Key Insights

The North American transportation infrastructure construction market is poised for significant expansion, driven by urbanization, aging infrastructure, and strategic government initiatives for enhanced connectivity and sustainability. Projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% from 2025 to 2033, the market is estimated to reach $153.4 billion by 2025. Segmentation includes roadways, railways, marine, and aviation infrastructure, with roadways currently leading due to substantial investment in highway development and maintenance. However, increasing focus on climate change mitigation and efficient freight movement is fueling rapid growth in rail and marine infrastructure segments. The United States commands the largest market share, followed by Canada and Mexico, with the Rest of North America presenting emerging opportunities. Leading players like L&T Construction, Bechtel Corporation, and Kiewit Corporation are capitalizing on this trend by focusing on large-scale, sustainable, and technologically advanced projects. Regulatory emphasis on carbon emission reduction is also spurring demand for eco-friendly construction materials and practices. Challenges such as fluctuating material costs, labor shortages, and complex project approval processes persist, yet the long-term outlook remains highly favorable.

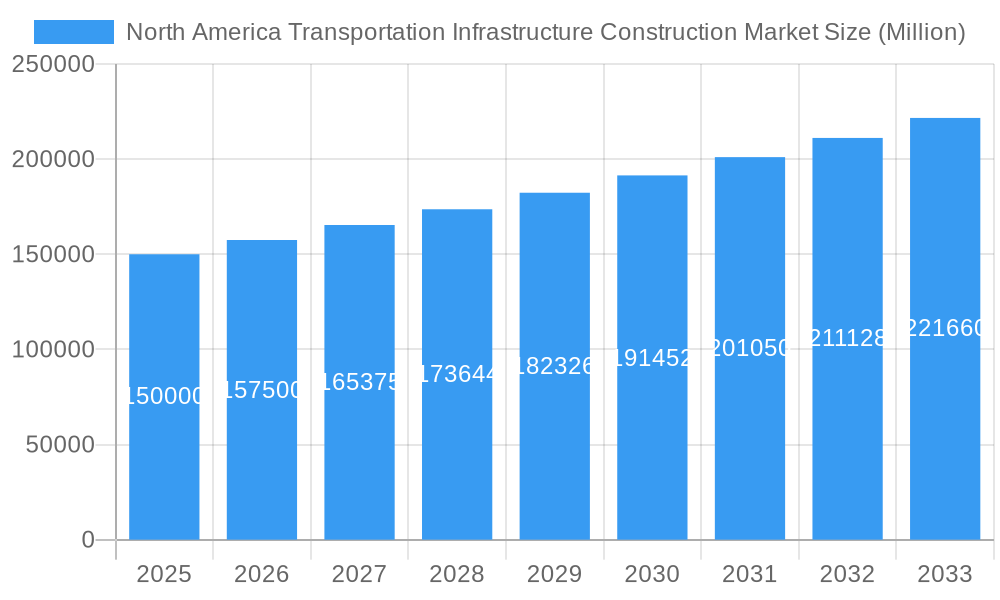

North America Transportation Infrastructure Construction Market Market Size (In Billion)

Market growth is strongly supported by federal and state-level infrastructure renewal and expansion programs, with Public-Private Partnerships (PPPs) increasingly facilitating project execution. Technological advancements, including Building Information Modeling (BIM) and the integration of smart technologies, are enhancing efficiency, optimizing project lifecycles, and improving infrastructure performance through cost savings and higher productivity. The growing adoption of sustainable construction practices, driven by environmental consciousness and regulatory mandates, is fostering innovation and creating new avenues for companies offering green solutions. Intense market competition necessitates that companies excel in securing projects, managing complex logistics, and delivering on-time and within budget, while adhering to stringent environmental and safety regulations.

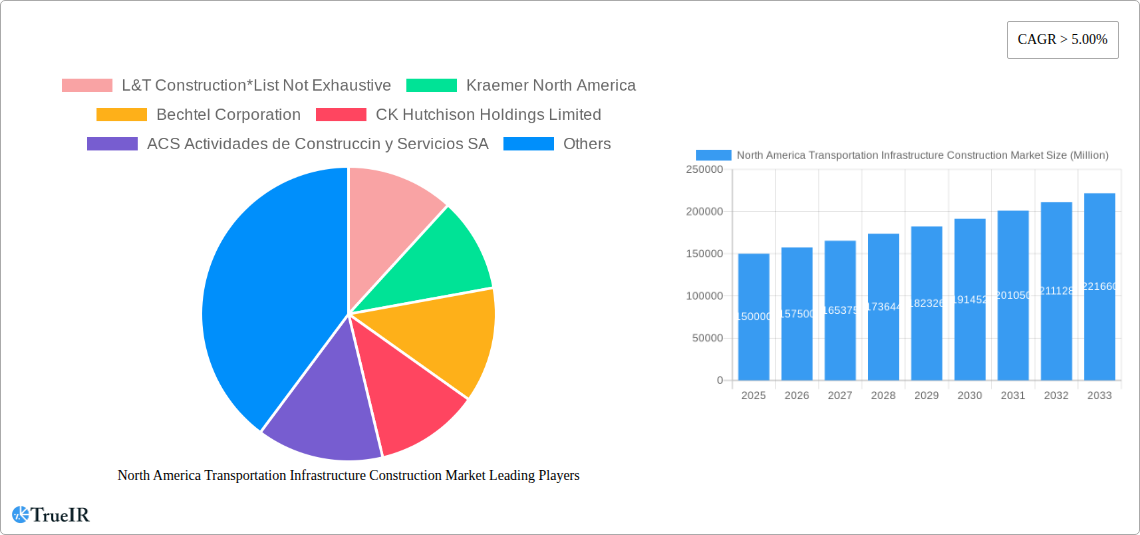

North America Transportation Infrastructure Construction Market Company Market Share

North America Transportation Infrastructure Construction Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Transportation Infrastructure Construction Market, covering the period from 2019 to 2033. It offers invaluable insights into market size, growth drivers, challenges, competitive landscape, and future outlook, empowering stakeholders to make informed decisions. With a focus on key segments – Roadways, Railways, Marine Transportation, and Airways – across the United States, Canada, Mexico, and the Rest of North America, this report is an essential resource for investors, industry professionals, and policymakers. The base year is 2025, with estimations for 2025 and forecasts spanning 2025-2033, supported by historical data from 2019-2024.

North America Transportation Infrastructure Construction Market Structure & Competitive Landscape

The North American transportation infrastructure construction market is characterized by a moderately consolidated structure with a few major players and numerous smaller firms. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is driven by advancements in materials science (e.g., high-performance concrete, advanced composites), construction techniques (e.g., 3D printing, prefabrication), and digital technologies (e.g., Building Information Modeling (BIM), Internet of Things (IoT) sensors for infrastructure monitoring). Regulatory frameworks, varying across states and provinces, significantly impact market dynamics, including permitting processes and environmental regulations. Product substitutes are limited, primarily involving alternative materials with varying cost and performance trade-offs. The market is segmented by end-user, encompassing government agencies, private sector developers, and concessionaires. M&A activity has been steady, with xx major transactions recorded between 2019 and 2024, driven by consolidation efforts and expansion into new markets. The top 5 companies held approximately xx% market share in 2024.

- Market Concentration: HHI estimated at xx in 2024.

- Innovation Drivers: Advanced materials, construction techniques, and digital technologies.

- Regulatory Impacts: Significant variations across jurisdictions impacting permitting and environmental compliance.

- End-User Segmentation: Government agencies, private developers, and concessionaires.

- M&A Trends: xx major transactions from 2019-2024, reflecting consolidation and expansion strategies.

North America Transportation Infrastructure Construction Market Trends & Opportunities

The North American transportation infrastructure construction market is poised for significant growth, driven by increasing urbanization, expanding trade, and government initiatives to modernize aging infrastructure. The market size is projected to reach USD xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). Technological advancements are transforming the industry, including the adoption of BIM for improved project management and the use of IoT sensors for predictive maintenance. Consumer preferences are shifting towards sustainable and resilient infrastructure solutions. The market exhibits intense competition, with both established players and new entrants vying for market share. This competitive pressure is spurring innovation and improving efficiency. Market penetration rates for new technologies vary considerably, with higher adoption in certain segments (e.g., roadways in larger metropolitan areas). Specific examples include increased adoption of sustainable construction materials (a 5% increase from 2024 to 2028), leading to reduced environmental impact. Market penetration for BIM software is estimated to reach xx% by 2033. The increasing use of advanced analytics is expected to significantly improve project efficiency and reduce overall costs by xx% in 2033.

Dominant Markets & Segments in North America Transportation Infrastructure Construction Market

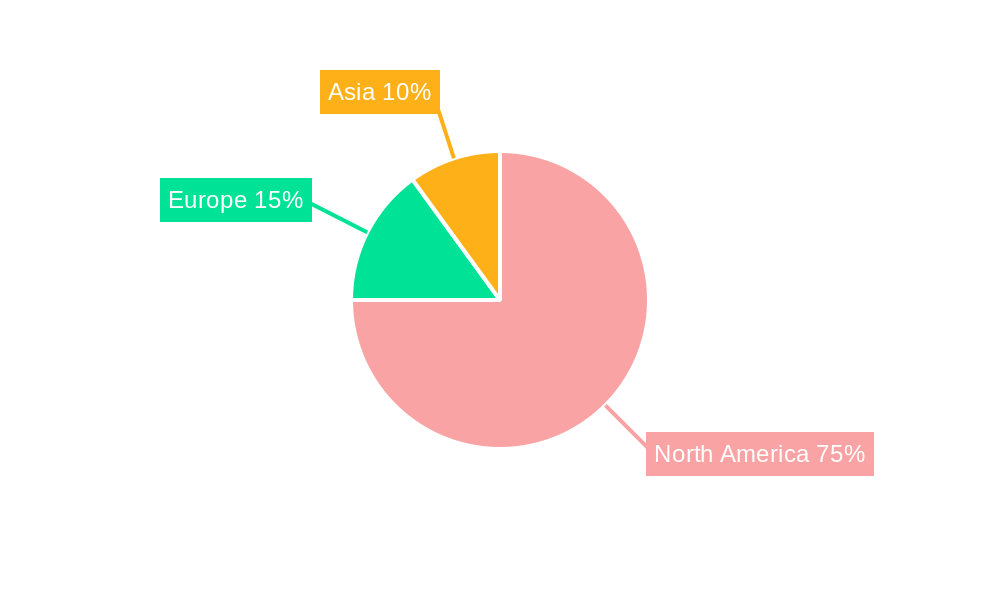

The United States represents the largest market within North America, accounting for xx% of the total market value in 2024, driven by substantial government investment in infrastructure development programs. The roadways segment dominates the overall market, owing to the extensive network requiring continuous maintenance and expansion.

- United States: Largest market share due to high government spending and extensive infrastructure needs.

- Roadways: Largest segment due to high demand for maintenance, expansion, and new construction.

- Key Growth Drivers: Government funding for infrastructure upgrades, increasing urbanization, growing freight transportation.

Detailed Analysis: The dominance of the United States is attributed to its vast network of roads, railways, and airports, which requires continuous maintenance, expansion, and modernization. Federal and state-level investments in infrastructure projects fuel substantial demand in this market. Similarly, the roadways segment's dominance reflects the ever-increasing need for highway improvements, expansion of road networks, and the construction of new roads to accommodate population growth and economic activity. Canada and Mexico exhibit significant growth potential, particularly in their respective railway and marine transportation sectors, while the "Rest of North America" segment offers niche opportunities for specialized infrastructure projects.

North America Transportation Infrastructure Construction Market Product Analysis

Product innovation focuses on sustainable materials, such as recycled aggregates and bio-based composites, enhanced construction techniques like prefabrication and 3D printing, and improved monitoring technologies via sensors and AI for predictive maintenance. These advancements translate to cost efficiencies, reduced environmental impact, and extended asset lifespans.

Key Drivers, Barriers & Challenges in North America Transportation Infrastructure Construction Market

Key Drivers: Increased government spending on infrastructure, technological advancements, growing urbanization, and rising freight transportation demands. For example, the Bipartisan Infrastructure Law in the US is injecting billions of dollars into transportation infrastructure projects.

Challenges: Supply chain disruptions leading to material shortages and cost increases (estimated xx% increase in material costs from 2024 to 2026). Regulatory hurdles, including permitting delays and environmental compliance requirements. Intense competition with varying pricing strategies impacting profit margins.

Growth Drivers in the North America Transportation Infrastructure Construction Market Market

Government investments in infrastructure modernization projects, technological innovation, and population growth are key growth catalysts. The push towards sustainable and resilient infrastructure is creating new market opportunities.

Challenges Impacting North America Transportation Infrastructure Construction Market Growth

Supply chain bottlenecks, labor shortages, and rising material costs constrain market growth. Regulatory complexities and environmental concerns also present significant challenges.

Key Players Shaping the North America Transportation Infrastructure Construction Market Market

- L&T Construction

- Kraemer North America

- Bechtel Corporation

- CK Hutchison Holdings Limited

- ACS Actividades de Construccin y Servicios SA

- Kiewit Corporation

- Balfour Beatty

- OBRASCON HUARTE LAIN SA (OHLA)

- BOUYGUES CONSTRUCTION SA

- VINCI Construction

- GLOBALVIA Inversiones SAU

Significant North America Transportation Infrastructure Construction Market Industry Milestones

- August 2021: USD 837 Million Trans-Canada Highway widening project announced, creating over 1,900 jobs.

- February 2021: US and Canada plan joint investment in transport infrastructure, focusing on pipeline projects.

Future Outlook for North America Transportation Infrastructure Construction Market Market

The market is projected to experience robust growth, driven by continued government investment, technological innovation, and the increasing focus on sustainable infrastructure solutions. Strategic partnerships and acquisitions will shape the competitive landscape, with opportunities for growth in emerging technologies and specialized infrastructure segments.

North America Transportation Infrastructure Construction Market Segmentation

-

1. Mode

- 1.1. Roadways

- 1.2. Railways

- 1.3. Marine Transportation

- 1.4. Airways

North America Transportation Infrastructure Construction Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Transportation Infrastructure Construction Market Regional Market Share

Geographic Coverage of North America Transportation Infrastructure Construction Market

North America Transportation Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy

- 3.3. Market Restrains

- 3.3.1. 4.; Limited Land Availability4.; Economic Uncertainties

- 3.4. Market Trends

- 3.4.1. Increasing Infrastructure Activities in the United States

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Transportation Infrastructure Construction Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 5.1.1. Roadways

- 5.1.2. Railways

- 5.1.3. Marine Transportation

- 5.1.4. Airways

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Mode

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L&T Construction*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kraemer North America

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bechtel Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CK Hutchison Holdings Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ACS Actividades de Construccin y Servicios SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kiewit Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Balfour Beatty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OBRASCON HUARTE LAIN SA (OHLA)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BOUYGUES CONSTRUCTION SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VINCI Construction

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GLOBALVIA Inversiones SAU

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 L&T Construction*List Not Exhaustive

List of Figures

- Figure 1: North America Transportation Infrastructure Construction Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Transportation Infrastructure Construction Market Share (%) by Company 2025

List of Tables

- Table 1: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 2: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Mode 2020 & 2033

- Table 4: North America Transportation Infrastructure Construction Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Transportation Infrastructure Construction Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Transportation Infrastructure Construction Market?

The projected CAGR is approximately 3.5%.

2. Which companies are prominent players in the North America Transportation Infrastructure Construction Market?

Key companies in the market include L&T Construction*List Not Exhaustive, Kraemer North America, Bechtel Corporation, CK Hutchison Holdings Limited, ACS Actividades de Construccin y Servicios SA, Kiewit Corporation, Balfour Beatty, OBRASCON HUARTE LAIN SA (OHLA), BOUYGUES CONSTRUCTION SA, VINCI Construction, GLOBALVIA Inversiones SAU.

3. What are the main segments of the North America Transportation Infrastructure Construction Market?

The market segments include Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 153.4 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapid Urbanization and Rising Disposable Income4.; Government Initiatives and Expanding Economy.

6. What are the notable trends driving market growth?

Increasing Infrastructure Activities in the United States.

7. Are there any restraints impacting market growth?

4.; Limited Land Availability4.; Economic Uncertainties.

8. Can you provide examples of recent developments in the market?

August 2021: The Ministry of Transportation and Infrastructure announced a USD 837 million Trans-Canada highway widening project between Alberta and B.C. This project involves the construction of bridges and the widening of two lanes highways to four lanes, creating more than 1,200 direct jobs and 700 indirect jobs.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Transportation Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Transportation Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Transportation Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the North America Transportation Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence