Key Insights

The European condominiums and apartments market is poised for significant expansion, fueled by increasing urbanization, a growing young demographic, and persistent housing affordability challenges in major continental cities. The market is projected to reach $1279.93 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.9%. Key growth drivers include robust investment from domestic and international players in prominent markets such as Germany, the United Kingdom, and France. Leading developers, including CPI Property Group, Vonovia SE, and Unibail-Rodamco, are instrumental in shaping the market through high-quality developments in prime urban locations. Despite potential headwinds from rising construction costs and regulatory complexities, long-term prospects remain strong, supported by government initiatives focused on affordable and sustainable urban housing solutions. Market segmentation by country reveals varied growth dynamics, with Germany's strong economy and housing demand expected to remain a primary contributor. The UK and France will also play vital roles, though their market trajectories will be influenced by distinct regulatory environments and economic conditions. Emerging markets within the "Rest of Europe" segment are exhibiting increasing investment activity, presenting considerable future growth potential.

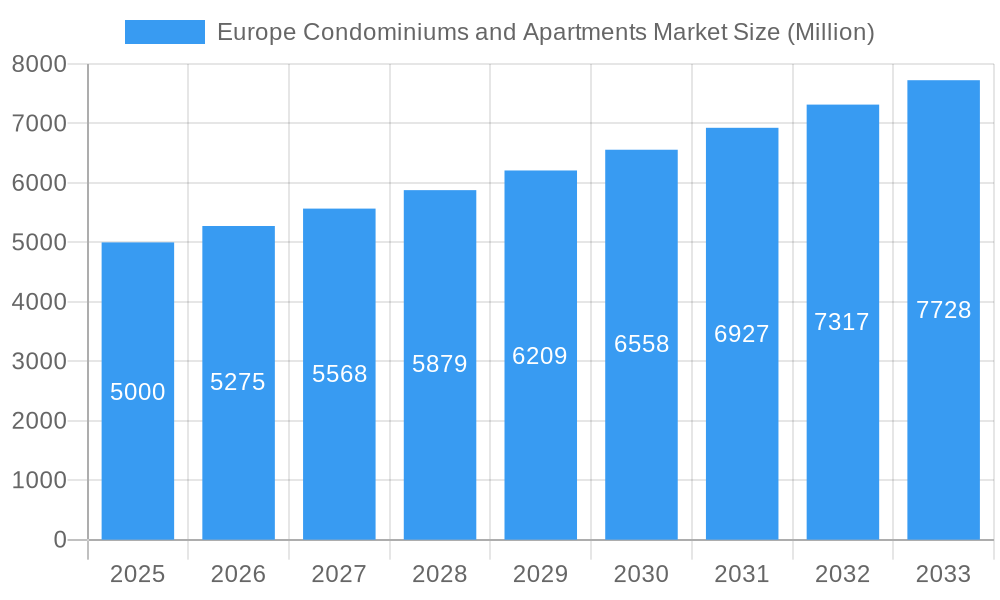

Europe Condominiums and Apartments Market Market Size (In Million)

The forecast period (2025-2033) anticipates sustained market growth, potentially at a more measured rate due to anticipated interest rate fluctuations affecting mortgage accessibility and broader macroeconomic trends. Nevertheless, fundamental drivers such as urbanization, population increases, and the demand for modern residential units will sustain the market's positive trajectory. Significant undisclosed investments from non-listed entities further bolster the market's valuation and expansion. The diverse competitive landscape, comprising large publicly traded corporations and specialized smaller developers, signifies a dynamic and competitive market. Detailed analysis of individual company performance and strategic initiatives is crucial for a comprehensive understanding of evolving market trends and future growth opportunities.

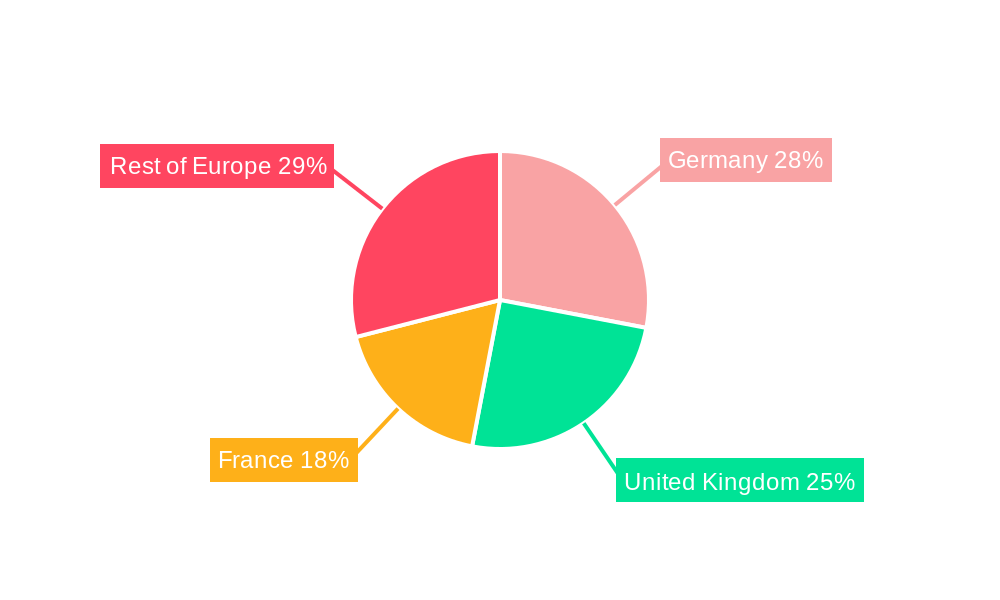

Europe Condominiums and Apartments Market Company Market Share

Europe Condominiums and Apartments Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the European condominiums and apartments market, offering invaluable insights for investors, developers, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report examines market trends, competitive dynamics, and future growth potential across key European countries.

Europe Condominiums and Apartments Market Market Structure & Competitive Landscape

The European condominiums and apartments market exhibits a moderately concentrated structure, with several large players holding significant market share. However, the market is characterized by a dynamic competitive landscape, influenced by factors such as innovation, regulatory changes, and ongoing mergers and acquisitions (M&A) activity.

Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market in 2024 was estimated at xx, indicating a moderately concentrated market. This is expected to remain relatively stable through 2033, though potential M&A activity could shift the landscape.

Innovation Drivers: Technological advancements, such as smart home integration and sustainable building materials, are driving innovation. These innovations appeal to environmentally conscious buyers and enhance the value proposition of new developments.

Regulatory Impacts: Varying regulations across European countries significantly impact development costs and timelines. Building codes, zoning laws, and environmental regulations create both opportunities and challenges for market players.

Product Substitutes: The market faces competition from alternative housing options like rental apartments and co-living spaces. This competition is particularly intense in urban areas.

End-User Segmentation: The market caters to diverse end-users including first-time homebuyers, families, and investors. Understanding the specific needs and preferences of these segments is crucial for success.

M&A Trends: The past five years have witnessed a considerable level of M&A activity, with xx major transactions recorded in 2024 alone. This suggests a consolidating trend within the sector, driven by economies of scale and portfolio diversification strategies. Consolidation is anticipated to continue through 2033.

Europe Condominiums and Apartments Market Market Trends & Opportunities

The European condominiums and apartments market is experiencing robust growth, fueled by several key factors. Urbanization, increasing disposable incomes, and a shift towards rental accommodations are driving demand. Technological advancements and evolving consumer preferences further contribute to market expansion.

The market size reached xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Market penetration rates are highest in major metropolitan areas, though significant growth potential exists in secondary cities. Technological shifts, such as the increasing adoption of smart home technologies and sustainable building practices, are reshaping the market. Consumers are increasingly demanding energy-efficient and technologically advanced housing solutions, creating opportunities for developers offering such features. Furthermore, the rise of flexible work arrangements and the increasing demand for co-living spaces have presented new opportunities for market players. The competitive landscape is characterized by both established players and emerging developers, leading to dynamic market dynamics and continuous innovation.

Dominant Markets & Segments in Europe Condominiums and Apartments Market

The United Kingdom, Germany, and France represent the dominant markets within the European condominiums and apartments sector, driven by strong economies, high population density, and favorable regulatory environments.

Germany:

- Strong economic growth

- High demand for urban housing

- Supportive government policies

United Kingdom:

- Large and diverse population

- Robust rental market

- Significant investment in infrastructure

France:

- High urban population concentration

- Growing demand for luxury apartments

- Favorable tax incentives for property investment

Rest of Europe: While exhibiting slower growth compared to the leading three, this segment shows promise, with certain countries such as the Netherlands and Spain experiencing increasing demand driven by economic growth and tourism.

The market is further segmented by property type (condominiums vs. apartments), price range, and location within each country. High-end properties in prime urban locations tend to command premium prices and exhibit strong demand, while more affordable options in suburban or peripheral areas also contribute to overall market volume.

Europe Condominiums and Apartments Market Product Analysis

Product innovation is driven by technological advancements, focusing on energy efficiency, smart home integration, and sustainable materials. Modern condominiums and apartments increasingly feature smart building technologies, high-speed internet connectivity, and environmentally friendly designs. These innovations enhance the appeal to environmentally conscious buyers and investors seeking long-term value. The market offers a diverse range of products catering to varying budgets and lifestyle preferences.

Key Drivers, Barriers & Challenges in Europe Condominiums and Apartments Market

Key Drivers:

- Rapid urbanization driving increased demand for housing.

- Rising disposable incomes among a growing middle class.

- Favorable government policies in certain regions promoting real estate development.

Challenges:

- High construction costs and material scarcity impacting profitability.

- Strict building regulations and lengthy approval processes causing delays.

- Competition from existing housing stock and alternative housing options. The impact of these challenges varies across European countries depending on local market conditions and government policies.

Growth Drivers in the Europe Condominiums and Apartments Market Market

Key growth drivers include robust economic growth in several European countries, increasing urbanization, and rising disposable incomes. Government incentives promoting homeownership and rental housing further stimulate market growth. Technological innovations, such as smart home technologies and sustainable building materials, are also enhancing market appeal.

Challenges Impacting Europe Condominiums and Apartments Market Growth

Significant challenges include high construction costs, stringent regulations leading to project delays, and increasing competition within the sector. Supply chain disruptions and the scarcity of skilled labor further add pressure. These factors can impact the affordability and timely delivery of new projects.

Key Players Shaping the Europe Condominiums and Apartments Market Market

- CPI Property Group

- Aroundtown Property Holdings

- Elm Group

- Altarea Cogedim

- Places for People Group Limited

- Gecina

- Segro

- Vonovia SE

- Castellum AB

- LEG Immobilien AG

- Unibail-Rodamco

- Covivio

- Consus Real Estate AG

Significant Europe Condominiums and Apartments Market Industry Milestones

- September 2022: Gamuda Land announced plans to significantly expand its international projects, adding an average of five new overseas developments annually starting in FY2023. This signals increased foreign investment and competition in the European market.

- November 2022: Ukio, a short-term furnished apartment rental platform, secured EUR 27 Million in Series-A funding. This indicates growing interest in the flexible short-term rental sector, potentially impacting the long-term rental market.

Future Outlook for Europe Condominiums and Apartments Market Market

The European condominiums and apartments market is poised for continued growth, driven by sustained economic expansion in several key markets, ongoing urbanization, and technological advancements. Strategic opportunities exist for developers focusing on sustainable and technologically advanced projects catering to evolving consumer preferences. The market's future trajectory will depend heavily on navigating macroeconomic conditions, regulatory changes, and the ongoing impact of technological disruptions.

Europe Condominiums and Apartments Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Condominiums and Apartments Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Condominiums and Apartments Market Regional Market Share

Geographic Coverage of Europe Condominiums and Apartments Market

Europe Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Developments in the Residential Segment; Investments in the Senior Living Units

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Land Hindering the Market

- 3.4. Market Trends

- 3.4.1. Demand for Affordable Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Condominiums and Apartments Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CPI Property Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aroundtown Property Holdings

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elm Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Altarea Cogedim

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Places for People Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gecina**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Segro

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vonovia SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Castellum AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LEG Immobilien AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Unibail-Rodamco

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Covivio

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Consus Real Estate AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CPI Property Group

List of Figures

- Figure 1: Europe Condominiums and Apartments Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Condominiums and Apartments Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Condominiums and Apartments Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Europe Condominiums and Apartments Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Condominiums and Apartments Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Condominiums and Apartments Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Condominiums and Apartments Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Condominiums and Apartments Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Condominiums and Apartments Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Germany Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Netherlands Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Belgium Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Sweden Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Norway Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Poland Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Denmark Europe Condominiums and Apartments Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Condominiums and Apartments Market?

The projected CAGR is approximately 4.9%.

2. Which companies are prominent players in the Europe Condominiums and Apartments Market?

Key companies in the market include CPI Property Group, Aroundtown Property Holdings, Elm Group, Altarea Cogedim, Places for People Group Limited, Gecina**List Not Exhaustive, Segro, Vonovia SE, Castellum AB, LEG Immobilien AG, Unibail-Rodamco, Covivio, Consus Real Estate AG.

3. What are the main segments of the Europe Condominiums and Apartments Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 1279.93 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Developments in the Residential Segment; Investments in the Senior Living Units.

6. What are the notable trends driving market growth?

Demand for Affordable Housing.

7. Are there any restraints impacting market growth?

Limited Availability of Land Hindering the Market.

8. Can you provide examples of recent developments in the market?

November 2022: Ukio, a short-term furnished apartment rental platform aimed at the "flexible workforce," raised a Series-A round of funding totalling EUR 27 million (USD 28 million). The cash injection totalled EUR 17 million (USD 18.03 million) in equity and EUR 10 million (USD 10.61 million) in debt and came 14 months after the Spanish company announced a seed round of funding of EUR 9 million (USD 9.54 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Europe Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence