Key Insights

The Asia-Pacific oral care market is poised for robust expansion, driven by escalating disposable incomes, heightened oral hygiene awareness, and the prevalence of dental conditions. The region's substantial and growing population, particularly in China and India, fuels demand for a diverse product portfolio. Key segments like toothpaste, toothbrushes, and mouthwashes are experiencing significant growth, augmented by advanced formulations offering whitening, sensitivity relief, and therapeutic benefits. The burgeoning e-commerce sector further enhances market accessibility and consumer convenience. While challenges such as counterfeit products and varying dental awareness levels persist, the market outlook remains highly positive, presenting considerable opportunities for both established and emerging brands. The premium and specialized oral care segment exhibits particularly strong growth due to increased consumer spending power and a greater emphasis on preventative oral health. Expansion into rural markets and strategic dental professional partnerships are anticipated to stimulate further growth.

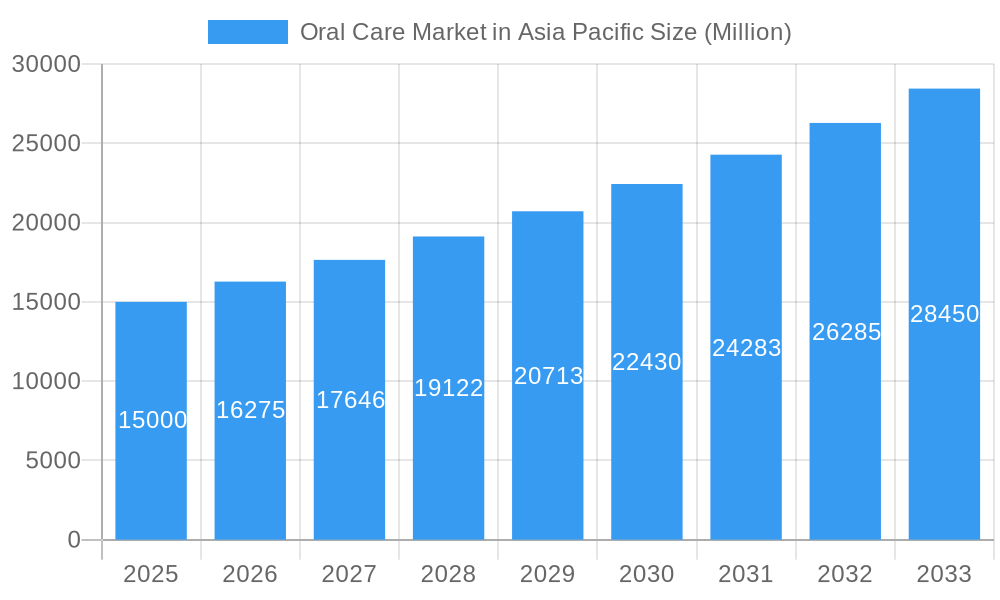

Oral Care Market in Asia Pacific Market Size (In Billion)

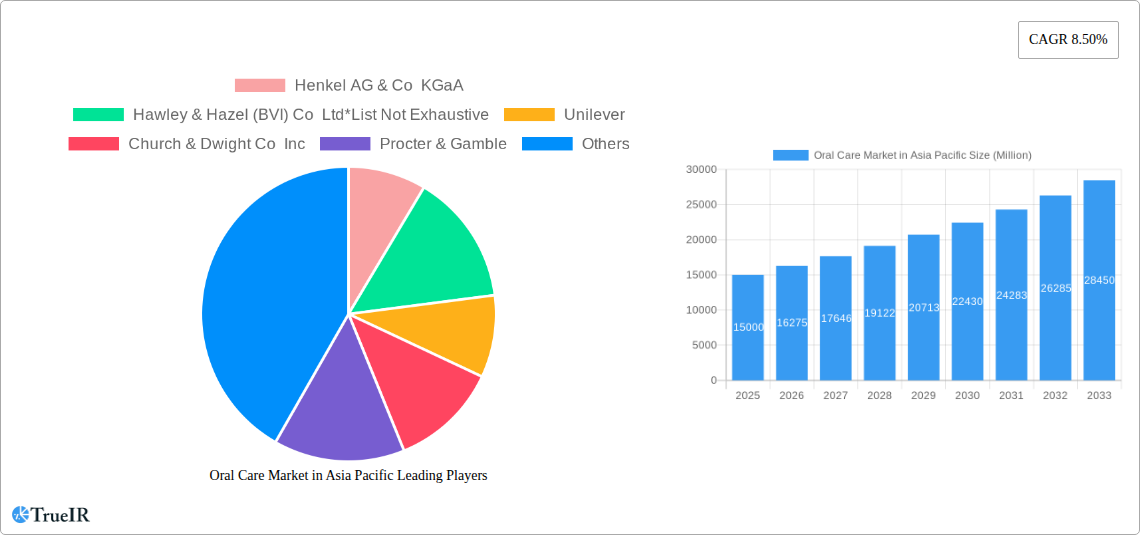

The competitive landscape features a blend of global leaders and local contenders. Multinational corporations like Colgate-Palmolive, Procter & Gamble, and Unilever maintain significant market share through strong brand equity and extensive distribution. However, local brands are increasingly gaining traction in specific regional markets. This competitive dynamic fosters innovation, driving product development and offering consumers a wider array of choices. Trends towards natural, organic ingredients, and sustainable packaging are influencing consumer preferences and compelling companies to adapt their offerings and strategies. The rising incidence of gum disease and other oral health issues is propelling demand for specialized products and services within this dynamic market, ensuring sustained growth for the Asia-Pacific oral care sector.

Oral Care Market in Asia Pacific Company Market Share

Asia Pacific Oral Care Market Analysis: Growth, Trends, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the Asia Pacific oral care market, providing critical insights for industry stakeholders. Covering the forecast period 2025-2033, with a base year of 2025, this study leverages extensive data and expert analysis to highlight key trends, opportunities, and challenges. The market is valued at 13.67 billion in 2025 and is projected to reach significant future valuations by 2033, exhibiting a CAGR of 3.84%.

Oral Care Market in Asia Pacific Market Structure & Competitive Landscape

The Asia Pacific oral care market is characterized by a moderately concentrated landscape, with key players such as Colgate-Palmolive Company, Procter & Gamble, Unilever, and Henkel AG & Co KGaA holding significant market share. However, the presence of numerous regional and local players contributes to a dynamic competitive environment. The market's structure is influenced by several factors:

- High Market Concentration: The top 5 players account for approximately xx% of the total market revenue in 2025, indicating a relatively concentrated market. This is likely to remain relatively stable over the forecast period.

- Innovation Drivers: Continuous innovation in product formulations (e.g., natural ingredients, whitening technologies), packaging (e.g., sustainable materials), and delivery systems (e.g., electric toothbrushes) fuels market growth.

- Regulatory Impacts: Stringent regulations regarding product safety and labeling across different countries in the region influence product development and marketing strategies. Variations in regulations across countries create both challenges and opportunities for market players.

- Product Substitutes: The market faces competition from traditional and alternative oral hygiene products, impacting market share dynamics. The rise of natural and organic products presents both a threat and an opportunity.

- End-User Segmentation: The market caters to diverse demographic segments with varying needs and preferences, creating niche opportunities for specialized products. This includes age-specific products for children, adults, and the elderly.

- M&A Trends: The market has witnessed several mergers and acquisitions in recent years, with xx major deals recorded between 2019 and 2024, primarily driven by the need for expansion into new markets and technological advancements.

Oral Care Market in Asia Pacific Market Trends & Opportunities

The Asia Pacific oral care market exhibits significant growth potential driven by several key trends:

The market is experiencing robust growth, fueled by rising disposable incomes, increasing awareness of oral health, and the expanding middle class across several Asian countries. Technological advancements, such as the introduction of electric toothbrushes and innovative toothpaste formulations with enhanced efficacy, are significantly driving market growth. Consumer preferences are shifting towards natural and organic products, premium offerings, and convenient online purchasing options. The competitive dynamics are intense, with established multinational corporations and emerging local brands vying for market share. This competitive landscape drives innovation and product diversification. The market's growth is further influenced by the increasing penetration of online retail channels and the rising popularity of subscription models for oral care products. Specific market penetration rates vary significantly across regions and product categories. The CAGR for the forecast period is projected at xx%, indicating strong and continued expansion. China and India continue to lead in market size and future growth expectations. Specific market sizes for key countries (e.g., China, India, Japan) are included in detailed tables within the report.

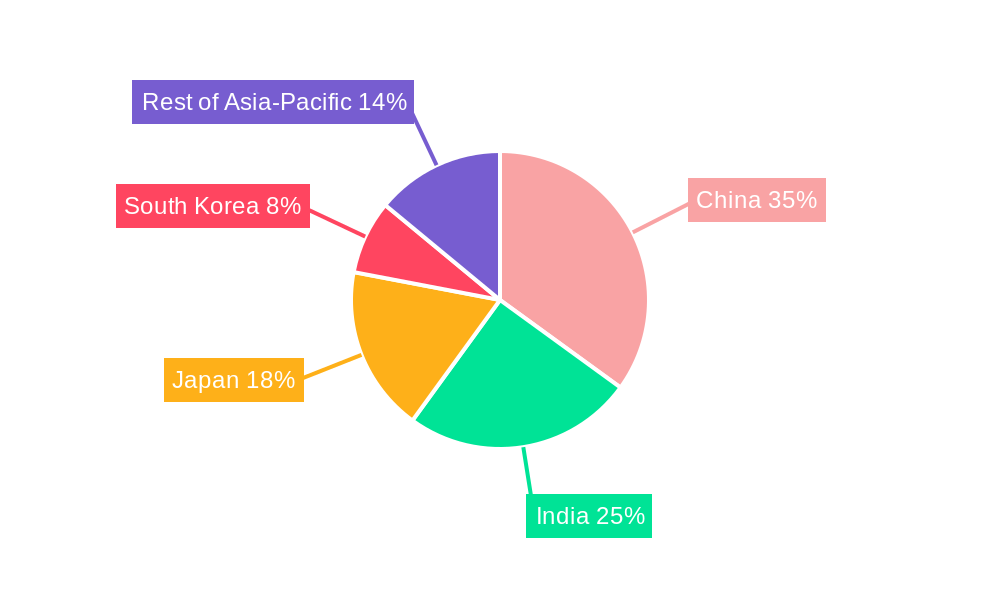

Dominant Markets & Segments in Oral Care Market in Asia Pacific

The Asia Pacific oral care market is dominated by several key countries and product segments:

- Leading Regions: China and India represent the largest markets, driven by their vast populations and increasing disposable incomes. Other significant markets include Japan, South Korea, and Australia.

- Leading Segments (By Product Type): Toothpaste commands the largest market share, followed by toothbrushes. The demand for specialized products like mouthwashes and dental floss is also growing. Denture care is showing a steady growth trajectory, driven by aging populations.

- Leading Segments (By Distribution Channel): Supermarkets/hypermarkets remain the dominant distribution channel, offering broad reach and consumer convenience. However, online retail stores are experiencing rapid growth, fueled by increasing internet penetration and e-commerce adoption.

Key Growth Drivers:

- Rising disposable incomes: Increased purchasing power across the region fuels demand for higher-quality oral care products.

- Growing awareness of oral health: Increased public awareness campaigns and improved healthcare infrastructure contribute to greater demand.

- Expanding middle class: The burgeoning middle class in many Asian countries drives greater adoption of premium oral care products.

- Technological advancements: Innovations in product formulations and delivery systems enhance consumer appeal and drive market expansion.

- Government initiatives: Government-led public health campaigns and supportive policies create a favorable environment for market growth.

Oral Care Market in Asia Pacific Product Analysis

The oral care market showcases continuous innovation, with new product launches encompassing electric toothbrushes with advanced cleaning modes, natural and organic toothpaste formulations, and sustainable packaging solutions. Companies are focusing on improving product efficacy, enhancing user experience, and addressing sustainability concerns. This focus on innovation, coupled with effective marketing and distribution strategies, is crucial in gaining competitive advantage in this crowded marketplace.

Key Drivers, Barriers & Challenges in Oral Care Market in Asia Pacific

Key Drivers:

- Technological advancements (e.g., electric toothbrushes, smart sensors)

- Rising disposable incomes and increased healthcare spending

- Growing awareness of oral hygiene and its link to overall health

- Expanding distribution networks, particularly online retail

Key Challenges and Restraints:

- Intense competition among established players and new entrants

- Fluctuations in raw material prices impacting production costs

- Stringent regulatory requirements for product approval and labeling

- Supply chain disruptions affecting product availability and cost.

Growth Drivers in the Oral Care Market in Asia Pacific Market

The market's growth is propelled by factors such as rising disposable incomes, increased health consciousness, expanding e-commerce penetration, and technological innovations in product formulations and delivery mechanisms. Government initiatives promoting oral health further contribute to this growth.

Challenges Impacting Oral Care Market in Asia Pacific Growth

The market faces challenges such as intense competition, price sensitivity among consumers, fluctuating raw material costs, and the regulatory complexities involved in navigating different market standards across the diverse Asian region. Supply chain disruptions, especially post-pandemic, have also affected product availability and pricing.

Key Players Shaping the Oral Care Market in Asia Pacific Market

- Henkel AG & Co KGaA

- Hawley & Hazel (BVI) Co Ltd

- Unilever

- Church & Dwight Co Inc

- Procter & Gamble

- Oral Essentials inc

- Chongqing Textile Holding (Group) Company

- Colgate-Palmolive Company

- Pigeon Corporation

- Sunstar Suisse SA

- GlaxoSmithKline PLC

Significant Oral Care Market in Asia Pacific Industry Milestones

- April 2022: Colgate partners with Shopee to launch a new electric toothbrush in five Southeast Asian markets.

- June 2021: Unilever introduces entirely recyclable toothpaste tubes in India.

- May 2021: Albéa Group and GlaxoSmithKline launch fully recyclable toothpaste tubes globally.

Future Outlook for Oral Care Market in Asia Pacific Market

The Asia Pacific oral care market is poised for continued strong growth, driven by several factors. The rising middle class, increasing health awareness, and technological innovations are major catalysts. Companies are focusing on sustainability, premiumization, and digitalization to capture market share. The market's potential remains significant, with opportunities for both established and emerging players.

Oral Care Market in Asia Pacific Segmentation

-

1. Product Type

- 1.1. Breath Fresheners

- 1.2. Dental Floss

- 1.3. Denture Care

- 1.4. Mouthwashes and Rinses

- 1.5. Toothbrushes and Replacements

- 1.6. Toothpaste

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies And Drug Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Oral Care Market in Asia Pacific Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Oral Care Market in Asia Pacific Regional Market Share

Geographic Coverage of Oral Care Market in Asia Pacific

Oral Care Market in Asia Pacific REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products

- 3.3. Market Restrains

- 3.3.1. Enhanced Presence of Counterfeit Skin Care Products

- 3.4. Market Trends

- 3.4.1. Deterring Oral Health among Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Breath Fresheners

- 5.1.2. Dental Floss

- 5.1.3. Denture Care

- 5.1.4. Mouthwashes and Rinses

- 5.1.5. Toothbrushes and Replacements

- 5.1.6. Toothpaste

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies And Drug Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Breath Fresheners

- 6.1.2. Dental Floss

- 6.1.3. Denture Care

- 6.1.4. Mouthwashes and Rinses

- 6.1.5. Toothbrushes and Replacements

- 6.1.6. Toothpaste

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacies And Drug Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Breath Fresheners

- 7.1.2. Dental Floss

- 7.1.3. Denture Care

- 7.1.4. Mouthwashes and Rinses

- 7.1.5. Toothbrushes and Replacements

- 7.1.6. Toothpaste

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacies And Drug Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Breath Fresheners

- 8.1.2. Dental Floss

- 8.1.3. Denture Care

- 8.1.4. Mouthwashes and Rinses

- 8.1.5. Toothbrushes and Replacements

- 8.1.6. Toothpaste

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacies And Drug Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Breath Fresheners

- 9.1.2. Dental Floss

- 9.1.3. Denture Care

- 9.1.4. Mouthwashes and Rinses

- 9.1.5. Toothbrushes and Replacements

- 9.1.6. Toothpaste

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacies And Drug Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Oral Care Market in Asia Pacific Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Breath Fresheners

- 10.1.2. Dental Floss

- 10.1.3. Denture Care

- 10.1.4. Mouthwashes and Rinses

- 10.1.5. Toothbrushes and Replacements

- 10.1.6. Toothpaste

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacies And Drug Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henkel AG & Co KGaA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hawley & Hazel (BVI) Co Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Unilever

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Church & Dwight Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Procter & Gamble

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Oral Essentials inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chongqing Textile Holding (Group) Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Colgate-Palmolive Company

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pigeon Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sunstar Suisse SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Oral Care Market in Asia Pacific Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Oral Care Market in Asia Pacific Share (%) by Company 2025

List of Tables

- Table 1: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Oral Care Market in Asia Pacific Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Oral Care Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Oral Care Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Oral Care Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Oral Care Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Oral Care Market in Asia Pacific Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Oral Care Market in Asia Pacific Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Oral Care Market in Asia Pacific Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Oral Care Market in Asia Pacific Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oral Care Market in Asia Pacific?

The projected CAGR is approximately 3.84%.

2. Which companies are prominent players in the Oral Care Market in Asia Pacific?

Key companies in the market include Henkel AG & Co KGaA, Hawley & Hazel (BVI) Co Ltd*List Not Exhaustive, Unilever, Church & Dwight Co Inc, Procter & Gamble, Oral Essentials inc, Chongqing Textile Holding (Group) Company, Colgate-Palmolive Company, Pigeon Corporation, Sunstar Suisse SA, GlaxoSmithKline PLC.

3. What are the main segments of the Oral Care Market in Asia Pacific?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.67 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Influence of Social Media and Impact of Digital Technology; Rising Demand for Natural and Organic Skincare Products.

6. What are the notable trends driving market growth?

Deterring Oral Health among Population.

7. Are there any restraints impacting market growth?

Enhanced Presence of Counterfeit Skin Care Products.

8. Can you provide examples of recent developments in the market?

In April 2022, to launch a new electric toothbrush, Colgate partnered with Shopee, one of the leading online shopping platforms in Southeast Asia and Taiwan. The company claims the product has four cleaning modes: squeaky clean, sparkle, gum care, and night spa. This product is only available online in five markets - Singapore, Malaysia, Thailand, Vietnam, and the Philippine

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oral Care Market in Asia Pacific," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oral Care Market in Asia Pacific report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oral Care Market in Asia Pacific?

To stay informed about further developments, trends, and reports in the Oral Care Market in Asia Pacific, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence