Key Insights

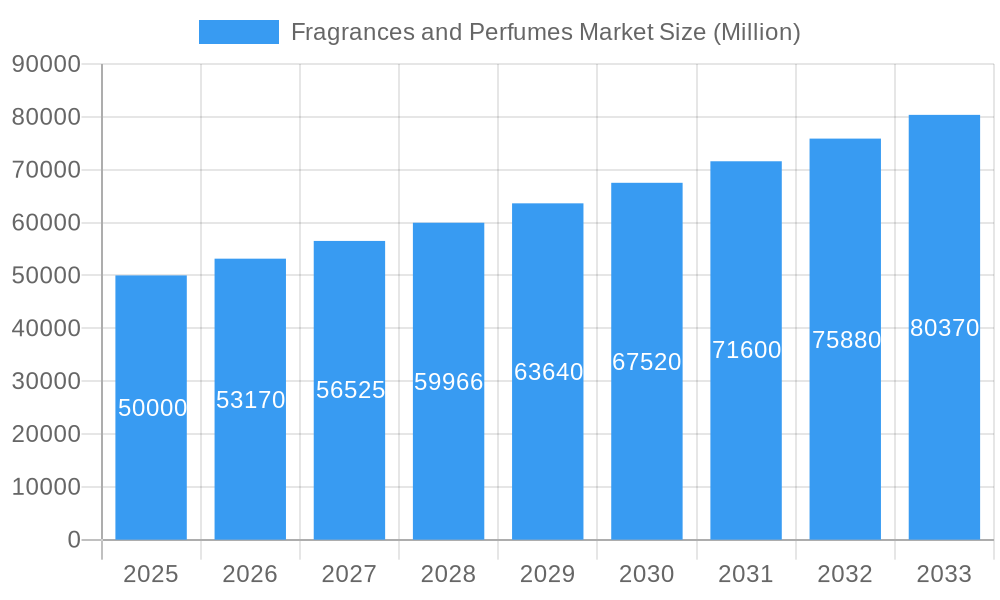

The global fragrances and perfumes market is projected to reach $53.04 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.57% from 2025 to 2033. This growth is attributed to rising disposable incomes in emerging markets, increased emphasis on personal grooming and self-expression, and the expanding e-commerce landscape. Innovations in natural and sustainable formulations are also attracting environmentally conscious consumers. Eau de Parfum (EDP) leads product segments, while men's and women's fragrances remain dominant, with unisex options showing emerging traction.

Fragrances and Perfumes Market Market Size (In Billion)

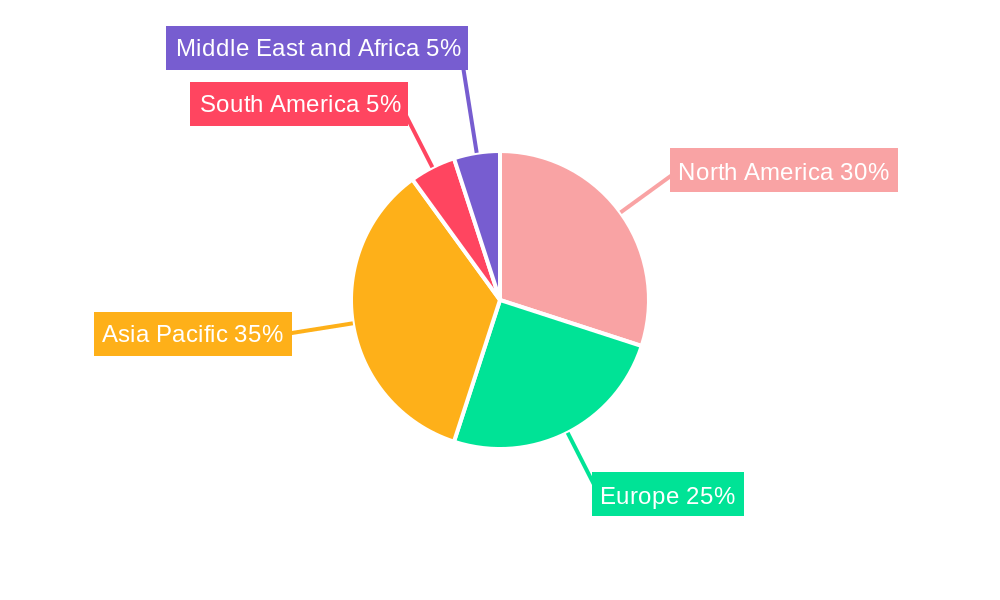

Market restraints include volatile raw material costs, stringent chemical regulations, and intense competition. Nevertheless, trends in personalization, social media influence, and celebrity endorsements indicate a positive market outlook. The Asia-Pacific region, especially China and India, presents significant growth opportunities, complemented by continued contributions from mature North American and European markets, offering strategic avenues for tailored product development and marketing initiatives.

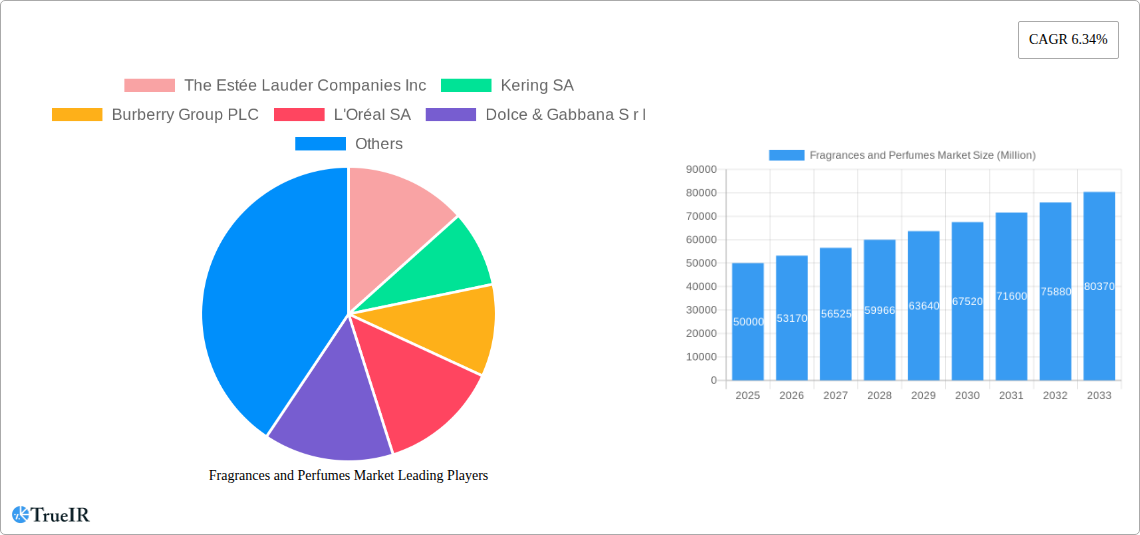

Fragrances and Perfumes Market Company Market Share

Fragrances and Perfumes Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the global Fragrances and Perfumes Market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). Leveraging extensive market research and incorporating key industry developments, this report offers invaluable insights for businesses, investors, and stakeholders seeking to navigate this lucrative and evolving sector. The report delves into market size, segmentation, competitive landscape, growth drivers, and challenges, providing a 360-degree view of the Fragrances and Perfumes Market.

Fragrances and Perfumes Market Structure & Competitive Landscape

The global fragrances and perfumes market is characterized by a moderately concentrated structure with several multinational players dominating the landscape. The Herfindahl-Hirschman Index (HHI) for the market in 2024 is estimated at xx, indicating a moderately consolidated market. Key players, including The Estée Lauder Companies Inc, Kering SA, Burberry Group PLC, L'Oréal SA, Dolce & Gabbana S r l, Coty Inc, Chanel SA, PVH Corp, Natura Cosmeticos SA, and LVMH Moët Hennessy Louis Vuitton, hold significant market share, driving innovation and competition.

- Market Concentration: The HHI suggests a moderately concentrated market with significant room for smaller players.

- Innovation Drivers: Sustainability initiatives (e.g., refillable packaging), personalized fragrance experiences, and the incorporation of advanced technologies in fragrance creation are key drivers.

- Regulatory Impacts: Regulations regarding ingredient sourcing, labeling, and environmental impact significantly influence market dynamics. Compliance costs and evolving regulations can impact profitability.

- Product Substitutes: The market faces competition from other personal care products like body lotions and essential oils, though the unique sensory experience of perfumes maintains significant appeal.

- End-User Segmentation: The market is broadly segmented into men's, women's, and unisex fragrances, each with distinct preferences and trends.

- M&A Trends: The market has witnessed a moderate level of mergers and acquisitions in recent years (estimated at xx Million USD in value between 2019 and 2024), primarily focused on expanding product portfolios and geographical reach. Larger players are strategically acquiring smaller niche brands to diversify offerings.

Fragrances and Perfumes Market Market Trends & Opportunities

The global fragrances and perfumes market is experiencing robust growth, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by factors such as rising disposable incomes in emerging economies, increasing consumer awareness of personal grooming, and evolving trends in fragrance preferences. Technological advancements, particularly in scent creation and delivery, are enabling the development of innovative products and personalized fragrance experiences. The market penetration rate for online sales is steadily rising, reflecting the growing preference for convenient and personalized shopping experiences. The increasing demand for natural and organic fragrances presents a significant opportunity for brands that focus on sustainability and ethical sourcing. Competitive dynamics are intense, with established brands focusing on product innovation, brand building, and strategic partnerships to maintain market leadership. The market size is projected to reach xx Million USD by 2033.

Dominant Markets & Segments in Fragrances and Perfumes Market

The North American and European regions currently dominate the global fragrances and perfumes market, driven by high per capita consumption and strong brand recognition. However, Asia Pacific is projected to witness the fastest growth rate over the forecast period.

Leading Segments:

- Product Type: Eau de Parfum (EDP) currently holds the largest market share, followed by Eau de Toilette (EDT). The demand for premium Parfum or De Parfum is also steadily rising.

- Consumer Group: Women's fragrances account for the major share, however, the unisex segment is experiencing significant growth.

- Distribution Channel: Offline retail stores remain the dominant distribution channel, but online retail stores are witnessing rapid growth, particularly among younger consumers.

Key Growth Drivers:

- North America: Strong consumer spending power, established distribution networks, and well-established luxury brands.

- Europe: Similar to North America, but with a greater emphasis on niche and artisanal fragrances.

- Asia Pacific: Rising disposable incomes, increasing urbanization, and a growing preference for premium beauty products.

Fragrances and Perfumes Market Product Analysis

Significant product innovations are shaping the market. The trend toward natural and sustainable ingredients, refillable packaging, and personalized fragrance experiences is gaining momentum. Technological advancements in fragrance creation, such as the use of AI in scent development, are improving the efficiency and precision of fragrance production. Companies are increasingly leveraging digital marketing and e-commerce platforms to enhance consumer engagement and personalize the fragrance-buying experience. This is improving the market fit of products by offering greater choice and convenience.

Key Drivers, Barriers & Challenges in Fragrances and Perfumes Market

Key Drivers:

- Rising disposable incomes: Particularly in emerging markets, fueling demand for premium fragrances.

- Evolving consumer preferences: Growing interest in natural, sustainable, and personalized products.

- Technological advancements: Enabling innovation in scent creation and delivery systems.

Challenges:

- Supply chain disruptions: Fluctuations in raw material prices and geopolitical events impact production costs and availability.

- Regulatory hurdles: Stringent regulations regarding ingredient safety and environmental impact pose challenges for manufacturers.

- Intense competition: The presence of established brands and new entrants creates pressure on pricing and profitability (estimated xx% decrease in profit margin in 2024 compared to 2019).

Growth Drivers in the Fragrances and Perfumes Market Market

The market's growth is primarily driven by increasing consumer spending on personal care products, the growing popularity of personalized fragrance experiences, and the expansion of e-commerce channels. Government initiatives promoting sustainable practices within the beauty industry also contribute to market growth. Advances in fragrance technology are constantly enhancing the market by producing novel products.

Challenges Impacting Fragrances and Perfumes Market Growth

Significant challenges include supply chain volatility, impacting both raw material availability and distribution costs. Stringent environmental regulations necessitate greater investment in sustainable practices, increasing operational expenses. The highly competitive market with established and emerging brands necessitates continuous innovation and strong brand building to secure market share.

Key Players Shaping the Fragrances and Perfumes Market Market

Significant Fragrances and Perfumes Market Industry Milestones

- July 2022: Chanel SA launched Gabrielle Chanel Eau de Parfum (online exclusive) and Gabrielle Chanel Essence Twist & Spray (domestic and select travel retail). This highlights the trend towards both online-only and physical presence.

- November 2022: Coty Inc. launched the first-ever refillable perfume, Chloé Rose Naturelle Intense, showcasing a commitment to sustainability and reducing environmental impact.

- April 2023: Coty Inc. launched Gucci Eau de Parfum, "Where My Heart Beats," using 100% carbon-captured alcohol, demonstrating innovation in sustainable ingredient sourcing.

Future Outlook for Fragrances and Perfumes Market Market

The future of the fragrances and perfumes market is promising. Continued growth is anticipated, driven by increasing consumer spending, evolving preferences for personalized and sustainable products, and the expansion of e-commerce. Strategic opportunities exist for brands that prioritize innovation, sustainability, and personalized consumer experiences. The market is poised for significant growth, with substantial potential for expansion into new markets and product categories.

Fragrances and Perfumes Market Segmentation

-

1. Product Type

- 1.1. Parfum or De Parfum

- 1.2. Eau De Parfum (EDP)

- 1.3. Eau De Toilette (EDT)

- 1.4. Eau De Cologne (EDC)

- 1.5. Other Product Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Unisex

-

3. Distribution Channel

- 3.1. Online Retail Stores

-

3.2. Offline Retail Stores

- 3.2.1. Supermarkets/Hypermarkets

- 3.2.2. Specialty Stores

- 3.2.3. Convenience Stores

- 3.2.4. Other Offline Retail Stores

Fragrances and Perfumes Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Fragrances and Perfumes Market Regional Market Share

Geographic Coverage of Fragrances and Perfumes Market

Fragrances and Perfumes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Luxury Perfumes; Popularity of Natural Products

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Luxury Perfumes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Parfum or De Parfum

- 5.1.2. Eau De Parfum (EDP)

- 5.1.3. Eau De Toilette (EDT)

- 5.1.4. Eau De Cologne (EDC)

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Unisex

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online Retail Stores

- 5.3.2. Offline Retail Stores

- 5.3.2.1. Supermarkets/Hypermarkets

- 5.3.2.2. Specialty Stores

- 5.3.2.3. Convenience Stores

- 5.3.2.4. Other Offline Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Parfum or De Parfum

- 6.1.2. Eau De Parfum (EDP)

- 6.1.3. Eau De Toilette (EDT)

- 6.1.4. Eau De Cologne (EDC)

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Unisex

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online Retail Stores

- 6.3.2. Offline Retail Stores

- 6.3.2.1. Supermarkets/Hypermarkets

- 6.3.2.2. Specialty Stores

- 6.3.2.3. Convenience Stores

- 6.3.2.4. Other Offline Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Parfum or De Parfum

- 7.1.2. Eau De Parfum (EDP)

- 7.1.3. Eau De Toilette (EDT)

- 7.1.4. Eau De Cologne (EDC)

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Unisex

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online Retail Stores

- 7.3.2. Offline Retail Stores

- 7.3.2.1. Supermarkets/Hypermarkets

- 7.3.2.2. Specialty Stores

- 7.3.2.3. Convenience Stores

- 7.3.2.4. Other Offline Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Parfum or De Parfum

- 8.1.2. Eau De Parfum (EDP)

- 8.1.3. Eau De Toilette (EDT)

- 8.1.4. Eau De Cologne (EDC)

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Unisex

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online Retail Stores

- 8.3.2. Offline Retail Stores

- 8.3.2.1. Supermarkets/Hypermarkets

- 8.3.2.2. Specialty Stores

- 8.3.2.3. Convenience Stores

- 8.3.2.4. Other Offline Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Parfum or De Parfum

- 9.1.2. Eau De Parfum (EDP)

- 9.1.3. Eau De Toilette (EDT)

- 9.1.4. Eau De Cologne (EDC)

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Unisex

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online Retail Stores

- 9.3.2. Offline Retail Stores

- 9.3.2.1. Supermarkets/Hypermarkets

- 9.3.2.2. Specialty Stores

- 9.3.2.3. Convenience Stores

- 9.3.2.4. Other Offline Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Fragrances and Perfumes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Parfum or De Parfum

- 10.1.2. Eau De Parfum (EDP)

- 10.1.3. Eau De Toilette (EDT)

- 10.1.4. Eau De Cologne (EDC)

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Men

- 10.2.2. Women

- 10.2.3. Unisex

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online Retail Stores

- 10.3.2. Offline Retail Stores

- 10.3.2.1. Supermarkets/Hypermarkets

- 10.3.2.2. Specialty Stores

- 10.3.2.3. Convenience Stores

- 10.3.2.4. Other Offline Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Estée Lauder Companies Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Burberry Group PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L'Oréal SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dolce & Gabbana S r l

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Coty Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chanel SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PVH Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Natura Cosmeticos SA*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LVMH Moët Hennessy Louis Vuitton

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Estée Lauder Companies Inc

List of Figures

- Figure 1: Fragrances and Perfumes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Fragrances and Perfumes Market Share (%) by Company 2025

List of Tables

- Table 1: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Fragrances and Perfumes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 7: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Fragrances and Perfumes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Fragrances and Perfumes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Italy Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 25: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 26: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Fragrances and Perfumes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: China Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Japan Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: India Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 34: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Fragrances and Perfumes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Fragrances and Perfumes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 41: Fragrances and Perfumes Market Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Fragrances and Perfumes Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Fragrances and Perfumes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: South Africa Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Saudi Arabia Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Fragrances and Perfumes Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fragrances and Perfumes Market?

The projected CAGR is approximately 5.57%.

2. Which companies are prominent players in the Fragrances and Perfumes Market?

Key companies in the market include The Estée Lauder Companies Inc, Kering SA, Burberry Group PLC, L'Oréal SA, Dolce & Gabbana S r l, Coty Inc, Chanel SA, PVH Corp, Natura Cosmeticos SA*List Not Exhaustive, LVMH Moët Hennessy Louis Vuitton.

3. What are the main segments of the Fragrances and Perfumes Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Luxury Perfumes; Popularity of Natural Products.

6. What are the notable trends driving market growth?

Increasing Demand for Luxury Perfumes.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

April 2023: Coty Inc. launched its new Gucci Eau de Parfum, Where My Heart Beats fragrance. The company claims that the fragrance is made from 100% carbon-captured alcohol. The product is included in Gucci's Alchemist's Garden range.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fragrances and Perfumes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fragrances and Perfumes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fragrances and Perfumes Market?

To stay informed about further developments, trends, and reports in the Fragrances and Perfumes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence