Key Insights

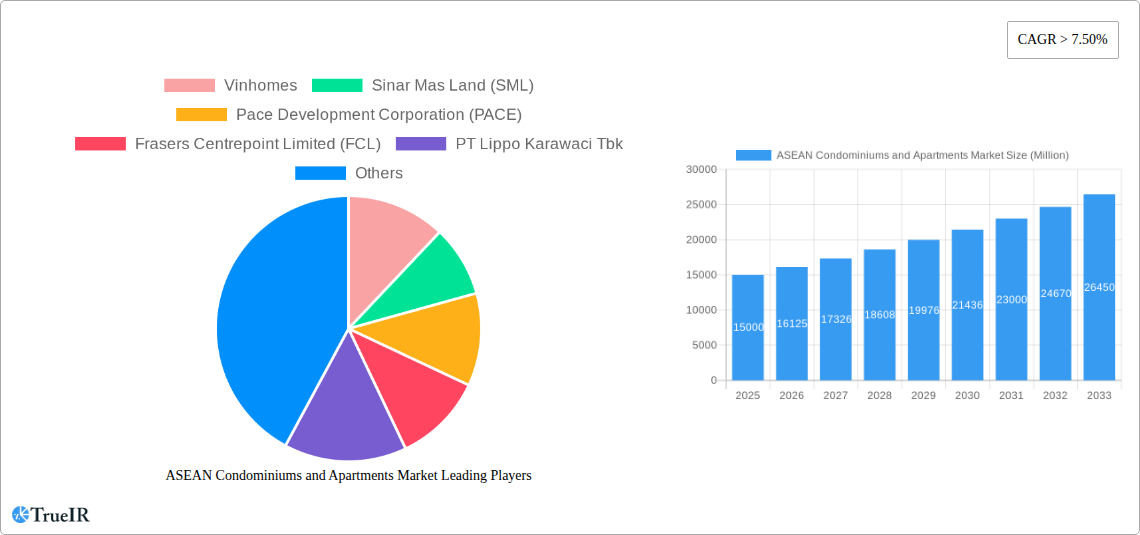

The ASEAN condominiums and apartments market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 7.50% from 2025 to 2033. This expansion is fueled by several key drivers. Rapid urbanization across the region, particularly in major cities like Jakarta, Bangkok, and Ho Chi Minh City, is creating significant demand for modern housing. A burgeoning middle class with increasing disposable incomes is also a major contributor, coupled with a preference for condominium living offering amenities and security not always found in traditional housing. Furthermore, government initiatives promoting infrastructure development and foreign investment are further bolstering the market. While challenges exist, such as fluctuating land prices and potential economic uncertainties, the long-term outlook remains positive. The market is segmented geographically, with Indonesia, Thailand, Vietnam, Singapore, and Malaysia representing significant portions of the total market size. Competition is fierce amongst developers such as Vinhomes, Sinar Mas Land, and Ayala Land, each vying for market share through innovative designs, attractive pricing strategies, and strategic location choices. The growth trajectory suggests a promising investment opportunity, especially for developers focusing on sustainable and technologically advanced housing solutions catering to the evolving preferences of the ASEAN consumer.

The substantial growth predicted for the ASEAN condominium and apartment market reflects a confluence of factors. While precise market sizing figures were not provided, a logical estimation based on the stated CAGR and the mentioned key players indicates a sizable market with significant potential for expansion. The dominance of specific countries such as Indonesia and Thailand underscores the importance of localized market understanding, recognizing distinct preferences and regulatory landscapes. Continued infrastructure investment and supportive government policies will likely shape future growth patterns. However, factors such as potential interest rate fluctuations and global economic conditions could influence investment decisions and consequently, the market's overall trajectory. Long-term strategies should prioritize sustainability, technological integration within housing developments, and adaptable designs catering to changing demographics and lifestyles.

ASEAN Condominiums and Apartments Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the ASEAN condominiums and apartments market, offering invaluable insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils key trends, challenges, and opportunities shaping this rapidly evolving market. Expect comprehensive data, expert analysis, and actionable strategies to navigate the complexities of the ASEAN real estate landscape.

ASEAN Condominiums and Apartments Market Market Structure & Competitive Landscape

The ASEAN condominiums and apartments market exhibits a moderately concentrated structure, with several key players dominating specific national markets. While concentration ratios vary significantly by country (e.g., higher in Singapore compared to Indonesia), the market is characterized by increasing competition, driven by both local and international developers. Innovation is a key differentiator, with developers focusing on sustainable designs, smart home technologies, and enhanced amenities to attract discerning buyers. Regulatory landscapes differ across ASEAN nations, impacting development timelines and costs. Substitute products, such as landed properties, compete for a segment of the market, particularly in certain price ranges. The end-user segment is diverse, encompassing first-time homebuyers, investors, and high-net-worth individuals. M&A activity has been steadily increasing in recent years, with a total estimated value of xx Million USD in transactions between 2019 and 2024. This activity is driven by the desire for scale, portfolio diversification, and access to new markets.

- Market Concentration: Variable across ASEAN nations, ranging from highly concentrated (Singapore) to fragmented (Indonesia).

- Innovation Drivers: Sustainable building materials, smart home technology, co-living spaces, and mixed-use developments.

- Regulatory Impacts: Varying building codes, land acquisition processes, and foreign ownership restrictions influence development costs and timelines.

- Product Substitutes: Landed properties, rental apartments, and other forms of housing.

- End-User Segmentation: First-time homebuyers, investors, expatriates, and high-net-worth individuals.

- M&A Trends: Increasing activity driven by consolidation, expansion, and access to capital.

ASEAN Condominiums and Apartments Market Market Trends & Opportunities

The ASEAN condominiums and apartments market is experiencing robust growth, fueled by rapid urbanization, rising disposable incomes, and a growing preference for modern living spaces. The market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of smart home technologies and online property platforms, are transforming the market, improving efficiency and enhancing the buyer experience. Consumer preferences are shifting towards sustainable and environmentally friendly developments, creating opportunities for developers that prioritize green building practices. Competition is intensifying, requiring developers to differentiate themselves through innovative designs, superior amenities, and strategic location choices. Market penetration rates vary across countries, with higher penetration observed in more developed economies like Singapore and relatively lower penetration in less developed ones such as Myanmar. The growth of the middle class and increase in tourism and foreign investment further strengthens the market.

Dominant Markets & Segments in ASEAN Condominiums and Apartments Market

Singapore consistently emerges as a dominant market in the ASEAN condominium and apartment sector, driven by strong economic growth, robust infrastructure, and a high concentration of expatriates. However, other countries such as Thailand, Vietnam, and Malaysia are experiencing rapid growth, fuelled by expanding populations and improving economies. The Philippines also holds strong potential, with increasing demand from a growing middle class.

- Singapore: Strong economic fundamentals, robust infrastructure, and high demand from expatriates.

- Thailand: Growing tourism sector and sustained economic growth driving demand.

- Vietnam: Rapid urbanization and a young, expanding population.

- Malaysia: Expanding middle class and government initiatives supporting property development.

- Indonesia: Largest population in ASEAN, presenting significant potential despite market fragmentation.

- Philippines: Rising middle class and growing demand for modern housing.

- Rest of ASEAN: Emerging markets with growth potential, though subject to greater economic and political volatility.

The key growth drivers for these dominant markets include robust infrastructure development, supportive government policies, and improving economic conditions.

ASEAN Condominiums and Apartments Market Product Analysis

The ASEAN condominiums and apartments market showcases a diverse range of product offerings, from budget-friendly units to luxury high-rises. Technological advancements are transforming product design, with the integration of smart home technology, sustainable materials, and innovative architectural designs becoming increasingly prevalent. This diversification caters to various segments of the market, focusing on functionality, sustainability, and luxurious amenities to compete in different pricing brackets.

Key Drivers, Barriers & Challenges in ASEAN Condominiums and Apartments Market

Key Drivers: Rapid urbanization, rising disposable incomes, government initiatives promoting property development, and technological advancements in construction and design. For instance, the Malaysian government's initiatives to improve infrastructure and boost foreign investment have positively impacted the country's real estate market.

Challenges: Regulatory hurdles including varying building codes and land acquisition processes across ASEAN nations, supply chain disruptions impacting construction costs and timelines, and intense competition from both local and international developers. For example, lengthy approval processes in some countries can significantly delay project completion and increase costs. Supply chain issues during 2022 caused xx Million USD in increased building costs across the region.

Growth Drivers in the ASEAN Condominiums and Apartments Market Market

Several factors fuel the growth of the ASEAN condominiums and apartments market. These include robust economic growth in several ASEAN nations, leading to increased disposable incomes and purchasing power. Supportive government policies, such as infrastructure development initiatives and tax incentives, further stimulate the sector. Technological advancements in construction and design contribute to cost efficiencies and improved product quality, while the increasing popularity of smart home technologies enhances consumer appeal.

Challenges Impacting ASEAN Condominiums and Apartments Market Growth

The market faces challenges including variations in regulatory frameworks across ASEAN countries, creating complexity for developers. Supply chain disruptions and rising material costs can significantly impact project feasibility and profitability. Additionally, increasing competition among developers necessitates differentiation strategies and innovative product offerings to maintain market share.

Key Players Shaping the ASEAN Condominiums and Apartments Market Market

- Vinhomes

- Sinar Mas Land (SML)

- Pace Development Corporation (PACE)

- Frasers Centrepoint Limited (FCL)

- PT Lippo Karawaci Tbk

- Ayala Land Inc

- Sunway Integrated Properties

- Knight Frank

- Absolute World Group

- Major Development PCL

- Henry Butcher Malaysia

- SM Development Corporation (SMDC)

Significant ASEAN Condominiums and Apartments Market Industry Milestones

- September 2022: GuocoLand's Lentor Modern, a 99-year leasehold integrated private residential project in Singapore, sold 508 units (84% of its 605 units) during its initial launch, highlighting strong buyer interest in high-end properties. Prices ranged from USD 1.07 million to USD 3.33 million.

- June 2022: A Chinese national purchased 20 units at CanningHill Piers in Singapore for over USD 62.92 million, indicating significant high-value investment in the Singaporean market. Further purchases were planned, suggesting strong investor confidence.

Future Outlook for ASEAN Condominiums and Apartments Market Market

The ASEAN condominiums and apartments market is poised for continued growth, driven by long-term economic expansion and urbanization. Strategic opportunities exist for developers to leverage technological advancements and cater to evolving consumer preferences. The market's potential is significant, presenting attractive prospects for investors and developers willing to navigate the inherent complexities and challenges of this dynamic region.

ASEAN Condominiums and Apartments Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

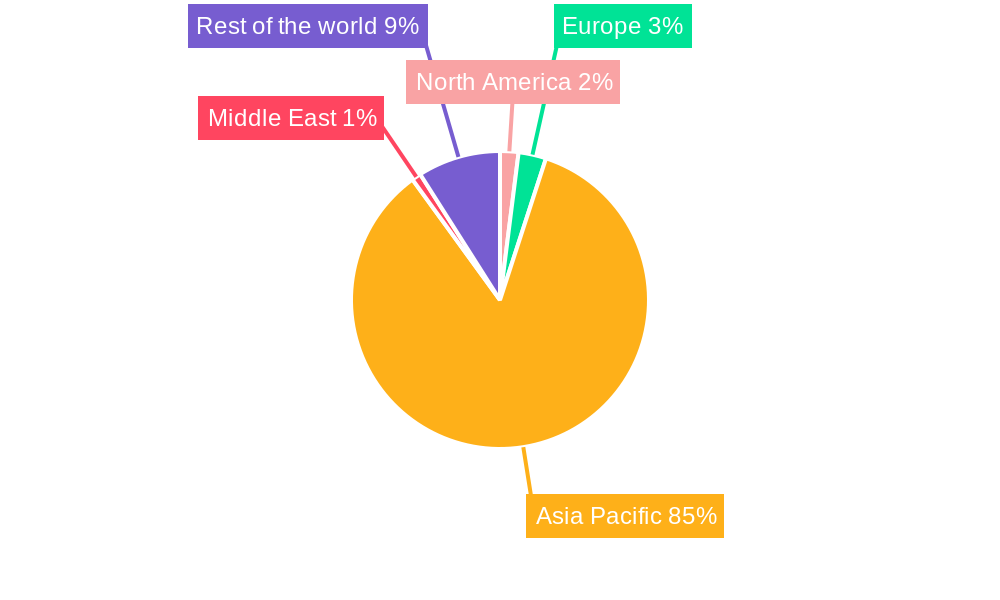

ASEAN Condominiums and Apartments Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ASEAN Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Framework4.; The Risk of Oversupply

- 3.4. Market Trends

- 3.4.1. Increase in demand for multifamily housing driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. North America ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Middle East ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the world ASEAN Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Vinhomes

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Sinar Mas Land (SML)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Pace Development Corporation (PACE)

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Frasers Centrepoint Limited (FCL)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 PT Lippo Karawaci Tbk

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Ayala Land Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sunway Integrated Properties

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Knight Frank

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Absolute World Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Major Development PCL

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Henry Butcher Malaysia**List Not Exhaustive

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 SM Development Corporation (SMDC)

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Vinhomes

List of Figures

- Figure 1: Global ASEAN Condominiums and Apartments Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Rest of the world ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Rest of the world ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 13: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 14: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 15: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 16: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 17: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 18: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 19: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 20: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 21: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 22: North America ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 23: North America ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 25: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 26: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 27: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 28: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 29: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 30: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 31: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 32: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 33: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 34: South America ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 37: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 38: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 39: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 40: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 41: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 42: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 43: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 44: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 45: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 46: Europe ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 47: Europe ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 48: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 49: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 50: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 51: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 52: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 53: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 54: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 55: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 56: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 57: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 58: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Production Analysis 2024 & 2032

- Figure 61: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Production Analysis 2024 & 2032

- Figure 62: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Consumption Analysis 2024 & 2032

- Figure 63: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Consumption Analysis 2024 & 2032

- Figure 64: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 65: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2024 & 2032

- Figure 66: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 67: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2024 & 2032

- Figure 68: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Price Trend Analysis 2024 & 2032

- Figure 69: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Price Trend Analysis 2024 & 2032

- Figure 70: Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million), by Country 2024 & 2032

- Figure 71: Asia Pacific ASEAN Condominiums and Apartments Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 19: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 20: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 21: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 22: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 23: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Canada ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Mexico ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 28: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 29: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 30: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 31: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 32: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Rest of South America ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 37: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 38: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 39: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 40: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 41: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United Kingdom ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Germany ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Italy ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Spain ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Russia ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Benelux ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Nordics ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 52: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 53: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 54: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 55: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 56: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 57: Turkey ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: GCC ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: North Africa ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: South Africa ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East & Africa ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 64: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 65: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 66: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 67: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 68: Global ASEAN Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 69: China ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: India ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Japan ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: ASEAN ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Oceania ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 75: Rest of Asia Pacific ASEAN Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Condominiums and Apartments Market?

The projected CAGR is approximately > 7.50%.

2. Which companies are prominent players in the ASEAN Condominiums and Apartments Market?

Key companies in the market include Vinhomes, Sinar Mas Land (SML), Pace Development Corporation (PACE), Frasers Centrepoint Limited (FCL), PT Lippo Karawaci Tbk, Ayala Land Inc, Sunway Integrated Properties, Knight Frank, Absolute World Group, Major Development PCL, Henry Butcher Malaysia**List Not Exhaustive, SM Development Corporation (SMDC).

3. What are the main segments of the ASEAN Condominiums and Apartments Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Disposable Incomes4.; Government Initiatives4.; Growing Expatriate Population.

6. What are the notable trends driving market growth?

Increase in demand for multifamily housing driving the market.

7. Are there any restraints impacting market growth?

4.; Regulatory Framework4.; The Risk of Oversupply.

8. Can you provide examples of recent developments in the market?

September 2022 - GuocoLand's Lentor Modern, a 99-year leasehold integrated private residential project, sold 508 units, or 84% of its 605 units, during its initial launch. GuocoLand said in a press release that units in the integrated mixed-use development to be built in the new Lentor Hills estate in District 20 ranged from USD 1,856 per sq ft to USD 2,538 per sq ft. Prices for the units ranged from USD 1.07 million for a 527 sq ft one-bedroom unit to USD 3.33 million for a 1,528 sq ft four-bedroom apartment at the time of launch.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the ASEAN Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence