Key Insights

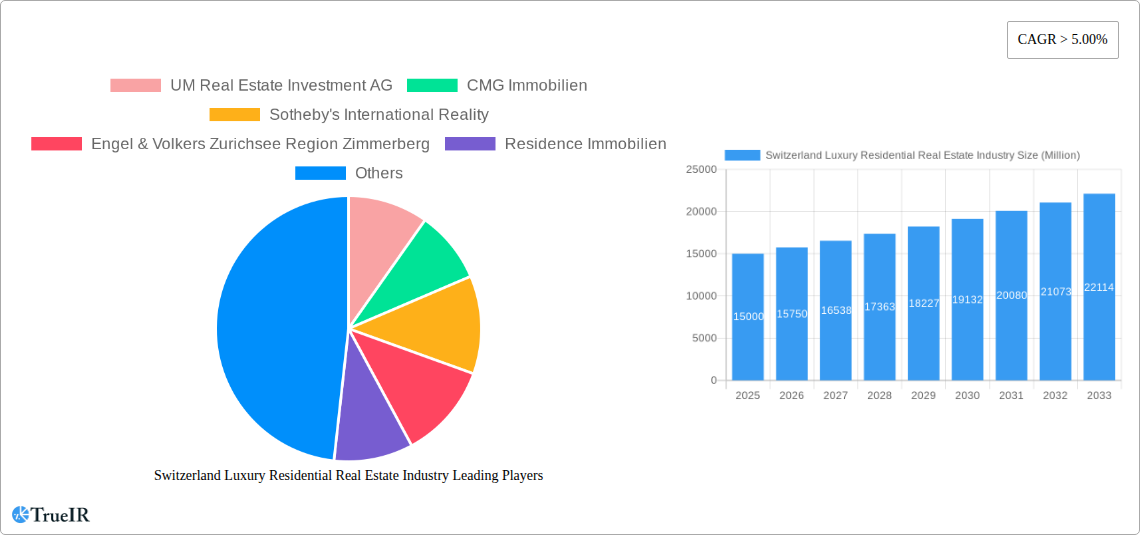

The Switzerland luxury residential real estate market, valued at approximately CHF 15 billion in 2025, exhibits robust growth potential, driven by a confluence of factors. High net-worth individuals (HNWIs), attracted by Switzerland's political stability, strong economy, and exceptional quality of life, fuel consistent demand. Furthermore, low interest rates (though potentially fluctuating) and a limited supply of luxury properties in prime locations like Zurich, Geneva, and Bern, contribute to escalating prices. The market is segmented primarily by property type (villas/landed houses and apartments/condominiums) and location, with significant concentration in major cities. While fluctuating global economic conditions pose a potential restraint, the enduring appeal of Swiss luxury properties and the continuous influx of HNWIs are expected to mitigate these risks. The ongoing trend towards sustainable and smart home technologies is also reshaping the luxury market, impacting both construction and buyer preferences. Companies like UM Real Estate Investment AG and Sotheby's International Realty are key players, reflecting the market's sophistication and high level of professional service.

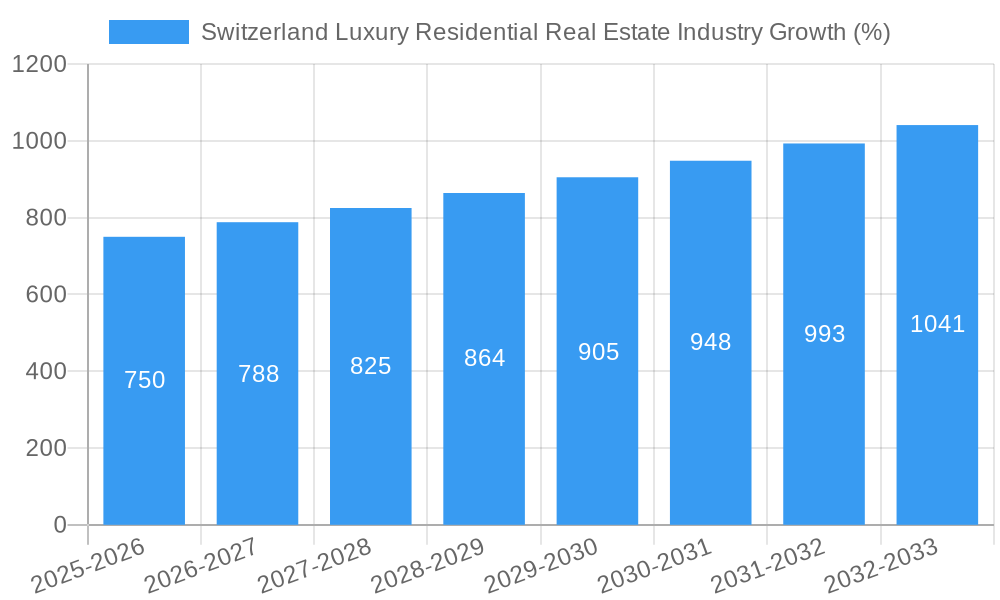

With a projected Compound Annual Growth Rate (CAGR) exceeding 5%, the Switzerland luxury residential real estate market is poised for substantial expansion over the forecast period (2025-2033). This growth trajectory is expected to be sustained by continued demand from domestic and international buyers seeking secure and prestigious investments. The increasing popularity of Swiss citizenship programs and the appeal of the country's robust healthcare and education systems further contribute to the market's attractiveness. However, strict building regulations and land scarcity in prime areas will likely influence the rate of new development, potentially sustaining price appreciation. Competitive pricing among luxury developers and real estate agencies, alongside innovative marketing strategies leveraging digital platforms, will play a crucial role in shaping market dynamics.

Switzerland Luxury Residential Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate industry, covering market structure, trends, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for investors, developers, and industry professionals seeking to navigate this dynamic market. The report leverages extensive data analysis to provide actionable insights and strategic recommendations. The total market value is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Switzerland Luxury Residential Real Estate Industry Market Structure & Competitive Landscape

The Swiss luxury residential real estate market exhibits a moderately concentrated structure, with several prominent players vying for market share. While precise concentration ratios require proprietary data, anecdotal evidence suggests a relatively high level of competition, especially in prime locations like Zurich and Geneva. Innovation is driven by technological advancements in property marketing, virtual tours, and data analytics, enhancing the customer experience and efficiency. Regulatory impacts, particularly zoning laws and environmental regulations, significantly influence development and pricing. Luxury rental properties act as a key product substitute for outright purchasing. End-user segmentation largely focuses on high-net-worth individuals (HNWIs), both domestic and international, with distinct preferences based on location, property type, and lifestyle. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a reported xx Million in M&A volume in 2024, mainly involving smaller firms consolidating to enhance their market presence.

- Market Concentration: Moderately concentrated, with a few dominant players and several smaller firms.

- Innovation Drivers: Technological advancements in property marketing, virtual tours, and data analytics.

- Regulatory Impacts: Zoning laws, environmental regulations, and tax policies significantly shape the market.

- Product Substitutes: Luxury rental properties and alternative investment options.

- End-User Segmentation: Primarily HNWIs, both domestic and international, with varying preferences.

- M&A Trends: Moderate activity in recent years, with a focus on consolidation among smaller firms.

Switzerland Luxury Residential Real Estate Industry Market Trends & Opportunities

The Swiss luxury residential real estate market demonstrates consistent growth, with a Compound Annual Growth Rate (CAGR) of xx% projected during the forecast period (2025-2033). Market size, valued at xx Million in 2025, is driven by strong demand from HNWIs, fueled by economic stability, political neutrality, and a high quality of life. Technological shifts toward online platforms, virtual reality property tours, and data-driven pricing strategies are reshaping the industry. Consumer preferences lean toward sustainable, energy-efficient properties, located in prime urban areas or scenic locations with proximity to nature. Competitive dynamics involve a balance between established firms and emerging boutique agencies, leading to specialized service offerings and a heightened focus on personalized client experiences. Market penetration of new technologies is estimated at xx% in 2025, projected to increase to xx% by 2033.

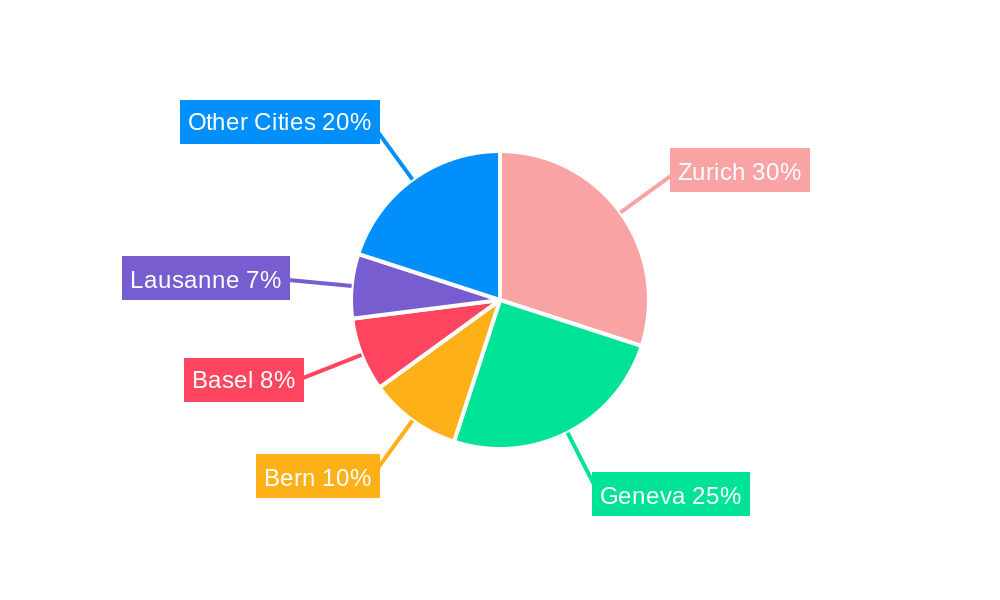

Dominant Markets & Segments in Switzerland Luxury Residential Real Estate Industry

Zurich, Geneva, and other select cities within the Lake Geneva region remain the dominant markets in the Swiss luxury residential real estate sector. Within these high demand areas the "Villas and Landed Houses" segment commands premium pricing and enjoys considerable market share owing to their exclusivity and prime locations.

- Key Growth Drivers (Zurich): Strong economy, high concentration of HNWIs, excellent infrastructure, and limited land availability pushing prices upwards.

- Key Growth Drivers (Geneva): International organizations, diplomatic presence, stunning lakeside views, and a sophisticated lifestyle appeal.

- Key Growth Drivers (Villas & Landed Houses): Exclusivity, privacy, and larger living spaces which are highly desirable by HNWIs.

- Key Growth Drivers (Apartments & Condominiums): Convenience, modern amenities, and lower maintenance which appeals to high net worth individuals.

- Other Dominant Cities: Basel, Lausanne, and other cities in prime locations benefit from proximity to major urban centers and scenic landscapes.

Switzerland Luxury Residential Real Estate Industry Product Analysis

The Swiss luxury residential real estate sector offers a diverse range of products, including ultra-modern apartments with smart home technology, historical renovations blending heritage with modern design, and eco-friendly villas integrated with renewable energy systems. The market's competitive landscape necessitates innovative features, high-quality construction, and exceptional service to attract discerning clientele. Technological advancements in construction materials, energy efficiency, and smart home integration are constantly redefining the standards of luxury living. Market fit focuses on satisfying individual requirements of HNWIs, whether focused on size, location, amenities, or unique architectural elements.

Key Drivers, Barriers & Challenges in Switzerland Luxury Residential Real Estate Industry

Key Drivers: Strong economic fundamentals, high disposable income of HNWIs, ongoing demand from international buyers, and the appeal of Switzerland as a safe haven for investment are among the key drivers. Government policies promoting sustainable development and eco-friendly buildings also play a key role.

Challenges: Limited land availability, stringent construction regulations, and high construction costs represent major challenges. Competition from other luxury real estate markets and fluctuations in the global economy also influence market dynamics.

Growth Drivers in the Switzerland Luxury Residential Real Estate Industry Market

Robust economic conditions, a stable political environment, and increased demand from both domestic and international high-net-worth individuals are primary growth drivers. Technological innovation in sustainable building materials and smart home integration is creating new opportunities and adding value. Furthermore, government initiatives promoting eco-friendly development contribute significantly to market growth.

Challenges Impacting Switzerland Luxury Residential Real Estate Industry Growth

Stringent regulations, lengthy approval processes, and limited land availability create significant barriers. Rising construction costs due to material shortages and skilled labor scarcity add further pressure. Intense competition among established agencies and new entrants, particularly those focused on niche markets within the luxury segment, necessitates investment and innovation to maintain market share.

Key Players Shaping the Switzerland Luxury Residential Real Estate Industry Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury Places SA

- La Roche Residential

Significant Switzerland Luxury Residential Real Estate Industry Industry Milestones

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg expanded to over 50 locations in Switzerland, increasing its market presence and local brand recognition.

- March 2023: Honeywell Immobilier partnered with the Watershed Organization Trust (WOTR) to promote sustainable practices, enhancing its corporate social responsibility profile and potentially attracting environmentally conscious buyers.

Future Outlook for Switzerland Luxury Residential Real Estate Industry Market

The Swiss luxury residential real estate market is poised for continued growth, driven by consistent demand from HNWIs and ongoing economic stability. Strategic opportunities lie in leveraging technology, focusing on sustainable developments, and catering to the evolving preferences of discerning buyers. The market is expected to remain attractive for investors and developers seeking long-term value in this stable and desirable location.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence