Key Insights

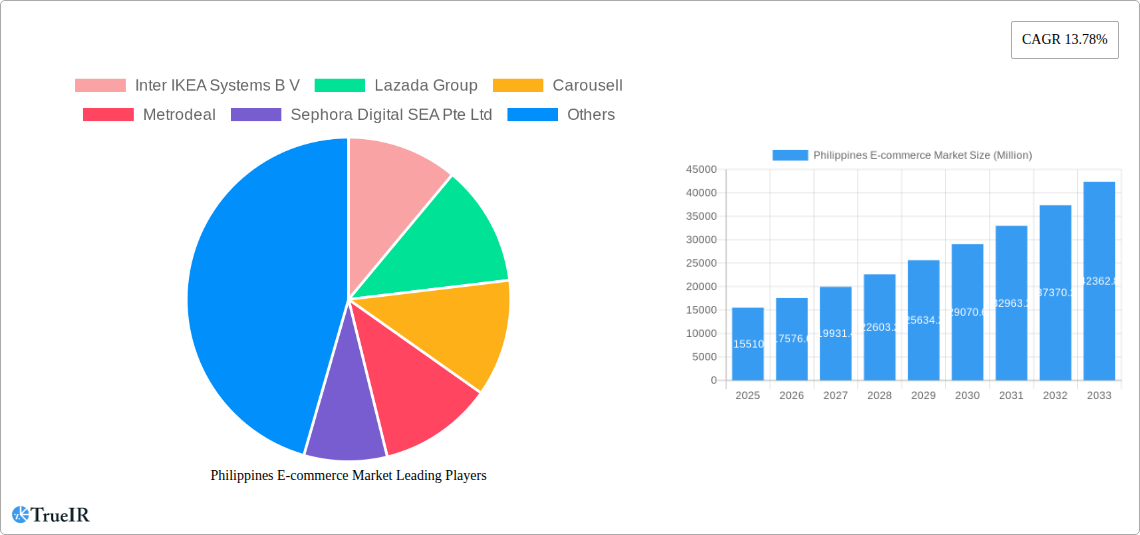

The Philippines e-commerce market, valued at $15.51 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 13.78% from 2025 to 2033. This surge is fueled by several key drivers. Increasing internet and smartphone penetration are empowering a larger segment of the population to participate in online shopping. A growing young and tech-savvy demographic readily adopts e-commerce platforms for convenience and access to a wider variety of goods and services than traditional retail allows. Furthermore, the rise of digital payment solutions and improved logistics infrastructure are significantly enhancing the overall e-commerce experience, making online transactions safer and more reliable. The market is segmented by application, encompassing various categories like fashion, electronics, groceries, and beauty products, each experiencing unique growth trajectories. Key players such as Shopee, Lazada, and smaller, specialized platforms like BeautyMNL, contribute to a competitive landscape that fosters innovation and customer choice. This competitive environment, coupled with consumer preference shifts, will continue to shape the market’s future trajectory.

Philippines E-commerce Market Market Size (In Billion)

The continued growth, however, is not without its challenges. While infrastructure improvements are underway, logistical hurdles in remote areas can still impact delivery times and costs. Addressing consumer concerns regarding online security and building trust remain crucial for sustained expansion. Furthermore, the market's susceptibility to economic fluctuations and the increasing prominence of cross-border e-commerce represent both opportunities and potential risks for domestic players. Successful navigation of these challenges will require companies to focus on providing excellent customer service, enhancing security measures, and adapting to evolving consumer preferences to maintain their competitive edge in this dynamic and rapidly growing market.

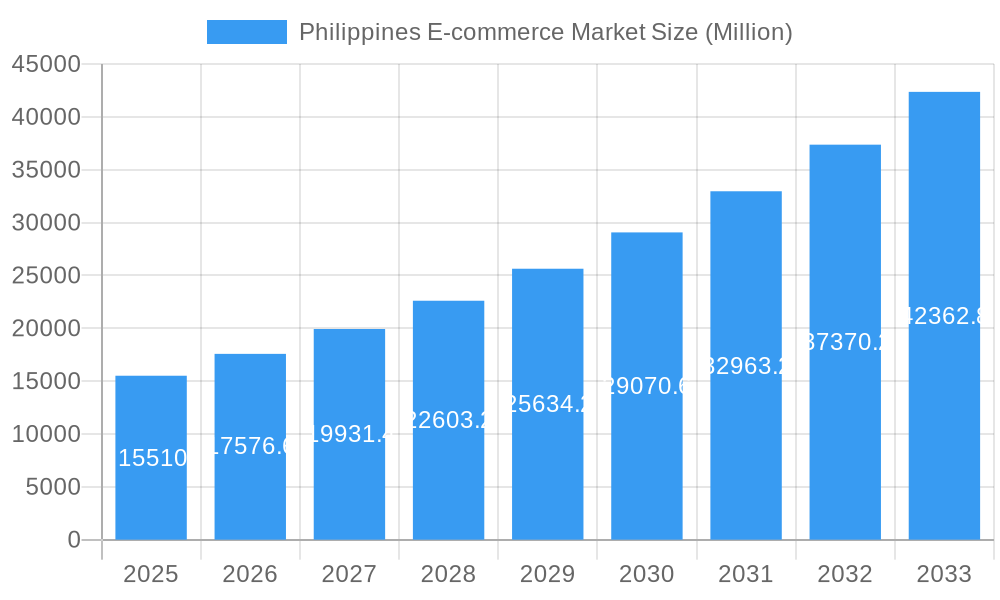

Philippines E-commerce Market Company Market Share

Philippines E-commerce Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Philippines e-commerce market, offering invaluable insights for businesses, investors, and stakeholders. Analyzing the period from 2019 to 2033, with a focus on 2025, this study unveils the market's structure, competitive landscape, key trends, and future projections. Expect comprehensive data, including market size, CAGR, and penetration rates, alongside qualitative analysis of industry developments and challenges. The report leverages high-impact keywords such as "Philippines e-commerce," "market size," "CAGR," "market trends," and "competitive landscape" to maximize search engine visibility.

Philippines E-commerce Market Market Structure & Competitive Landscape

This section analyzes the structure of the Philippines e-commerce market, examining key aspects such as market concentration, innovation drivers, regulatory influences, product substitutes, and M&A activity. The market shows a high degree of concentration with major players controlling a significant share, estimated at xx% in 2025. This is reflected in the high volume of M&A activity observed between 2019 and 2024, totaling an estimated value of xx Million.

- Market Concentration: The market is dominated by a few major players, with Shopee and Lazada holding substantial market shares. Smaller players compete through niche offerings and localized strategies. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, suggesting a moderately concentrated market.

- Innovation Drivers: Technological advancements such as mobile commerce, improved logistics, and digital payments are driving market expansion. The adoption of social commerce platforms and live-streaming sales further fuels innovation.

- Regulatory Impacts: Government initiatives promoting digitalization and e-commerce, coupled with evolving data privacy regulations, significantly impact market dynamics.

- Product Substitutes: Traditional retail remains a significant competitor, although e-commerce's convenience and reach are steadily eroding its dominance.

- End-User Segmentation: The market is segmented by demographics (age, income, location) and purchasing behavior (frequency, product categories). Growth is seen across segments, especially in younger, tech-savvy demographics.

- M&A Trends: The period 2019-2024 witnessed numerous mergers and acquisitions, primarily driven by market consolidation and expansion strategies. The estimated value of completed M&A transactions during this period is xx Million.

Philippines E-commerce Market Market Trends & Opportunities

The Philippines e-commerce market is experiencing robust growth, driven by increasing internet and smartphone penetration, a burgeoning middle class, and a rising preference for online shopping convenience. The market size reached xx Million in 2024, demonstrating a CAGR of xx% during the historical period (2019-2024). This positive trajectory is expected to continue, with a forecasted market size of xx Million in 2025 and xx Million in 2033. Market penetration rates have steadily increased, reflecting wider adoption across various demographics and product categories. Technological advancements in areas such as artificial intelligence (AI), big data analytics, and personalized marketing are reshaping the competitive landscape and consumer engagement strategies. Evolving consumer preferences towards omnichannel experiences and seamless delivery options are influencing platform strategies and logistics solutions.

Dominant Markets & Segments in Philippines E-commerce Market

The Philippines e-commerce market showcases robust growth across various regions and segments. While Metro Manila retains a dominant position due to higher internet penetration and purchasing power, significant growth is observed in other key urban centers and emerging regions across the archipelago.

- Key Growth Drivers:

- Improving Infrastructure: Investments in broadband infrastructure and improved logistics networks are enhancing e-commerce accessibility.

- Supportive Government Policies: Initiatives to foster digitalization and e-commerce adoption are creating a favorable business environment.

- Rising Smartphone Penetration: The increasing ownership of smartphones provides wider access to e-commerce platforms.

- Growing Middle Class: An expanding middle class with disposable income fuels online shopping growth.

Market Dominance Analysis: Metro Manila accounts for the largest share of e-commerce transactions due to its higher concentration of population, businesses, and internet penetration. However, the expansion of logistics networks and increased smartphone adoption in other regions are fostering significant growth across the country. Specific regional data is unfortunately not available for this report.

Philippines E-commerce Market Product Analysis

The Philippines e-commerce market offers a diverse range of products and services. Technological advancements are driving product innovation and enhancing customer experiences. For example, the integration of AI-powered chatbots for customer service and personalized recommendations is becoming commonplace, streamlining the online shopping experience. Moreover, the rise of social commerce platforms has led to innovative product discovery and marketing approaches. The market is witnessing the emergence of new product categories and specialized e-commerce niches, catering to diverse consumer preferences.

Key Drivers, Barriers & Challenges in Philippines E-commerce Market

Key Drivers: Rapid growth in internet and smartphone penetration, expanding middle class, government initiatives promoting digitalization, and technological advancements (e.g., mobile payment solutions, improved logistics) are key drivers of market expansion.

Key Challenges: Logistical challenges in delivering to remote areas, limited access to reliable internet connectivity in certain regions, cybersecurity concerns, and the need for stronger consumer protection regulations pose significant obstacles. Supply chain disruptions, seen during xx, further emphasize the need for robust logistics and resilient networks. The impact of these disruptions on overall revenue was estimated at xx Million.

Growth Drivers in the Philippines E-commerce Market Market

The robust expansion of the Philippines e-commerce market is fuelled by several crucial factors. Technological advancements, such as improved payment gateways and logistics solutions, greatly enhance accessibility and user experience. The burgeoning middle class, with greater disposable income, fuels increased spending. Furthermore, supportive government policies, designed to accelerate digital adoption, create a favorable environment for e-commerce businesses.

Challenges Impacting Philippines E-commerce Market Growth

Several challenges hinder the growth trajectory of the Philippine e-commerce sector. Regulatory complexities and hurdles surrounding data privacy and cross-border transactions create uncertainties. Inefficient and expensive logistics in certain regions, especially in rural areas, impact delivery times and costs. Intense competition among e-commerce platforms necessitates continuous innovation and strategic investments.

Key Players Shaping the Philippines E-commerce Market Market

- Inter IKEA Systems B V

- Lazada Group

- Carousell

- Metrodeal

- Sephora Digital SEA Pte Ltd

- Zalora

- Ubuy Co

- Galleon (Sterling Galleon Corporation)

- Kimstore

- BeautyMNL (Taste Central Curators Inc)

- Perfume Philippines

- Shopee

- eBay Inc

Significant Philippines E-commerce Market Industry Milestones

- July 2022: eBay and FedEx partnered to enhance delivery services in the Asia Pacific, offering competitive pricing and premium options. This improved cross-border shipping and returns.

- June 2022: Shopee expanded its Shopee Xpress hubs across Mindanao, reducing delivery times within the region and encouraging seller participation.

- May 2022: Lazada Philippines launched Same Day Delivery with GrabExpress in Metro Manila, significantly reducing delivery times for various goods.

Future Outlook for Philippines E-commerce Market Market

The Philippines e-commerce market exhibits significant growth potential. Expanding internet and mobile penetration, coupled with increasing digital literacy and a thriving middle class, will continue to fuel market expansion. Strategic investments in infrastructure, logistics, and technological innovation are expected to further enhance the overall ecosystem, opening up new opportunities for market participants. The anticipated market size and CAGR suggest a positive and promising future.

Philippines E-commerce Market Segmentation

-

1. B2C E-commerce

- 1.1. Market Size (GMV) for the Period of 2017-2027

-

1.2. Market Segmentation - by Application

- 1.2.1. Beauty & Personal Care

- 1.2.2. Consumer Electronics

- 1.2.3. Fashion & Apparel

- 1.2.4. Food & Beverage

- 1.2.5. Furniture & Home

- 1.2.6. Others (Toys, DIY, Media, etc.)

- 2. Market Size (GMV) for the Period of 2017-2027

-

3. Application

- 3.1. Beauty & Personal Care

- 3.2. Consumer Electronics

- 3.3. Fashion & Apparel

- 3.4. Food & Beverage

- 3.5. Furniture & Home

- 3.6. Others (Toys, DIY, Media, etc.)

- 4. Beauty & Personal Care

- 5. Consumer Electronics

- 6. Fashion & Apparel

- 7. Food & Beverage

- 8. Furniture & Home

- 9. Others (Toys, DIY, Media, etc.)

-

10. B2B E-commerce

- 10.1. Market Size for the Period of 2017-2027

Philippines E-commerce Market Segmentation By Geography

- 1. Philippines

Philippines E-commerce Market Regional Market Share

Geographic Coverage of Philippines E-commerce Market

Philippines E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Security Flaw Related to Hacking of Password Managers

- 3.4. Market Trends

- 3.4.1. Fashion Industry to Dominate the Market Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 5.1.1. Market Size (GMV) for the Period of 2017-2027

- 5.1.2. Market Segmentation - by Application

- 5.1.2.1. Beauty & Personal Care

- 5.1.2.2. Consumer Electronics

- 5.1.2.3. Fashion & Apparel

- 5.1.2.4. Food & Beverage

- 5.1.2.5. Furniture & Home

- 5.1.2.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Market Size (GMV) for the Period of 2017-2027

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Beauty & Personal Care

- 5.3.2. Consumer Electronics

- 5.3.3. Fashion & Apparel

- 5.3.4. Food & Beverage

- 5.3.5. Furniture & Home

- 5.3.6. Others (Toys, DIY, Media, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Beauty & Personal Care

- 5.5. Market Analysis, Insights and Forecast - by Consumer Electronics

- 5.6. Market Analysis, Insights and Forecast - by Fashion & Apparel

- 5.7. Market Analysis, Insights and Forecast - by Food & Beverage

- 5.8. Market Analysis, Insights and Forecast - by Furniture & Home

- 5.9. Market Analysis, Insights and Forecast - by Others (Toys, DIY, Media, etc.)

- 5.10. Market Analysis, Insights and Forecast - by B2B E-commerce

- 5.10.1. Market Size for the Period of 2017-2027

- 5.11. Market Analysis, Insights and Forecast - by Region

- 5.11.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by B2C E-commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inter IKEA Systems B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lazada Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Carousell

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Metrodeal

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sephora Digital SEA Pte Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zalora

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ubuy Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Galleon (Sterling Galleon Corporation)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kimstore

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BeautyMNL (Taste Central Curators Inc )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Perfume Philippines*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Shopee

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 eBay Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Inter IKEA Systems B V

List of Figures

- Figure 1: Philippines E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Philippines E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines E-commerce Market Revenue Million Forecast, by B2C E-commerce 2020 & 2033

- Table 2: Philippines E-commerce Market Revenue Million Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 3: Philippines E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Philippines E-commerce Market Revenue Million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 5: Philippines E-commerce Market Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 6: Philippines E-commerce Market Revenue Million Forecast, by Fashion & Apparel 2020 & 2033

- Table 7: Philippines E-commerce Market Revenue Million Forecast, by Food & Beverage 2020 & 2033

- Table 8: Philippines E-commerce Market Revenue Million Forecast, by Furniture & Home 2020 & 2033

- Table 9: Philippines E-commerce Market Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 10: Philippines E-commerce Market Revenue Million Forecast, by B2B E-commerce 2020 & 2033

- Table 11: Philippines E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 12: Philippines E-commerce Market Revenue Million Forecast, by B2C E-commerce 2020 & 2033

- Table 13: Philippines E-commerce Market Revenue Million Forecast, by Market Size (GMV) for the Period of 2017-2027 2020 & 2033

- Table 14: Philippines E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Philippines E-commerce Market Revenue Million Forecast, by Beauty & Personal Care 2020 & 2033

- Table 16: Philippines E-commerce Market Revenue Million Forecast, by Consumer Electronics 2020 & 2033

- Table 17: Philippines E-commerce Market Revenue Million Forecast, by Fashion & Apparel 2020 & 2033

- Table 18: Philippines E-commerce Market Revenue Million Forecast, by Food & Beverage 2020 & 2033

- Table 19: Philippines E-commerce Market Revenue Million Forecast, by Furniture & Home 2020 & 2033

- Table 20: Philippines E-commerce Market Revenue Million Forecast, by Others (Toys, DIY, Media, etc.) 2020 & 2033

- Table 21: Philippines E-commerce Market Revenue Million Forecast, by B2B E-commerce 2020 & 2033

- Table 22: Philippines E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines E-commerce Market?

The projected CAGR is approximately 13.78%.

2. Which companies are prominent players in the Philippines E-commerce Market?

Key companies in the market include Inter IKEA Systems B V, Lazada Group, Carousell, Metrodeal, Sephora Digital SEA Pte Ltd, Zalora, Ubuy Co, Galleon (Sterling Galleon Corporation), Kimstore, BeautyMNL (Taste Central Curators Inc ), Perfume Philippines*List Not Exhaustive, Shopee, eBay Inc.

3. What are the main segments of the Philippines E-commerce Market?

The market segments include B2C E-commerce, Market Size (GMV) for the Period of 2017-2027, Application, Beauty & Personal Care, Consumer Electronics, Fashion & Apparel, Food & Beverage, Furniture & Home, Others (Toys, DIY, Media, etc.), B2B E-commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Fashion Industry to Dominate the Market Significantly.

7. Are there any restraints impacting market growth?

Security Flaw Related to Hacking of Password Managers.

8. Can you provide examples of recent developments in the market?

July 2022 - eBay and FedEx partner to strengthen delivery services in the Asia Pacific, offering service options at competitive prices. The partnership would allow eBay sellers to avail of premium delivery options through FedEx, including cross-border services like FedEx Ecletrocinc Trade Documents and FedEx Home Delivery for delivery and returns.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines E-commerce Market?

To stay informed about further developments, trends, and reports in the Philippines E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence