Key Insights

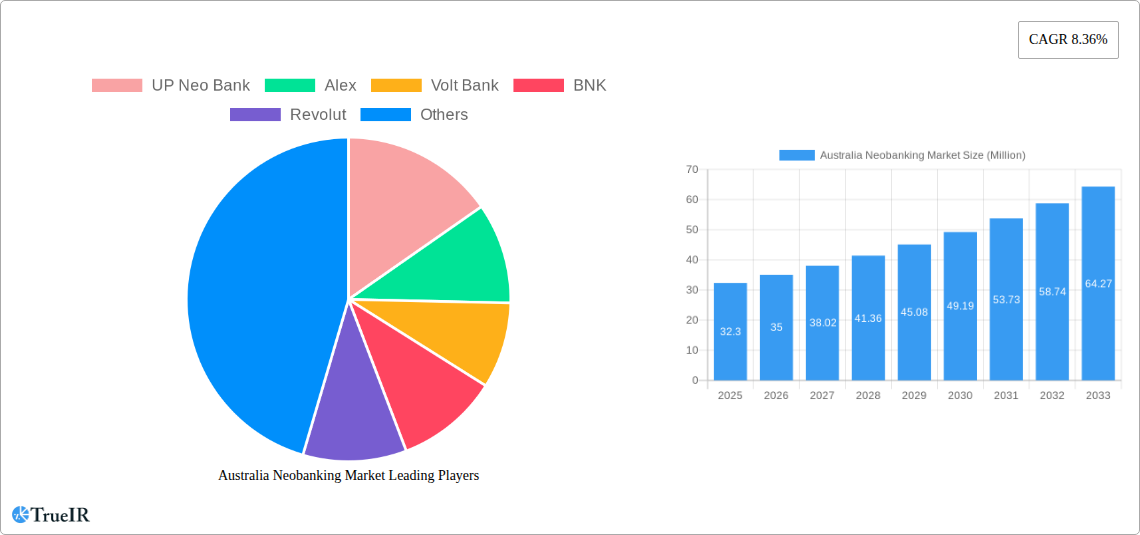

The Australian neobanking market, valued at $32.30 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.36% from 2025 to 2033. This surge is driven by several key factors. Increasing smartphone penetration and digital literacy among Australians are fueling the adoption of convenient and accessible digital banking solutions. Furthermore, the demand for personalized financial services and streamlined user experiences is significantly contributing to the market's expansion. The rise of open banking initiatives in Australia is also playing a crucial role, enabling seamless data sharing and fostering innovation within the neobanking sector. Competition among established players like UP Neo Bank, Revolut, and emerging fintechs is intensifying, leading to continuous product improvements and attractive offers for consumers. Regulatory changes aimed at promoting financial inclusion are also creating a favorable environment for neobanks to thrive. However, challenges remain, including concerns around data security and the need for robust customer support infrastructure to address potential technical issues and maintain customer trust. The market is witnessing a gradual shift towards integrated financial solutions, with neobanks expanding beyond basic banking services to offer investment products, insurance, and other financial tools within their platforms.

Australia Neobanking Market Market Size (In Million)

Looking ahead, the Australian neobanking market's growth trajectory is expected to remain positive. Continued technological advancements, such as improved AI-powered personalization and enhanced security features, will further attract customers. The focus on embedded finance, where financial services are integrated into non-financial platforms, presents significant opportunities for growth. To maintain a competitive edge, neobanks must prioritize innovation, customer experience, and regulatory compliance. Building strong brand trust and addressing potential cybersecurity vulnerabilities are paramount to ensuring long-term success in this dynamic and rapidly evolving market. The expansion of neobanking services into regional areas of Australia, currently underserved by traditional banking institutions, also represents a significant area for future market growth.

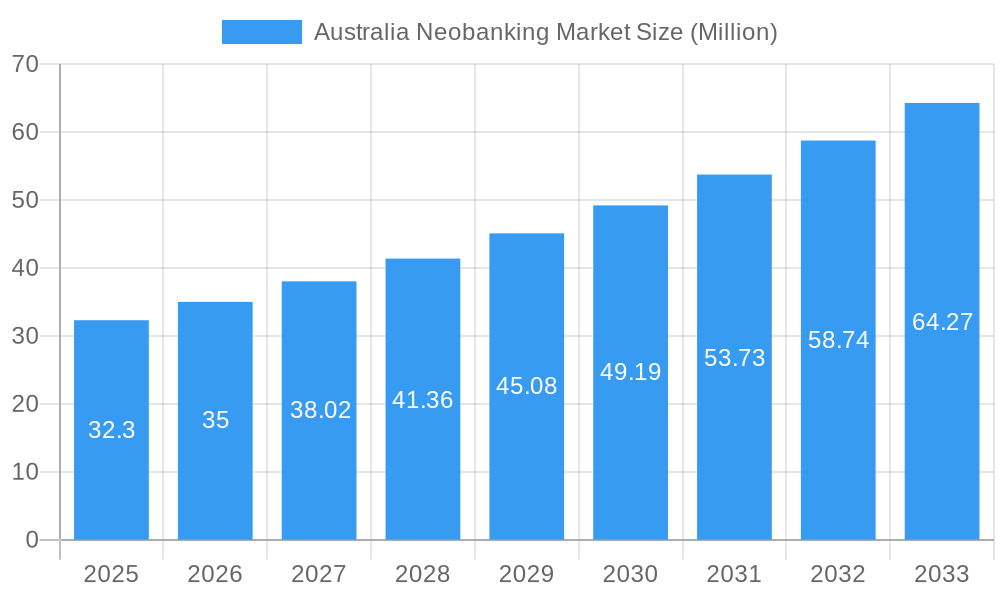

Australia Neobanking Market Company Market Share

Australia Neobanking Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning Australian neobanking market, projecting robust growth from 2019 to 2033. Leveraging extensive market research and data analysis, this report offers invaluable insights for investors, industry professionals, and strategic decision-makers seeking to navigate this rapidly evolving landscape. The report covers market size, competitive dynamics, key players, technological advancements, and future growth projections, providing a holistic understanding of the Australian neobanking sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Australia Neobanking Market Market Structure & Competitive Landscape

The Australian neobanking market exhibits a moderately concentrated structure, with a handful of established players and a growing number of emerging challengers. The market concentration ratio (CR4) in 2024 was estimated at xx%, indicating room for further market consolidation. Innovation is a key driver, with neobanks continuously developing new products and services to meet evolving customer demands. Regulatory changes, particularly those related to open banking and data privacy, significantly impact market dynamics. Product substitutes, such as traditional banking services and fintech platforms, also influence market competition. The end-user segmentation primarily comprises millennials and Gen Z, known for their tech-savviness and preference for digital-first solutions. M&A activity has been moderate in recent years, with a total of xx acquisitions recorded between 2019 and 2024 (estimated). Future M&A activity is predicted to increase as larger players seek to expand their market share and smaller players seek capital and scale.

- Market Concentration: CR4 (2024) estimated at xx%

- Innovation Drivers: AI-powered personalization, embedded finance, blockchain integration

- Regulatory Impacts: Open banking regulations, data privacy laws

- Product Substitutes: Traditional banks, fintech platforms

- End-User Segmentation: Millennials, Gen Z, small businesses

- M&A Trends: xx acquisitions (2019-2024), increasing forecast for 2025-2033

Australia Neobanking Market Market Trends & Opportunities

The Australian neobanking market is experiencing significant growth, with the market size estimated at $xx Million in 2024. This growth is primarily driven by the increasing adoption of digital banking services, particularly among younger demographics. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), leading to a market size of $xx Million by 2033. Market penetration rates for neobanking are rising, reaching xx% in 2024. Technological advancements, such as the rise of open banking and improved mobile banking capabilities, are key catalysts for market expansion. Consumer preferences are shifting toward greater personalization, seamless user experiences, and transparent fee structures. Intense competition among neobanks is driving innovation and forcing companies to constantly adapt and refine their offerings. This competitive landscape presents significant opportunities for agile and innovative players to capture market share.

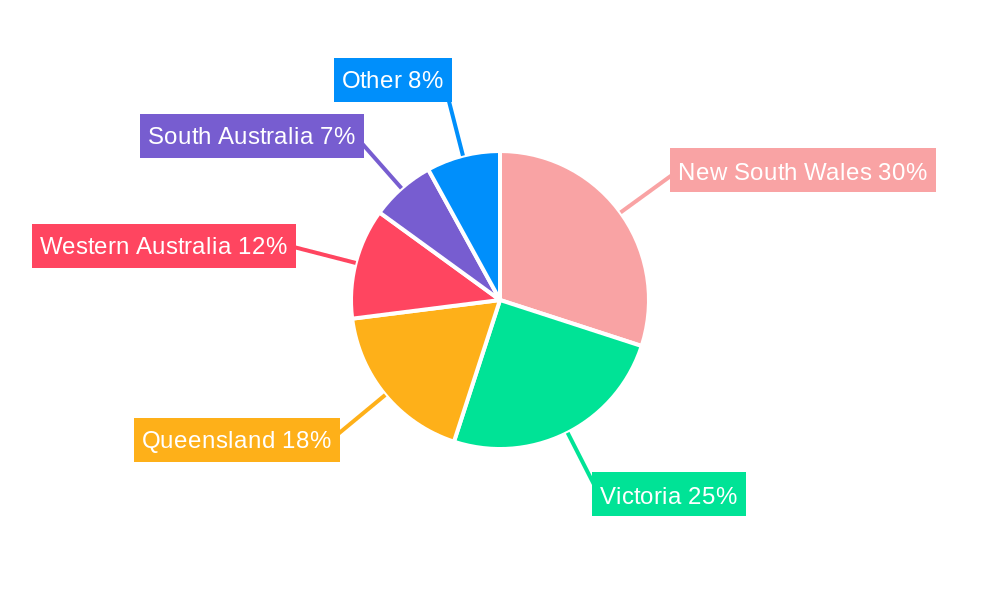

Dominant Markets & Segments in Australia Neobanking Market

While the neobanking market is nationwide, certain regions and segments show greater adoption rates. Major metropolitan areas like Sydney and Melbourne exhibit higher penetration rates due to higher smartphone ownership and internet access. The key growth drivers in these areas include:

- Robust Digital Infrastructure: High-speed internet access and advanced mobile networks

- Tech-Savvy Population: High adoption rates of smartphones and digital technologies

- Supportive Regulatory Environment: Government initiatives promoting fintech innovation

The dominance of these regions is projected to continue, although smaller cities and regional areas are expected to see increased adoption as digital infrastructure improves and awareness grows.

Australia Neobanking Market Product Analysis

Neobanks in Australia offer a range of products and services, including transaction accounts, savings accounts, personal loans, and credit cards. A key differentiator is the seamless integration of technology, offering personalized experiences, sophisticated budgeting tools, and advanced fraud detection capabilities. The focus is on user-friendly mobile interfaces and personalized financial management solutions. The success of these products hinges on strong security measures, robust customer support, and a clear understanding of customer needs. Features like international money transfers and integrated investment platforms enhance the attractiveness of neobanking solutions.

Key Drivers, Barriers & Challenges in Australia Neobanking Market

Key Drivers: The rise of fintech, growing smartphone penetration, increasing demand for personalized financial services, and supportive government policies are key drivers. Open banking regulations are also creating opportunities for collaboration and innovation.

Key Challenges: Regulatory hurdles, competition from established banks, concerns about data security and privacy, and the need for significant investments in technology and infrastructure pose substantial challenges. Attracting and retaining talent is another critical factor.

Growth Drivers in the Australia Neobanking Market Market

The key drivers for growth are the increasing adoption of digital financial services by a younger generation, coupled with the rise of open banking and related opportunities for collaboration and innovation. Technological advancements in AI and machine learning enable hyper-personalization of financial products and services further fueling market growth. Government support and the relatively less stringent regulations compared to many global markets also play a critical role.

Challenges Impacting Australia Neobanking Market Growth

Challenges include securing funding, navigating stringent regulatory frameworks, managing cybersecurity risks, and competing with well-established banks offering comprehensive services and customer loyalty programs. Building trust and ensuring a seamless customer experience are also crucial for success in a competitive market. The cost of attracting and retaining highly skilled developers and other talent can also be significant.

Key Players Shaping the Australia Neobanking Market Market

- UP Neo Bank

- Alex

- Volt Bank

- BNK

- Revolut

- Hay

- Judo Bank

- Tyro

- Douugh

- DayTek

- List Not Exhaustive

Significant Australia Neobanking Market Industry Milestones

- December 2023: Ubank and designer Jordan Gogos collaborated to launch custom fashion pieces and introduce the Feel-Good Fashion Fund initiative for emerging designers. This highlights the evolving strategies of neobanks to engage with customers beyond core financial services.

- May 2022: Australia’s first digital bank, UBank, revealed a new look and feel after merging with smart bank, 86400. This merger demonstrated the consolidation trend within the neobanking sector, combining established customer bases with advanced technology.

Future Outlook for Australia Neobanking Market Market

The Australian neobanking market is poised for continued strong growth, driven by technological advancements, increasing consumer adoption, and supportive regulatory frameworks. Strategic partnerships, expansion into new product offerings, and a focus on personalized customer experiences will be crucial for success. The market's potential for expansion into underserved segments and the integration of embedded finance solutions present exciting opportunities for future growth and innovation. The market is expected to witness further consolidation as players seek scale and efficiency, creating a more competitive yet innovative financial landscape.

Australia Neobanking Market Segmentation

-

1. Account

- 1.1. Business Account

- 1.2. Saving Account

-

2. Service

- 2.1. Mobile Banking

- 2.2. Payments & Money transfer

- 2.3. Savings account

- 2.4. Loans

- 2.5. Others

-

3. Application

- 3.1. Enterprise

- 3.2. Personal

- 3.3. Others

Australia Neobanking Market Segmentation By Geography

- 1. Australia

Australia Neobanking Market Regional Market Share

Geographic Coverage of Australia Neobanking Market

Australia Neobanking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Next Generation Technologies.

- 3.3. Market Restrains

- 3.3.1. Next Generation Technologies.

- 3.4. Market Trends

- 3.4.1. Rising Investment in Fintech in Australia Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Neobanking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Account

- 5.1.1. Business Account

- 5.1.2. Saving Account

- 5.2. Market Analysis, Insights and Forecast - by Service

- 5.2.1. Mobile Banking

- 5.2.2. Payments & Money transfer

- 5.2.3. Savings account

- 5.2.4. Loans

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Enterprise

- 5.3.2. Personal

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Account

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UP Neo Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volt Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BNK

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Revolut

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Judo Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tyro

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Douugh

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DayTek**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UP Neo Bank

List of Figures

- Figure 1: Australia Neobanking Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Neobanking Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 2: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 3: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 5: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 7: Australia Neobanking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Australia Neobanking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Australia Neobanking Market Revenue Million Forecast, by Account 2020 & 2033

- Table 10: Australia Neobanking Market Volume Billion Forecast, by Account 2020 & 2033

- Table 11: Australia Neobanking Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Australia Neobanking Market Volume Billion Forecast, by Service 2020 & 2033

- Table 13: Australia Neobanking Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Australia Neobanking Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: Australia Neobanking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Australia Neobanking Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Neobanking Market?

The projected CAGR is approximately 8.36%.

2. Which companies are prominent players in the Australia Neobanking Market?

Key companies in the market include UP Neo Bank, Alex, Volt Bank, BNK, Revolut, Hay, Judo Bank, Tyro, Douugh, DayTek**List Not Exhaustive.

3. What are the main segments of the Australia Neobanking Market?

The market segments include Account, Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Next Generation Technologies..

6. What are the notable trends driving market growth?

Rising Investment in Fintech in Australia Driving the Market.

7. Are there any restraints impacting market growth?

Next Generation Technologies..

8. Can you provide examples of recent developments in the market?

December 2023: Ubank and designer Jordan Gogos collaborated to launch custom fashion pieces and introduce the Feel-Good Fashion Fund initiative for emerging designers. Jordan Gogos is known for his innovative and boundary-pushing work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Neobanking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Neobanking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Neobanking Market?

To stay informed about further developments, trends, and reports in the Australia Neobanking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence