Key Insights

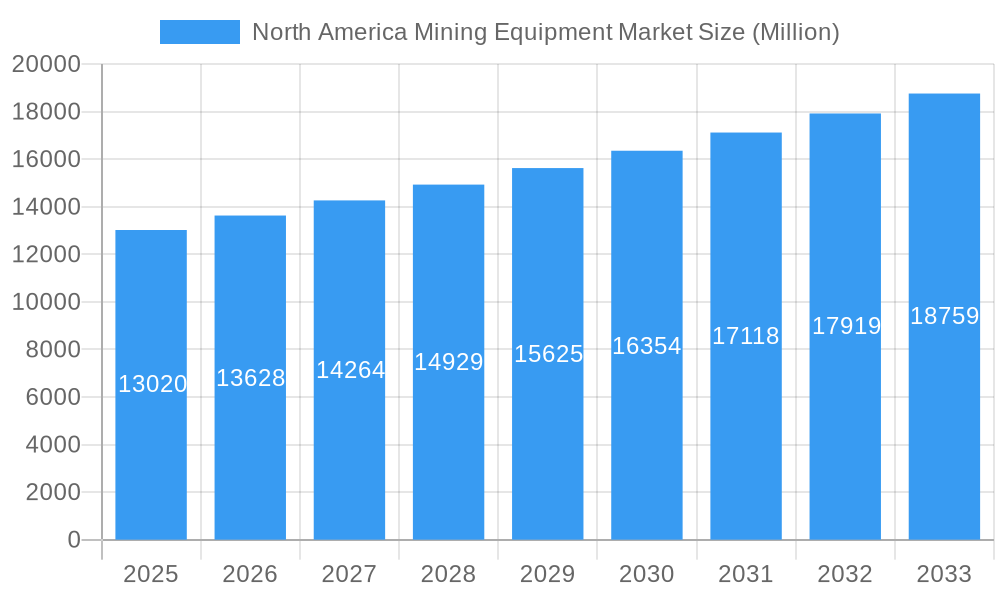

The North American mining equipment market, valued at $13.02 billion in 2025, is projected to experience robust growth, driven by increasing demand for minerals and metals fueled by infrastructure development and the burgeoning electric vehicle sector. The market's Compound Annual Growth Rate (CAGR) of 4.58% from 2025 to 2033 indicates a steady expansion, with significant contributions anticipated from surface mining, underground mining, and mineral processing equipment segments. The United States, being a major consumer of mining equipment and a key player in resource extraction, will dominate the regional market. Canada's robust mining sector also contributes significantly to the overall growth, particularly in metal and mineral mining applications. Technological advancements, such as automation and digitalization, are key trends enhancing efficiency and productivity within mining operations, further propelling market growth. However, regulatory hurdles concerning environmental protection and worker safety, along with fluctuating commodity prices, pose potential restraints. Leading market players, including Metso Corporation, Liebherr Group, and Caterpillar Inc., are strategically investing in research and development to meet evolving industry demands and maintain their market positions. The forecast period (2025-2033) suggests a continued upward trajectory, driven by sustained infrastructure investment and the ongoing transition towards sustainable mining practices.

North America Mining Equipment Market Market Size (In Billion)

Further market analysis reveals a significant role for specific equipment types. The demand for surface mining equipment is expected to remain strong, driven by large-scale open-pit mining operations. Underground mining equipment will experience growth, albeit potentially at a slightly slower pace than surface mining, owing to the complexity and higher costs associated with underground operations. Mineral processing equipment is expected to witness substantial growth, driven by the need for enhanced mineral recovery and efficiency in processing plants. Metal mining will continue to be a major driver, supported by the growing demand for various metals used in industrial and technological applications. However, the coal mining segment may experience more moderate growth, due to the global shift towards renewable energy sources. Overall, the North American mining equipment market presents a lucrative opportunity for both established players and new entrants, emphasizing the need for adaptation and innovation to navigate the dynamic industry landscape.

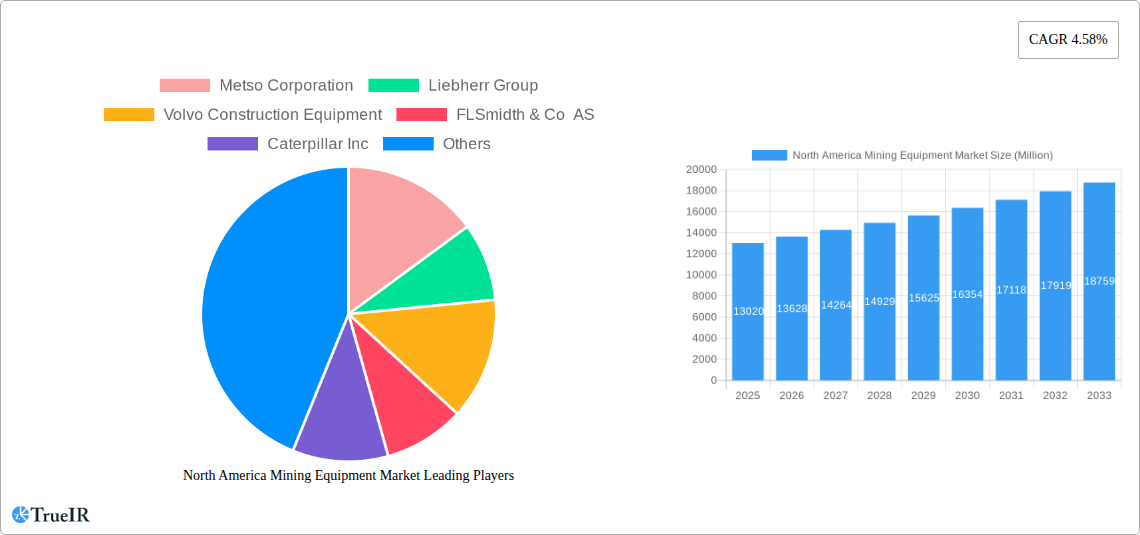

North America Mining Equipment Market Company Market Share

North America Mining Equipment Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the North America mining equipment market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Analyzing the market from 2019 to 2033, with a focus on 2025, this research unveils key trends, growth drivers, and challenges shaping this vital sector. The report encompasses a comprehensive analysis across various segments, including equipment types, applications, and geographical regions, providing a granular understanding of market dynamics. Expect detailed analysis of major players like Metso Corporation, Liebherr Group, Volvo Construction Equipment, FLSmidth & Co AS, Caterpillar Inc, RDH-Scharf, Komatsu Ltd, Mining Equipment Limited, SANY Group, and Terex Corporation, along with a forecast highlighting lucrative opportunities and potential market disruptions. The report's findings are supported by extensive quantitative and qualitative data, making it an indispensable resource for navigating the complexities of the North American mining equipment landscape.

North America Mining Equipment Market Structure & Competitive Landscape

The North American mining equipment market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a competitive yet consolidated landscape. Innovation plays a crucial role, with companies investing heavily in automation, digitalization, and sustainable technologies to enhance efficiency and reduce operational costs. Stringent environmental regulations and safety standards significantly impact market dynamics, driving the adoption of eco-friendly equipment and advanced safety features. Product substitutes, such as alternative excavation methods or recycling initiatives, pose a moderate competitive threat, especially in certain mining applications. The market is segmented primarily by end-users, including metal mining (xx Million), mineral mining (xx Million), and coal mining (xx Million) sectors.

The market has witnessed several significant mergers and acquisitions (M&A) in recent years. The total value of M&A transactions between 2019 and 2024 is estimated at xx Million. This trend reflects strategic consolidation within the industry and a focus on expanding market reach and technological capabilities. Further, the market is characterized by:

- High capital expenditure: Significant upfront investment is required for mining equipment, creating a barrier to entry for new players.

- Long-term contracts: Many mining companies engage in long-term contracts with equipment suppliers, creating stable revenue streams but also limiting flexibility.

- Technological advancements: Continuous advancements in automation, remote operation, and data analytics are reshaping the competitive landscape.

North America Mining Equipment Market Trends & Opportunities

The North America mining equipment market is poised for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size in 2025 is estimated at xx Million, expected to reach xx Million by 2033. Technological advancements, such as the integration of Artificial Intelligence (AI) and Internet of Things (IoT) technologies in mining equipment, are driving increased efficiency and productivity. The growing demand for sustainable mining practices is boosting the adoption of electric and hybrid equipment, while autonomous haulage systems are gaining traction, enhancing safety and reducing labor costs. Market penetration rates for these technologies are still relatively low, offering considerable growth potential.

Consumer preferences are shifting toward equipment offering enhanced safety features, improved fuel efficiency, and reduced environmental impact. The competitive dynamics are characterized by intense rivalry among established players, ongoing innovation, and a focus on strategic partnerships to gain access to new technologies and markets. The market's evolution is driven by:

- Increasing demand for metals and minerals fueled by infrastructure development and technological advancements.

- Growing emphasis on enhancing operational efficiency and reducing environmental footprint.

- Strategic acquisitions and partnerships to leverage technological capabilities and expand market reach.

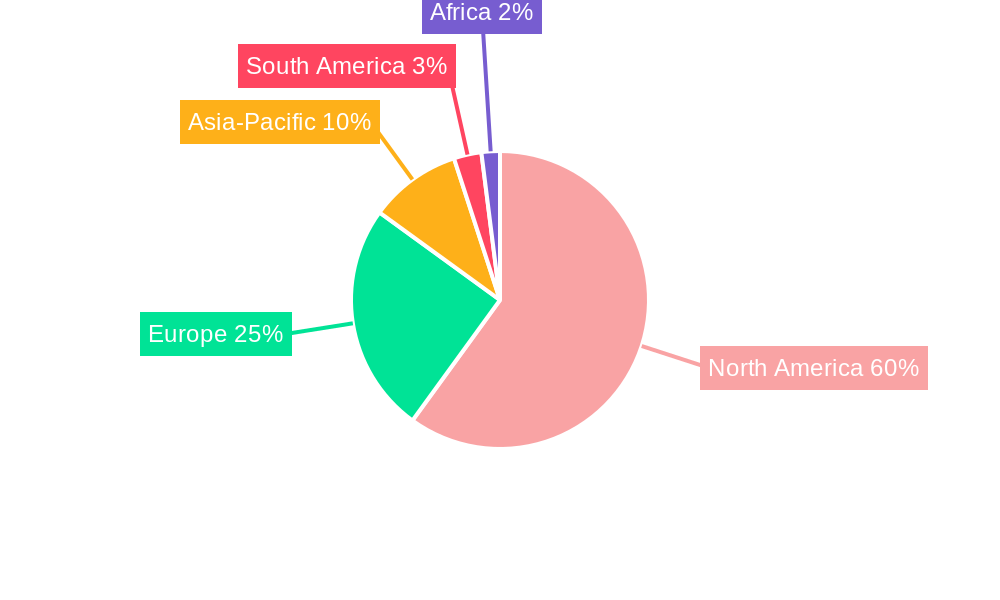

Dominant Markets & Segments in North America Mining Equipment Market

The United States dominates the North American mining equipment market, accounting for approximately xx% of the total market value in 2025. Canada holds the second-largest market share, followed by the Rest of North America. Among equipment types, Surface Mining Equipment commands the largest share, driven by the prevalence of open-pit mining operations. However, Underground Mining Equipment is also experiencing significant growth, propelled by investments in deep-mine projects. The Metal Mining segment dominates the application-based classification, reflecting the robust demand for metals used in various industries.

Key Growth Drivers:

- United States: Robust infrastructure development projects, significant investments in mining operations, and technological advancements.

- Canada: Abundance of mineral resources, government support for mining activities, and ongoing exploration initiatives.

- Surface Mining Equipment: High efficiency, adaptability to various mining conditions, and lower operational costs compared to underground methods.

- Metal Mining: Strong demand for metals across several sectors, including construction, automotive, and electronics.

North America Mining Equipment Market Product Analysis

Recent product innovations focus on enhancing automation, connectivity, and sustainability. Autonomous haulage systems, remote-controlled equipment, and advanced sensor technologies are improving efficiency, safety, and operational precision. The market is witnessing a significant shift towards electric and hybrid equipment, driven by environmental concerns and the need to reduce carbon footprints. These advancements are enhancing the market fit of mining equipment by improving productivity, reducing costs, and minimizing environmental impact, thereby increasing the overall competitiveness of the industry.

Key Drivers, Barriers & Challenges in North America Mining Equipment Market

Key Drivers:

The North American mining equipment market is primarily driven by increasing demand for minerals and metals globally, fueled by infrastructure development and industrialization. Furthermore, technological advancements in automation, digitization, and sustainable mining practices are enhancing operational efficiency and productivity, boosting market growth. Government initiatives promoting sustainable mining and investments in infrastructure further stimulate market expansion.

Challenges & Restraints:

Significant challenges include volatile commodity prices, fluctuating demand, and supply chain disruptions that can impact production and delivery timelines. Stringent environmental regulations and safety standards increase production costs and compliance complexities. Intense competition among established players and the emergence of new technologies also create pressure on margins and profitability. These factors, alongside potential labor shortages, collectively influence the market's trajectory.

Growth Drivers in the North America Mining Equipment Market

Several factors propel market growth, including increased mining activities, technological innovation (automation, AI), and supportive government policies promoting sustainable mining practices. The rise of electric and autonomous vehicles fuels demand for battery metals, further stimulating investment in mining equipment. Infrastructure development and the growing demand for critical minerals used in renewable energy and electronics technologies also contribute significantly.

Challenges Impacting North America Mining Equipment Market Growth

Challenges include volatile commodity prices and potential supply chain disruptions. Stringent environmental regulations and the need for skilled labor can also impact market growth. Additionally, intense competition among established players and high initial capital investment required for advanced equipment could pose obstacles.

Key Players Shaping the North America Mining Equipment Market Market

- Metso Corporation

- Liebherr Group

- Volvo Construction Equipment

- FLSmidth & Co AS

- Caterpillar Inc

- RDH-Scharf

- Komatsu Ltd

- Mining Equipment Limited

- SANY Group

- Terex Corporation

Significant North America Mining Equipment Market Industry Milestones

- January 2023: Sandvik wins a mining equipment order in Canada from New Gold, a Canadian gold mining company. This highlights the ongoing demand for advanced mining equipment in the Canadian gold mining sector.

- June 2022: Komatsu's acquisition of Mine Site Technologies signifies a strategic move towards enhancing connectivity and digitalization within underground mining operations, driving efficiency and safety improvements.

- March 2022: Hitachi Construction Machinery Americas' launch of new machines and technologies focused on reducing operational costs and promoting sustainable practices reflects the increasing industry focus on environmental responsibility and optimized resource utilization.

Future Outlook for North America Mining Equipment Market

The North American mining equipment market is expected to experience sustained growth, driven by increasing demand for minerals and metals, technological advancements, and a focus on sustainable mining practices. Strategic investments in automation, digitization, and the development of eco-friendly equipment will create significant opportunities for market expansion. The continued exploration and development of new mining projects, coupled with infrastructure investments, are expected to fuel demand for advanced mining equipment in the coming years. The market's future is bright, promising significant opportunities for both established players and innovative newcomers.

North America Mining Equipment Market Segmentation

-

1. Type

- 1.1. Surface Mining Equipment

- 1.2. Underground Mining Equipment

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

North America Mining Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Mining Equipment Market Regional Market Share

Geographic Coverage of North America Mining Equipment Market

North America Mining Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing use of Electric Machinery in Mining

- 3.3. Market Restrains

- 3.3.1. Stringent Government Policies Might Hinder the Growth of the Market for Equipment

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Surface Mining Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mining Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining Equipment

- 5.1.2. Underground Mining Equipment

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Metso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo Construction Equipment

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FLSmidth & Co AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Caterpillar Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RDH-Scharf*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Komatsu Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mining Equipment Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SANY Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Terex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Metso Corporation

List of Figures

- Figure 1: North America Mining Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Mining Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Mining Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Mining Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Mining Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Mining Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Mining Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Mining Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mining Equipment Market?

The projected CAGR is approximately 4.58%.

2. Which companies are prominent players in the North America Mining Equipment Market?

Key companies in the market include Metso Corporation, Liebherr Group, Volvo Construction Equipment, FLSmidth & Co AS, Caterpillar Inc, RDH-Scharf*List Not Exhaustive, Komatsu Ltd, Mining Equipment Limited, SANY Group, Terex Corporation.

3. What are the main segments of the North America Mining Equipment Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing use of Electric Machinery in Mining.

6. What are the notable trends driving market growth?

Increasing Demand for Surface Mining Equipment.

7. Are there any restraints impacting market growth?

Stringent Government Policies Might Hinder the Growth of the Market for Equipment.

8. Can you provide examples of recent developments in the market?

January 2023: Sandvik wins mining equipment order in Canada from the Canadian gold mining company New Gold.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mining Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mining Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mining Equipment Market?

To stay informed about further developments, trends, and reports in the North America Mining Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence