Key Insights

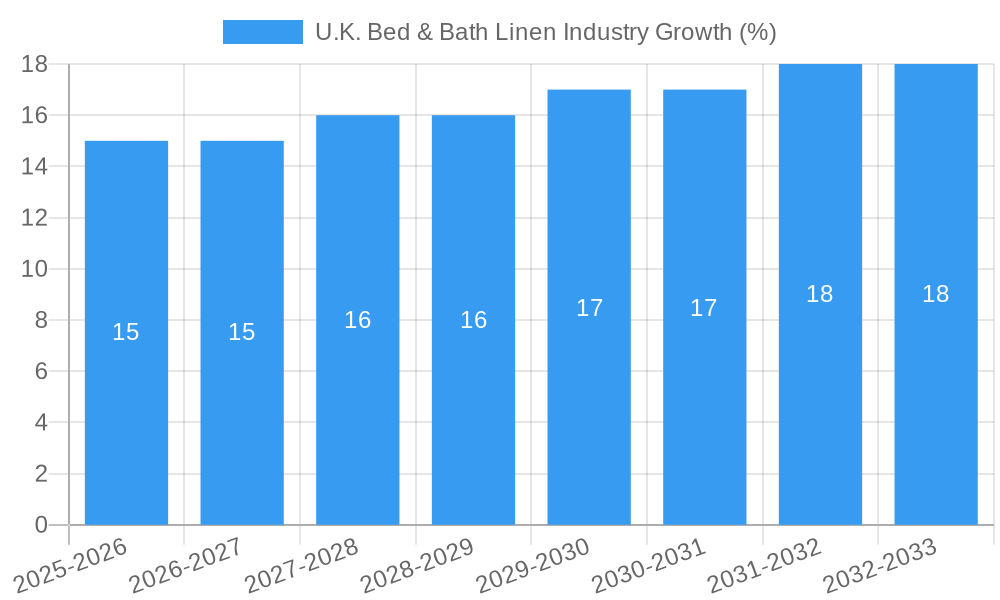

The UK bed and bath linen market, valued at approximately £X million in 2025 (assuming a reasonable market size based on similar European markets and the provided CAGR), is projected to experience robust growth with a CAGR exceeding 1.00% through 2033. This growth is fueled by several key factors. Rising disposable incomes among UK households are driving demand for higher-quality, premium bed and bath linens. The increasing popularity of online shopping, particularly through e-commerce platforms, provides convenient access and wider choices for consumers. Furthermore, a growing awareness of sustainable and ethically sourced products is influencing purchase decisions, creating opportunities for brands emphasizing eco-friendly materials and manufacturing practices. The market is segmented by type (bed linen, bath linen, other), end-users (residential, commercial), and distribution channels (hypermarkets, supermarkets, specialty stores, e-commerce). While the residential segment currently dominates, the commercial sector presents a notable growth avenue as hotels and hospitality businesses prioritize high-quality linens to enhance guest experience.

However, the market faces challenges. Fluctuations in raw material prices, particularly cotton, can impact production costs and profitability. Intense competition among established brands and emerging players necessitates innovative product offerings and effective marketing strategies to maintain market share. Economic downturns could also dampen consumer spending on non-essential items like premium linens, influencing overall market growth. Nevertheless, the long-term outlook remains positive, driven by consistent consumer demand for comfort, style, and sustainability in bedding and bath products. The diverse range of brands operating in the UK, from established players like Marks & Spencer and John Lewis to smaller, niche brands, indicates a vibrant and dynamic market with opportunities for both large corporations and entrepreneurial ventures. Growth is further supported by a strong focus on improving home environments, a trend that shows no sign of slowing down in the coming years.

U.K. Bed & Bath Linen Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the U.K. bed and bath linen industry, offering invaluable insights for businesses, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report examines market size, key players, trends, and future growth potential. The £xx Million market is poised for significant expansion, presenting lucrative opportunities for strategic players.

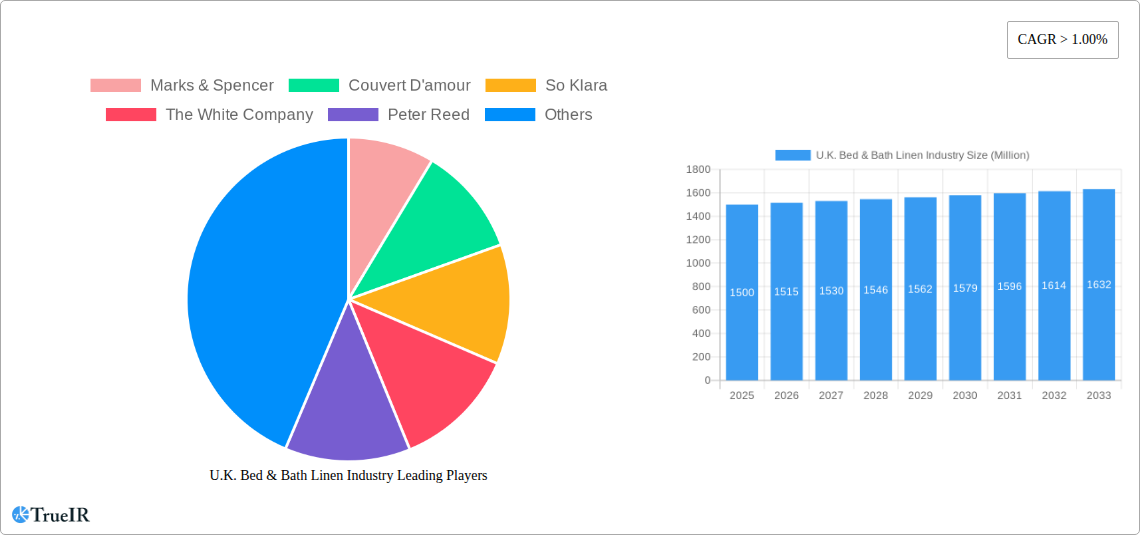

U.K. Bed & Bath Linen Industry Market Structure & Competitive Landscape

The U.K. bed and bath linen market exhibits a moderately concentrated structure, with several key players commanding significant market share. The industry's competitive landscape is characterized by a mix of established brands and emerging players, leading to dynamic competition. Key factors influencing the market include continuous product innovation (e.g., sustainable materials, smart technologies), evolving consumer preferences, and stringent regulatory frameworks regarding product safety and environmental impact. Mergers and acquisitions (M&A) activity remains moderate, with a focus on expanding product portfolios and strengthening distribution networks. In 2024, M&A activity resulted in approximately £xx Million in deals. The concentration ratio (CR4) for the top four players is estimated at xx%, indicating a moderately consolidated market.

- Key Players: Marks & Spencer, Couvert D'amour, So Klara, The White Company, Peter Reed, Dunelm, Primark, IKEA, Finest Linen Company, John Lewis and Partners, Victoria Linen, Ralph Lauren Corporation, Debenhams, Coco and Wolf, Emma Hardicker, Mairi Helena, NEXT (List Not Exhaustive).

- Market Segmentation: The market is segmented by product type (bed linen, bath linen, other bed linens), end-user (residential, commercial), and distribution channel (hypermarkets/supermarkets, specialty stores, e-commerce, other).

- Innovation Drivers: Sustainable materials, technological advancements in fabric production, and personalized designs.

- Regulatory Impacts: EU and UK regulations on product safety, labeling, and environmental impact.

- Product Substitutes: Alternative bedding and bath materials (e.g., microfiber, bamboo).

U.K. Bed & Bath Linen Industry Market Trends & Opportunities

The U.K. bed and bath linen market is experiencing steady growth, driven by increasing disposable incomes, a growing preference for high-quality home textiles, and the rise of online retail. The market size is estimated at £xx Million in 2025, and is projected to reach £xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key trends include a rising demand for sustainable and ethically sourced products, increasing popularity of luxury linens, and the growing adoption of e-commerce platforms for purchasing bed and bath linens. Market penetration rates for online sales are steadily increasing, currently estimated at xx%, and are expected to reach xx% by 2033. These trends present significant opportunities for businesses to innovate, cater to evolving consumer preferences, and expand their market share. The shift towards sustainable products is particularly noticeable, with growing consumer awareness and demand for eco-friendly options pushing companies to adopt more responsible practices.

Dominant Markets & Segments in U.K. Bed & Bath Linen Industry

The residential segment dominates the U.K. bed and bath linen market, accounting for xx% of total revenue in 2025. E-commerce is also a rapidly growing distribution channel, with online sales expected to contribute significantly to market growth in the coming years.

Leading Segments:

- By Type: Bed linen holds the largest market share, followed by bath linen.

- By End-User: Residential segment commands the highest market share.

- By Distribution Channel: E-commerce and specialty stores are experiencing significant growth.

Key Growth Drivers:

- Residential Segment: Rising disposable incomes, increased focus on home improvement, and growing preference for high-quality home textiles.

- E-commerce Channel: Convenience, wide product selection, and competitive pricing.

U.K. Bed & Bath Linen Industry Product Analysis

The U.K. bed and bath linen market showcases a diverse range of products, encompassing various materials (cotton, linen, silk, microfiber), designs, and price points. Technological advancements are driving product innovation, with features like moisture-wicking fabrics, antimicrobial treatments, and temperature-regulating technologies gaining traction. These innovations cater to diverse consumer needs and preferences, enhancing product appeal and competitive advantage.

Key Drivers, Barriers & Challenges in U.K. Bed & Bath Linen Industry

Key Drivers: Rising disposable incomes, increasing focus on home comfort and aesthetics, growing demand for luxury linens, and the rise of e-commerce. Government initiatives promoting sustainable manufacturing practices also contribute positively.

Key Challenges: Fluctuations in raw material prices, intense competition from both domestic and international players, and maintaining sustainable supply chains are significant hurdles. Stringent environmental regulations also impact production costs and operational efficiency. Supply chain disruptions, particularly those witnessed in recent years, impacted sales and profitability. Estimates suggest a xx% decrease in revenue for some players in 2022 due to these disruptions.

Growth Drivers in the U.K. Bed & Bath Linen Industry Market

Strong growth is propelled by rising disposable incomes, a trend towards premiumization in home textiles, and the expanding online retail sector. Furthermore, increased consumer awareness of sustainability is boosting demand for eco-friendly products, creating new opportunities for innovative businesses.

Challenges Impacting U.K. Bed & Bath Linen Industry Growth

The industry faces challenges from fluctuating raw material costs, intense competition, and the need to navigate complex supply chains. Maintaining ethical and sustainable sourcing practices adds further complexity and cost. Stringent regulations around product safety and environmental impact also present ongoing hurdles.

Key Players Shaping the U.K. Bed & Bath Linen Industry Market

- Marks & Spencer

- Couvert D'amour

- So Klara

- The White Company

- Peter Reed

- Dunelm

- Primark

- IKEA

- Finest Linen Company

- John Lewis and Partners

- Victoria Linen

- Ralph Lauren Corporation

- Debenhams

- Coco and Wolf

- Emma Hardicker

- Mairi Helena

- NEXT

Significant U.K. Bed & Bath Linen Industry Milestones

- May 2023: Standard Fiber secured a licensing agreement with Highclere Castle to develop and distribute bed, bath, and pet products. This significantly expands Standard Fiber's product portfolio and market reach.

- April 2023: XPO Logistics won a multi-year contract to manage Christy England's supply chain, optimizing logistics and enhancing efficiency for the luxury retailer. This showcases the increasing importance of efficient supply chain management within the industry.

Future Outlook for U.K. Bed & Bath Linen Industry Market

The U.K. bed and bath linen market is poised for continued growth, driven by positive economic indicators and evolving consumer preferences. Strategic opportunities lie in developing sustainable and innovative products, leveraging e-commerce platforms, and focusing on niche market segments. The market's potential for expansion is substantial, promising attractive returns for businesses that effectively adapt to market dynamics.

U.K. Bed & Bath Linen Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

U.K. Bed & Bath Linen Industry Segmentation By Geography

- 1. U.K.

U.K. Bed & Bath Linen Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in Hospitality Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Number of Hotel Constructions Growing the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

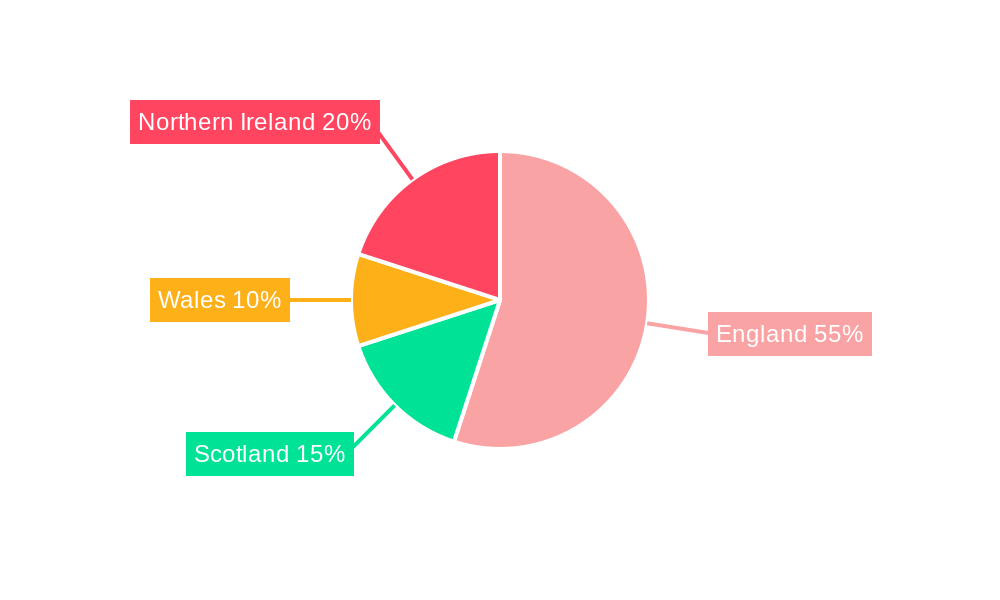

- 6. England U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 7. Wales U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 8. Scotland U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 10. Ireland U.K. Bed & Bath Linen Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Marks & Spencer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Couvert D'amour

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 So Klara

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The White Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Peter Reed

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dunelm

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Primark

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IKEA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Finest Linen Company**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 John Lewis and Partners

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Victoria Linen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ralph Lauren Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Debenhams

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Coco and Wolf

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Emma Hardicker

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Mairi Helena

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 NEXT

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Marks & Spencer

List of Figures

- Figure 1: U.K. Bed & Bath Linen Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: U.K. Bed & Bath Linen Industry Share (%) by Company 2024

List of Tables

- Table 1: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: England U.K. Bed & Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Wales U.K. Bed & Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Scotland U.K. Bed & Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Northern U.K. Bed & Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Ireland U.K. Bed & Bath Linen Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 15: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 16: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 17: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 18: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 19: U.K. Bed & Bath Linen Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. Bed & Bath Linen Industry?

The projected CAGR is approximately > 1.00%.

2. Which companies are prominent players in the U.K. Bed & Bath Linen Industry?

Key companies in the market include Marks & Spencer, Couvert D'amour, So Klara, The White Company, Peter Reed, Dunelm, Primark, IKEA, Finest Linen Company**List Not Exhaustive, John Lewis and Partners, Victoria Linen, Ralph Lauren Corporation, Debenhams, Coco and Wolf, Emma Hardicker, Mairi Helena, NEXT.

3. What are the main segments of the U.K. Bed & Bath Linen Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in Hospitality Sector is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Number of Hotel Constructions Growing the Market.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market.

8. Can you provide examples of recent developments in the market?

May 2023: Standard Fiber, one of the suppliers to the home textile and hospitality markets, has established a licensing agreement with Highclere Castle, enabling the company the rights to develop and distribute a broad assortment of bed, bath, and pet products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. Bed & Bath Linen Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. Bed & Bath Linen Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. Bed & Bath Linen Industry?

To stay informed about further developments, trends, and reports in the U.K. Bed & Bath Linen Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence