Key Insights

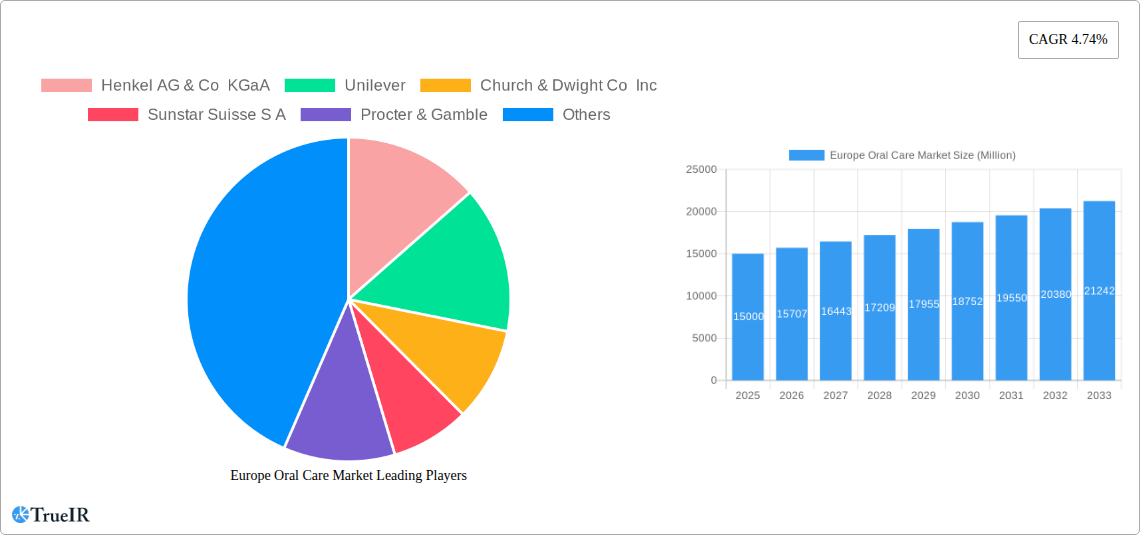

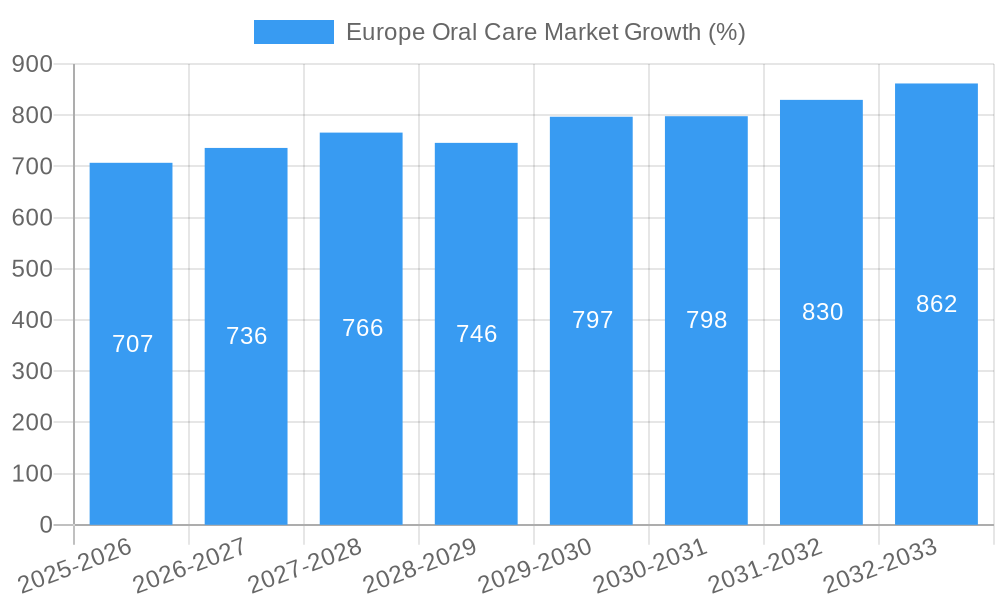

The European oral care market, valued at approximately €[Estimate based on market size XX and currency conversion; assume €15 Billion in 2025 for example], is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.74% from 2025 to 2033. This expansion is driven by several key factors. Rising consumer awareness regarding oral hygiene and its correlation with overall health is a major catalyst. The increasing prevalence of dental diseases, coupled with improved access to dental care services across Europe, further fuels market demand. Furthermore, the growing popularity of premium and specialized oral care products, such as whitening toothpastes and electric toothbrushes, contributes to market growth. The market is segmented by distribution channel (supermarkets/hypermarkets, convenience stores, pharmacies, online retail, others) and product type (breath fresheners, dental floss, denture care, mouthwashes, toothbrushes, toothpaste). Online retail channels are experiencing significant growth, driven by increasing e-commerce penetration and consumer preference for convenient purchasing options.

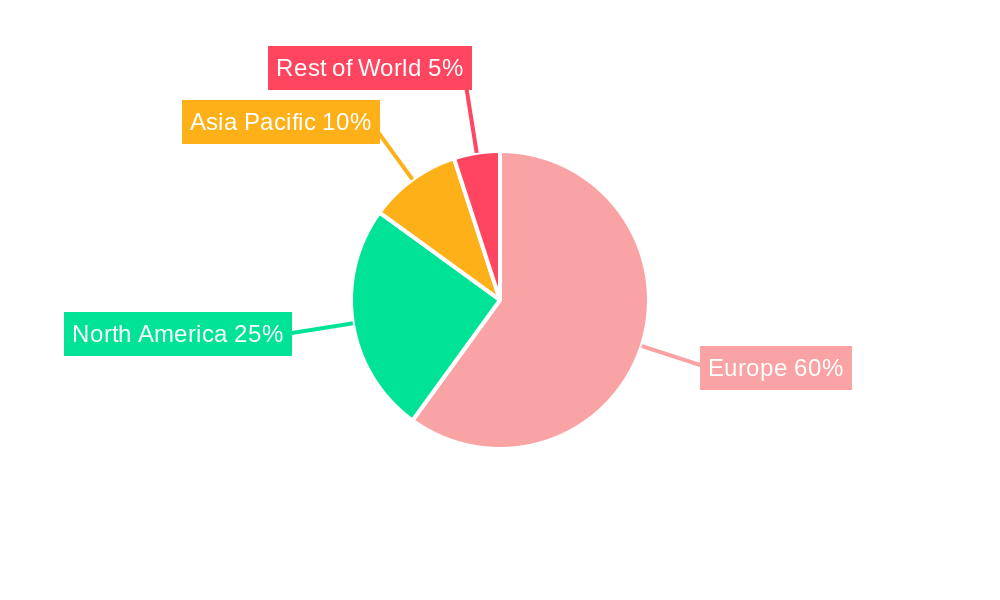

The competitive landscape is dominated by major players such as Colgate-Palmolive, Procter & Gamble, Unilever, and Henkel, who leverage extensive distribution networks and strong brand recognition to maintain market share. However, smaller, specialized brands are gaining traction by offering innovative and niche products catering to specific consumer needs and preferences. Market restraints include economic fluctuations impacting consumer spending and the potential for increased regulatory scrutiny related to product ingredients. Geographical variations in market growth are expected, with Western European countries like Germany, UK, France, and Italy leading the market due to higher disposable incomes and established oral care infrastructure. The forecast period (2025-2033) anticipates continued market expansion driven by factors mentioned above, though the pace of growth may vary year to year depending on economic and social trends.

Europe Oral Care Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Oral Care Market, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033 (base year 2025, forecast period 2025-2033), this report delivers a data-driven perspective on market trends, competitive landscapes, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Europe Oral Care Market Market Structure & Competitive Landscape

The European oral care market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Key players like Henkel AG & Co KGaA, Unilever, Church & Dwight Co Inc, Sunstar Suisse S A, Procter & Gamble, Pierre Fabre S A, Colgate-Palmolive Company, Pierrot (Fushima SL), Johnson & Johnson Consumer Inc, Hawley & Hazel (BVI) Co Ltd, Lactona Europe BV, and GlaxoSmithKline PLC constantly engage in innovation, driving product diversification and market expansion.

- Innovation Drivers: Focus on natural ingredients, advanced whitening technologies, and sustainable packaging are key innovation drivers.

- Regulatory Impacts: EU regulations regarding product safety and labeling significantly influence market dynamics.

- Product Substitutes: The rise of alternative oral hygiene practices poses a moderate competitive threat.

- End-User Segmentation: The market caters to diverse demographics, with distinct product preferences across age groups and income levels.

- M&A Trends: The past five years have witnessed xx M&A deals, primarily driven by strategic acquisitions to expand product portfolios and geographic reach. The average deal value is estimated at xx Million.

Europe Oral Care Market Market Trends & Opportunities

The Europe Oral Care market is experiencing robust growth fueled by increasing awareness of oral hygiene, rising disposable incomes, and the growing adoption of premium oral care products. The market size is projected to expand significantly, driven by several factors.

Technological advancements such as smart toothbrushes and augmented reality (AR) applications are enhancing the user experience and creating new market opportunities. Consumer preferences are shifting towards natural and organic products, along with a growing demand for convenience and portability. This trend is evident in the rising popularity of toothpaste tablets and travel-sized products. Furthermore, the e-commerce boom is reshaping distribution channels and creating new avenues for market penetration. The increasing penetration of online retail channels, particularly among younger demographics, presents a considerable growth opportunity for oral care brands. The market is also witnessing intense competitive activity, with established players investing heavily in research and development and new product launches to maintain their market share and attract new customers. The market is expected to grow at a CAGR of xx% during the forecast period, driven by these factors.

Dominant Markets & Segments in Europe Oral Care Market

Leading Region/Country: Germany and the UK are projected to remain dominant markets due to high per capita consumption and strong consumer preference for premium products.

Dominant Distribution Channel: Supermarkets/Hypermarkets hold the largest market share, owing to their widespread accessibility and extensive product offerings. Online retail stores are experiencing rapid growth, gaining considerable market share, particularly among younger consumers.

Dominant Product Type: Toothpaste continues to dominate the product type segment, accounting for approximately xx% of the market. However, other segments like mouthwashes and rinses are witnessing above-average growth rates, driven by changing consumer preferences.

Key Growth Drivers:

- Strong consumer awareness of oral health.

- Rising disposable incomes.

- Increased availability of innovative products.

- Expansion of e-commerce channels.

The significant market share of supermarkets and hypermarkets is attributed to their vast reach, extensive product assortments, and competitive pricing strategies. The consistent growth of online retail channels reflects evolving consumer behaviour, with the convenience of online shopping attracting a growing number of customers. The dominance of toothpaste highlights the importance of this essential oral care product, while the rapid expansion of mouthwash and rinse segments reflects rising consumer preferences for advanced oral hygiene solutions.

Europe Oral Care Market Product Analysis

Recent innovations in the European oral care market showcase a trend towards enhanced functionality, sustainability, and personalized experiences. The introduction of recyclable toothpaste tubes and innovative formulations like charcoal-infused toothpaste reflect a growing consumer demand for environmentally friendly and efficacious products. AR applications, simulating the effects of teeth whitening products, are enhancing the consumer decision-making process. The success of these innovations hinges on their ability to meet evolving consumer needs and preferences, coupled with effective marketing strategies to build brand awareness and loyalty.

Key Drivers, Barriers & Challenges in Europe Oral Care Market

Key Drivers: Rising awareness of oral health, increased disposable incomes, technological advancements (e.g., smart toothbrushes), and the growth of e-commerce are key drivers, propelling market expansion. Government initiatives promoting oral hygiene also contribute to market growth.

Challenges: Intense competition among established players, the rising cost of raw materials, and stringent regulatory requirements (e.g., labeling and safety standards) pose significant challenges. Supply chain disruptions resulting from geopolitical instability also impede market growth. The estimated impact of these challenges on market growth is approximately xx% over the forecast period.

Growth Drivers in the Europe Oral Care Market Market

The Europe Oral Care Market is driven by several factors: increasing consumer awareness of oral health, rising disposable incomes, technological advancements leading to better product offerings, and the expanding e-commerce sector. Government regulations supporting oral hygiene awareness campaigns also play a significant role.

Challenges Impacting Europe Oral Care Market Growth

The market faces challenges including intense competition, rising raw material costs, and stringent regulations. Supply chain disruptions caused by global events can significantly impact market growth, creating unpredictable fluctuations in supply and demand.

Key Players Shaping the Europe Oral Care Market Market

- Henkel AG & Co KGaA

- Unilever

- Church & Dwight Co Inc

- Sunstar Suisse S A

- Procter & Gamble

- Pierre Fabre S A

- Colgate-Palmolive Company

- Pierrot (Fushima SL)

- Johnson & Johnson Consumer Inc

- Hawley & Hazel (BVI) Co Ltd

- Lactona Europe BV

- GlaxoSmithKline PLC

Significant Europe Oral Care Market Industry Milestones

- November 2022: Colgate partnered with Perfect Corp. to utilize augmented reality (AR) for its Optic White Overnight Teeth Whitening Pen.

- November 2022: Colgate launched CO., a Gen-Z targeted oral beauty care line, featuring innovative products like charcoal toothpaste and toothpaste tablets.

- February 2022: Colgate-Palmolive introduced a recyclable toothpaste tube made from easily recyclable HDPE plastic.

These milestones demonstrate a growing focus on innovation, sustainability, and meeting evolving consumer demands within the Europe Oral Care Market.

Future Outlook for Europe Oral Care Market Market

The Europe Oral Care Market is poised for continued expansion, driven by innovation, growing consumer awareness, and expanding e-commerce. Strategic opportunities exist in developing sustainable products, personalized solutions, and leveraging digital marketing channels. The market's robust growth potential is expected to attract further investments and competition, shaping the future landscape of oral care in Europe.

Europe Oral Care Market Segmentation

-

1. Product Type

- 1.1. Breath Fresheners

- 1.2. Dental Floss

- 1.3. Denture Care

- 1.4. Mouthwashes and Rinses

- 1.5. Toothbrushes and Replacements

- 1.6. Toothpaste

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies And Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Oral Care Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Oral Care Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.74% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Mouth Washes and Rinses to Experience Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Breath Fresheners

- 5.1.2. Dental Floss

- 5.1.3. Denture Care

- 5.1.4. Mouthwashes and Rinses

- 5.1.5. Toothbrushes and Replacements

- 5.1.6. Toothpaste

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies And Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Oral Care Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Henkel AG & Co KGaA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Unilever

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Church & Dwight Co Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Sunstar Suisse S A

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Procter & Gamble

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Pierre Fabre S A

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Colgate-Palmolive Company

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pierrot (Fushima SL)*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Johnson & Johnson Consumer Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hawley & Hazel (BVI) Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Lactona Europe BV

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 GlaxoSmithKline PLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Europe Oral Care Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Oral Care Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Oral Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Oral Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Oral Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Europe Oral Care Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Oral Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Oral Care Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Oral Care Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Europe Oral Care Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Oral Care Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Oral Care Market?

The projected CAGR is approximately 4.74%.

2. Which companies are prominent players in the Europe Oral Care Market?

Key companies in the market include Henkel AG & Co KGaA, Unilever, Church & Dwight Co Inc, Sunstar Suisse S A, Procter & Gamble, Pierre Fabre S A, Colgate-Palmolive Company, Pierrot (Fushima SL)*List Not Exhaustive, Johnson & Johnson Consumer Inc, Hawley & Hazel (BVI) Co Ltd, Lactona Europe BV, GlaxoSmithKline PLC.

3. What are the main segments of the Europe Oral Care Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Mouth Washes and Rinses to Experience Fastest Growth Rate.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

In November 2022, Colgate partnered with Perfect Corp. to use augmented reality (AR) simulation to bring the outcomes of the brands' Colgate Optic White Overnight Teeth Whitening Pen to life.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Oral Care Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Oral Care Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Oral Care Market?

To stay informed about further developments, trends, and reports in the Europe Oral Care Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence