Key Insights

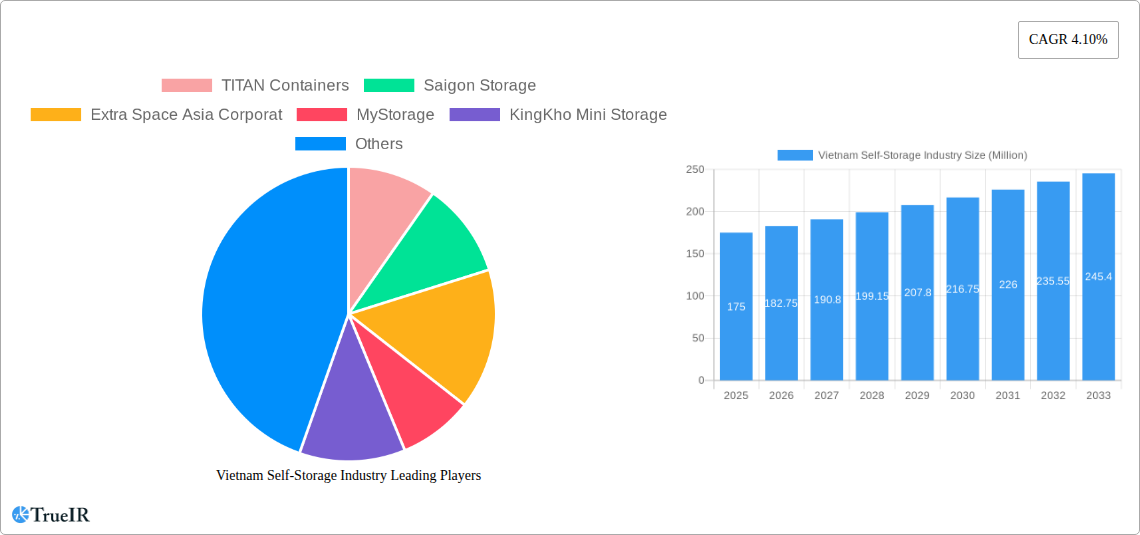

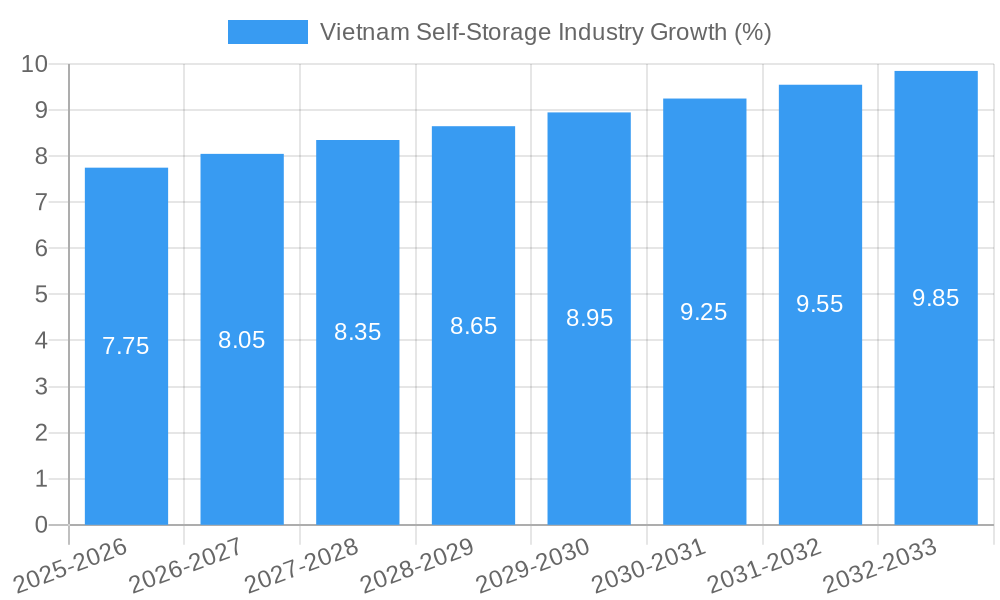

The Vietnam self-storage industry, currently experiencing robust growth, presents a compelling investment opportunity. With a Compound Annual Growth Rate (CAGR) of 4.10% from 2019 to 2024, the market demonstrates consistent expansion. While the exact 2025 market size isn't explicitly stated, projecting from the historical data and considering typical market dynamics for emerging economies experiencing rapid urbanization and economic growth, we can reasonably estimate the 2025 market value to be in the range of $150-200 million. This projection accounts for factors such as increasing disposable incomes, a burgeoning e-commerce sector requiring warehousing solutions, and the growing number of small and medium-sized enterprises (SMEs) needing flexible storage options. The market is segmented primarily into consumer and business self-storage, with both segments exhibiting strong growth potential. Key drivers include rising urbanization, population growth, and the increasing adoption of a more mobile lifestyle. Trends indicate a shift towards more technologically advanced facilities, including online booking systems and enhanced security measures. However, restraints such as land scarcity and regulatory hurdles in certain areas may pose challenges to future growth.

Leading players like Titan Containers, Saigon Storage, Extra Space Asia Corporation, MyStorage, and KingKho Mini Storage are shaping the market's competitive landscape. Their strategies focus on strategic location, diverse storage offerings, and enhanced customer service to capture market share. The forecast period (2025-2033) suggests continued expansion, driven by sustained economic development and increasing demand for efficient storage solutions. Further analysis into specific regional variations within Vietnam (North, Central, South) would provide even greater granularity for investment decisions and strategic planning for existing and potential market entrants. This industry segment is ripe for innovation and investment, offering significant returns for businesses catering to the evolving needs of Vietnamese consumers and businesses.

Vietnam Self-Storage Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of Vietnam's burgeoning self-storage industry, offering invaluable insights for investors, operators, and industry professionals. Leveraging a robust data set covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive dynamics, growth drivers, and future potential. The report utilizes a detailed methodology incorporating both primary and secondary research, resulting in a data-rich and insightful analysis of this rapidly evolving sector. Expect to find detailed information on market size (valued in Millions), CAGR, market segmentation (consumer and business), and key player analysis.

Vietnam Self-Storage Industry Market Structure & Competitive Landscape

The Vietnamese self-storage market, while relatively nascent compared to more mature markets, is experiencing rapid growth. Market concentration is currently low, with several key players vying for market share. The industry is characterized by a fragmented landscape, with many smaller, independent operators competing alongside larger, established players. This analysis assesses the market concentration using Herfindahl-Hirschman Index (HHI) of xx, suggesting a moderately competitive market. Innovation drivers include the adoption of technology, such as online booking platforms and automated storage systems, and the increasing demand for flexible and convenient storage solutions. Regulatory impacts remain minimal, with minimal government intervention in the sector. Key product substitutes include traditional warehousing and home storage, although self-storage is gaining popularity due to its convenience and security features.

The end-user segmentation is predominantly split between the consumer and business segments, with consumer demand driven by factors such as urbanization and increasing mobility, and business demand driven by the growth of e-commerce and SMEs. M&A activity in the sector has been relatively limited to date, with only xx Million USD in transactions recorded in the historical period (2019-2024). However, the report projects an increase in M&A activity over the forecast period as larger players consolidate their position in the market.

- Market Concentration: Low, with an HHI of xx.

- Innovation Drivers: Technology adoption, flexible solutions.

- Regulatory Impacts: Minimal, favorable for growth.

- Product Substitutes: Traditional warehousing, home storage.

- End-User Segmentation: Consumer and business sectors.

- M&A Activity (2019-2024): xx Million USD.

Vietnam Self-Storage Industry Market Trends & Opportunities

The Vietnam self-storage market is exhibiting significant growth, projected to reach xx Million USD by 2033, with a CAGR of xx% during the forecast period (2025-2033). This expansion is fueled by several key trends, including rapid urbanization, a burgeoning e-commerce sector, and the increasing adoption of flexible work arrangements. Market penetration remains low, indicating substantial untapped potential. Technological advancements, such as online booking systems and climate-controlled units, are enhancing the customer experience and driving market expansion. Changing consumer preferences, particularly amongst the younger generation, favor convenience and accessibility, creating a favorable environment for the growth of self-storage facilities. Competitive dynamics are shaping the market landscape, leading to increased investment in innovative solutions and improved customer service. The evolving economic landscape and government policies also contribute significantly to the growth trajectory.

Dominant Markets & Segments in Vietnam Self-Storage Industry

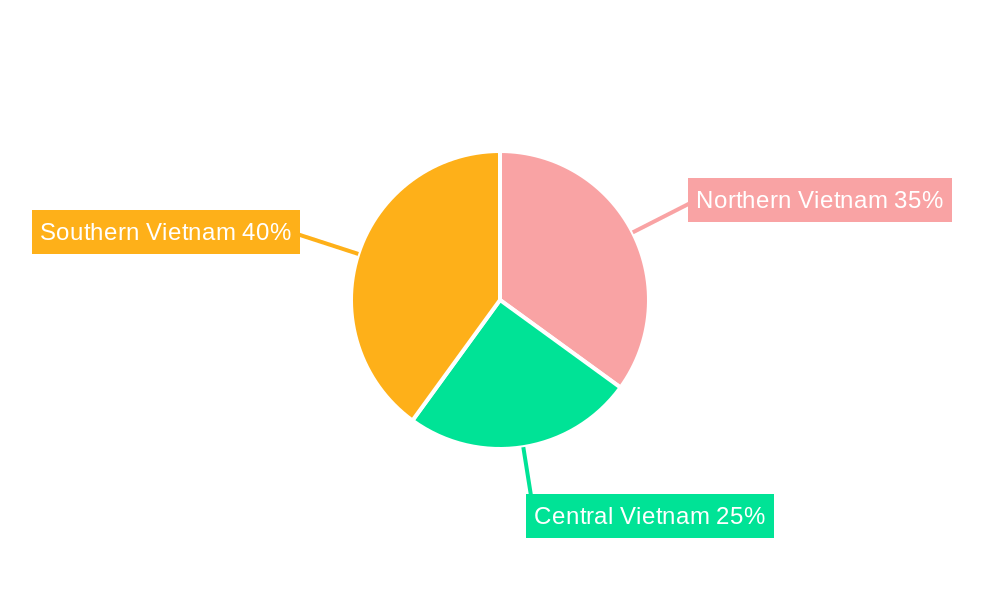

The Ho Chi Minh City and Hanoi metropolitan areas represent the dominant markets within Vietnam's self-storage industry. These regions benefit from higher population densities, robust economic activity, and a greater concentration of businesses.

- Key Growth Drivers in Ho Chi Minh City and Hanoi:

- Rapid urbanization and population growth.

- Expanding e-commerce and logistics sectors.

- Increasing demand from businesses and individuals.

- Development of improved infrastructure and transportation networks.

- Supportive government policies and regulations.

The consumer segment currently dominates the market, driven by factors such as increased mobility and the need for flexible storage solutions. However, the business segment is projected to experience faster growth in the coming years, fueled by the expansion of the e-commerce sector and the rise of small and medium-sized enterprises (SMEs). The report analyzes the distinct needs and preferences of both segments to provide a detailed understanding of the market dynamics.

Vietnam Self-Storage Industry Product Analysis

The self-storage industry in Vietnam offers a range of products, from basic storage units to climate-controlled units and specialized storage for specific items like documents or art. Technological advancements, such as automated storage and retrieval systems and online booking platforms, are improving efficiency and convenience. The market's competitive advantages lie in its ability to provide flexible, secure, and cost-effective storage solutions, tailored to the specific needs of consumers and businesses. The increasing adoption of technology is creating new opportunities for innovation and differentiation in the market.

Key Drivers, Barriers & Challenges in Vietnam Self-Storage Industry

Key Drivers:

- Economic Growth: Rising disposable incomes and expanding middle class fuel demand for convenient storage solutions.

- Urbanization: Increasing population density in urban areas necessitates efficient storage solutions.

- E-commerce Growth: The booming e-commerce sector necessitates warehousing and fulfillment capabilities.

Challenges:

- Land Acquisition Costs: Securing land for new facilities presents a significant challenge, especially in urban areas, impacting the supply and price of storage units. This is estimated to increase operational costs by xx%.

- Regulatory Hurdles: Navigating bureaucratic processes can delay project development and increase costs.

- Competition: The market's growing popularity is attracting new entrants, intensifying competition.

Growth Drivers in the Vietnam Self-Storage Industry Market

The primary growth drivers for the Vietnamese self-storage market include rapid urbanization, the expansion of the e-commerce sector, and increasing consumer demand for flexible and convenient storage solutions. Government initiatives to improve infrastructure and support business development also contribute significantly to market growth.

Challenges Impacting Vietnam Self-Storage Industry Growth

Significant challenges hindering industry growth include high land acquisition costs, particularly in urban areas, regulatory complexities, and the intensifying competition from new market entrants. These factors can impact profitability and limit expansion potential.

Key Players Shaping the Vietnam Self-Storage Industry Market

- TITAN Containers

- Saigon Storage

- Extra Space Asia Corporat

- MyStorage

- KingKho Mini Storage

Significant Vietnam Self-Storage Industry Industry Milestones

- 2021 Q4: TITAN Containers expands operations into Hanoi.

- 2022 Q2: Saigon Storage launches a new online booking platform.

- 2023 Q1: Extra Space Asia Corporat opens a large facility in Ho Chi Minh City.

- 2024 Q3: MyStorage secures significant funding for expansion.

Future Outlook for Vietnam Self-Storage Industry Market

The Vietnam self-storage market is poised for continued robust growth driven by ongoing urbanization, economic expansion, and increasing consumer demand. Strategic opportunities exist for industry players to leverage technological advancements, expand into new markets, and develop innovative products and services. The market presents significant potential for both domestic and international investors.

Vietnam Self-Storage Industry Segmentation

-

1. Self-storage Type

- 1.1. Consumer

- 1.2. Business

Vietnam Self-Storage Industry Segmentation By Geography

- 1. Vietnam

Vietnam Self-Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Favorable Demographic Trends Such as High-income Population

- 3.2.2 Demand in Urban Areas and Growing Market Concentration

- 3.3. Market Restrains

- 3.3.1. High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom

- 3.4. Market Trends

- 3.4.1 Increased Urbanization

- 3.4.2 Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Vietnam Self-Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 5.1.1. Consumer

- 5.1.2. Business

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Vietnam

- 5.1. Market Analysis, Insights and Forecast - by Self-storage Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 TITAN Containers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saigon Storage

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Extra Space Asia Corporat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MyStorage

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 KingKho Mini Storage

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 TITAN Containers

List of Figures

- Figure 1: Vietnam Self-Storage Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Vietnam Self-Storage Industry Share (%) by Company 2024

List of Tables

- Table 1: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 3: Vietnam Self-Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Vietnam Self-Storage Industry Revenue Million Forecast, by Self-storage Type 2019 & 2032

- Table 6: Vietnam Self-Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vietnam Self-Storage Industry?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Vietnam Self-Storage Industry?

Key companies in the market include TITAN Containers, Saigon Storage, Extra Space Asia Corporat, MyStorage, KingKho Mini Storage.

3. What are the main segments of the Vietnam Self-Storage Industry?

The market segments include Self-storage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Favorable Demographic Trends Such as High-income Population. Demand in Urban Areas and Growing Market Concentration.

6. What are the notable trends driving market growth?

Increased Urbanization. Coupled with Smaller Living Spaces is Expected to Drive the Self-Storage Demand in Vietnam.

7. Are there any restraints impacting market growth?

High Raw Materials and Manufacturing Cost; Complicated and Variable Regulations of Cleanroom.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vietnam Self-Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vietnam Self-Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vietnam Self-Storage Industry?

To stay informed about further developments, trends, and reports in the Vietnam Self-Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence