Key Insights

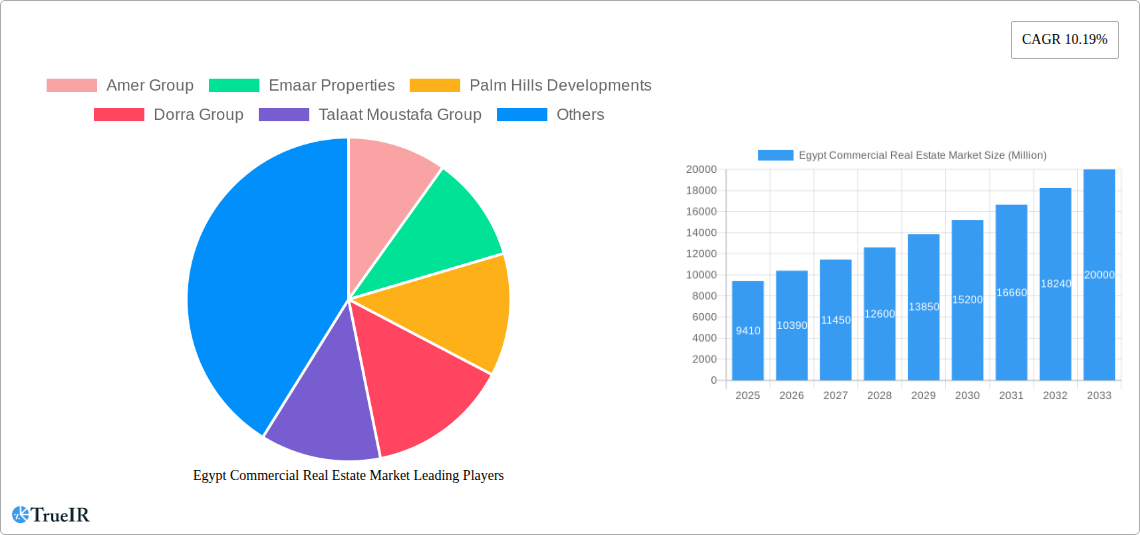

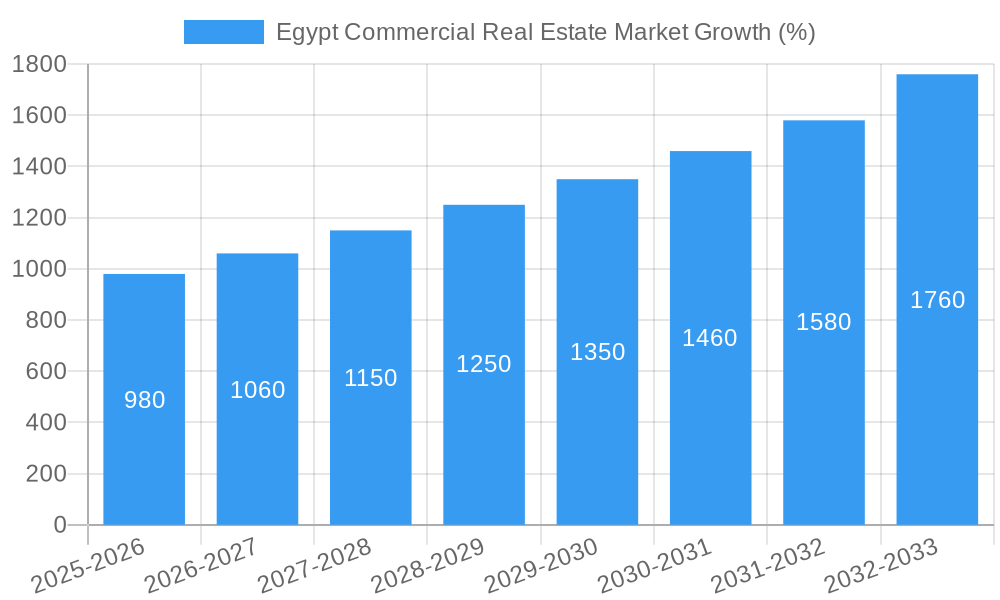

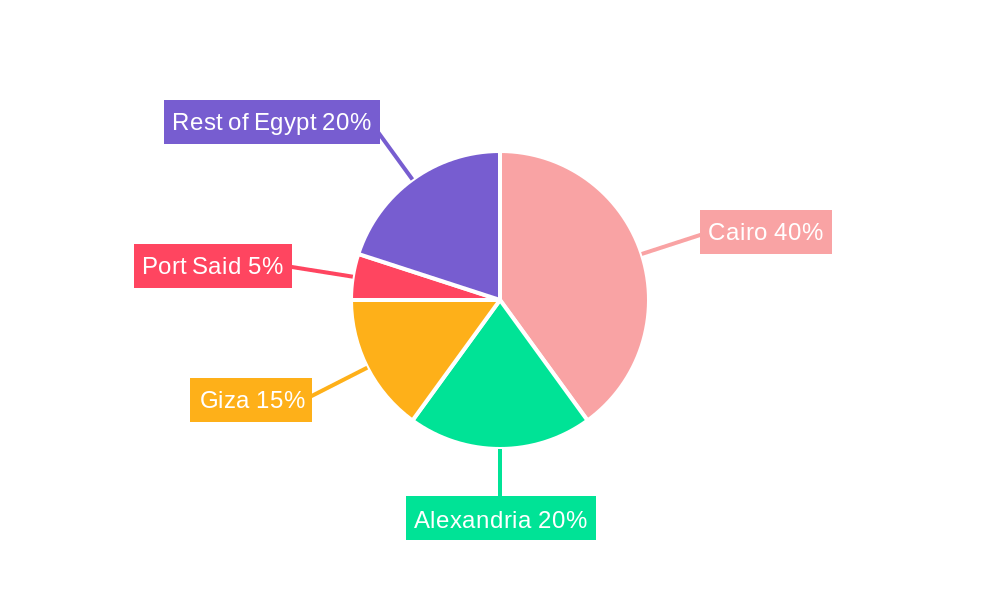

The Egypt commercial real estate market exhibits robust growth potential, projected to reach a market size of $9.41 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 10.19% from 2025 to 2033. This expansion is driven by several key factors. Firstly, Egypt's burgeoning population and expanding economy are fueling increased demand for office, retail, and industrial spaces. Government initiatives focused on infrastructure development and attracting foreign investment further contribute to market dynamism. The tourism sector's revival, impacting the hospitality segment, also positively influences market growth. Furthermore, the rise of e-commerce is boosting the demand for logistics and warehousing facilities, signifying a significant opportunity for investment in this sector. The market is segmented geographically, with Cairo, Alexandria, and Giza dominating market share due to their established infrastructure and economic activity. However, other cities like Port Said are also witnessing significant growth, demonstrating the market’s decentralization potential. Major players, including Amer Group, Emaar Properties, and Talaat Moustafa Group, are key contributors to the market's development, shaping the landscape through their large-scale projects and ongoing investments.

Significant growth is expected across all segments, but the industrial and logistics sector is poised for particularly rapid expansion, reflecting the rise of e-commerce and manufacturing activity. The multi-family segment is also anticipated to experience considerable growth driven by urbanization and population increase. While opportunities abound, challenges such as fluctuating economic conditions, regulatory hurdles, and infrastructural limitations in certain areas need consideration for sustainable long-term growth. The market's performance depends on maintaining investor confidence and addressing potential risks. The forecast period of 2025-2033 presents a promising outlook for both domestic and international investors seeking exposure to the dynamic Egyptian commercial real estate market.

Egypt Commercial Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the dynamic Egypt commercial real estate market, offering crucial insights for investors, developers, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market trends, key players, and future growth prospects.

Egypt Commercial Real Estate Market Structure & Competitive Landscape

The Egyptian commercial real estate market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Concentration ratios vary across segments, with the office and retail sectors showing higher levels of concentration compared to the industrial and logistics segment. Amer Group, Emaar Properties, Palm Hills Developments, and Talaat Moustafa Group are among the key players, impacting market dynamics through significant developments and acquisitions. Innovation is driven by the adoption of sustainable building practices, technological advancements in property management, and a growing demand for flexible workspaces. Regulatory impacts, including building codes and zoning regulations, play a significant role in shaping market development. Product substitutes, such as co-working spaces and virtual offices, exert pressure on traditional office spaces. End-user segmentation is diverse, encompassing multinational corporations, SMEs, and individual investors. M&A activity remains robust, with several high-profile transactions in recent years. Based on available data, the total value of M&A transactions in the Egyptian commercial real estate market from 2019-2024 reached approximately XX Million. This is expected to increase to XX Million from 2025-2033 reflecting continued investor interest and market consolidation.

- High Market Concentration: Dominated by a few large players in key segments.

- Innovation Drivers: Sustainable building practices, technological advancements in property management, and flexible workspaces.

- Regulatory Impacts: Building codes, zoning regulations, and land use policies significantly influence market development.

- Product Substitutes: Co-working spaces and virtual offices are impacting traditional office space demand.

- End-User Segmentation: Diverse, including multinational corporations, SMEs, and individual investors.

- M&A Activity: Significant M&A transactions observed, contributing to market consolidation.

Egypt Commercial Real Estate Market Market Trends & Opportunities

The Egyptian commercial real estate market is poised for substantial growth, driven by several key trends. Market size is expanding steadily, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Technological advancements are transforming the sector, with the adoption of smart building technologies and digital platforms enhancing efficiency and property management. Shifting consumer preferences towards sustainable and technologically advanced spaces are influencing development strategies. Intense competition among developers is driving innovation and pushing down prices in some segments. The increasing demand for modern office spaces and retail developments in key cities like Cairo and Alexandria is shaping market dynamics. Market penetration rates for technologically advanced buildings are steadily rising, indicating a growing adoption of smart technologies. Opportunities exist in developing sustainable commercial properties, leveraging technology in property management, and catering to the growing needs of e-commerce and logistics companies. The government's focus on infrastructure development and investment in new cities is also a significant catalyst for growth. In 2024, the market size was estimated to be XX Million, projected to reach XX Million by 2033.

Dominant Markets & Segments in Egypt Commercial Real Estate Market

The Cairo metropolitan area remains the dominant market for commercial real estate in Egypt, attracting significant investment and driving growth in all major segments. Cairo's strong economic activity, established infrastructure, and large population base create a favorable environment for commercial development. Alexandria also holds a significant position, benefiting from its coastal location and port activities. While other cities such as Giza and Port Said contribute, they exhibit comparatively lower market share. The office segment is a leading sector, fueled by sustained demand from both local and international businesses. The retail sector shows consistent growth, particularly in modern shopping malls and lifestyle centers. Industrial and logistics spaces are witnessing increasing demand driven by the growth of e-commerce and manufacturing industries. The hospitality sector is experiencing a period of growth and modernization.

- Key Growth Drivers in Cairo: Strong economic activity, established infrastructure, large population.

- Key Growth Drivers in Alexandria: Coastal location, port activities, tourism.

- Office Segment Drivers: Strong corporate demand, growth of business process outsourcing.

- Retail Segment Drivers: Growing middle class, rise of e-commerce, increasing consumer spending.

- Industrial & Logistics Segment Drivers: Growth of manufacturing and e-commerce.

- Hospitality Segment Drivers: Increasing tourism, investments in hotel modernization.

Egypt Commercial Real Estate Market Product Analysis

Product innovation in Egypt's commercial real estate market is focused on enhancing sustainability, incorporating smart building technologies, and creating flexible and adaptable spaces to meet evolving end-user needs. Green building certifications are gaining prominence, reflecting a rising focus on environmentally friendly practices. The integration of smart building technologies, such as energy-efficient systems and advanced security features, is becoming a crucial competitive advantage, attracting environmentally and technology-conscious tenants. These innovations are enhancing the marketability of commercial properties, appealing to businesses seeking cost-effective and sustainable spaces.

Key Drivers, Barriers & Challenges in Egypt Commercial Real Estate Market

Key Drivers: Government initiatives promoting investment in infrastructure and urban development are significant drivers. The rising population and burgeoning middle class fuel demand for commercial spaces. Economic diversification and the growth of key sectors (e.g., tourism, manufacturing) contribute to the expansion of the commercial real estate market.

Challenges: Bureaucratic hurdles and regulatory complexities can impede project approvals and timelines. Supply chain disruptions, especially in construction materials, affect project costs and schedules. Intense competition and oversupply in certain segments can depress pricing and rental yields. These challenges require proactive solutions from both the government and private sector stakeholders.

Growth Drivers in the Egypt Commercial Real Estate Market Market

The growth of the Egyptian economy, coupled with government initiatives fostering investment in infrastructure and new cities, are significant catalysts. The expansion of e-commerce and logistics necessitate more warehousing and distribution centers. A growing population and increasing consumer spending create demand for retail spaces.

Challenges Impacting Egypt Commercial Real Estate Market Growth

Regulatory hurdles, particularly land acquisition and permitting processes, pose a significant challenge. Fluctuations in the Egyptian pound can affect project financing and costs. Supply chain disruptions increase construction costs and delays project timelines. The availability of skilled labor remains a constraint in certain regions.

Key Players Shaping the Egypt Commercial Real Estate Market Market

- Amer Group

- Emaar Properties

- Palm Hills Developments

- Dorra Group

- Talaat Moustafa Group

- Hassan Allam Holding

- The Arab Contractors

- Secon Egypt

- Orascom Construction PLC

- Rowad Modern Engineering

Significant Egypt Commercial Real Estate Market Industry Milestones

- December 2022: Urbnlanes Developments announced a USD 122 Million commercial project in New Cairo's 5th Settlement, scheduled for launch in Q1 2023. This signifies investor confidence and further development in the New Cairo area.

- October 2022: Afifi Investment Group's USD 17 Million investment in modernizing the Uni Sharm Hotel highlights the growing interest in upgrading hospitality infrastructure and integrating commercial elements.

Future Outlook for Egypt Commercial Real Estate Market Market

The Egyptian commercial real estate market presents considerable opportunities for growth. Continued government investment in infrastructure, a growing population, and the expansion of key economic sectors promise sustained demand for commercial properties. Strategic investments in sustainable and technologically advanced developments will be crucial for capturing market share and achieving long-term success. The market is expected to benefit from the government's focus on urban development and tourism.

Egypt Commercial Real Estate Market Segmentation

-

1. Type

- 1.1. Offices

- 1.2. Retail

- 1.3. Industrial and Logistics

- 1.4. Multi-family

- 1.5. Hospitality

-

2. Key Cities

- 2.1. Cairo

- 2.2. Alexandria

- 2.3. Giza

- 2.4. Port Said

- 2.5. Rest of Egypt

Egypt Commercial Real Estate Market Segmentation By Geography

- 1. Egypt

Egypt Commercial Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing tourism is boosting the market; Rapid surge in population is driving the market

- 3.3. Market Restrains

- 3.3.1. Rising inflation in the Market restraining the growth; Increasing cost of real estate affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Rise in Demand for Commercial Spaces Across Greater Cairo

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Commercial Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Offices

- 5.1.2. Retail

- 5.1.3. Industrial and Logistics

- 5.1.4. Multi-family

- 5.1.5. Hospitality

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Cairo

- 5.2.2. Alexandria

- 5.2.3. Giza

- 5.2.4. Port Said

- 5.2.5. Rest of Egypt

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amer Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Emaar Properties

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Palm Hills Developments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dorra Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Talaat Moustafa Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hassan Allam Holding

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Arab Contractors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Secon Egypt

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orascom Construction PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rowad Modern Engineering**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amer Group

List of Figures

- Figure 1: Egypt Commercial Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Egypt Commercial Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: Egypt Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Egypt Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Egypt Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: Egypt Commercial Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Egypt Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Egypt Commercial Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Egypt Commercial Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 8: Egypt Commercial Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Commercial Real Estate Market?

The projected CAGR is approximately 10.19%.

2. Which companies are prominent players in the Egypt Commercial Real Estate Market?

Key companies in the market include Amer Group, Emaar Properties, Palm Hills Developments, Dorra Group, Talaat Moustafa Group, Hassan Allam Holding, The Arab Contractors, Secon Egypt, Orascom Construction PLC, Rowad Modern Engineering**List Not Exhaustive.

3. What are the main segments of the Egypt Commercial Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.41 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing tourism is boosting the market; Rapid surge in population is driving the market.

6. What are the notable trends driving market growth?

Rise in Demand for Commercial Spaces Across Greater Cairo.

7. Are there any restraints impacting market growth?

Rising inflation in the Market restraining the growth; Increasing cost of real estate affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

December 2022: Egyptian developer Urbnlanes Developments, a subsidiary of Emeel Abdalla Investments, will launch a 3-billion-Egyptian-pound (USD 122 million) commercial project in the 5th Settlement, New Cairo, in the first quarter of 2023

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Commercial Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Commercial Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Commercial Real Estate Market?

To stay informed about further developments, trends, and reports in the Egypt Commercial Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence