Key Insights

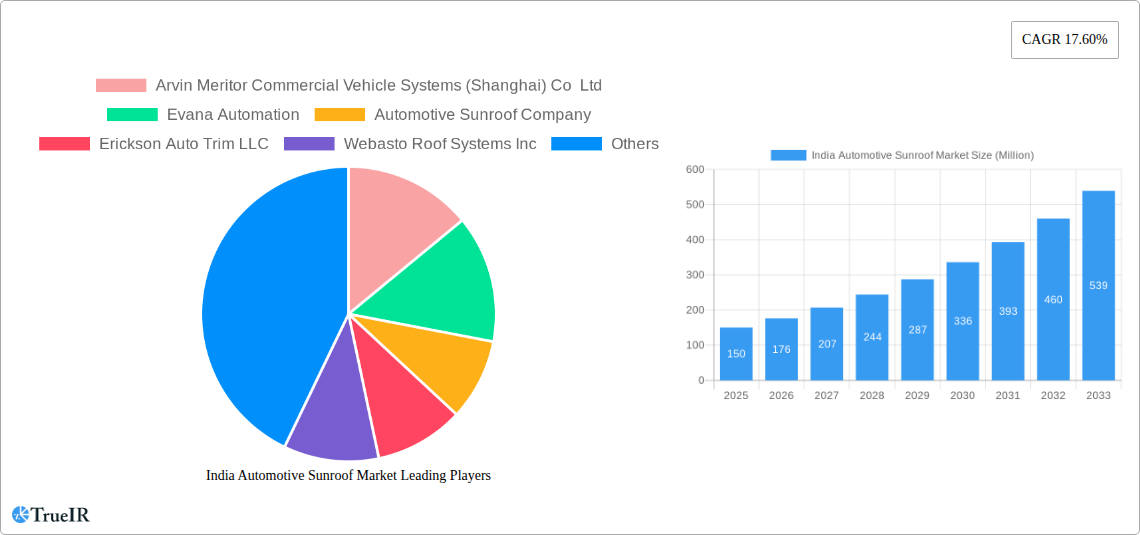

The India automotive sunroof market is experiencing robust growth, driven by rising disposable incomes, increasing vehicle ownership, particularly among younger demographics, and a preference for enhanced vehicle aesthetics and comfort features. The market's Compound Annual Growth Rate (CAGR) of 17.60% from 2019 to 2024 indicates significant expansion. The segmentation reveals a preference for glass sunroofs over fabric, aligning with trends towards premium features and improved insulation. While hatchback and sedan segments currently dominate, the Sports Utility Vehicle (SUV) segment is projected to witness accelerated growth, fueled by the increasing popularity of SUVs in India. Key players like Webasto, Inalfa, and domestic manufacturers are actively competing, leading to product innovation and competitive pricing. Regional variations exist, with southern and western India potentially showcasing higher adoption rates due to factors such as climate and higher per capita income. The market's expansion is further supported by the growing demand for technologically advanced sunroofs with features like tilt and slide mechanisms, panoramic views, and integration with smart vehicle systems. However, factors such as the relatively high cost of sunroofs compared to standard vehicle features and concerns about potential damage or maintenance could act as restraints. The forecast period (2025-2033) anticipates continued growth, driven by sustained consumer demand and the anticipated influx of new vehicle models incorporating sunroof features.

The future of the Indian automotive sunroof market appears bright, with substantial growth opportunities across all segments. Continued investment in R&D, focusing on innovative designs, advanced features, and cost-effective manufacturing, is likely to be crucial for sustained success. The market's strong growth trajectory is expected to attract further investments and collaborations between domestic and international players, fostering increased competition and innovation. Moreover, the government's focus on infrastructure development and the overall economic growth will continue to contribute positively to the market's trajectory, making it an attractive investment destination for stakeholders in the automotive industry. Strategic partnerships and targeted marketing campaigns will be essential for manufacturers to effectively reach potential customers and penetrate the different regional markets, leading to wider sunroof adoption across diverse vehicle types.

India Automotive Sunroof Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning India Automotive Sunroof Market, offering invaluable insights for stakeholders across the automotive value chain. Leveraging extensive research and data analysis from 2019-2024 (historical period), the report presents a robust estimate for 2025 (base and estimated year) and a detailed forecast spanning 2025-2033 (forecast period). The study period covers 2019-2033. This report is crucial for understanding market trends, competitive dynamics, and future growth opportunities in this rapidly expanding sector.

India Automotive Sunroof Market Market Structure & Competitive Landscape

The Indian automotive sunroof market exhibits a moderately concentrated structure. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately competitive landscape. Key drivers for innovation include increasing consumer demand for premium features, technological advancements in sunroof materials and mechanisms (e.g., panoramic sunroofs, smart glass technology), and stringent safety regulations. Regulatory impacts, particularly concerning emissions and safety standards, are shaping product design and manufacturing processes. Direct substitutes include conventional sunshades and aftermarket sunroof installations. The end-user segment is primarily driven by passenger vehicle manufacturers (hatchbacks, sedans, SUVs), with a growing contribution from the commercial vehicle segment. M&A activity in the period 2019-2024 witnessed xx deals, primarily focused on expanding geographic reach and technological capabilities. This activity is expected to accelerate in the forecast period due to increasing market consolidation.

- Market Concentration: HHI (2025): xx

- Innovation Drivers: Premiumization, Technological advancements, Safety Regulations

- M&A Activity (2019-2024): xx deals

India Automotive Sunroof Market Market Trends & Opportunities

The Indian automotive sunroof market is experiencing robust growth, driven by rising disposable incomes, increasing vehicle sales, and shifting consumer preferences toward premium vehicle features. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is fueled by technological advancements, including the introduction of panoramic sunroofs and electrically operated sunshades, enhancing convenience and luxury. Consumer preference is steadily shifting towards larger sunroof sizes and integrated functionalities. Intense competition among sunroof manufacturers is leading to product differentiation through innovative designs, improved durability, and enhanced features. Market penetration rates for sunroofs in passenger vehicles are expected to increase significantly, from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in India Automotive Sunroof Market

The SUV segment dominates the Indian automotive sunroof market, accounting for xx% of total sales in 2025, followed by sedans (xx%) and hatchbacks (xx%). The glass sunroof type holds the largest market share (xx%), surpassing fabric sunroofs (xx%) due to its superior durability, aesthetics, and thermal insulation.

Key Growth Drivers (SUV Segment):

- Rising demand for premium SUVs

- Increasing purchasing power

- Growing popularity of lifestyle vehicles

Key Growth Drivers (Glass Sunroofs):

- Superior aesthetics and durability

- Enhanced thermal insulation

- Growing preference for advanced features

The Southern and Western regions of India are witnessing the highest growth rates due to robust economic development and increasing vehicle ownership.

India Automotive Sunroof Market Product Analysis

Product innovation in the Indian automotive sunroof market is focused on enhancing functionalities, improving aesthetics, and optimizing cost-effectiveness. Technological advancements include the incorporation of smart glass technology, providing features like automatic dimming and thermal control. Sunroof designs are increasingly integrated with vehicle aesthetics, creating seamless and stylish designs. Competitive advantages are derived from superior manufacturing capabilities, efficient supply chains, and innovative product features catering to specific regional preferences.

Key Drivers, Barriers & Challenges in India Automotive Sunroof Market

Key Drivers: Rising disposable incomes, increasing urbanization, growing preference for premium vehicle features, technological advancements, and favorable government policies supporting the automotive industry.

Challenges: Supply chain disruptions (particularly related to raw materials), stringent safety and emission regulations increasing manufacturing costs, and intense competition from both domestic and international players resulting in price pressure. Import duties and tariffs also add to the cost of imported components.

Growth Drivers in the India Automotive Sunroof Market Market

The market growth is driven by factors like increasing demand for luxury vehicles, technological advancements leading to innovative sunroof designs, and government initiatives promoting the growth of the automotive sector in India.

Challenges Impacting India Automotive Sunroof Market Growth

Challenges include the high cost of advanced sunroof technologies, fluctuations in raw material prices, and intense competition from existing and new market entrants.

Key Players Shaping the India Automotive Sunroof Market Market

- Arvin Meritor Commercial Vehicle Systems (Shanghai) Co Ltd

- Evana Automation

- Automotive Sunroof Company

- Erickson Auto Trim LLC

- Webasto Roof Systems Inc

- Mitsuba Corp

- Inalfa Roof Systems Group

- Prestige Sunroof

- Yachiyo Industry Co Ltd

- Shanghai Wanchao Car Sunroof Co Ltd

- ACS France SAS

- Inteva Products

- Retro Vehicle Enhancement Ltd

Significant India Automotive Sunroof Market Industry Milestones

- 2020: Introduction of the first domestically manufactured panoramic sunroof by [Company Name].

- 2022: Implementation of stricter safety standards for automotive sunroofs by the Indian government.

- 2023: Strategic partnership between [Company A] and [Company B] to enhance sunroof manufacturing capabilities. (More milestones to be added as data becomes available).

Future Outlook for India Automotive Sunroof Market Market

The India automotive sunroof market is poised for significant growth over the next decade. Continued economic growth, increasing vehicle sales, and the rising popularity of premium vehicle features will drive demand. Strategic partnerships, technological advancements, and government support will further propel market expansion. Opportunities exist for manufacturers to focus on innovative product design, cost optimization, and expansion into untapped market segments.

India Automotive Sunroof Market Segmentation

-

1. Type

- 1.1. Glass

- 1.2. Fabric

-

2. Vehicle Type

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. Sports Utility Vehicle

- 2.4. Others

India Automotive Sunroof Market Segmentation By Geography

- 1. India

India Automotive Sunroof Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strict Government Regulations to Adopt Fire Safety Standards

- 3.3. Market Restrains

- 3.3.1. High Purchase and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Decreasing Passenger Car Vehicles During H1 2019

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Glass

- 5.1.2. Fabric

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. Sports Utility Vehicle

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automotive Sunroof Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Arvin Meritor Commercial Vehicle Systems (Shanghai) Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Evana Automation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Automotive Sunroof Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Erickson Auto Trim LLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Webasto Roof Systems Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsuba Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Inalfa Roof Systems Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Prestige Sunroof

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Yachiyo Industry Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Shanghai Wanchao Car Sunroof Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ACS France SAS

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Inteva Products

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Retro Vehicle Enhancement Ltd

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Arvin Meritor Commercial Vehicle Systems (Shanghai) Co Ltd

List of Figures

- Figure 1: India Automotive Sunroof Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automotive Sunroof Market Share (%) by Company 2024

List of Tables

- Table 1: India Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automotive Sunroof Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Automotive Sunroof Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 4: India Automotive Sunroof Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automotive Sunroof Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automotive Sunroof Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automotive Sunroof Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automotive Sunroof Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automotive Sunroof Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Automotive Sunroof Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 12: India Automotive Sunroof Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automotive Sunroof Market?

The projected CAGR is approximately 17.60%.

2. Which companies are prominent players in the India Automotive Sunroof Market?

Key companies in the market include Arvin Meritor Commercial Vehicle Systems (Shanghai) Co Ltd, Evana Automation, Automotive Sunroof Company, Erickson Auto Trim LLC, Webasto Roof Systems Inc, Mitsuba Corp, Inalfa Roof Systems Group, Prestige Sunroof, Yachiyo Industry Co Ltd, Shanghai Wanchao Car Sunroof Co Ltd, ACS France SAS, Inteva Products, Retro Vehicle Enhancement Ltd.

3. What are the main segments of the India Automotive Sunroof Market?

The market segments include Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Strict Government Regulations to Adopt Fire Safety Standards.

6. What are the notable trends driving market growth?

Decreasing Passenger Car Vehicles During H1 2019.

7. Are there any restraints impacting market growth?

High Purchase and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automotive Sunroof Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automotive Sunroof Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automotive Sunroof Market?

To stay informed about further developments, trends, and reports in the India Automotive Sunroof Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence