, Koppers Inc, Mitsubishi Chemical Holdings Corporation, negroven, Orion Engineered Carbons, Phillips Carbon Black Ltd, and Tokai Carbon Co Ltd are actively driving market dynamics through strategic product diversification, capacity enhancements, and advancements in sustainable manufacturing practices. These companies are investing heavily in research and development to meet the evolving needs of diverse applications.

- Market Concentration: The current HHI value indicates a moderately consolidated market. The leading five players are estimated to command approximately xx% of the total market share in 2024, underscoring the influence of established global brands.

- Innovation Drivers: A primary focus of R&D investment is the development of specialized carbon blacks designed to offer enhanced performance characteristics. This includes grades with improved reinforcement, conductivity, UV protection, and color properties tailored for demanding applications across various industries.

- Regulatory Impacts: Stringent environmental regulations concerning emissions, waste management, and sustainable production processes are significantly shaping the industry. The implementation of stricter controls on tire wear particles and emissions is particularly influential, pushing manufacturers towards cleaner production technologies and more environmentally friendly product formulations.

- Product Substitutes: While carbon black remains the predominant material due to its cost-effectiveness and performance benefits, the market continuously evaluates alternatives. Emerging materials like advanced silica compounds and novel nanomaterials are being explored for specific applications where their unique properties offer advantages, although widespread substitution is limited.

- End-User Segmentation: The automotive sector, with its primary reliance on tire manufacturing, along with the broader rubber and plastics industries, represent the largest consumers of carbon black in South America. These segments collectively accounted for approximately xx% of the total demand in 2024. The demand from the printing ink and coatings sectors is also significant and growing.

- M&A Trends: Over the past five years, the South American carbon black industry has seen xx strategic merger and acquisition (M&A) deals. These transactions have largely been driven by the objective of expanding geographical footprints, acquiring new technologies, and consolidating product portfolios to better serve regional markets.

South America Carbon Black Industry Market Trends & Opportunities

The South American carbon black market is poised for sustained growth, propelled by ongoing industrial expansion, robust automotive production, and significant infrastructure development initiatives across the region. The market size was valued at approximately xx Million USD in 2024 and is projected to ascend to xx Million USD by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of xx% throughout the forecast period. This upward trajectory is significantly influenced by the escalating demand from the tire industry, with Brazil and Argentina being key contributors. Furthermore, the increasing adoption of carbon black in other critical applications, such as plastics, coatings, and printing inks, is augmenting market expansion. Technological advancements are primarily directed towards the production of more sustainable and higher-performance carbon blacks, aligning with the evolving environmental standards and performance expectations of various end-use sectors. The penetration of specialized carbon black grades is on the rise, particularly in high-performance applications demanding advanced material properties. Competitive dynamics are being shaped by strategic capacity expansions, the formation of synergistic partnerships, and the continuous introduction of innovative product lines that address niche market requirements.

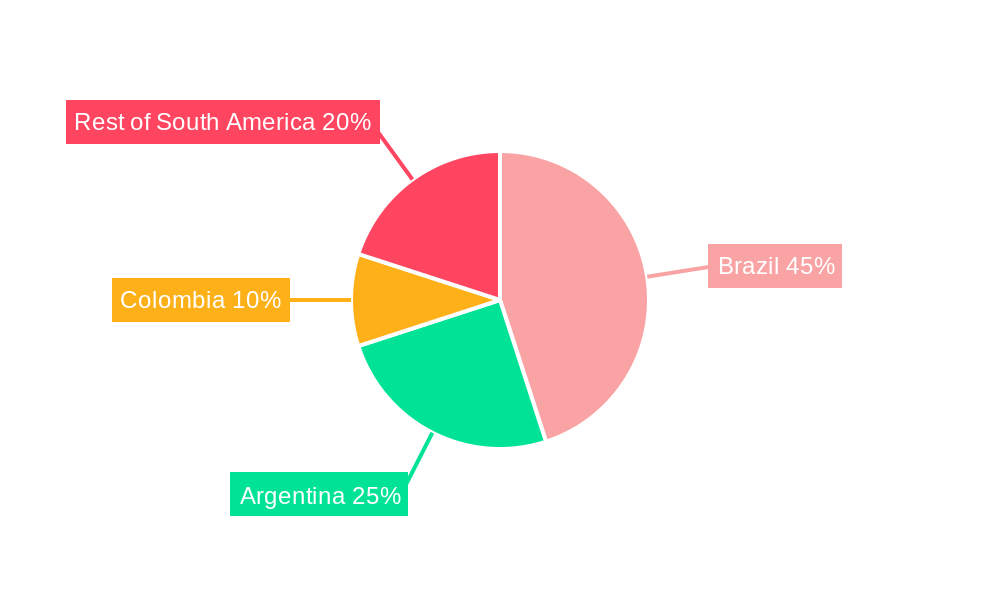

Dominant Markets & Segments in South America Carbon Black Industry

Brazil stands out as the largest national market for carbon black within South America, accounting for an estimated xx% of the regional demand in 2024. This dominance is largely attributable to Brazil's expansive and dynamic automotive manufacturing sector and its continuous investment in large-scale infrastructure projects. These factors collectively drive a substantial and consistent demand for various grades of carbon black.

- Key Growth Drivers in Brazil:

- The rapid and sustained growth of the domestic automotive sector, leading to increased tire production.

- Significant government and private sector investments in infrastructure development, including roads, bridges, and urban renewal projects, which utilize rubberized materials.

- A growing demand for high-performance and specialized tires that require advanced carbon black formulations for enhanced durability, fuel efficiency, and safety.

- Supportive government policies and industrial incentives aimed at fostering manufacturing growth and attracting foreign investment in key sectors.

- Market Dominance Analysis: Brazil's robust and diversified economy, coupled with its leading position in the South American automotive industry and substantial infrastructure development initiatives, solidifies its status as the primary consumer of carbon black in the region. While Argentina and Colombia represent secondary markets, their overall demand for carbon black is considerably lower compared to Brazil's significant consumption. Emerging applications in other South American countries are also being monitored for potential future growth.

South America Carbon Black Industry Product Analysis

The South American carbon black market offers a diverse range of products, including furnace black, thermal black, and acetylene black, each tailored to specific applications. Technological advancements focus on enhancing product characteristics such as particle size distribution, surface area, and structure to improve the performance of end products. These advancements are primarily driven by the demand for higher-performance tires and specialized applications in plastics and inks. Competitive advantages are derived through superior product quality, efficient production processes, and strong customer relationships.

Key Drivers, Barriers & Challenges in South America Carbon Black Industry

Key Drivers: Growing automotive production, expanding infrastructure projects, and increasing demand from the plastics and rubber industries are the primary forces propelling market growth. Government initiatives promoting industrial development also contribute positively.

Challenges: Fluctuations in raw material prices (primarily petroleum), stringent environmental regulations, and intense competition from international players represent significant challenges. Supply chain disruptions, especially related to raw material sourcing and transportation, can impact production and profitability. These challenges necessitate continuous innovation, efficient resource management, and strategic adaptation to maintain market competitiveness. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% in the forecast period.

Growth Drivers in the South America Carbon Black Industry Market

The South American carbon black market is driven by the robust growth of the automotive sector, increasing demand for tires, and expansion of infrastructure projects. Technological advancements leading to the development of higher-performance carbon blacks further stimulate market growth. Government support for industrial development and favorable economic conditions in some regions contribute positively to the market’s expansion.

Challenges Impacting South America Carbon Black Industry Growth

Challenges facing the South American carbon black market include fluctuations in crude oil prices, which directly impact production costs. Stringent environmental regulations pose compliance challenges and necessitate investments in cleaner production technologies. Intense competition from established global players requires continuous innovation and strategic adaptation to maintain market share. Supply chain disruptions, notably impacting raw material availability and transportation logistics, can constrain production.

Key Players Shaping the South America Carbon Black Industry Market

- Birla Carbon

- Bridgestone Corporation

- Cabot Corporation

- Hubron International

- Koppers Inc

- Mitsubishi Chemical Holdings Corporation

- negroven

- Orion Engineered Carbons

- Phillips Carbon Black Ltd

- Tokai Carbon Co Ltd

- List Not Exhaustive

Significant South America Carbon Black Industry Industry Milestones

- 2020: Orion Engineered Carbons made a strategic announcement regarding the expansion of its production facility located in Brazil, aimed at increasing its regional output capacity.

- 2021: Brazil implemented new and enhanced environmental regulations specifically impacting carbon black production processes, driving industry-wide adoption of more sustainable manufacturing practices.

- 2022: Birla Carbon successfully launched a new portfolio of high-performance carbon black grades meticulously developed for the demanding requirements of the modern tire industry.

- 2023: A notable surge in R&D investments was observed across several major players, with a strong focus on developing innovative and sustainable carbon black production methodologies and environmentally friendly product alternatives.

Future Outlook for South America Carbon Black Industry Market

The South American carbon black market is poised for continued growth, driven by long-term trends such as urbanization, increasing vehicle ownership, and expanding industrial activity. Strategic investments in new production capacities, technological innovation, and sustainable practices will be crucial for maintaining market competitiveness. The market presents opportunities for both established players and new entrants focused on providing innovative and sustainable carbon black solutions. Continued economic growth and infrastructure development in key markets will further contribute to a positive outlook for the industry.

South America Carbon Black Industry Segmentation

-

1. Process Type

- 1.1. Furnace Black

- 1.2. Gas Black

- 1.3. Lamp Black

- 1.4. Thermal Black

-

2. Application

- 2.1. Tires and Industrial Rubber Products

- 2.2. Plastics

- 2.3. Toners and Printing Inks

- 2.4. Coatings

- 2.5. Textile Fibers

- 2.6. Other Applications

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Chile

- 3.5. Rest of South America

South America Carbon Black Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Chile

- 5. Rest of South America

South America Carbon Black Industry Regional Market Share

Geographic Coverage of South America Carbon Black Industry

South America Carbon Black Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Market Penetration of Specialty Black; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Market Penetration of Specialty Black; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Application for Tires and Industrial Rubber Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Furnace Black

- 5.1.2. Gas Black

- 5.1.3. Lamp Black

- 5.1.4. Thermal Black

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Tires and Industrial Rubber Products

- 5.2.2. Plastics

- 5.2.3. Toners and Printing Inks

- 5.2.4. Coatings

- 5.2.5. Textile Fibers

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Chile

- 5.3.5. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Chile

- 5.4.5. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Brazil South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 6.1.1. Furnace Black

- 6.1.2. Gas Black

- 6.1.3. Lamp Black

- 6.1.4. Thermal Black

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Tires and Industrial Rubber Products

- 6.2.2. Plastics

- 6.2.3. Toners and Printing Inks

- 6.2.4. Coatings

- 6.2.5. Textile Fibers

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Chile

- 6.3.5. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 7. Argentina South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 7.1.1. Furnace Black

- 7.1.2. Gas Black

- 7.1.3. Lamp Black

- 7.1.4. Thermal Black

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Tires and Industrial Rubber Products

- 7.2.2. Plastics

- 7.2.3. Toners and Printing Inks

- 7.2.4. Coatings

- 7.2.5. Textile Fibers

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Chile

- 7.3.5. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 8. Colombia South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 8.1.1. Furnace Black

- 8.1.2. Gas Black

- 8.1.3. Lamp Black

- 8.1.4. Thermal Black

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Tires and Industrial Rubber Products

- 8.2.2. Plastics

- 8.2.3. Toners and Printing Inks

- 8.2.4. Coatings

- 8.2.5. Textile Fibers

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Chile

- 8.3.5. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 9. Chile South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 9.1.1. Furnace Black

- 9.1.2. Gas Black

- 9.1.3. Lamp Black

- 9.1.4. Thermal Black

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Tires and Industrial Rubber Products

- 9.2.2. Plastics

- 9.2.3. Toners and Printing Inks

- 9.2.4. Coatings

- 9.2.5. Textile Fibers

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Chile

- 9.3.5. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 10. Rest of South America South America Carbon Black Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process Type

- 10.1.1. Furnace Black

- 10.1.2. Gas Black

- 10.1.3. Lamp Black

- 10.1.4. Thermal Black

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Tires and Industrial Rubber Products

- 10.2.2. Plastics

- 10.2.3. Toners and Printing Inks

- 10.2.4. Coatings

- 10.2.5. Textile Fibers

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Brazil

- 10.3.2. Argentina

- 10.3.3. Colombia

- 10.3.4. Chile

- 10.3.5. Rest of South America

- 10.1. Market Analysis, Insights and Forecast - by Process Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Birla Carbon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bridgestone Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cabot Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hubron International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Koppers Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Chemical Holdings Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 negroven

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Orion Engineered Carbons

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Phillips Carbon Black Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokai Carbon Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Birla Carbon

List of Figures

- Figure 1: Global South America Carbon Black Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Brazil South America Carbon Black Industry Revenue (billion), by Process Type 2025 & 2033

- Figure 3: Brazil South America Carbon Black Industry Revenue Share (%), by Process Type 2025 & 2033

- Figure 4: Brazil South America Carbon Black Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: Brazil South America Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Brazil South America Carbon Black Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Brazil South America Carbon Black Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil South America Carbon Black Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Brazil South America Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina South America Carbon Black Industry Revenue (billion), by Process Type 2025 & 2033

- Figure 11: Argentina South America Carbon Black Industry Revenue Share (%), by Process Type 2025 & 2033

- Figure 12: Argentina South America Carbon Black Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Argentina South America Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Argentina South America Carbon Black Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Argentina South America Carbon Black Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina South America Carbon Black Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Argentina South America Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Colombia South America Carbon Black Industry Revenue (billion), by Process Type 2025 & 2033

- Figure 19: Colombia South America Carbon Black Industry Revenue Share (%), by Process Type 2025 & 2033

- Figure 20: Colombia South America Carbon Black Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Colombia South America Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Colombia South America Carbon Black Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Colombia South America Carbon Black Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Colombia South America Carbon Black Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Colombia South America Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Chile South America Carbon Black Industry Revenue (billion), by Process Type 2025 & 2033

- Figure 27: Chile South America Carbon Black Industry Revenue Share (%), by Process Type 2025 & 2033

- Figure 28: Chile South America Carbon Black Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Chile South America Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Chile South America Carbon Black Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Chile South America Carbon Black Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Chile South America Carbon Black Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Chile South America Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of South America South America Carbon Black Industry Revenue (billion), by Process Type 2025 & 2033

- Figure 35: Rest of South America South America Carbon Black Industry Revenue Share (%), by Process Type 2025 & 2033

- Figure 36: Rest of South America South America Carbon Black Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: Rest of South America South America Carbon Black Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Rest of South America South America Carbon Black Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Rest of South America South America Carbon Black Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Rest of South America South America Carbon Black Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Rest of South America South America Carbon Black Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 2: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global South America Carbon Black Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 6: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global South America Carbon Black Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 10: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global South America Carbon Black Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 14: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global South America Carbon Black Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 18: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global South America Carbon Black Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global South America Carbon Black Industry Revenue billion Forecast, by Process Type 2020 & 2033

- Table 22: Global South America Carbon Black Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global South America Carbon Black Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global South America Carbon Black Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Carbon Black Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the South America Carbon Black Industry?

Key companies in the market include Birla Carbon, Bridgestone Corporation, Cabot Corporation, Hubron International, Koppers Inc, Mitsubishi Chemical Holdings Corporation, negroven, Orion Engineered Carbons, Phillips Carbon Black Ltd, Tokai Carbon Co Ltd*List Not Exhaustive.

3. What are the main segments of the South America Carbon Black Industry?

The market segments include Process Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.6 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Market Penetration of Specialty Black; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Application for Tires and Industrial Rubber Products.

7. Are there any restraints impacting market growth?

; Increasing Market Penetration of Specialty Black; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Carbon Black Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Carbon Black Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Carbon Black Industry?

To stay informed about further developments, trends, and reports in the South America Carbon Black Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence