Key Insights

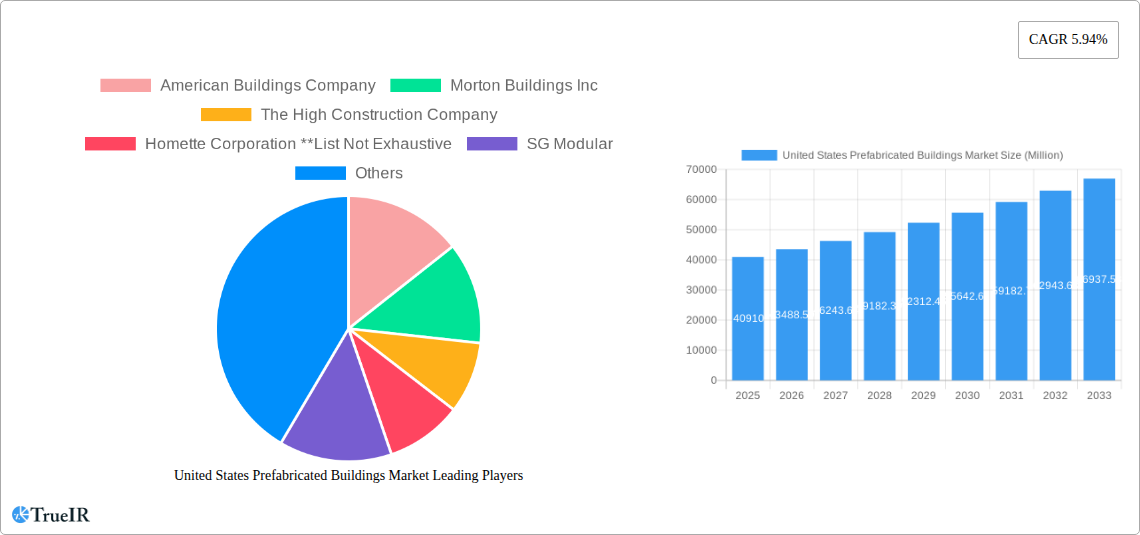

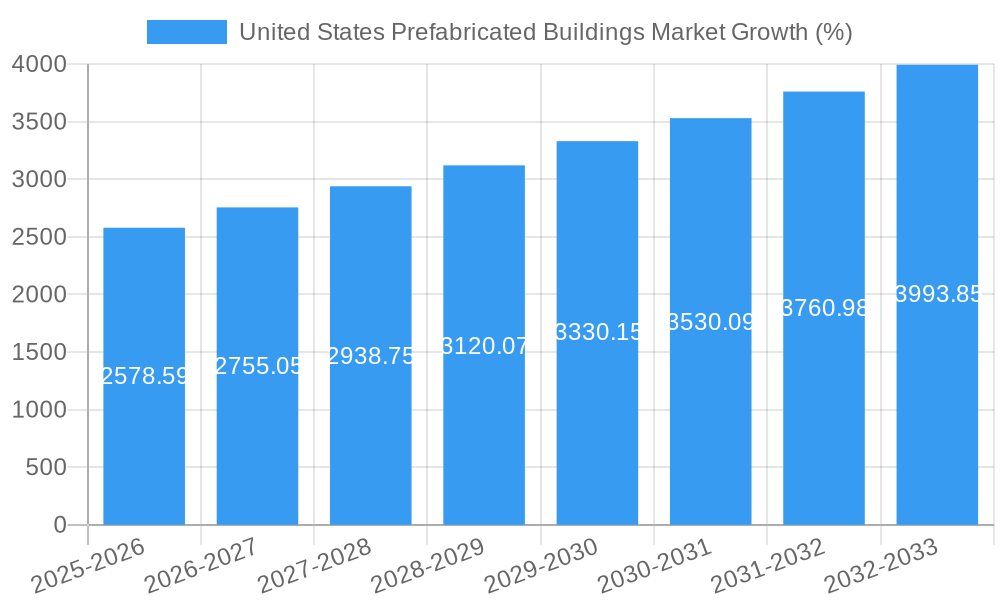

The United States prefabricated buildings market, valued at $40.91 billion in 2025, is projected to experience robust growth, driven by several key factors. Increased demand for affordable and efficient housing solutions, coupled with rising construction costs and labor shortages, fuels the adoption of prefabricated building methods. The residential segment is a major contributor, with growing urbanization and a preference for faster construction times boosting demand. Commercial applications, encompassing offices, retail spaces, and hotels, also contribute significantly to market growth. Prefabricated structures' inherent sustainability advantages, such as reduced waste and lower energy consumption during construction, align with the growing emphasis on eco-friendly building practices, further driving market expansion. Technological advancements in design and manufacturing processes, leading to improved quality and customization options, are enhancing the appeal of prefabricated buildings. The market is segmented by material type (concrete, glass, metal, timber, and others) and application (residential, commercial, and other applications, including industrial, institutional, and infrastructure). Competition within the market is intense, with major players including American Buildings Company, Morton Buildings Inc., and others vying for market share through product innovation and strategic partnerships.

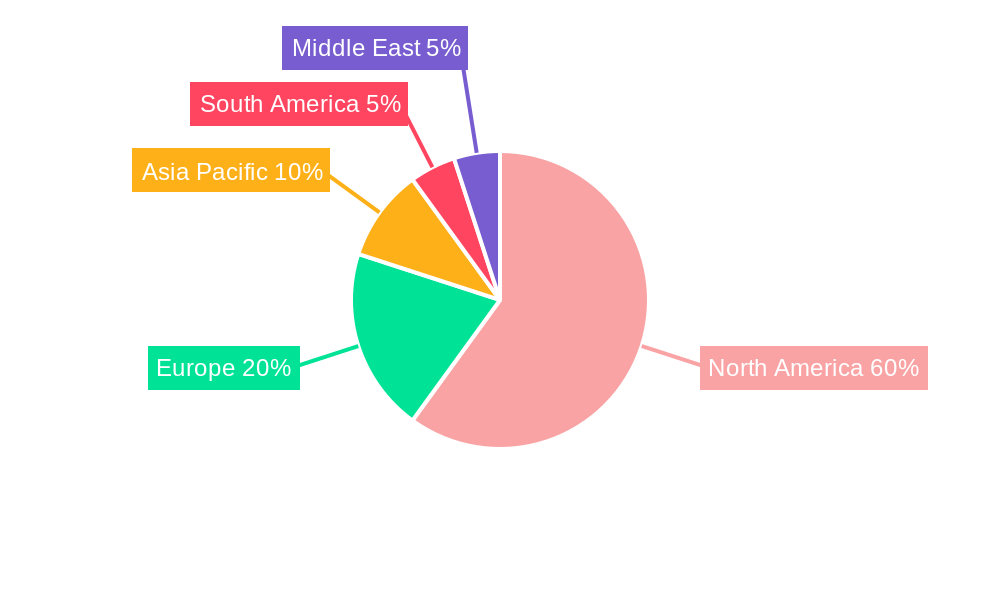

Looking ahead to 2033, the market is poised for continued expansion, fueled by sustained demand for efficient construction and the ongoing advantages of prefabrication. While potential restraints such as regulatory hurdles and public perception might exist, the overall growth trajectory remains positive. The increasing focus on sustainable and resilient infrastructure projects will also create significant opportunities for the prefabricated building industry. Geographic variations in market growth are anticipated, with regions experiencing rapid urbanization and infrastructure development likely exhibiting faster growth rates. The continued refinement of prefabrication techniques and the integration of smart building technologies will further shape the market's future, paving the way for innovative and high-performance buildings.

United States Prefabricated Buildings Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning United States Prefabricated Buildings Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive market research and data analysis covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report unveils key trends, growth drivers, and challenges shaping this rapidly evolving sector. With a focus on key players like American Buildings Company, Morton Buildings Inc, The High Construction Company, Homette Corporation, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, and Z Modular, this report provides a complete picture of the competitive landscape.

United States Prefabricated Buildings Market Market Structure & Competitive Landscape

The United States prefabricated buildings market exhibits a moderately consolidated structure, with a handful of large players and a significant number of smaller, regional operators. The market concentration ratio (CR4) is estimated at xx% in 2025, indicating a moderately competitive landscape. Innovation is a key driver, with companies continually developing new materials, designs, and construction techniques to enhance efficiency, sustainability, and cost-effectiveness. Stringent building codes and environmental regulations significantly impact the market, pushing companies to adopt sustainable practices. While traditional construction methods pose a competitive threat, the advantages of prefabrication in terms of speed, cost, and quality are steadily increasing market penetration. Mergers and acquisitions (M&A) activity is moderate, with approximately xx M&A deals recorded in the historical period (2019-2024), primarily focused on expanding geographic reach and product portfolios. End-user segmentation is diverse, encompassing residential, commercial, and other applications (industrial, institutional, and infrastructure), each with unique requirements and growth trajectories.

- Market Concentration: CR4 estimated at xx% in 2025.

- Innovation Drivers: Sustainable materials, advanced manufacturing techniques, smart building integration.

- Regulatory Impacts: Building codes, environmental regulations, and zoning laws.

- Product Substitutes: Traditional construction methods.

- End-User Segmentation: Residential (xx%), Commercial (xx%), Other Applications (xx%).

- M&A Trends: xx deals recorded between 2019-2024, focusing on expansion and diversification.

United States Prefabricated Buildings Market Market Trends & Opportunities

The US prefabricated buildings market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including increasing demand for affordable housing, rapid urbanization, and the rising adoption of sustainable building practices. Technological advancements, such as Building Information Modeling (BIM) and modular construction techniques, are streamlining the design and construction process, reducing lead times, and improving overall quality. Consumer preferences are shifting towards energy-efficient and customizable prefabricated homes, driving innovation in design and materials. Competitive dynamics are characterized by ongoing innovation, strategic partnerships, and a focus on market differentiation through specialized product offerings and superior customer service. Market penetration rates are steadily increasing, particularly in the residential and commercial sectors, driven by the advantages of prefabrication over traditional construction methods. The increasing acceptance of modular construction techniques across sectors signals significant growth potential across different application areas.

Dominant Markets & Segments in United States Prefabricated Buildings Market

The metal segment currently dominates the US prefabricated buildings market by material type, accounting for approximately xx% of total market share in 2025. This is driven by its durability, versatility, and cost-effectiveness. The residential sector represents the largest application segment, with xx% market share, mainly due to the rising demand for affordable and quick-to-build homes. However, the commercial sector demonstrates strong growth potential, driven by the increasing adoption of prefabricated solutions for retail spaces, offices, and other commercial buildings. The Southwest and Southeast regions show the highest growth due to rapid population growth and infrastructure development.

- Leading Material Type: Metal (xx% market share in 2025)

- Leading Application: Residential (xx% market share in 2025)

- Key Growth Drivers:

- Increasing demand for affordable and sustainable housing

- Growing commercial construction activity

- Infrastructure development projects

- Favorable government policies and incentives for green building practices

- Market Dominance Analysis: The dominance of metal and residential segments is primarily due to the cost-effectiveness, ease of construction, durability, and suitability for mass production. The shift towards sustainability will cause more growth in timber and other materials.

United States Prefabricated Buildings Market Product Analysis

Product innovations in the US prefabricated buildings market focus on enhancing energy efficiency, sustainability, and customization. Advancements in material science are leading to the development of lighter, stronger, and more eco-friendly building materials. Smart home technologies are increasingly being integrated into prefabricated buildings, enhancing functionality and user experience. Prefabricated buildings are increasingly being designed to meet specific application requirements, offering a range of customizable options to meet diverse needs. The market fit of these innovations is strong, driven by consumer demand for sustainable, efficient, and technologically advanced buildings.

Key Drivers, Barriers & Challenges in United States Prefabricated Buildings Market

Key Drivers: The increasing demand for affordable housing, coupled with the need for faster construction timelines, is a major driver. Technological advancements, such as improved design software and advanced manufacturing techniques, are also contributing to market growth. Government incentives and supportive policies promoting sustainable building practices further fuel market expansion.

Key Challenges and Restraints: Supply chain disruptions resulting in material shortages and cost increases pose a significant challenge. Regulatory complexities and obtaining necessary permits can delay projects and increase costs. Competition from traditional construction methods remains a factor limiting market expansion. Estimated impact of supply chain disruptions on the market is a xx% reduction in overall production capacity.

Growth Drivers in the United States Prefabricated Buildings Market Market

Technological advancements in design and manufacturing, coupled with increasing government support for sustainable building practices and rising demand for affordable housing, fuel significant market growth. The growing acceptance of modular construction methods across various sectors enhances efficiency and lowers construction costs.

Challenges Impacting United States Prefabricated Buildings Market Growth

Supply chain disruptions, fluctuating material costs, and regulatory hurdles pose significant barriers. Competition from traditional construction and skilled labor shortages impact the market. The lack of standardized building codes for prefabricated structures presents another significant challenge to industry growth and standardization.

Key Players Shaping the United States Prefabricated Buildings Market Market

- American Buildings Company

- Morton Buildings Inc

- The High Construction Company

- Homette Corporation

- SG Modular

- Plant Prefab

- Skyline Champion Corporation

- Westchester Modular Homes Inc

- Varco Pruden

- Affinity Building Systems

- Z Modular

Significant United States Prefabricated Buildings Market Industry Milestones

- May 2023: Morton Buildings opened its eighth manufacturing plant, expanding its reach across the western US. This significantly increases its production capacity and strengthens its market position in the region.

- May 2023: WillScot Mobile Mini's acquisition of Hallwood Modular Buildings and BRT Structures expands its modular building offerings and establishes it as a leader in blast-resistant modules. This acquisition expands the market's capacity for specialized modular structures.

Future Outlook for United States Prefabricated Buildings Market Market

The US prefabricated buildings market is poised for continued robust growth, driven by technological advancements, increasing demand for sustainable and affordable housing, and supportive government policies. Strategic partnerships and collaborations will further drive innovation and market expansion. The market offers significant opportunities for companies focused on delivering high-quality, sustainable, and cost-effective prefabricated building solutions. The rising popularity of modular and sustainable buildings presents immense opportunities for growth and market expansion in the coming years.

United States Prefabricated Buildings Market Segmentation

-

1. Material Type

- 1.1. Concrete

- 1.2. Glass

- 1.3. Metal

- 1.4. Timber

- 1.5. Other Material Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

- 2.3. Other Ap

United States Prefabricated Buildings Market Segmentation By Geography

- 1. United States

United States Prefabricated Buildings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.94% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for prefab buildings; Surge in demand from residential segment

- 3.3. Market Restrains

- 3.3.1. Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas

- 3.4. Market Trends

- 3.4.1. The Trend of BIM in the Prefab Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Concrete

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Timber

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Other Ap

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. South America United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East United States Prefabricated Buildings Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 American Buildings Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Morton Buildings Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The High Construction Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Homette Corporation **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SG Modular

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Plant Prefab

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Skyline Champion Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Westchester Modular Homes Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Varco Pruden

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Affinity Building Systems

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Z Modular

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 American Buildings Company

List of Figures

- Figure 1: United States Prefabricated Buildings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Prefabricated Buildings Market Share (%) by Company 2024

List of Tables

- Table 1: United States Prefabricated Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: United States Prefabricated Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: United States Prefabricated Buildings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Prefabricated Buildings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Prefabricated Buildings Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 16: United States Prefabricated Buildings Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: United States Prefabricated Buildings Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Prefabricated Buildings Market?

The projected CAGR is approximately 5.94%.

2. Which companies are prominent players in the United States Prefabricated Buildings Market?

Key companies in the market include American Buildings Company, Morton Buildings Inc, The High Construction Company, Homette Corporation **List Not Exhaustive, SG Modular, Plant Prefab, Skyline Champion Corporation, Westchester Modular Homes Inc, Varco Pruden, Affinity Building Systems, Z Modular.

3. What are the main segments of the United States Prefabricated Buildings Market?

The market segments include Material Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for prefab buildings; Surge in demand from residential segment.

6. What are the notable trends driving market growth?

The Trend of BIM in the Prefab Sector.

7. Are there any restraints impacting market growth?

Lack of knowledge about modular building; Unreliability of modular building in earthquake-prone areas.

8. Can you provide examples of recent developments in the market?

May 2023: Morton Buildings has expanded its business in a new 67,429-square-foot manufacturing plant in Pocatello Regional Airport Business Park. The facility in Pocatello is Morton’s eighth manufacturing plant. It will stock the business’s construction projects in Idaho, Montana, Washington, Wyoming, Colorado, Utah, and other surrounding areas so that current and future building needs are met.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Prefabricated Buildings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Prefabricated Buildings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Prefabricated Buildings Market?

To stay informed about further developments, trends, and reports in the United States Prefabricated Buildings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence