Key Insights

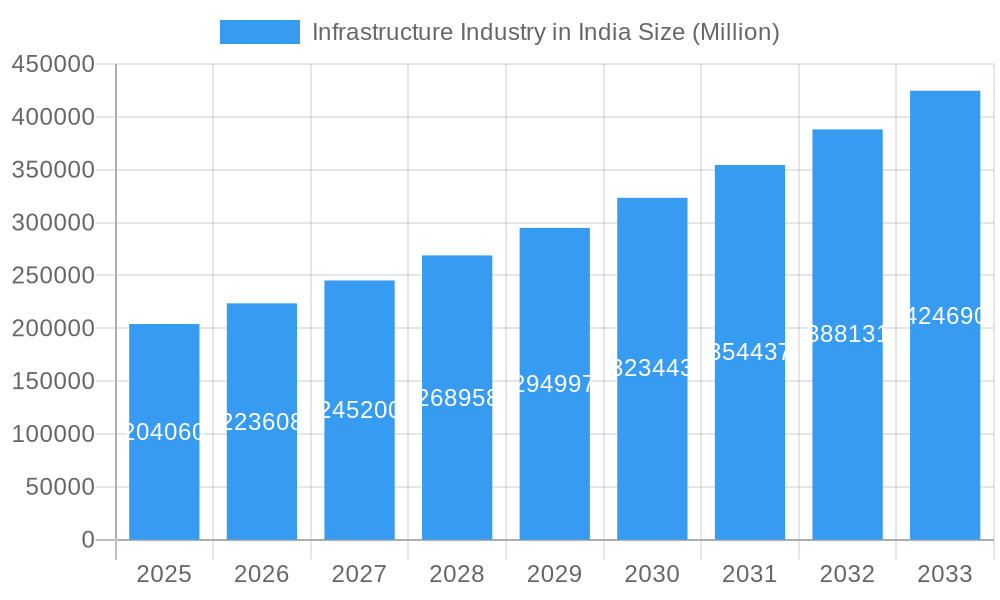

The Indian infrastructure sector is experiencing robust growth, projected to reach \$204.06 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by significant government investments in key areas like transportation (roads, railways, and airports), social infrastructure (schools, hospitals, and sanitation), and utilities (power and water). Increased urbanization, industrialization, and a growing middle class are fueling demand for improved infrastructure, creating opportunities across various segments. The focus on smart cities initiatives and the government's emphasis on sustainable infrastructure development further contribute to this positive outlook. Key players like Larsen & Toubro, Shapoorji Pallonji, and Reliance Infrastructure are major contributors, though the sector also benefits from the presence of numerous smaller players, creating a competitive landscape. Regional disparities exist, with states like Maharashtra, Karnataka, Delhi, and Telangana leading the growth due to higher investments and favorable policies. However, challenges remain, including land acquisition issues, regulatory hurdles, and the need for efficient project management to ensure timely completion. Despite these challenges, the long-term outlook for the Indian infrastructure sector remains overwhelmingly positive, driven by sustained economic growth and government support. The sector's future hinges on effectively addressing these challenges to fully realize its potential.

Infrastructure Industry in India Market Size (In Billion)

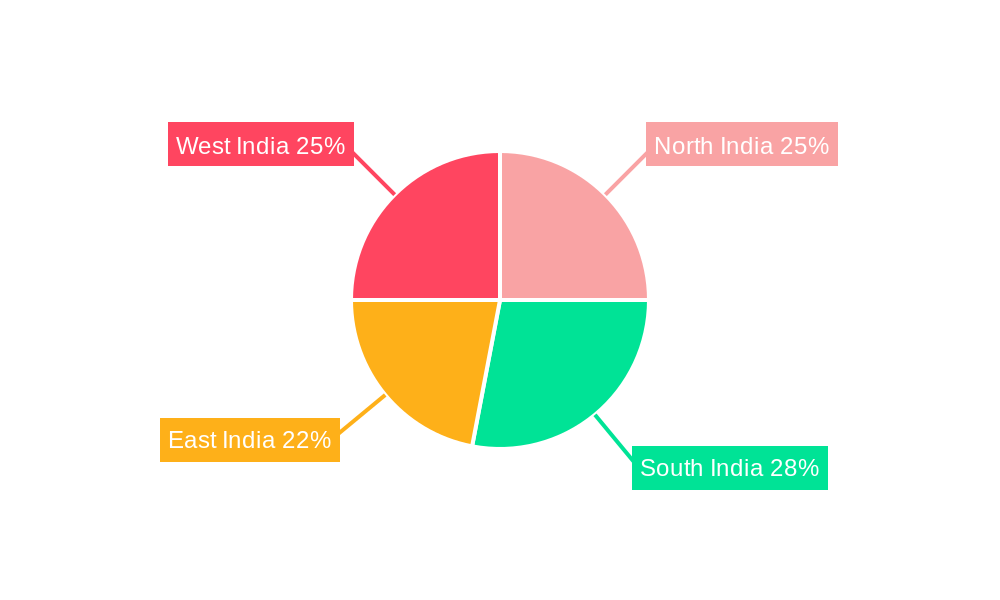

The various infrastructure segments, namely social, transportation, extraction, manufacturing, and utilities infrastructure, each contribute significantly to the overall market growth. The distribution of investment across these segments might vary due to policy priorities and economic conditions. While the provided data highlights key states driving growth, detailed regional breakdowns (North, South, East, and West India) require further analysis to accurately reflect the market share within each region. The consistent high CAGR indicates a sustained positive trend that is expected to continue throughout the forecast period (2025-2033). This robust growth is expected to attract further foreign investment and technological advancements within the industry, stimulating innovation and creating a dynamic and evolving market.

Infrastructure Industry in India Company Market Share

Infrastructure Industry in India: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Indian infrastructure industry, offering invaluable insights for investors, industry professionals, and policymakers. With a focus on market size, growth projections, key players, and emerging trends, this report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The report leverages extensive data analysis to provide a clear understanding of this crucial sector's current state and future potential. Expect detailed breakdowns of market segments, competitive dynamics, and major growth drivers and challenges.

Infrastructure Industry in India Market Structure & Competitive Landscape

The Indian infrastructure industry is characterized by a complex interplay of public and private sector participation, resulting in a moderately concentrated market. While a few large players dominate certain segments, a significant number of smaller and medium-sized enterprises (SMEs) contribute to the overall market landscape. The Herfindahl-Hirschman Index (HHI) for the overall sector is estimated at xx, indicating a moderately concentrated market. However, this concentration varies significantly across different infrastructure segments. For example, the transportation infrastructure segment shows a higher degree of concentration compared to the social infrastructure segment.

Key Aspects of Market Structure:

- Market Concentration: The top 5 players account for approximately xx% of the total market revenue in 2024. This concentration is expected to increase slightly by 2033, reaching xx%.

- Innovation Drivers: Government initiatives promoting technological advancements, such as the adoption of Building Information Modeling (BIM) and digital twin technology, are driving innovation. Increased adoption of sustainable materials and construction methods further boosts innovation.

- Regulatory Impacts: Stringent environmental regulations and land acquisition processes create significant challenges for industry players. However, government policies aimed at streamlining approvals and promoting ease of doing business are improving the regulatory environment.

- Product Substitutes: The availability of substitute materials and technologies (e.g., alternative building materials, prefabricated construction) is impacting the traditional construction materials market.

- End-User Segmentation: The end-user base is diverse, including government agencies, private developers, and industrial clients. The demand patterns vary significantly across these segments, impacting overall market dynamics.

- M&A Trends: The last five years have seen xx major mergers and acquisitions (M&As) in the Indian infrastructure industry, valued at approximately INR xx Million. Consolidation is expected to continue, driven by the need for scale and access to capital.

Infrastructure Industry in India Market Trends & Opportunities

The Indian infrastructure market is experiencing robust growth, driven by increasing government spending, rising urbanization, and expanding industrialization. The market size, currently valued at INR xx Million in 2025, is projected to reach INR xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by a number of key trends:

- Government Initiatives: Government programs like the National Infrastructure Pipeline (NIP) are significantly boosting infrastructure development across various sectors.

- Technological Advancements: Adoption of advanced construction technologies, such as prefabrication, 3D printing, and digitalization, is improving efficiency and reducing costs.

- Private Sector Participation: Increasing private sector investment in infrastructure projects is supplementing public funding and fostering competition.

- Focus on Sustainability: Growing awareness of environmental concerns is driving the adoption of sustainable construction practices and green building materials.

Dominant Markets & Segments in Infrastructure Industry in India

The Transportation Infrastructure segment dominates the Indian infrastructure market, accounting for the largest share of the total market value. This is followed by Utilities Infrastructure and Social Infrastructure. Maharashtra, Karnataka, Delhi, and Telangana are the leading states in terms of infrastructure development and investment.

Key Growth Drivers by Segment:

- Transportation Infrastructure: Government initiatives like Bharatmala Pariyojana and expansion of metro rail networks are driving significant growth.

- Utilities Infrastructure: Increasing energy demands and the expansion of power grids are major contributors to market growth.

- Social Infrastructure: Government focus on affordable housing and healthcare infrastructure development is fueling this segment's growth.

Key Growth Drivers by State:

- Maharashtra: Strong industrial base, robust urban development, and favorable government policies drive the state's dominance.

- Karnataka: Growing IT sector and industrial expansion create significant demand for infrastructure.

- Delhi: Large population and high urbanization contribute to the high demand for infrastructure projects.

- Telangana: Government investments in industrial corridors and urban development are boosting the infrastructure sector.

Infrastructure Industry in India Product Analysis

The Indian infrastructure industry is witnessing the adoption of innovative products and technologies to enhance efficiency, sustainability, and safety. This includes the use of advanced construction materials like high-performance concrete and composite materials, and technological advancements in project management and construction techniques such as BIM (Building Information Modeling) and IoT (Internet of Things) for real-time monitoring and data analysis. These innovations are aimed at improving project delivery timelines, reducing costs and enhancing overall structural integrity. Moreover, the focus on prefabricated components and modular construction is gaining momentum due to their efficiency and cost-effectiveness.

Key Drivers, Barriers & Challenges in Infrastructure Industry in India

Key Drivers:

- Government Initiatives: Increased public spending on infrastructure projects, coupled with policy reforms to ease the regulatory burden, is a major driver.

- Economic Growth: The steady growth of the Indian economy necessitates further investments in infrastructure to support industrial and urban development.

- Technological Advancements: The adoption of advanced technologies enhances efficiency and cost-effectiveness of projects.

Key Challenges:

- Land Acquisition: Complex land acquisition processes and bureaucratic hurdles often lead to project delays and cost overruns. The average delay due to land acquisition issues is estimated at xx months, resulting in an average cost overrun of INR xx Million per project.

- Regulatory Hurdles: Complex and often contradictory regulations create uncertainties and hinder project implementation.

- Funding Constraints: Securing adequate funding for large-scale infrastructure projects remains a challenge, despite increasing private sector participation.

Growth Drivers in the Infrastructure Industry in India Market

The Indian infrastructure sector's growth is propelled by factors like government initiatives promoting infrastructure development through policies like the National Infrastructure Pipeline (NIP) and the Smart Cities Mission, increased private sector participation attracting foreign direct investment and promoting Public-Private Partnerships (PPPs), and technological advancements improving project efficiency and lowering costs. These drivers are fostering growth across various infrastructure segments, including transportation, utilities, and social infrastructure.

Challenges Impacting Infrastructure Industry in India Growth

Despite the significant growth potential, the Indian infrastructure sector faces challenges including land acquisition complexities, which lead to project delays and cost escalation, regulatory hurdles stemming from bureaucratic processes and inconsistent policy implementation, and funding constraints with securing sufficient capital for large-scale projects impacting implementation timelines. These issues necessitate effective policy reforms and efficient project management to fully realize the sector's potential.

Key Players Shaping the Infrastructure Industry in India Market

- Shapoorji Pallonji & Co Ltd

- Lanco Infratech Limited

- Hindustan Construction Co Ltd

- Reliance Infrastructure Limited

- 6 3 Other Companies

- Larsen & Toubro Limited

- Gammon India Ltd

- Tata Projects Ltd

- Nagarjuna Construction Company Limited (NCC Ltd)

- Jaiprakash Associates Ltd

- Simplex Infrastructures Ltd

Significant Infrastructure Industry in India Industry Milestones

- February 2024: Tata Steel partnered with South Eastern Railway (SER) to promote sustainable rail infrastructure using slag-based aggregates. This highlights a shift towards environmentally friendly construction practices.

- January 2024: Highway Infrastructure Trust (HIT) acquired 12 road projects from PNC Infratech Ltd and PNC Infra Holdings Ltd, totaling INR 90.06 billion (USD 1.08 billion). This signifies significant consolidation within the road infrastructure sector.

Future Outlook for Infrastructure Industry in India Market

The Indian infrastructure sector is poised for sustained growth, driven by continued government investment, technological advancements, and increasing private sector participation. Strategic opportunities exist in developing sustainable infrastructure solutions, leveraging digital technologies for improved project management, and expanding into emerging segments like renewable energy infrastructure. The market's substantial potential warrants further investment and innovation, ensuring India's infrastructure meets the demands of its rapidly growing economy.

Infrastructure Industry in India Segmentation

-

1. Infrastructure segment

- 1.1. Social Infrastructure

- 1.2. Transportation Infrastructure

- 1.3. Extraction Infrastructure

- 1.4. Manufacturing Infrastructure

- 1.5. Utilities Infrastructure

-

2. Key States

- 2.1. Maharashtra

- 2.2. Karnataka

- 2.3. Delhi

- 2.4. Telangana

- 2.5. Other States

Infrastructure Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Infrastructure Industry in India Regional Market Share

Geographic Coverage of Infrastructure Industry in India

Infrastructure Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market

- 3.4. Market Trends

- 3.4.1. Increase in Road Infrastructure Investment is Expected to Propel the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 5.1.1. Social Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.3. Extraction Infrastructure

- 5.1.4. Manufacturing Infrastructure

- 5.1.5. Utilities Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Key States

- 5.2.1. Maharashtra

- 5.2.2. Karnataka

- 5.2.3. Delhi

- 5.2.4. Telangana

- 5.2.5. Other States

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6. North America Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 6.1.1. Social Infrastructure

- 6.1.2. Transportation Infrastructure

- 6.1.3. Extraction Infrastructure

- 6.1.4. Manufacturing Infrastructure

- 6.1.5. Utilities Infrastructure

- 6.2. Market Analysis, Insights and Forecast - by Key States

- 6.2.1. Maharashtra

- 6.2.2. Karnataka

- 6.2.3. Delhi

- 6.2.4. Telangana

- 6.2.5. Other States

- 6.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7. South America Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 7.1.1. Social Infrastructure

- 7.1.2. Transportation Infrastructure

- 7.1.3. Extraction Infrastructure

- 7.1.4. Manufacturing Infrastructure

- 7.1.5. Utilities Infrastructure

- 7.2. Market Analysis, Insights and Forecast - by Key States

- 7.2.1. Maharashtra

- 7.2.2. Karnataka

- 7.2.3. Delhi

- 7.2.4. Telangana

- 7.2.5. Other States

- 7.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8. Europe Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 8.1.1. Social Infrastructure

- 8.1.2. Transportation Infrastructure

- 8.1.3. Extraction Infrastructure

- 8.1.4. Manufacturing Infrastructure

- 8.1.5. Utilities Infrastructure

- 8.2. Market Analysis, Insights and Forecast - by Key States

- 8.2.1. Maharashtra

- 8.2.2. Karnataka

- 8.2.3. Delhi

- 8.2.4. Telangana

- 8.2.5. Other States

- 8.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9. Middle East & Africa Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 9.1.1. Social Infrastructure

- 9.1.2. Transportation Infrastructure

- 9.1.3. Extraction Infrastructure

- 9.1.4. Manufacturing Infrastructure

- 9.1.5. Utilities Infrastructure

- 9.2. Market Analysis, Insights and Forecast - by Key States

- 9.2.1. Maharashtra

- 9.2.2. Karnataka

- 9.2.3. Delhi

- 9.2.4. Telangana

- 9.2.5. Other States

- 9.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10. Asia Pacific Infrastructure Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 10.1.1. Social Infrastructure

- 10.1.2. Transportation Infrastructure

- 10.1.3. Extraction Infrastructure

- 10.1.4. Manufacturing Infrastructure

- 10.1.5. Utilities Infrastructure

- 10.2. Market Analysis, Insights and Forecast - by Key States

- 10.2.1. Maharashtra

- 10.2.2. Karnataka

- 10.2.3. Delhi

- 10.2.4. Telangana

- 10.2.5. Other States

- 10.1. Market Analysis, Insights and Forecast - by Infrastructure segment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Shapoorji Pallonji & Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lanco Infratech Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hindustan Construction Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Larsen & Toubro Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Gammon India Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tata Projects Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nagarjuna Construction Company Limited (NCC Ltd)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jaiprakash Associates Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Simplex Infrastructures Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Shapoorji Pallonji & Co Ltd

List of Figures

- Figure 1: Global Infrastructure Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 3: North America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 4: North America Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 5: North America Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 6: North America Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 9: South America Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 10: South America Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 11: South America Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 12: South America Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 15: Europe Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 16: Europe Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 17: Europe Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 18: Europe Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 21: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 22: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 23: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 24: Middle East & Africa Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Infrastructure Industry in India Revenue (Million), by Infrastructure segment 2025 & 2033

- Figure 27: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Infrastructure segment 2025 & 2033

- Figure 28: Asia Pacific Infrastructure Industry in India Revenue (Million), by Key States 2025 & 2033

- Figure 29: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Key States 2025 & 2033

- Figure 30: Asia Pacific Infrastructure Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Infrastructure Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 2: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 3: Global Infrastructure Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 5: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 6: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 11: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 12: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 17: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 18: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 29: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 30: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Infrastructure Industry in India Revenue Million Forecast, by Infrastructure segment 2020 & 2033

- Table 38: Global Infrastructure Industry in India Revenue Million Forecast, by Key States 2020 & 2033

- Table 39: Global Infrastructure Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Infrastructure Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Infrastructure Industry in India?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Infrastructure Industry in India?

Key companies in the market include Shapoorji Pallonji & Co Ltd, Lanco Infratech Limited, Hindustan Construction Co Ltd, Reliance Infrastructure Limited**List Not Exhaustive 6 3 Other Companie, Larsen & Toubro Limited, Gammon India Ltd, Tata Projects Ltd, Nagarjuna Construction Company Limited (NCC Ltd), Jaiprakash Associates Ltd, Simplex Infrastructures Ltd.

3. What are the main segments of the Infrastructure Industry in India?

The market segments include Infrastructure segment, Key States.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Urbanization is Driving the Market; Surge in Foreign Direct Investments is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Road Infrastructure Investment is Expected to Propel the Market Growth.

7. Are there any restraints impacting market growth?

Bureaucratic Processes are Affecting the Market; Environmental Concerns and Regulatory Hurdles are Affecting the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Tata Steel, a prominent private steel firm, unveiled its partnership with South Eastern Railway (SER). The collaboration aims to foster sustainable rail infrastructure by leveraging slag-based aggregates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Infrastructure Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Infrastructure Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Infrastructure Industry in India?

To stay informed about further developments, trends, and reports in the Infrastructure Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence