Key Insights

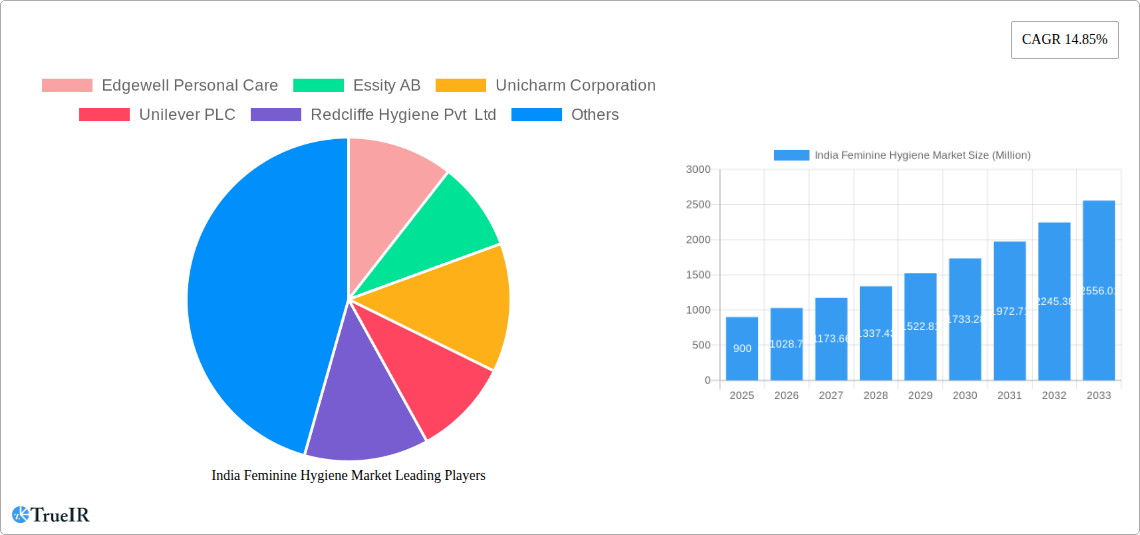

The India feminine hygiene market, valued at approximately $0.90 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 14.85% from 2025 to 2033. This significant expansion is driven by several key factors. Rising awareness of hygiene and health among women, coupled with increasing disposable incomes and urbanization, are fueling demand for a wider range of products beyond traditional sanitary napkins. The market is witnessing a notable shift towards premium products and innovative solutions like menstrual cups and organic sanitary napkins, reflecting a growing preference for eco-friendly and sustainable options. Effective marketing campaigns and increased product availability through diverse distribution channels, including online retail and pharmacies, are further bolstering market penetration. However, challenges remain, such as persistent taboos surrounding menstruation in certain regions, limited awareness in rural areas, and price sensitivity among a significant portion of the population. These factors present opportunities for companies to focus on targeted marketing strategies, product affordability and educational initiatives to drive further growth.

India Feminine Hygiene Market Market Size (In Million)

The market segmentation reveals a dynamic landscape. Sanitary napkins/pads currently dominate, but the segments of menstrual cups and other innovative products are experiencing accelerated growth, indicating a changing consumer preference towards convenience, sustainability, and health. Distribution channels are diversifying, with online retail showing strong potential. Key players such as Edgewell Personal Care, Essity AB, and Unilever are actively competing, driving innovation and expanding product portfolios. The Asia-Pacific region, particularly India, presents a substantial opportunity due to its large and growing female population, making it a focal point for expansion and investment within the feminine hygiene industry. Strategic partnerships and investments in research and development will further solidify the market's trajectory.

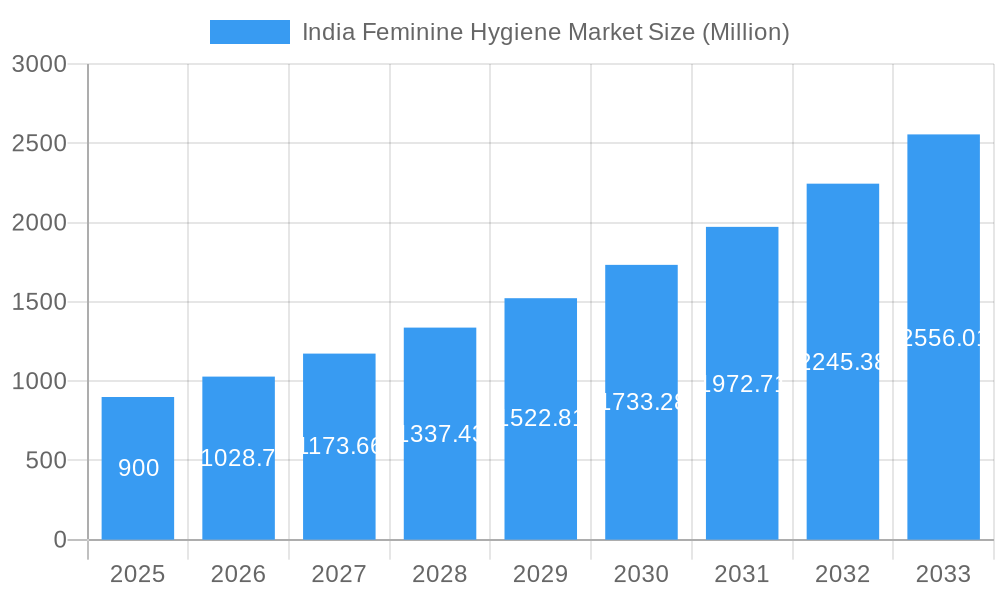

India Feminine Hygiene Market Company Market Share

India Feminine Hygiene Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India Feminine Hygiene Market, offering invaluable insights for stakeholders across the value chain. With a robust analysis spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report leverages extensive market data and qualitative analysis to illuminate current trends and future growth potential. The market is projected to reach xx Million by 2033, showcasing significant growth opportunities. This report is essential reading for investors, manufacturers, distributors, and anyone seeking to understand this dynamic and expanding market.

India Feminine Hygiene Market Market Structure & Competitive Landscape

The Indian feminine hygiene market is characterized by a moderately concentrated structure, with key players like Procter & Gamble, Unilever, and Essity AB holding significant market share. However, the market also witnesses the presence of numerous smaller players and startups, fostering competition and innovation. The market concentration ratio (CR4) is estimated at xx%, indicating a moderately competitive landscape. Innovation in product offerings, particularly in sustainable and eco-friendly options, is a key driver. Regulatory changes concerning product safety and labeling significantly influence market dynamics. Product substitutes, including reusable cloth pads and menstrual cups, are gaining traction, driven by environmental consciousness and cost-effectiveness. The market is segmented by end-users based on age, socioeconomic status, and geographic location. M&A activity in the sector has been moderate, with a few strategic acquisitions aiming to expand product portfolios and distribution networks. The volume of M&A deals in the past five years is estimated at xx.

- Market Concentration: Moderately concentrated, CR4 estimated at xx%

- Innovation Drivers: Sustainable products, technological advancements in absorbency and comfort

- Regulatory Impacts: Stringent safety and labeling regulations

- Product Substitutes: Reusable cloth pads, menstrual cups

- End-user Segmentation: Age, socioeconomic status, geographic location

- M&A Trends: Moderate activity, focusing on portfolio expansion and distribution reach

India Feminine Hygiene Market Market Trends & Opportunities

The India Feminine Hygiene Market is experiencing robust growth, driven by rising female literacy and awareness, increasing disposable incomes, and changing consumer preferences towards hygiene and comfort. The market size, valued at xx Million in 2025, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. This growth is fueled by a shift towards premium and technologically advanced products, including biodegradable sanitary napkins and innovative menstrual cups. Consumer preference is shifting towards convenient and discreet options, driving the growth of online retail channels. The market penetration rate for modern feminine hygiene products is still relatively low, presenting significant untapped potential, particularly in rural areas. Competitive dynamics are marked by intense competition among established players and the emergence of innovative startups.

Dominant Markets & Segments in India Feminine Hygiene Market

The sanitary napkins/pads segment dominates the product type category, accounting for the largest market share due to high awareness and established distribution networks. However, the menstrual cup and other alternative segments are witnessing rapid growth due to increasing awareness regarding eco-friendliness and cost-effectiveness. Online retail channels are experiencing faster growth compared to traditional distribution channels due to increasing internet penetration and ease of access.

Key Growth Drivers:

- Urbanization: Increased disposable incomes and changing lifestyles

- Rising Awareness: Improved health education and media campaigns

- Technological Advancements: Introduction of innovative, eco-friendly, and comfortable products

- Government Initiatives: Policies promoting menstrual hygiene management

Dominant Segments:

- Product Type: Sanitary napkins/pads (dominates market share)

- Distribution Channel: Supermarkets/hypermarkets (largest share), followed by rapid growth in online retail.

India Feminine Hygiene Market Product Analysis

The Indian feminine hygiene market showcases diverse product innovations focused on improving comfort, absorbency, and sustainability. Sanitary napkins are witnessing advancements in materials and designs for enhanced comfort and leak protection. Menstrual cups, a growing segment, offer a reusable and eco-friendly alternative. Other products like menstrual discs and period underwear are emerging to provide consumers with a wider range of choices. Competitive advantages are driven by factors such as superior product quality, brand reputation, strong distribution networks, and effective marketing campaigns. Technological advancements lead to enhanced product features like improved absorbency, breathability, and eco-friendly materials. The market fit is strong for products catering to diverse consumer needs, preferences, and price points.

Key Drivers, Barriers & Challenges in India Feminine Hygiene Market

Key Drivers:

Rising disposable incomes, increasing female literacy and awareness, and government initiatives promoting menstrual hygiene management are significant growth drivers. Technological advancements in product design and manufacturing contribute to improved comfort and hygiene.

Key Challenges:

Limited access to sanitary products in rural areas, coupled with deeply rooted social stigma around menstruation, poses a significant challenge. Supply chain inefficiencies and fluctuating raw material prices impact profitability. Intense competition from established and emerging players necessitates continuous innovation and effective marketing strategies. Regulatory hurdles and stringent quality standards also present challenges for market players.

Growth Drivers in the India Feminine Hygiene Market Market

The growth of the India Feminine Hygiene Market is propelled by factors such as rising disposable incomes, particularly in urban areas, leading to increased spending on personal care products. Enhanced awareness campaigns promoting menstrual hygiene and improved sanitation facilities drive market expansion. Government initiatives supporting women's health and access to hygiene products are further bolstering growth. Technological advancements in product design, manufacturing processes, and distribution networks contribute significantly to market growth.

Challenges Impacting India Feminine Hygiene Market Growth

Significant barriers include the persistent social stigma surrounding menstruation, especially in rural areas, leading to restricted access to hygiene products. Uneven distribution networks hinder market penetration in remote regions. The high cost of premium products and a preference for cheaper alternatives, particularly in lower-income groups, creates a significant challenge. Supply chain complexities and the volatility of raw material prices add to the operational difficulties faced by companies.

Key Players Shaping the India Feminine Hygiene Market Market

- Edgewell Personal Care

- Essity AB

- Unicharm Corporation

- Unilever PLC

- Redcliffe Hygiene Pvt Ltd

- Johnson & Johnson Private Limited

- Procter & Gamble Company

- Wet and Dry Personal Care Pvt Ltd

- Tzmo SA

- Kimberly Clark Corporation

Significant India Feminine Hygiene Market Industry Milestones

- Oct 2021: Niine Hygiene and Personal Care launched a period tracking app and WhatsApp Store Locator service, enhancing product accessibility.

- Sep 2021: Launch of reusable, eco-friendly cloth-based sanitary napkins under the "Uday" project.

- Mar 2021: Care Form Labs launched the "Onpery Menstrual Cup," the first novel menstrual cup designed in India.

Future Outlook for India Feminine Hygiene Market Market

The future of the India Feminine Hygiene Market is exceptionally promising, driven by continued economic growth, increasing urbanization, and rising awareness levels. Strategic opportunities exist in expanding distribution networks to reach underserved rural populations, introducing innovative and sustainable products, and leveraging digital marketing channels. The market potential is immense, with substantial growth expected across all segments, particularly in menstrual cups and other eco-friendly alternatives. Addressing challenges like affordability and accessibility will be crucial for maximizing market growth and ensuring inclusive access to hygiene products.

India Feminine Hygiene Market Segmentation

-

1. Product Type

- 1.1. Sanitary Napkins/Pads

- 1.2. Tampons

- 1.3. Menstrual Cups

- 1.4. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

India Feminine Hygiene Market Segmentation By Geography

- 1. India

India Feminine Hygiene Market Regional Market Share

Geographic Coverage of India Feminine Hygiene Market

India Feminine Hygiene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Technological Evolutions and Increasing Penetration of Brands in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Feminine Hygiene Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sanitary Napkins/Pads

- 5.1.2. Tampons

- 5.1.3. Menstrual Cups

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Edgewell Personal Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Essity AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unicharm Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Unilever PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Redcliffe Hygiene Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson & Johnson Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Procter & Gamble Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wet and Dry Personal Care Pvt Ltd*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tzmo SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kimberly Clark Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Edgewell Personal Care

List of Figures

- Figure 1: India Feminine Hygiene Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Feminine Hygiene Market Share (%) by Company 2025

List of Tables

- Table 1: India Feminine Hygiene Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Feminine Hygiene Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Feminine Hygiene Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Feminine Hygiene Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: India Feminine Hygiene Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Feminine Hygiene Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Feminine Hygiene Market?

The projected CAGR is approximately 14.85%.

2. Which companies are prominent players in the India Feminine Hygiene Market?

Key companies in the market include Edgewell Personal Care, Essity AB, Unicharm Corporation, Unilever PLC, Redcliffe Hygiene Pvt Ltd, Johnson & Johnson Private Limited, Procter & Gamble Company, Wet and Dry Personal Care Pvt Ltd*List Not Exhaustive, Tzmo SA, Kimberly Clark Corporation.

3. What are the main segments of the India Feminine Hygiene Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Cosmetics; Increasing Demand for Cruelty Free Cosmetics.

6. What are the notable trends driving market growth?

Technological Evolutions and Increasing Penetration of Brands in the Market.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

OCT 2021: By ramping up its plan to streamline its promotion and distribution of sanitary napkins, Niine Hygiene and Personal Care became the first company in India to launch a period tracking app developed in consultation with medical professionals. To streamline the process of making Niine Sanitary napkins accessible to its customers, the WhatsApp Store Locator service enables customers to find the closest store where Niine Sanitary Napkins are available.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Feminine Hygiene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Feminine Hygiene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Feminine Hygiene Market?

To stay informed about further developments, trends, and reports in the India Feminine Hygiene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence