Key Insights

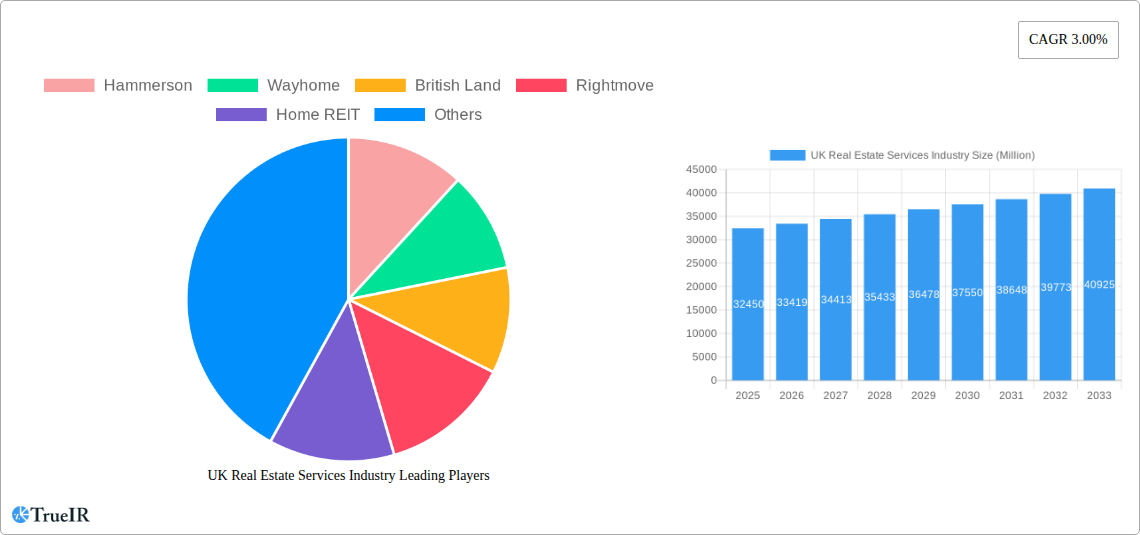

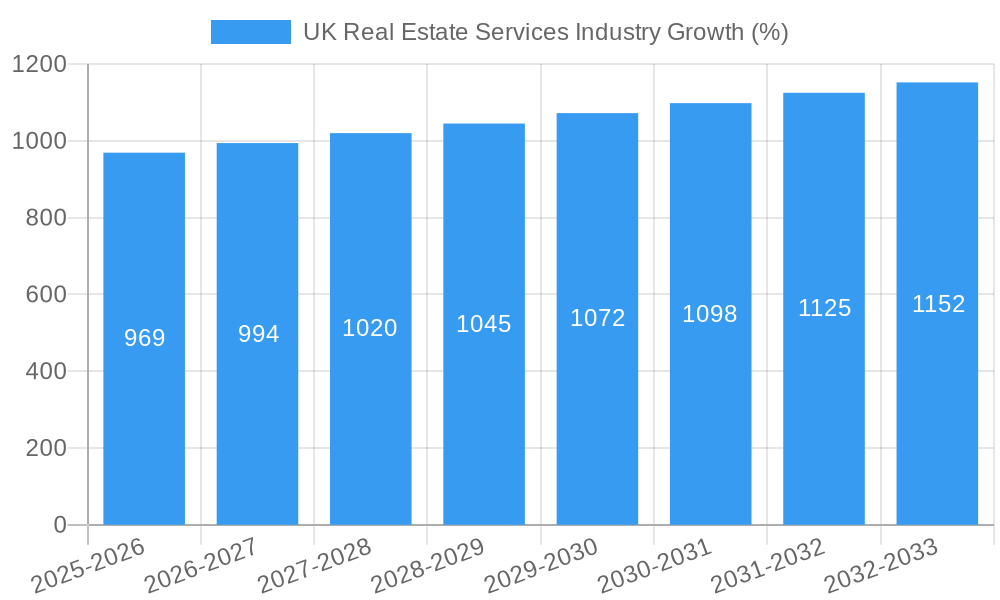

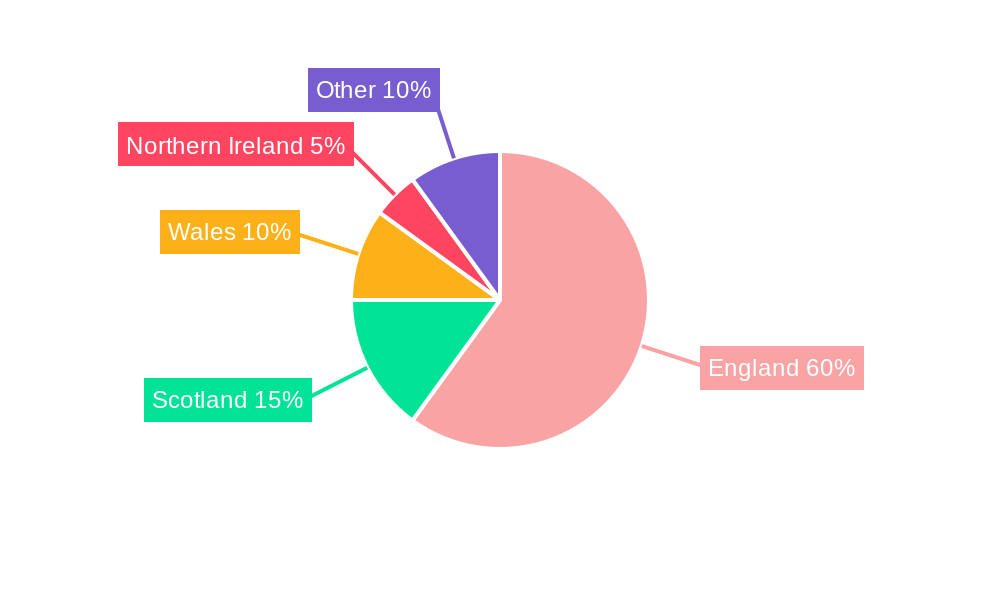

The UK real estate services industry, valued at £32.45 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 3.00% from 2025 to 2033. This growth is fueled by several key drivers. Increased urbanization and population growth in major cities like London, Manchester, and Birmingham are continuously driving demand for residential and commercial properties, boosting property management and valuation services. Furthermore, the ongoing development of sustainable and technologically advanced buildings is shaping the industry, requiring specialized services related to energy efficiency and smart building management. Government initiatives aimed at boosting infrastructure and improving housing stock are also contributing to market expansion. However, economic uncertainties, fluctuating interest rates, and potential regulatory changes pose challenges, potentially slowing down growth in certain segments. The market is segmented by property type (residential, commercial, and other) and service type (property management, valuation, and other services), with residential property management currently holding the largest market share. Competition is intense, with a mix of large national players like Hammerson, British Land, and Rightmove alongside smaller regional firms and specialized service providers. Regional variations exist, with London and the South East generally exhibiting higher activity levels due to higher property values and transaction volumes. The forecast anticipates a gradual increase in market size throughout the projected period, influenced by the interplay of these driving forces, trends, and potential restraints.

The competitive landscape is characterized by a blend of established corporations and smaller, specialized firms. Large players benefit from economies of scale and brand recognition, while smaller firms offer greater flexibility and niche expertise. The increasing adoption of technology, particularly in areas like proptech and data analytics, is reshaping how services are delivered, leading to increased efficiency and improved customer experiences. This technology-driven transformation presents opportunities for firms that can effectively integrate digital tools into their operations. Looking ahead, the industry's success hinges on adapting to evolving market dynamics, including changing consumer preferences, environmental concerns, and technological innovations. Companies that prioritize sustainability, innovation, and customer-centric approaches are best positioned for continued growth within the dynamic UK real estate services sector.

UK Real Estate Services Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the UK real estate services industry, offering invaluable insights for investors, stakeholders, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, trends, opportunities, and challenges, forecasting robust growth and highlighting key players. The report leverages extensive data and in-depth analysis to provide a comprehensive understanding of this ever-evolving market.

UK Real Estate Services Industry Market Structure & Competitive Landscape

The UK real estate services market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Concentration ratios vary significantly across service types and property categories. For instance, the residential property management segment shows a higher concentration than the commercial valuation segment. Innovation is primarily driven by technological advancements such as PropTech solutions (e.g., virtual tours, online property management platforms), increasing demand for data-driven insights, and evolving regulatory requirements. The market experiences significant regulatory impact from government policies on housing affordability, environmental standards, and taxation. Product substitutes, such as alternative investment vehicles and shared ownership schemes, are gradually impacting market share. End-user segmentation is predominantly categorized as residential, commercial, and other property types, each with unique needs and preferences. M&A activity has been significant, with approximately xx mergers and acquisitions recorded between 2019 and 2024, leading to increased market consolidation. This is likely to continue as larger firms seek to expand their market share and service offerings. Future consolidation could lead to a further increase in concentration ratios.

UK Real Estate Services Industry Market Trends & Opportunities

The UK real estate services market is experiencing robust growth, with an estimated market size of £xx Million in 2025. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, driven by several factors including sustained demand for residential and commercial properties, technological advancements leading to improved efficiency and service delivery, and favorable government policies promoting sustainable development. Significant shifts in consumer preferences are also noted, with increasing demand for eco-friendly properties and digitally enabled services. This trend creates significant opportunities for companies adopting sustainable practices and incorporating digital solutions into their offerings. Market penetration rates for various services vary widely, with property management exhibiting high penetration in urban areas while valuation services show comparatively lower penetration in rural regions. Competitive dynamics are characterized by intense competition among established players, coupled with the emergence of innovative PropTech startups. The integration of technology and data analytics is reshaping the competitive landscape, favoring firms with advanced capabilities in these areas.

Dominant Markets & Segments in UK Real Estate Services Industry

Leading Region: London and the South East continue to dominate the market, driven by strong economic activity, high property values, and significant investment in infrastructure. Other major cities like Manchester, Birmingham, and Edinburgh also exhibit considerable growth.

Dominant Property Type: The residential segment holds the largest market share, driven by persistent housing shortages and population growth.

Leading Service Type: Property management represents the most significant segment, fueled by increasing demand for professional property management services from both individual landlords and institutional investors.

Key Growth Drivers:

- Significant government investment in infrastructure projects (e.g., HS2).

- Favorable lending policies, facilitating increased access to mortgages.

- Government initiatives promoting affordable housing, thereby influencing residential property sector growth.

- Growth of the buy-to-let market.

- Continued increase in urbanisation.

The residential segment's dominance is fueled by consistent population growth, migration to urban centers, and increasing demand for rental accommodations, leading to substantial investments in build-to-rent developments. The commercial sector is experiencing dynamic growth with ongoing investment in office spaces and retail developments in prime urban areas, further strengthening market dominance.

UK Real Estate Services Industry Product Analysis

The UK real estate services market is witnessing a wave of product innovation, primarily driven by technological advancements. This includes the emergence of sophisticated property management software, AI-powered valuation tools, and virtual reality-based property tours. These innovative products offer enhanced efficiency, cost savings, and improved customer experience, giving companies a significant competitive advantage. The market fit for these new products is strong, particularly among younger generations who are digitally native and value convenience.

Key Drivers, Barriers & Challenges in UK Real Estate Services Industry

Key Drivers:

Technological advancements, including the rise of PropTech, are streamlining processes and improving efficiency. Economic growth and population increases fuel demand for both residential and commercial properties. Government policies aimed at boosting housing supply and infrastructure development are further supporting industry expansion.

Key Challenges:

Regulatory hurdles, including complex planning permissions and environmental regulations, cause delays and increase costs. Supply chain disruptions, particularly in construction materials, hinder new development projects. Intense competition among established players and the entry of new PropTech companies put pressure on margins and necessitate continuous innovation. A shortage of skilled labor in the construction and real estate sectors constrains growth. The estimated impact of these challenges is a reduction in annual growth of xx% based on current projections.

Growth Drivers in the UK Real Estate Services Industry Market

The UK real estate services market is propelled by technological innovation leading to increased efficiency and improved customer experience. Strong economic growth coupled with steady population increase fuel consistent demand for housing and commercial properties. Government policies focused on urban regeneration and infrastructure investments further stimulate market growth.

Challenges Impacting UK Real Estate Services Industry Growth

Regulatory complexities, including lengthy planning permissions, increase development costs and timelines. Supply chain vulnerabilities resulting in material shortages and price volatility directly impact construction projects and ultimately hamper market expansion. Intense competition both from established firms and new entrants in the PropTech space limits pricing power and profit margins.

Key Players Shaping the UK Real Estate Services Industry Market

- Hammerson

- Wayhome

- British Land

- Rightmove

- Home REIT

- Bridgewater Housing Association Ltd

- Shaftesbury PLC

- Berkeley Group Holdings PLC

- Derwent London

- Tritax Big Box Reit PLC

- Capital & Counties Properties PLC

- Sanctuary Housing Association

- Unite Group PLC

Significant UK Real Estate Services Industry Milestones

November 2022: JLL reported £10 Billion (USD 12.73 Billion) annual investment in UK living real estate in Q3 2022, highlighting significant investor confidence and the ongoing shortage of quality rental homes.

January 2023: Acquisition of United Kingdom Sotheby's Property Business by Sotheby's Dubai branch signifies a shift in international investment and influence within the luxury property market.

Future Outlook for UK Real Estate Services Industry Market

The UK real estate services market is poised for continued growth, driven by technological innovation, sustained economic activity, and evolving consumer preferences. Strategic opportunities exist for companies that can effectively leverage technology, embrace sustainable practices, and cater to the evolving needs of a diverse customer base. The market’s potential is substantial, particularly in the areas of sustainable development, PropTech integration, and providing innovative solutions to address the housing shortage. Further consolidation is expected through mergers and acquisitions, leading to a more concentrated market structure in the coming years.

UK Real Estate Services Industry Segmentation

-

1. Property type

- 1.1. Residential

- 1.2. Commercial

- 1.3. Other Property Types

-

2. Service

- 2.1. Property Management

- 2.2. Valuation

- 2.3. Other Services

UK Real Estate Services Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Real Estate Services Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improvements in Infrastructure and New Development; Population Growth and Demographic Changes

- 3.3. Market Restrains

- 3.3.1. Housing Shortages; Increasing Awareness towards Environmental Issues

- 3.4. Market Trends

- 3.4.1. Increasing in the United Kingdom House Prices

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 5.1.1. Residential

- 5.1.2. Commercial

- 5.1.3. Other Property Types

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Property Management

- 5.2.2. Valuation

- 5.2.3. Other Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Property type

- 6. North America UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 6.1.1. Residential

- 6.1.2. Commercial

- 6.1.3. Other Property Types

- 6.2. Market Analysis, Insights and Forecast - by Service

- 6.2.1. Property Management

- 6.2.2. Valuation

- 6.2.3. Other Services

- 6.1. Market Analysis, Insights and Forecast - by Property type

- 7. South America UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 7.1.1. Residential

- 7.1.2. Commercial

- 7.1.3. Other Property Types

- 7.2. Market Analysis, Insights and Forecast - by Service

- 7.2.1. Property Management

- 7.2.2. Valuation

- 7.2.3. Other Services

- 7.1. Market Analysis, Insights and Forecast - by Property type

- 8. Europe UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 8.1.1. Residential

- 8.1.2. Commercial

- 8.1.3. Other Property Types

- 8.2. Market Analysis, Insights and Forecast - by Service

- 8.2.1. Property Management

- 8.2.2. Valuation

- 8.2.3. Other Services

- 8.1. Market Analysis, Insights and Forecast - by Property type

- 9. Middle East & Africa UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 9.1.1. Residential

- 9.1.2. Commercial

- 9.1.3. Other Property Types

- 9.2. Market Analysis, Insights and Forecast - by Service

- 9.2.1. Property Management

- 9.2.2. Valuation

- 9.2.3. Other Services

- 9.1. Market Analysis, Insights and Forecast - by Property type

- 10. Asia Pacific UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 10.1.1. Residential

- 10.1.2. Commercial

- 10.1.3. Other Property Types

- 10.2. Market Analysis, Insights and Forecast - by Service

- 10.2.1. Property Management

- 10.2.2. Valuation

- 10.2.3. Other Services

- 10.1. Market Analysis, Insights and Forecast - by Property type

- 11. England UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Real Estate Services Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hammerson

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Wayhome

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 British Land

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Rightmove

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Home REIT

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Bridgewater Housing Association Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Shaftesbury PLC

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Berkeley Group Holdings PLC

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Derwent London

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Tritax Big Box Reit PLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Capital & Counties Properties PLC

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Sanctuary Housing Association

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Unite Group PLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Hammerson

List of Figures

- Figure 1: Global UK Real Estate Services Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Real Estate Services Industry Revenue (Million), by Property type 2024 & 2032

- Figure 5: North America UK Real Estate Services Industry Revenue Share (%), by Property type 2024 & 2032

- Figure 6: North America UK Real Estate Services Industry Revenue (Million), by Service 2024 & 2032

- Figure 7: North America UK Real Estate Services Industry Revenue Share (%), by Service 2024 & 2032

- Figure 8: North America UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UK Real Estate Services Industry Revenue (Million), by Property type 2024 & 2032

- Figure 11: South America UK Real Estate Services Industry Revenue Share (%), by Property type 2024 & 2032

- Figure 12: South America UK Real Estate Services Industry Revenue (Million), by Service 2024 & 2032

- Figure 13: South America UK Real Estate Services Industry Revenue Share (%), by Service 2024 & 2032

- Figure 14: South America UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UK Real Estate Services Industry Revenue (Million), by Property type 2024 & 2032

- Figure 17: Europe UK Real Estate Services Industry Revenue Share (%), by Property type 2024 & 2032

- Figure 18: Europe UK Real Estate Services Industry Revenue (Million), by Service 2024 & 2032

- Figure 19: Europe UK Real Estate Services Industry Revenue Share (%), by Service 2024 & 2032

- Figure 20: Europe UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Property type 2024 & 2032

- Figure 23: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Property type 2024 & 2032

- Figure 24: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Service 2024 & 2032

- Figure 25: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Service 2024 & 2032

- Figure 26: Middle East & Africa UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Property type 2024 & 2032

- Figure 29: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Property type 2024 & 2032

- Figure 30: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Service 2024 & 2032

- Figure 31: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Service 2024 & 2032

- Figure 32: Asia Pacific UK Real Estate Services Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UK Real Estate Services Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Real Estate Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 3: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 4: Global UK Real Estate Services Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 12: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 13: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 18: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 19: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 24: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 25: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 36: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 37: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global UK Real Estate Services Industry Revenue Million Forecast, by Property type 2019 & 2032

- Table 45: Global UK Real Estate Services Industry Revenue Million Forecast, by Service 2019 & 2032

- Table 46: Global UK Real Estate Services Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific UK Real Estate Services Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Real Estate Services Industry?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the UK Real Estate Services Industry?

Key companies in the market include Hammerson, Wayhome, British Land, Rightmove, Home REIT, Bridgewater Housing Association Ltd, Shaftesbury PLC, Berkeley Group Holdings PLC, Derwent London, Tritax Big Box Reit PLC, Capital & Counties Properties PLC, Sanctuary Housing Association, Unite Group PLC.

3. What are the main segments of the UK Real Estate Services Industry?

The market segments include Property type, Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Improvements in Infrastructure and New Development; Population Growth and Demographic Changes.

6. What are the notable trends driving market growth?

Increasing in the United Kingdom House Prices.

7. Are there any restraints impacting market growth?

Housing Shortages; Increasing Awareness towards Environmental Issues.

8. Can you provide examples of recent developments in the market?

January 2023: United Kingdom Sotheby's Property Business Acquired by the Dubai Branch of Sotheby's. UK Sotheby International Realty was previously owned by Robin Paterson, who sold the business to his business partner and affiliate, George Azar. George Azar currently holds and operates Sotheby's Dubai and the MENA region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Real Estate Services Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Real Estate Services Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Real Estate Services Industry?

To stay informed about further developments, trends, and reports in the UK Real Estate Services Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence