Key Insights

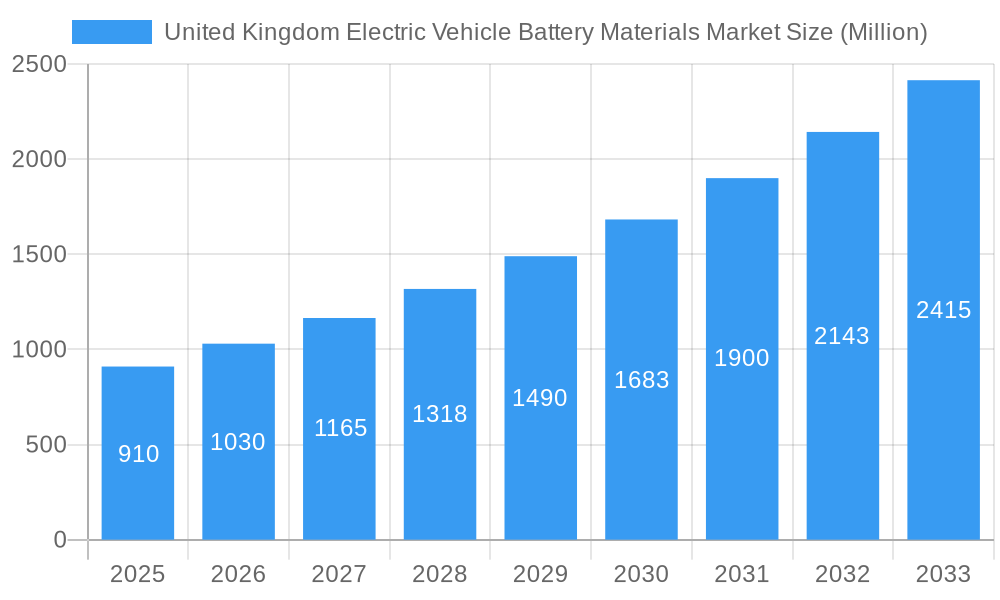

The United Kingdom Electric Vehicle (EV) battery materials market, currently valued at approximately £910 million in 2025, is projected to experience robust growth, driven by the UK government's ambitious electrification targets and increasing EV adoption rates. A Compound Annual Growth Rate (CAGR) of 13.06% from 2025 to 2033 indicates significant market expansion, reaching an estimated £2.7 billion by 2033. Key drivers include substantial investments in domestic battery manufacturing, growing demand for electric vehicles, stringent emission regulations, and incentives promoting EV adoption. Market trends reveal a shift towards higher energy density battery chemistries like lithium-ion batteries with improved nickel, manganese, and cobalt (NMC) compositions, driving demand for specialized materials. While challenges remain, such as the reliance on imported raw materials and the potential for supply chain disruptions, the UK's commitment to a green economy and the development of sustainable battery technologies are expected to mitigate these restraints. Leading players like Sumitomo Chemical, BASF, and others are strategically positioning themselves to capitalize on this burgeoning market through collaborations, research and development, and capacity expansions. The segmentation within the market likely includes cathode materials, anode materials, electrolytes, separators, and other critical components, each experiencing varying growth rates based on technological advancements and demand patterns.

United Kingdom Electric Vehicle Battery Materials Market Market Size (In Million)

The forecast period of 2025-2033 presents numerous opportunities for companies involved in the entire value chain, from raw material extraction to battery cell manufacturing and recycling. Sustained government support, focus on battery recycling infrastructure development, and the burgeoning research efforts on next-generation battery technologies (solid-state batteries, for example) further enhance the positive outlook. Competitive dynamics will continue to shape the market, with companies focused on innovation, cost optimization, and securing stable supply chains. The UK's geographic location within Europe provides access to a larger market, creating further avenues for growth and investment.

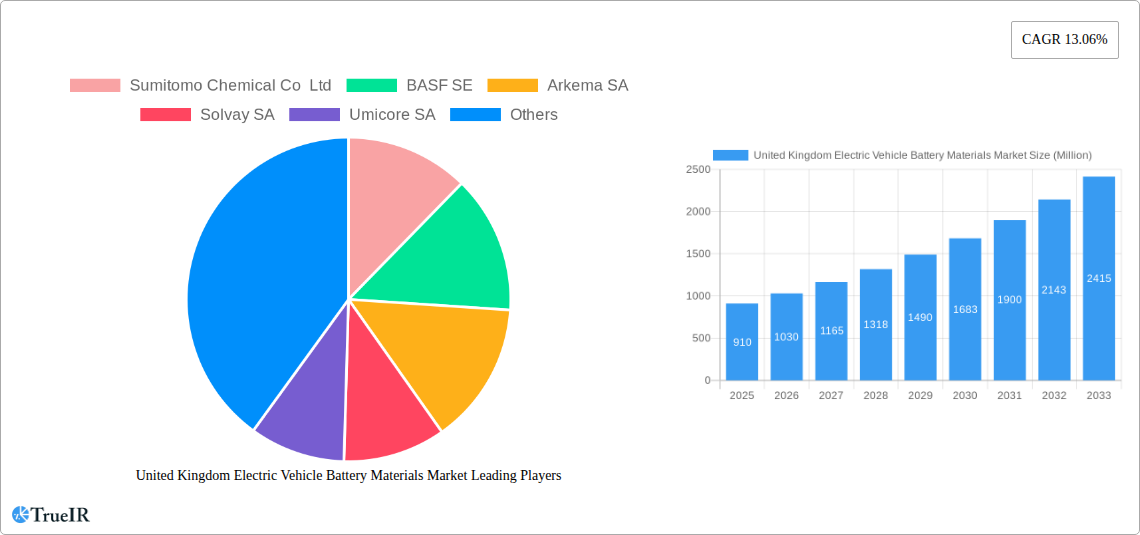

United Kingdom Electric Vehicle Battery Materials Market Company Market Share

United Kingdom Electric Vehicle Battery Materials Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning United Kingdom Electric Vehicle (EV) Battery Materials market, offering invaluable insights for industry stakeholders, investors, and researchers. Spanning the period 2019-2033, with a focus on 2025, this comprehensive study dissects market trends, competitive landscapes, and future growth prospects. The report leverages extensive data analysis and expert insights to illuminate key opportunities and challenges within this rapidly evolving sector. Expect a deep dive into market sizing (in Millions), CAGR projections, and segment-specific performance across the forecast period (2025-2033).

United Kingdom Electric Vehicle Battery Materials Market Market Structure & Competitive Landscape

This section analyzes the UK EV battery materials market's competitive landscape, including market concentration, innovation drivers, regulatory influences, and M&A activity. The market is characterized by a moderately concentrated structure, with several multinational players holding significant market share. Key players such as Sumitomo Chemical Co Ltd, BASF SE, Arkema SA, Solvay SA, Umicore SA, Mitsubishi Chemical Group Corporation, Fiamm Energy Technology, ENTEK International LLC, Johnson Matthey, and Epsilon Advanced Material are driving innovation and shaping the market dynamics. However, several other prominent companies also contribute significantly, impacting overall concentration ratios (estimated at xx%).

- Market Concentration: xx% (estimated) held by the top 5 players.

- Innovation Drivers: Focus on high-energy density materials, improved battery life, and cost reduction.

- Regulatory Impacts: Government incentives and environmental regulations significantly influence market growth.

- Product Substitutes: Research into alternative battery chemistries and materials presents potential challenges.

- End-User Segmentation: The market is segmented by battery type (Lithium-ion, etc.), material type (cathode, anode, electrolyte), and EV type (passenger cars, commercial vehicles).

- M&A Trends: Consolidation is anticipated, driven by companies seeking to secure raw material supplies and expand technological capabilities. The volume of M&A transactions in the past 5 years is estimated at xx deals.

United Kingdom Electric Vehicle Battery Materials Market Market Trends & Opportunities

The UK EV battery materials market exhibits substantial growth potential, driven by the increasing adoption of electric vehicles fueled by government policies promoting sustainable transportation and rising environmental concerns. The market size is projected to reach £xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements in battery technology, such as solid-state batteries and improved energy density, are further accelerating market growth. Consumer preferences are shifting towards EVs, creating a strong demand for high-performance battery materials. The competitive dynamics are characterized by intense competition amongst established players and emerging companies developing innovative battery materials. Market penetration rates for various battery materials are projected to increase significantly over the forecast period, especially for advanced materials offering improved performance and longevity.

Dominant Markets & Segments in United Kingdom Electric Vehicle Battery Materials Market

The UK market is experiencing strong growth across all regions, although specific areas benefit from more favorable infrastructure or supportive government policies. Currently, the dominance is shared across major urban centers and industrial regions with significant EV manufacturing or infrastructure development.

- Key Growth Drivers:

- Government incentives and subsidies for EV adoption.

- Investments in charging infrastructure.

- Stringent emission reduction targets.

- Growing consumer awareness of environmental issues.

- Market Dominance Analysis: While regional breakdown requires detailed data, the South East and Midlands are expected to be major contributors due to existing automotive industry presence and planned manufacturing facilities.

United Kingdom Electric Vehicle Battery Materials Market Product Analysis

The UK EV battery materials market is witnessing rapid innovation in battery technologies, focusing on enhancing energy density, lifespan, charging speed, and safety. Key advancements include the development of novel cathode and anode materials, improved electrolyte formulations, and advanced battery management systems. These innovations are leading to the production of batteries with higher energy densities and longer lifespans, meeting growing consumer demands. The market fit is strong, given the alignment with national decarbonization goals and the increasing popularity of electric vehicles.

Key Drivers, Barriers & Challenges in United Kingdom Electric Vehicle Battery Materials Market

Key Drivers: Technological advancements in battery chemistry, increasing EV adoption driven by government policies (e.g., grants, tax incentives, emission standards), and the growing need for sustainable transportation solutions are major market drivers. Furthermore, the development of robust recycling infrastructure is creating further momentum.

Key Challenges: Supply chain disruptions, particularly related to sourcing critical raw materials like lithium and cobalt, pose significant challenges. Regulatory hurdles, including complex permitting processes and environmental regulations, can increase operational costs. Finally, intense competition amongst established and emerging players could exert downward pressure on pricing. The impact of these factors on market growth is estimated to reduce the CAGR by an approximate xx%.

Growth Drivers in the United Kingdom Electric Vehicle Battery Materials Market Market

The UK government's commitment to achieving net-zero emissions by 2050 is a major driver, encouraging investment in the EV sector. Technological advancements, particularly in battery chemistries like solid-state batteries, offer enhanced performance and longevity. Furthermore, rising consumer demand for EVs, driven by environmental consciousness and cost savings, fuels market expansion.

Challenges Impacting United Kingdom Electric Vehicle Battery Materials Market Growth

Securing a stable and sustainable supply chain for critical raw materials is a primary challenge, along with navigating complex regulations and navigating geopolitical risks affecting raw material sourcing. The high capital expenditure needed for battery manufacturing also poses a barrier to entry for smaller companies.

Key Players Shaping the United Kingdom Electric Vehicle Battery Materials Market Market

- Sumitomo Chemical Co Ltd

- BASF SE

- Arkema SA

- Solvay SA

- Umicore SA

- Mitsubishi Chemical Group Corporation

- Fiamm Energy Technology

- ENTEK International LLC

- Johnson Matthey

- Epsilon Advanced Material

- List Not Exhaustive

Significant United Kingdom Electric Vehicle Battery Materials Market Industry Milestones

- December 2023: Researchers at the University of Birmingham demonstrate a technique to repurpose end-of-life EV battery waste into materials for advanced battery cathodes, potentially boosting cathode capacity and energy density.

- February 2024: Volkswagen Group UK partners with Ecoba for lithium-ion battery recycling, promoting a circular economy model and enhancing sustainability efforts within the UK automotive sector.

Future Outlook for United Kingdom Electric Vehicle Battery Materials Market Market

The UK EV battery materials market is poised for sustained growth, driven by continuous technological innovation, supportive government policies, and the increasing adoption of electric vehicles. Strategic opportunities exist in developing sustainable and efficient supply chains, investing in advanced battery technologies, and exploring innovative recycling solutions. The market's potential is substantial, promising a significant contribution to the UK's decarbonization goals and the growth of the broader EV ecosystem.

United Kingdom Electric Vehicle Battery Materials Market Segmentation

-

1. Battery Type

- 1.1. Lithium-ion Battery

- 1.2. Lead-Acid Battery

- 1.3. Others

-

2. Material

- 2.1. Cathode

- 2.2. Anode

- 2.3. Electrolyte

- 2.4. Separator

- 2.5. Others

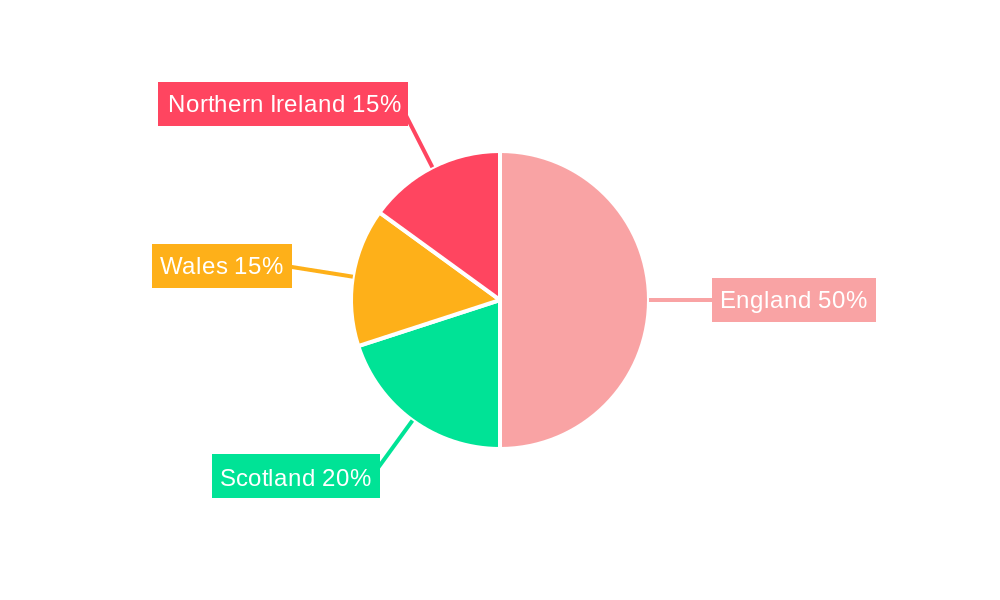

United Kingdom Electric Vehicle Battery Materials Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Electric Vehicle Battery Materials Market Regional Market Share

Geographic Coverage of United Kingdom Electric Vehicle Battery Materials Market

United Kingdom Electric Vehicle Battery Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.3. Market Restrains

- 3.3.1. 4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Electric Vehicle (EVs) Sales Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Electric Vehicle Battery Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 5.1.1. Lithium-ion Battery

- 5.1.2. Lead-Acid Battery

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cathode

- 5.2.2. Anode

- 5.2.3. Electrolyte

- 5.2.4. Separator

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Battery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sumitomo Chemical Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arkema SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solvay SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Umicore SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Chemical Group Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fiamm Energy Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ENTEK International LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Johnson Matthey

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Epsilon Adavnced Material*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sumitomo Chemical Co Ltd

List of Figures

- Figure 1: United Kingdom Electric Vehicle Battery Materials Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Electric Vehicle Battery Materials Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 2: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 3: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Battery Type 2020 & 2033

- Table 8: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Battery Type 2020 & 2033

- Table 9: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Material 2020 & 2033

- Table 10: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Material 2020 & 2033

- Table 11: United Kingdom Electric Vehicle Battery Materials Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Electric Vehicle Battery Materials Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Electric Vehicle Battery Materials Market?

The projected CAGR is approximately 13.06%.

2. Which companies are prominent players in the United Kingdom Electric Vehicle Battery Materials Market?

Key companies in the market include Sumitomo Chemical Co Ltd, BASF SE, Arkema SA, Solvay SA, Umicore SA, Mitsubishi Chemical Group Corporation, Fiamm Energy Technology, ENTEK International LLC, Johnson Matthey, Epsilon Adavnced Material*List Not Exhaustive 6 4 List of Other Prominent Companies6 5 Market Ranking/ Share Analysi.

3. What are the main segments of the United Kingdom Electric Vehicle Battery Materials Market?

The market segments include Battery Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.91 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

6. What are the notable trends driving market growth?

Growing Electric Vehicle (EVs) Sales Drives the Market.

7. Are there any restraints impacting market growth?

4.; Growing Electric Vehicle Sales4.; Supportive Government Policies and Regulations.

8. Can you provide examples of recent developments in the market?

February 2024: Volkswagen Group United Kingdom Ltd. inked a partnership with Ecoba, a prominent player in battery recycling, to repurpose lithium-ion materials from electric vehicle (EV) batteries. This collaboration not only aids VWG UK in advancing a circular energy model but also underscores the automotive giant's commitment to bolstering sustainability in the United Kingdom.December 2023: Researchers at the University of Birmingham showcased a technique for repurposing end-of-life battery waste into materials suitable for advanced battery cathodes. Leveraging material salvaged from retired EV batteries, the team crafted compounds featuring a disordered rocksalt (DRX) structure. This DRX configuration, viewed as a viable substitute for the typical layered structure in traditional cathode materials, not only enhances cathode capacity but also paves the way for the creation of lithium-ion batteries with higher energy densities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Electric Vehicle Battery Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Electric Vehicle Battery Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Electric Vehicle Battery Materials Market?

To stay informed about further developments, trends, and reports in the United Kingdom Electric Vehicle Battery Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence