Key Insights

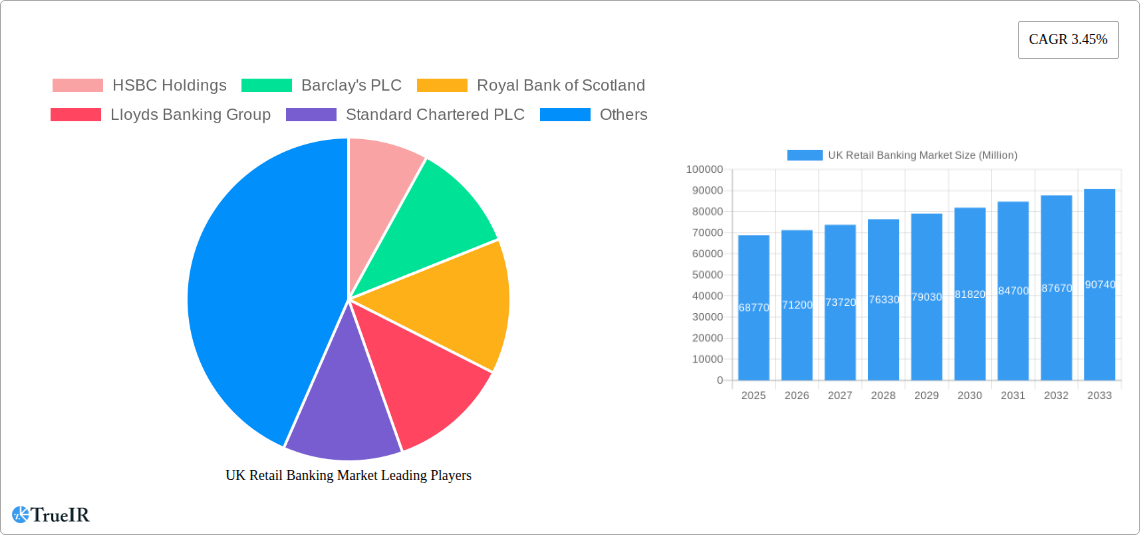

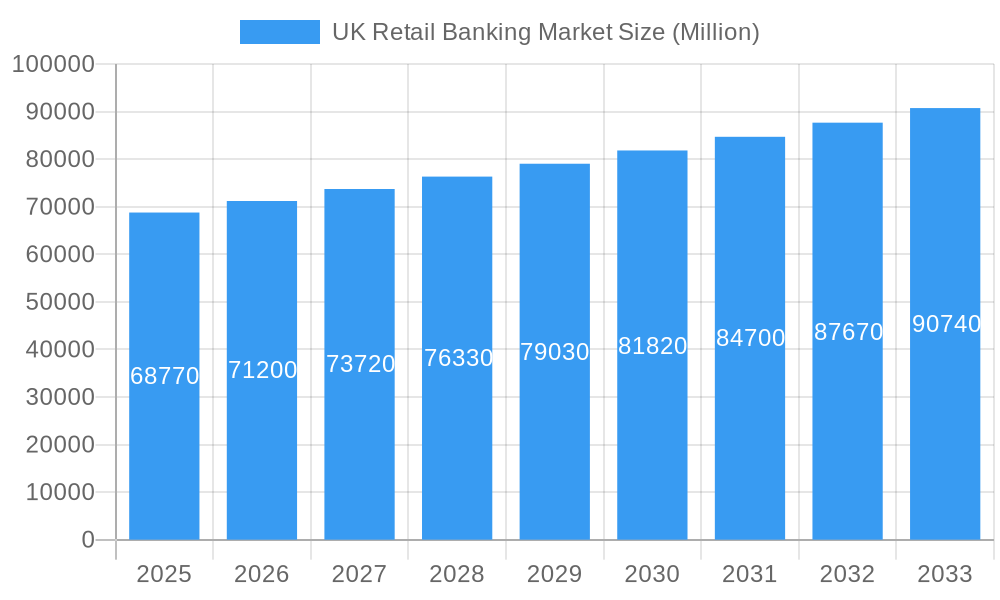

The UK retail banking market, valued at £68.77 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 3.45% from 2025 to 2033. This growth is driven by several key factors. Increasing digital adoption among consumers is fueling demand for innovative online and mobile banking services, creating opportunities for banks to enhance customer experience and efficiency. Furthermore, the growing adoption of open banking initiatives facilitates data sharing and the development of personalized financial products, contributing to market expansion. Regulatory changes focused on consumer protection and financial stability also shape the competitive landscape, prompting banks to invest in robust security measures and compliance frameworks. However, persistent low-interest rate environments and increasing competition from fintech companies pose challenges to profitability and market share for traditional banks. The market is segmented by various banking services (such as current accounts, savings accounts, mortgages, and loans) and geographic regions within the UK. Key players, including HSBC Holdings, Barclays PLC, Royal Bank of Scotland, Lloyds Banking Group, and others, are actively investing in technological advancements and strategic partnerships to maintain competitiveness and capitalize on emerging market opportunities. This necessitates a strategic approach to managing costs and optimizing operations while meeting evolving customer demands and regulatory requirements.

UK Retail Banking Market Market Size (In Billion)

The forecast period (2025-2033) will likely witness a consolidation of the market, with larger institutions potentially acquiring smaller players or merging to achieve greater economies of scale. Competition will intensify from agile fintech startups offering niche financial products and innovative digital solutions. Banks will need to invest in advanced analytics and data-driven decision-making to better understand customer needs and personalize their offerings. The success of retail banks in the coming years will depend on their ability to adapt quickly to technological advancements, enhance their customer experience, and successfully navigate the regulatory environment while maintaining profitability and financial stability in a highly competitive market. Understanding the dynamics of these factors is crucial for stakeholders in the UK retail banking sector.

UK Retail Banking Market Company Market Share

UK Retail Banking Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the UK retail banking market, covering the period from 2019 to 2033. We delve into market structure, competitive dynamics, key trends, growth drivers, and challenges, offering invaluable insights for stakeholders across the industry. With a focus on quantitative data and qualitative analysis, this report is an essential resource for strategic decision-making. The report includes detailed forecasts extending to 2033, using 2025 as the base and estimated year. The historical period analyzed is 2019-2024, and the forecast period is 2025-2033. This report leverages high-impact keywords like "UK Retail Banking," "Market Analysis," "Financial Services," "Banking Trends," and "Competitive Landscape" to maximize searchability and relevance.

UK Retail Banking Market Structure & Competitive Landscape

The UK retail banking market is characterized by a concentrated structure, dominated by a few major players. While precise concentration ratios for 2025 require further market analysis, we project xx% for the top 5 banks. This high level of concentration is influenced by factors like significant barriers to entry, including substantial capital requirements and extensive regulatory compliance. Key players continuously engage in M&A activities, although the volume has seen a xx% decrease in 2024 compared to 2023, estimated at xx Million deals. This indicates a period of consolidation rather than aggressive expansion.

- Market Concentration: High, dominated by established players. Projected top 5 concentration at xx% in 2025.

- Innovation Drivers: Fintech advancements, regulatory changes, customer demand for personalized services.

- Regulatory Impacts: Stringent regulations like PSD2 and open banking initiatives are reshaping the competitive landscape.

- Product Substitutes: The rise of non-bank financial institutions (NBFIs) and fintech companies offering alternative financial products creates competitive pressure.

- End-User Segmentation: The market is segmented by customer demographics (age, income, location), product usage (current accounts, mortgages, loans), and banking needs (digital-first vs. branch-based).

- M&A Trends: Consolidation is prevalent, with recent years seeing a decrease in deal volume, indicative of market saturation and increased regulatory scrutiny.

UK Retail Banking Market Market Trends & Opportunities

The UK retail banking market is experiencing significant transformation, driven by technological advancements, evolving consumer preferences, and intensifying competition. Market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% from 2025. This growth is fueled by increasing digital adoption, the demand for personalized financial solutions, and the emergence of open banking. Market penetration rates are expected to increase, particularly among younger demographics who are more comfortable utilizing digital banking platforms. However, challenges remain, including managing cybersecurity risks, and adapting to changing regulatory frameworks.

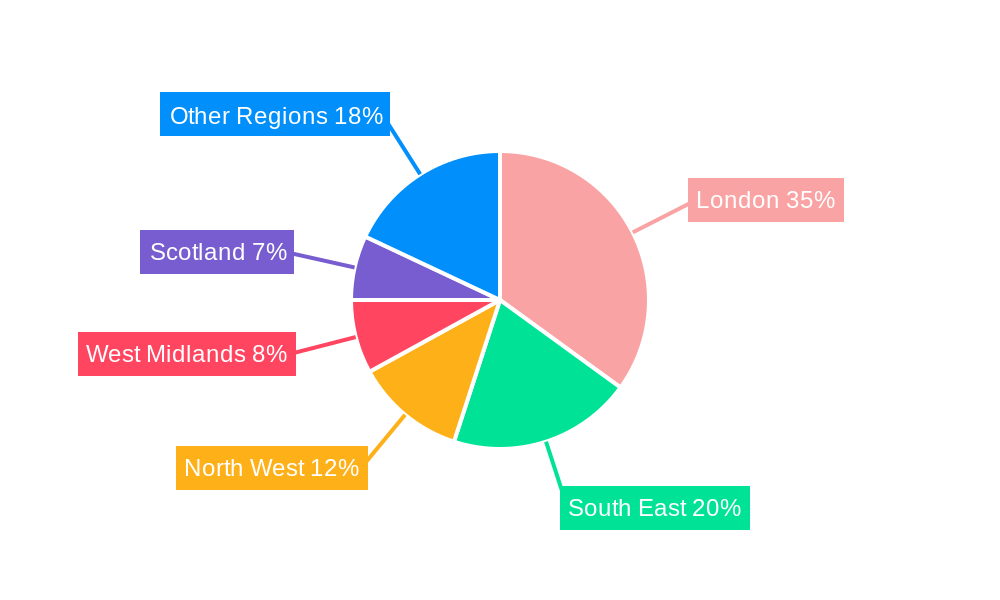

Dominant Markets & Segments in UK Retail Banking Market

While detailed regional and segmental dominance requires further analysis, we project that the London area will remain the most dominant market segment due to high population density and economic activity. Key growth drivers across the UK retail banking market include:

- Technological advancements: Digital banking and fintech innovations are driving efficiency and accessibility.

- Government policies: Open banking initiatives promote competition and innovation.

- Infrastructure development: Improved digital infrastructure facilitates wider digital banking adoption.

- Demographics: Shifting demographics and increasing financial literacy contribute to growth.

- Economic growth: Economic stability and expansion drive demand for financial services.

The dominance of London is attributable to its concentration of financial institutions, high income levels, and sophisticated financial markets. However, other regional markets show potential for growth with strategic investments in digital infrastructure and tailored financial solutions.

UK Retail Banking Market Product Analysis

The UK retail banking market showcases a continuous evolution in product offerings. Traditional products like current accounts and mortgages are being enhanced with digital features such as mobile banking apps, personalized financial management tools, and improved customer service interfaces. Technological advancements like AI-powered fraud detection and predictive analytics are improving security and risk management. The market is witnessing the emergence of new products tailored to specific customer segments like green finance initiatives or specialized services for small and medium-sized enterprises (SMEs). This trend towards personalized and technologically advanced solutions enhances competitiveness and market fit.

Key Drivers, Barriers & Challenges in UK Retail Banking Market

Key Drivers:

- Technological advancements: Open banking, AI, and mobile banking are streamlining operations and enhancing customer experience.

- Economic growth: A stable economy increases demand for financial products and services.

- Regulatory changes: Open banking initiatives are fostering competition and innovation.

Challenges:

- Regulatory hurdles: Compliance costs and evolving regulations present significant challenges.

- Cybersecurity threats: The increasing reliance on digital platforms exposes banks to cybersecurity risks, potentially impacting customer trust and operational efficiency.

- Competitive pressure: The entry of fintechs and NBFIs intensifies competition, requiring banks to adapt and innovate continuously. This pressure impacts profitability and market share.

Growth Drivers in the UK Retail Banking Market Market

The UK retail banking market's growth is propelled by several factors: technological advancements fostering innovation, expanding digitalization boosting efficiency and customer reach, regulatory changes promoting competition and inclusion, and economic stability stimulating financial activity. The emergence of open banking and embedded finance further contributes to the market's dynamic expansion.

Challenges Impacting UK Retail Banking Market Growth

Several factors impede growth: regulatory complexities increase compliance costs and slow innovation, cybersecurity threats pose risks to both customer data and financial stability, and intense competition from both established players and fintech startups impacts profitability and market share. Supply chain disruptions, though less direct, can impact the availability of technology and services.

Key Players Shaping the UK Retail Banking Market Market

- HSBC Holdings

- Barclays PLC

- Royal Bank of Scotland

- Lloyds Banking Group

- Standard Chartered PLC

- Santander UK

- Nationwide Building Society

- Schroders

- Close Brothers

- Coventry Building Society

List Not Exhaustive

Significant UK Retail Banking Market Industry Milestones

- September 2023: HSBC partnered with Nova Credit, enabling newcomers to access foreign credit histories, improving financial inclusion.

- August 2024: Lloyds Bank launched a USD 137 cash offer for students opening current accounts with specific deposit requirements, offering additional benefits like discounts and interest on balances up to USD 6,219.

Future Outlook for UK Retail Banking Market Market

The UK retail banking market is poised for continued growth, driven by ongoing digital transformation, evolving consumer expectations, and innovative financial products. Strategic partnerships between traditional banks and fintechs will shape the landscape. The market's future is bright, with significant opportunities for players who can effectively navigate regulatory changes, manage cybersecurity risks, and deliver personalized, technologically advanced services.

UK Retail Banking Market Segmentation

-

1. Type

- 1.1. Traditional Retail Banking

- 1.2. Online Banking

- 1.3. Personal Banking

- 1.4. Business Banking

- 1.5. Wealth Management

-

2. End-User

- 2.1. Individuals

- 2.2. Small Businesses

- 2.3. Corporates

- 2.4. High Net-Worth Individuals

-

3. Distribution Channel

- 3.1. Branches

- 3.2. Online Platforms

- 3.3. Mobile Apps

UK Retail Banking Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Retail Banking Market Regional Market Share

Geographic Coverage of UK Retail Banking Market

UK Retail Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Shift Toward Digital Banking

- 3.2.2 with Customers Increasingly Using Online and Mobile Banking Services

- 3.3. Market Restrains

- 3.3.1 The Shift Toward Digital Banking

- 3.3.2 with Customers Increasingly Using Online and Mobile Banking Services

- 3.4. Market Trends

- 3.4.1. Deposit Trends and Digital Transformation Driving Traditional Banking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Retail Banking

- 5.1.2. Online Banking

- 5.1.3. Personal Banking

- 5.1.4. Business Banking

- 5.1.5. Wealth Management

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Individuals

- 5.2.2. Small Businesses

- 5.2.3. Corporates

- 5.2.4. High Net-Worth Individuals

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Branches

- 5.3.2. Online Platforms

- 5.3.3. Mobile Apps

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Traditional Retail Banking

- 6.1.2. Online Banking

- 6.1.3. Personal Banking

- 6.1.4. Business Banking

- 6.1.5. Wealth Management

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Individuals

- 6.2.2. Small Businesses

- 6.2.3. Corporates

- 6.2.4. High Net-Worth Individuals

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Branches

- 6.3.2. Online Platforms

- 6.3.3. Mobile Apps

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Traditional Retail Banking

- 7.1.2. Online Banking

- 7.1.3. Personal Banking

- 7.1.4. Business Banking

- 7.1.5. Wealth Management

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Individuals

- 7.2.2. Small Businesses

- 7.2.3. Corporates

- 7.2.4. High Net-Worth Individuals

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Branches

- 7.3.2. Online Platforms

- 7.3.3. Mobile Apps

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Traditional Retail Banking

- 8.1.2. Online Banking

- 8.1.3. Personal Banking

- 8.1.4. Business Banking

- 8.1.5. Wealth Management

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Individuals

- 8.2.2. Small Businesses

- 8.2.3. Corporates

- 8.2.4. High Net-Worth Individuals

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Branches

- 8.3.2. Online Platforms

- 8.3.3. Mobile Apps

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Traditional Retail Banking

- 9.1.2. Online Banking

- 9.1.3. Personal Banking

- 9.1.4. Business Banking

- 9.1.5. Wealth Management

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Individuals

- 9.2.2. Small Businesses

- 9.2.3. Corporates

- 9.2.4. High Net-Worth Individuals

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Branches

- 9.3.2. Online Platforms

- 9.3.3. Mobile Apps

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UK Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Traditional Retail Banking

- 10.1.2. Online Banking

- 10.1.3. Personal Banking

- 10.1.4. Business Banking

- 10.1.5. Wealth Management

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Individuals

- 10.2.2. Small Businesses

- 10.2.3. Corporates

- 10.2.4. High Net-Worth Individuals

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Branches

- 10.3.2. Online Platforms

- 10.3.3. Mobile Apps

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 HSBC Holdings

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Barclay's PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Royal Bank of Scotland

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lloyds Banking Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Standard Chartered PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Santander UK

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nationwide Building Society

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schroders

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Close Brothers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Coventry Building Society**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 HSBC Holdings

List of Figures

- Figure 1: Global UK Retail Banking Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global UK Retail Banking Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America UK Retail Banking Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America UK Retail Banking Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America UK Retail Banking Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America UK Retail Banking Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America UK Retail Banking Market Revenue (Million), by End-User 2025 & 2033

- Figure 8: North America UK Retail Banking Market Volume (Billion), by End-User 2025 & 2033

- Figure 9: North America UK Retail Banking Market Revenue Share (%), by End-User 2025 & 2033

- Figure 10: North America UK Retail Banking Market Volume Share (%), by End-User 2025 & 2033

- Figure 11: North America UK Retail Banking Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 12: North America UK Retail Banking Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 13: North America UK Retail Banking Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: North America UK Retail Banking Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 15: North America UK Retail Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America UK Retail Banking Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America UK Retail Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America UK Retail Banking Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America UK Retail Banking Market Revenue (Million), by Type 2025 & 2033

- Figure 20: South America UK Retail Banking Market Volume (Billion), by Type 2025 & 2033

- Figure 21: South America UK Retail Banking Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America UK Retail Banking Market Volume Share (%), by Type 2025 & 2033

- Figure 23: South America UK Retail Banking Market Revenue (Million), by End-User 2025 & 2033

- Figure 24: South America UK Retail Banking Market Volume (Billion), by End-User 2025 & 2033

- Figure 25: South America UK Retail Banking Market Revenue Share (%), by End-User 2025 & 2033

- Figure 26: South America UK Retail Banking Market Volume Share (%), by End-User 2025 & 2033

- Figure 27: South America UK Retail Banking Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 28: South America UK Retail Banking Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 29: South America UK Retail Banking Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: South America UK Retail Banking Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 31: South America UK Retail Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America UK Retail Banking Market Volume (Billion), by Country 2025 & 2033

- Figure 33: South America UK Retail Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America UK Retail Banking Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe UK Retail Banking Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Europe UK Retail Banking Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Europe UK Retail Banking Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Europe UK Retail Banking Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Europe UK Retail Banking Market Revenue (Million), by End-User 2025 & 2033

- Figure 40: Europe UK Retail Banking Market Volume (Billion), by End-User 2025 & 2033

- Figure 41: Europe UK Retail Banking Market Revenue Share (%), by End-User 2025 & 2033

- Figure 42: Europe UK Retail Banking Market Volume Share (%), by End-User 2025 & 2033

- Figure 43: Europe UK Retail Banking Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Europe UK Retail Banking Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 45: Europe UK Retail Banking Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Europe UK Retail Banking Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Europe UK Retail Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Europe UK Retail Banking Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Europe UK Retail Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe UK Retail Banking Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa UK Retail Banking Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Middle East & Africa UK Retail Banking Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Middle East & Africa UK Retail Banking Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Middle East & Africa UK Retail Banking Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Middle East & Africa UK Retail Banking Market Revenue (Million), by End-User 2025 & 2033

- Figure 56: Middle East & Africa UK Retail Banking Market Volume (Billion), by End-User 2025 & 2033

- Figure 57: Middle East & Africa UK Retail Banking Market Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Middle East & Africa UK Retail Banking Market Volume Share (%), by End-User 2025 & 2033

- Figure 59: Middle East & Africa UK Retail Banking Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 60: Middle East & Africa UK Retail Banking Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 61: Middle East & Africa UK Retail Banking Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 62: Middle East & Africa UK Retail Banking Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 63: Middle East & Africa UK Retail Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East & Africa UK Retail Banking Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Middle East & Africa UK Retail Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa UK Retail Banking Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific UK Retail Banking Market Revenue (Million), by Type 2025 & 2033

- Figure 68: Asia Pacific UK Retail Banking Market Volume (Billion), by Type 2025 & 2033

- Figure 69: Asia Pacific UK Retail Banking Market Revenue Share (%), by Type 2025 & 2033

- Figure 70: Asia Pacific UK Retail Banking Market Volume Share (%), by Type 2025 & 2033

- Figure 71: Asia Pacific UK Retail Banking Market Revenue (Million), by End-User 2025 & 2033

- Figure 72: Asia Pacific UK Retail Banking Market Volume (Billion), by End-User 2025 & 2033

- Figure 73: Asia Pacific UK Retail Banking Market Revenue Share (%), by End-User 2025 & 2033

- Figure 74: Asia Pacific UK Retail Banking Market Volume Share (%), by End-User 2025 & 2033

- Figure 75: Asia Pacific UK Retail Banking Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 76: Asia Pacific UK Retail Banking Market Volume (Billion), by Distribution Channel 2025 & 2033

- Figure 77: Asia Pacific UK Retail Banking Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 78: Asia Pacific UK Retail Banking Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 79: Asia Pacific UK Retail Banking Market Revenue (Million), by Country 2025 & 2033

- Figure 80: Asia Pacific UK Retail Banking Market Volume (Billion), by Country 2025 & 2033

- Figure 81: Asia Pacific UK Retail Banking Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific UK Retail Banking Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 5: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global UK Retail Banking Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global UK Retail Banking Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 13: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global UK Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global UK Retail Banking Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 26: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 27: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 29: Global UK Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global UK Retail Banking Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Brazil UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Brazil UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 40: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 41: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global UK Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global UK Retail Banking Market Volume Billion Forecast, by Country 2020 & 2033

- Table 45: United Kingdom UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Germany UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Germany UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: France UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: France UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Italy UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Italy UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Spain UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Spain UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Russia UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Russia UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Benelux UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Benelux UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Nordics UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Nordics UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 65: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 66: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 67: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 68: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 69: Global UK Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global UK Retail Banking Market Volume Billion Forecast, by Country 2020 & 2033

- Table 71: Turkey UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Turkey UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Israel UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Israel UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: GCC UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: GCC UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: North Africa UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: North Africa UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: South Africa UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: South Africa UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Global UK Retail Banking Market Revenue Million Forecast, by Type 2020 & 2033

- Table 84: Global UK Retail Banking Market Volume Billion Forecast, by Type 2020 & 2033

- Table 85: Global UK Retail Banking Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 86: Global UK Retail Banking Market Volume Billion Forecast, by End-User 2020 & 2033

- Table 87: Global UK Retail Banking Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 88: Global UK Retail Banking Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 89: Global UK Retail Banking Market Revenue Million Forecast, by Country 2020 & 2033

- Table 90: Global UK Retail Banking Market Volume Billion Forecast, by Country 2020 & 2033

- Table 91: China UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: China UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 93: India UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 94: India UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 95: Japan UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 96: Japan UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 97: South Korea UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 98: South Korea UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 99: ASEAN UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 100: ASEAN UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 101: Oceania UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 102: Oceania UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific UK Retail Banking Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific UK Retail Banking Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Retail Banking Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the UK Retail Banking Market?

Key companies in the market include HSBC Holdings, Barclay's PLC, Royal Bank of Scotland, Lloyds Banking Group, Standard Chartered PLC, Santander UK, Nationwide Building Society, Schroders, Close Brothers, Coventry Building Society**List Not Exhaustive.

3. What are the main segments of the UK Retail Banking Market?

The market segments include Type, End-User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.77 Million as of 2022.

5. What are some drivers contributing to market growth?

The Shift Toward Digital Banking. with Customers Increasingly Using Online and Mobile Banking Services.

6. What are the notable trends driving market growth?

Deposit Trends and Digital Transformation Driving Traditional Banking.

7. Are there any restraints impacting market growth?

The Shift Toward Digital Banking. with Customers Increasingly Using Online and Mobile Banking Services.

8. Can you provide examples of recent developments in the market?

August 2024: Lloyds Bank launched a USD 137 cash offer for students opening current accounts. To qualify, students must deposit at least USD 622 between August 1 and October 31, 2024. Student account holders will also receive a 20% discount on selected Student Union events and can earn 2% interest on balances up to USD 6,219.September 2023: HSBC pioneered a partnership with Nova Credit, making it the first UK bank to allow newcomers to access their credit history from abroad. This initiative aims to facilitate smoother financial integration for individuals relocating to the United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Retail Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Retail Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Retail Banking Market?

To stay informed about further developments, trends, and reports in the UK Retail Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence