Key Insights

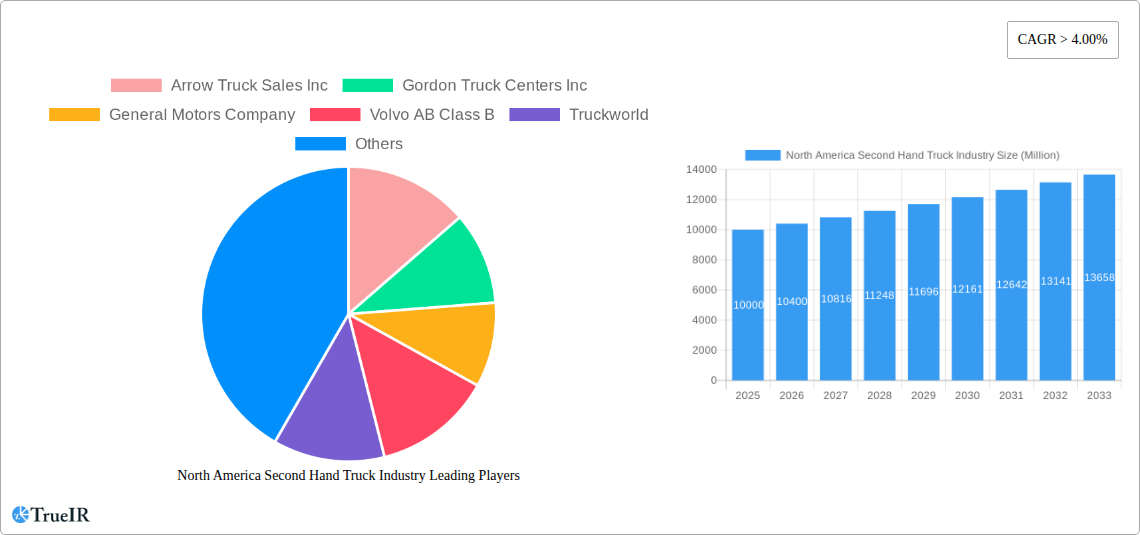

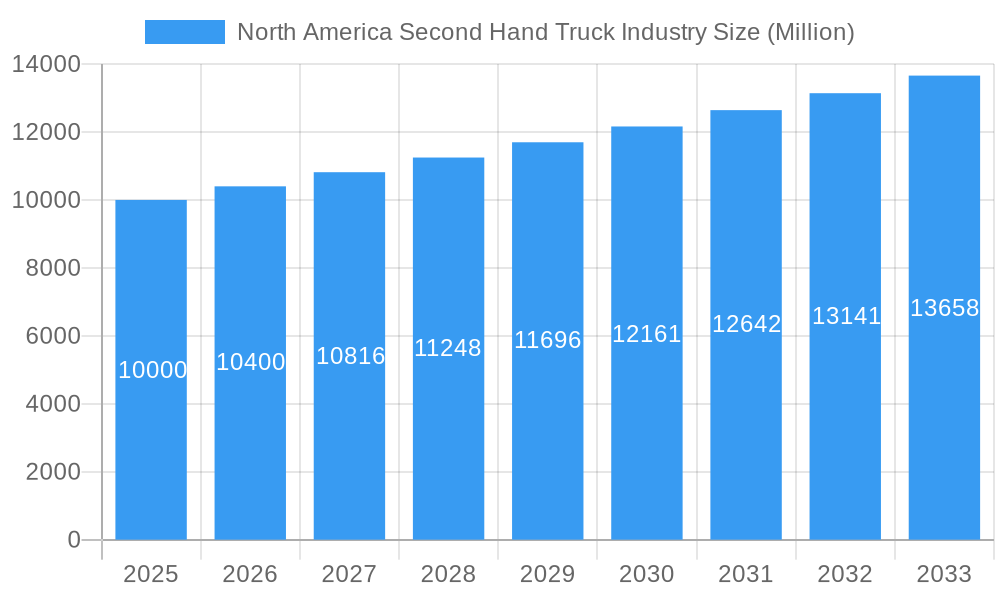

The North American used truck market, projected to reach $16103.28 million by 2024, is poised for significant expansion. The market is forecast to grow at a compound annual growth rate (CAGR) of 7.2% between 2024 and 2033. This growth is propelled by several key factors. Increasing demand for cost-effective transportation solutions across logistics, construction, and retail sectors drives the need for pre-owned trucks. Fluctuating new truck prices and extended lead times also steer businesses towards the used truck market for immediate availability. Furthermore, advancements in used truck refurbishment and maintenance are enhancing vehicle reliability and extending lifespans, boosting buyer confidence. Market segmentation shows robust demand across light-duty, medium-duty, and heavy-duty truck categories, with growth rates influenced by specific economic conditions and industry trends. Leading players such as Arrow Truck Sales, Gordon Truck Centers, and major manufacturers including General Motors and Volvo are actively contributing to market competitiveness.

North America Second Hand Truck Industry Market Size (In Billion)

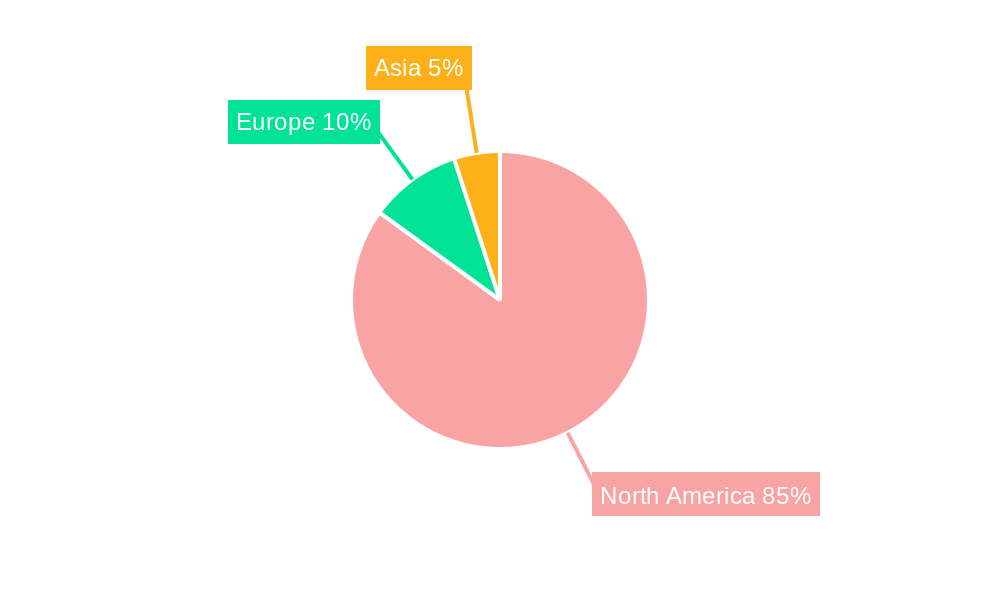

Within North America, the United States represents the largest market segment, followed by Canada and Mexico. Regional growth is significantly influenced by economic activity, infrastructure development, and government regulations. Despite strong growth prospects, the market faces challenges, including fuel price volatility and the broader economic climate. Evolving emission regulations and the increasing adoption of electric and alternative fuel vehicles may impact demand for specific used truck types. Nevertheless, the market's substantial growth potential presents an attractive opportunity for investors and businesses. The forecast period, 2024-2033, anticipates continued expansion and dynamic evolution within the used truck industry.

North America Second Hand Truck Industry Company Market Share

North America Second Hand Truck Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America second-hand truck market, offering invaluable insights for businesses, investors, and policymakers. Covering the period from 2019 to 2033, with a focus on 2025, this study unveils the market's structure, competitive landscape, key trends, and future growth potential. The report utilizes rigorous data analysis and expert insights to forecast market dynamics and identify lucrative opportunities within this dynamic sector. The market size is projected to reach xx Million by 2033, showcasing significant growth potential.

North America Second Hand Truck Industry Market Structure & Competitive Landscape

The North American second-hand truck market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Arrow Truck Sales Inc, Gordon Truck Centers Inc, General Motors Company, Volvo AB Class B, Truckworld, Isuzu Motor Ltd, Paccar Inc, International Used Trucks, Ryder System Inc, and Ford Motor Company, compete intensely, driving innovation and shaping market dynamics. The market is influenced by several factors including:

- Innovation Drivers: Technological advancements in telematics, fuel efficiency, and emission control systems are reshaping the second-hand truck market, influencing pricing and demand.

- Regulatory Impacts: Stringent emission regulations and safety standards influence the lifespan and resale value of trucks, impacting the overall market size and composition.

- Product Substitutes: The availability of alternative transportation modes like rail and shipping exerts competitive pressure on the second-hand truck market.

- End-User Segmentation: The market caters to a diverse range of end-users, including logistics companies, construction firms, and small businesses, each with specific needs and preferences.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) activities is anticipated to continue, resulting in xx Million in M&A volume by 2033. This will further shape the competitive landscape and potentially increase market concentration.

North America Second Hand Truck Industry Market Trends & Opportunities

The North American second-hand truck market is experiencing robust growth, driven by a surge in e-commerce, infrastructure development, and fluctuating new truck prices. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Key market trends include:

- Market Size Growth: The market size is expected to experience significant growth, reaching xx Million by 2033. This growth is fueled by increased demand from various sectors.

- Technological Shifts: The adoption of telematics and other technologies is enhancing operational efficiency and increasing the value of used trucks.

- Consumer Preferences: Buyers are increasingly prioritizing fuel efficiency, safety features, and maintenance history when selecting second-hand trucks.

- Competitive Dynamics: The market is characterized by intense competition, with companies vying for market share through pricing strategies, product differentiation, and service offerings. Market penetration rates for key players are expected to evolve significantly during the forecast period.

Dominant Markets & Segments in North America Second Hand Truck Industry

The heavy-duty truck segment dominates the North American second-hand truck market, accounting for xx% of the total market value in 2025. This dominance is primarily driven by the high demand from the logistics and transportation sectors.

- Key Growth Drivers in Heavy-Duty Segment:

- Robust Logistics Sector: The flourishing e-commerce industry and associated last-mile delivery requirements fuel demand.

- Infrastructure Development: Government investments in infrastructure projects necessitate the use of heavy-duty trucks.

- Favorable Government Policies: Tax incentives and subsidies related to vehicle replacement contribute to market growth.

The United States remains the largest market within North America, followed by Canada and Mexico. Regional variations are observed in terms of vehicle type preferences and market dynamics.

North America Second Hand Truck Industry Product Analysis

Technological advancements are significantly impacting the second-hand truck market. Advancements in engine technology, enhanced safety features, and telematics systems are increasing the demand for trucks with these features, leading to price differentiation based on technological integration. This also creates niche segments for trucks with specific functionalities attracting dedicated buyers. The market is witnessing a shift towards fuel-efficient and environmentally friendly vehicles, influencing buying decisions.

Key Drivers, Barriers & Challenges in North America Second Hand Truck Industry

Key Drivers:

- Growing E-commerce: The booming e-commerce sector fuels demand for efficient logistics solutions, driving up the demand for used trucks.

- Infrastructure Development: Ongoing infrastructure projects increase the need for heavy-duty trucks in construction and related sectors.

- Favorable Financing Options: Accessible financing options make used trucks more affordable for businesses.

Challenges & Restraints:

- Supply Chain Disruptions: Global supply chain bottlenecks impact the availability of parts and service, hindering the smooth functioning of the second-hand truck market.

- Emission Regulations: Stringent emission regulations increase the cost of maintaining and operating older trucks, impacting their resale value and demand. The estimated impact on market value by 2033 is xx Million.

- Economic Fluctuations: Economic downturns can severely impact demand, leading to market instability.

Growth Drivers in the North America Second Hand Truck Industry Market

The North America second-hand truck market is primarily driven by the escalating demand from various sectors and the growing preference for cost-effective transportation solutions. Technological advancements in fuel efficiency and safety features are further bolstering market growth. Government policies aimed at promoting sustainable transportation also contribute positively. Finally, readily available financing options play a key role in making used trucks accessible.

Challenges Impacting North America Second Hand Truck Industry Growth

Significant challenges impede the growth trajectory of this market. Stringent emission regulations necessitate continuous upgrades, impacting resale values. Economic fluctuations directly influence buying power. Supply chain disruptions, particularly the availability of spare parts, and intense competition within the market are other significant obstacles.

Key Players Shaping the North America Second Hand Truck Industry Market

- Arrow Truck Sales Inc

- Gordon Truck Centers Inc

- General Motors Company

- Volvo AB Class B

- Truckworld

- Isuzu Motor Ltd

- Paccar Inc

- International Used Trucks

- Ryder System Inc

- Ford Motor Company

Significant North America Second Hand Truck Industry Industry Milestones

- 2020, Q4: Increased adoption of telematics systems in used trucks.

- 2021, Q2: Several key players announced strategic partnerships to expand their service networks.

- 2022, Q3: Introduction of stricter emission regulations impacted the resale value of older trucks.

- 2023, Q1: Significant M&A activity reshaped the competitive landscape.

Future Outlook for North America Second Hand Truck Industry Market

The North America second-hand truck market is poised for continued growth, driven by sustained demand from various industries and technological advancements leading to more efficient and eco-friendly options. Strategic partnerships and further consolidation through M&A are expected, potentially leading to enhanced market efficiency and economies of scale. The market holds significant potential, with strategic opportunities emerging from the integration of new technologies and the expansion into new geographic regions.

North America Second Hand Truck Industry Segmentation

-

1. Vehicle Type

- 1.1. Light-duty Truck

- 1.2. Medium-duty Truck

- 1.3. Heavy-duty Truck

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Second Hand Truck Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Second Hand Truck Industry Regional Market Share

Geographic Coverage of North America Second Hand Truck Industry

North America Second Hand Truck Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sales of Electric Vehicles are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lack of Infrastructure May Hamper the growth of the Market

- 3.4. Market Trends

- 3.4.1. Heavy Duty Trucks will Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Light-duty Truck

- 5.1.2. Medium-duty Truck

- 5.1.3. Heavy-duty Truck

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. United States North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Light-duty Truck

- 6.1.2. Medium-duty Truck

- 6.1.3. Heavy-duty Truck

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Canada North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Light-duty Truck

- 7.1.2. Medium-duty Truck

- 7.1.3. Heavy-duty Truck

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Rest of North America North America Second Hand Truck Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Light-duty Truck

- 8.1.2. Medium-duty Truck

- 8.1.3. Heavy-duty Truck

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Arrow Truck Sales Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Gordon Truck Centers Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Motors Company

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Volvo AB Class B

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Truckworld

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Isuzu Motor Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Paccar Inc

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 International Used Trucks

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Ryder System Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Ford Motor Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Arrow Truck Sales Inc

List of Figures

- Figure 1: North America Second Hand Truck Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Second Hand Truck Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 3: North America Second Hand Truck Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 5: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 6: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 8: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 9: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Second Hand Truck Industry Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 11: North America Second Hand Truck Industry Revenue million Forecast, by Geography 2020 & 2033

- Table 12: North America Second Hand Truck Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Second Hand Truck Industry?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the North America Second Hand Truck Industry?

Key companies in the market include Arrow Truck Sales Inc, Gordon Truck Centers Inc, General Motors Company, Volvo AB Class B, Truckworld, Isuzu Motor Ltd, Paccar Inc, International Used Trucks, Ryder System Inc, Ford Motor Company.

3. What are the main segments of the North America Second Hand Truck Industry?

The market segments include Vehicle Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 16103.28 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sales of Electric Vehicles are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Heavy Duty Trucks will Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Infrastructure May Hamper the growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Second Hand Truck Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Second Hand Truck Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Second Hand Truck Industry?

To stay informed about further developments, trends, and reports in the North America Second Hand Truck Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence