Key Insights

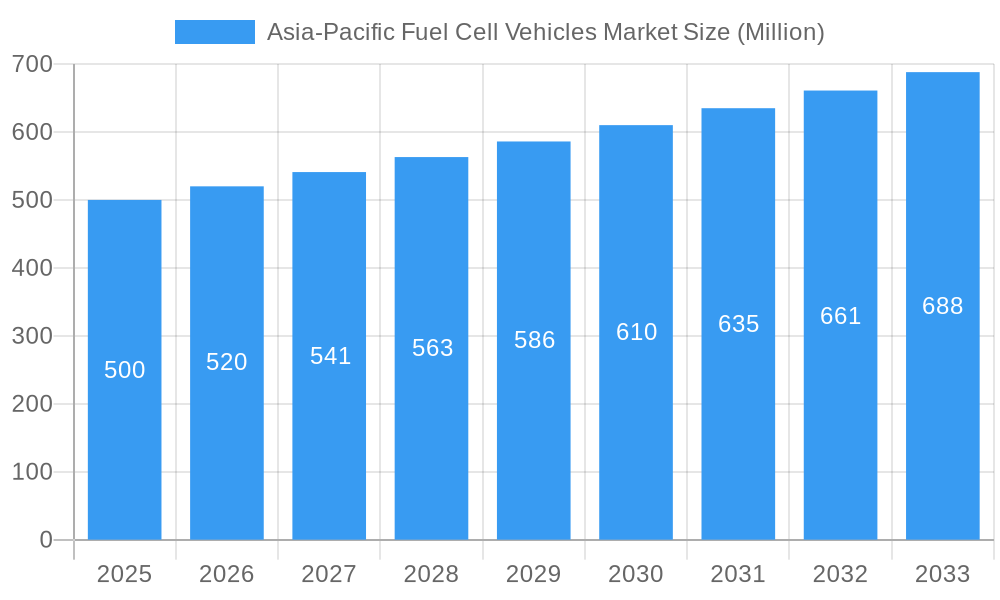

The Asia-Pacific Fuel Cell Vehicle (FCV) market is projected for significant expansion, propelled by robust government initiatives for clean transportation, escalating environmental consciousness, and advancements in fuel cell technology that enhance efficiency and reduce costs. The region's substantial population, developing economies, and growing automotive sector provide a favorable environment for FCV adoption. The market, currently in its early stages, is expected to achieve a Compound Annual Growth Rate (CAGR) of 3.4% between 2025 and 2033, indicating considerable future potential. Key growth catalysts include stringent emission regulations across numerous APAC nations, encouraging automakers to embrace cleaner alternatives, and a rise in consumer awareness regarding environmental sustainability. China, Japan, and South Korea are anticipated to spearhead market growth due to their established automotive industries, significant investments in FCV research and development, and progress in infrastructure development. Nevertheless, high initial vehicle costs, limited hydrogen refueling infrastructure, and technological hurdles concerning fuel cell durability and driving range remain prominent challenges.

Asia-Pacific Fuel Cell Vehicles Market Market Size (In Billion)

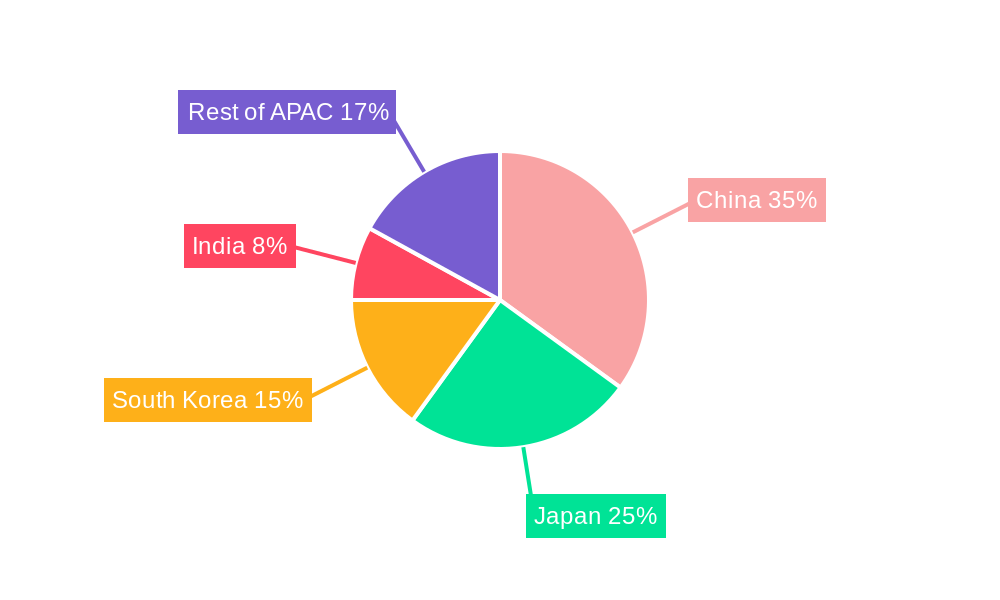

The market's segmentation by country within Asia-Pacific reveals diverse growth patterns. China's immense market scale and governmental support will drive substantial growth, followed by Japan, which benefits from its advanced technological capabilities. India and other Southeast Asian countries (Indonesia, Malaysia, Thailand) are expected to witness increasing adoption, albeit at a potentially slower initial pace due to infrastructural limitations. However, ongoing improvements in fuel cell technology, cost reductions, and the expansion of hydrogen infrastructure should accelerate market penetration in these regions. The active investment in FCV technology by major automotive manufacturers such as Toyota, Hyundai, and Honda further reinforces the market's long-term prospects. The period from 2025 to 2033 is critical for observing the transition from niche adoption to widespread market penetration as FCV technology and infrastructure challenges are progressively addressed.

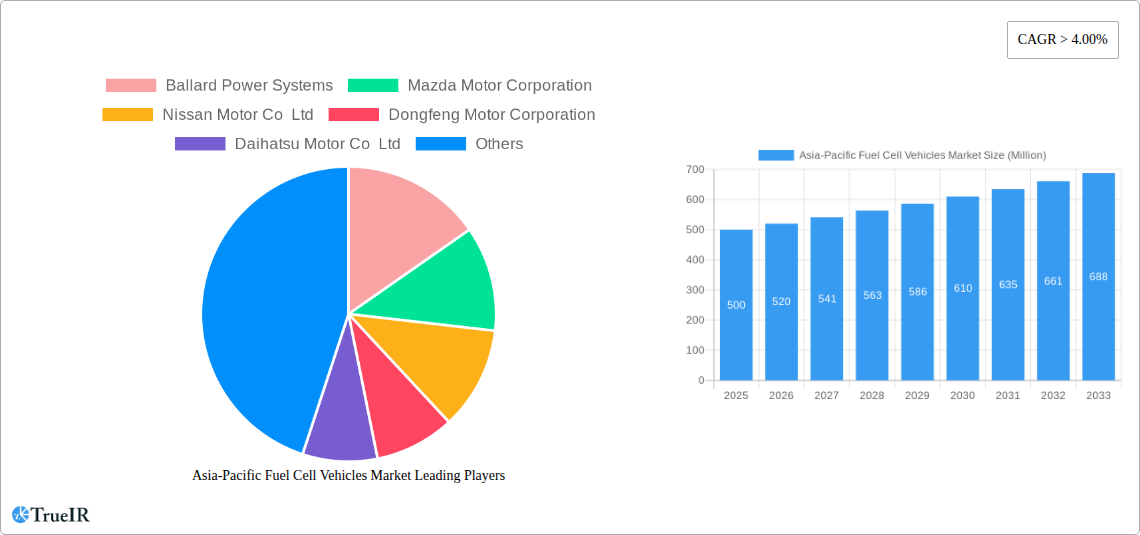

Asia-Pacific Fuel Cell Vehicles Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia-Pacific Fuel Cell Vehicles market, providing critical insights for industry stakeholders, investors, and researchers. Covering the period from 2019 to 2033, with a specific focus on 2025, this study meticulously examines market trends, competitive landscapes, and future growth opportunities. The report utilizes extensive data and analysis to deliver a clear understanding of this rapidly evolving sector. Expect detailed segmentation by country (Australia, China, India, Indonesia, Japan, Malaysia, South Korea, Thailand, Rest-of-APAC) and vehicle type (Commercial Vehicles), alongside profiles of leading players including Ballard Power Systems, Mazda Motor Corporation, and Nissan Motor Co Ltd. The estimated market size in 2025 is 4829.9 million.

Asia-Pacific Fuel Cell Vehicles Market Structure & Competitive Landscape

The Asia-Pacific fuel cell vehicle market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. Key players, including Ballard Power Systems, Mazda Motor Corporation, Nissan Motor Co Ltd, Dongfeng Motor Corporation, Daihatsu Motor Co Ltd, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Honda Motor Co Ltd, and Toyota Motor Corporation, drive innovation through continuous R&D investments and strategic partnerships. However, the market also sees participation from several smaller players and startups, fostering a dynamic competitive environment.

- Market Concentration: The HHI of xx indicates a moderately concentrated market, with potential for further consolidation through mergers and acquisitions (M&A).

- Innovation Drivers: Stringent emission regulations and government incentives are major drivers for technological advancements in fuel cell technology.

- Regulatory Impacts: Government policies, such as subsidies and tax benefits, significantly influence market growth and adoption.

- Product Substitutes: Battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs) represent the primary substitutes for fuel cell vehicles.

- End-User Segmentation: The market is segmented by commercial vehicles (e.g., buses, trucks) and passenger vehicles, with commercial vehicles expected to dominate in the forecast period due to their potential for longer driving ranges and faster refueling.

- M&A Trends: The Asia-Pacific region has witnessed xx M&A deals in the fuel cell vehicle sector between 2019 and 2024, signaling ongoing consolidation.

Asia-Pacific Fuel Cell Vehicles Market Trends & Opportunities

The Asia-Pacific fuel cell vehicle market is poised for significant growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during 2025-2033. This growth is driven by several key factors, including rising environmental concerns, supportive government policies, and technological advancements leading to improved fuel cell efficiency and reduced costs. Market penetration rates are expected to increase steadily, particularly in countries with robust infrastructure development and supportive regulations. Technological shifts towards more efficient and durable fuel cell stacks are attracting significant investment, fostering competition and driving innovation. Consumer preferences are shifting towards sustainable transportation solutions, creating a favorable market environment for fuel cell vehicles. However, challenges remain, including the high initial cost of fuel cell vehicles and the limited availability of hydrogen refueling infrastructure, limiting market penetration rates to xx% in 2025. Competition from BEVs also poses a significant challenge.

Dominant Markets & Segments in Asia-Pacific Fuel Cell Vehicles Market

Japan is expected to be the dominant market in the Asia-Pacific region for fuel cell vehicles during the forecast period due to its well-established automotive industry, extensive research and development in fuel cell technology, and a supportive government policy environment. China, although initially focused on battery electric vehicle (BEV) growth, is also steadily increasing its investments in fuel cell vehicle technology.

Key Growth Drivers in Japan:

- Robust Automotive Industry: Japan boasts a globally recognized automotive sector, which is actively involved in fuel cell technology development.

- Government Support: Significant government investment in R&D and infrastructure is propelling market growth.

- Technological Advancements: Japan is a leader in fuel cell technology, producing advanced and efficient fuel cell systems.

Key Growth Drivers in China:

- Government Initiatives: Increased government support and investments are attracting foreign and domestic players.

- Growing Infrastructure: Expansion of hydrogen refueling stations is facilitating broader adoption.

- Rising Environmental Awareness: Environmental concerns are motivating the government and consumers to adopt cleaner transportation options.

Other significant markets include South Korea and potentially India, while countries like Australia and Indonesia remain in the nascent stages of fuel cell vehicle adoption. The commercial vehicle segment is projected to exhibit stronger growth compared to the passenger vehicle segment, driven by the potential for longer range and faster refueling.

Asia-Pacific Fuel Cell Vehicles Market Product Analysis

Recent innovations in fuel cell technology have focused on increasing efficiency, durability, and reducing costs. Advancements in materials science and manufacturing processes have led to the development of more powerful and compact fuel cell stacks. These improvements are making fuel cell vehicles more competitive against traditional internal combustion engine vehicles and battery electric vehicles, particularly in applications requiring extended range and rapid refueling. The market is seeing the development of fuel cell systems tailored for various vehicle types and applications, from passenger cars to heavy-duty commercial vehicles and even stationary power generation.

Key Drivers, Barriers & Challenges in Asia-Pacific Fuel Cell Vehicles Market

Key Drivers:

- Stringent Emission Regulations: Governments in the region are implementing stricter emission standards, pushing the adoption of cleaner vehicles.

- Government Incentives: Subsidies, tax breaks, and other incentives are attracting investments and encouraging the uptake of fuel cell vehicles.

- Technological Advancements: Continuous improvements in fuel cell efficiency, durability, and cost-effectiveness are driving market growth.

Key Challenges:

- High Initial Costs: Fuel cell vehicles remain significantly more expensive than comparable internal combustion engine vehicles and battery electric vehicles.

- Limited Hydrogen Infrastructure: The lack of widespread hydrogen refueling infrastructure poses a significant barrier to adoption. This scarcity affects overall market penetration and poses a significant challenge to consumer adoption and widespread market acceptance. The existing infrastructure needs significant expansion and investment.

- Competition from BEVs: The rapid growth of the battery electric vehicle market creates intense competition for fuel cell vehicles.

Growth Drivers in the Asia-Pacific Fuel Cell Vehicles Market Market

The Asia-Pacific fuel cell vehicle market is driven primarily by the increasing focus on reducing greenhouse gas emissions, along with supportive government policies and technological advancements. Significant investments in research and development are leading to higher efficiency and lower costs for fuel cell systems, making them increasingly attractive compared to traditional internal combustion engines. Furthermore, the expanding hydrogen refueling infrastructure in key markets further incentivizes adoption and investment.

Challenges Impacting Asia-Pacific Fuel Cell Vehicles Market Growth

The high initial cost of fuel cell vehicles, coupled with the limited availability of hydrogen refueling infrastructure, poses significant challenges to market growth. Supply chain disruptions and potential volatility in hydrogen prices can also impact the long-term viability of the fuel cell vehicle market. Moreover, competition from established electric vehicle technologies requires continuous innovation and strategic partnerships to stay competitive.

Key Players Shaping the Asia-Pacific Fuel Cell Vehicles Market Market

- Ballard Power Systems

- Mazda Motor Corporation

- Nissan Motor Co Ltd

- Dongfeng Motor Corporation

- Daihatsu Motor Co Ltd

- Daimler AG (Mercedes-Benz AG)

- Hyundai Motor Company

- Honda Motor Co Ltd

- Toyota Motor Corporation

Significant Asia-Pacific Fuel Cell Vehicles Market Industry Milestones

- July 2023: Honda's next-generation fuel cell system makes its Chinese debut, signifying a major step in expanding the market into a key region. Its application across various sectors (fuel cell electric vehicles, commercial vehicles, fixed power supply, and engineering machinery) highlights its versatility.

- May 2023: The establishment of the "HySE" research body by Japanese motorcycle makers signals a commitment to advancing hydrogen technology in smaller mobility applications, expanding the potential market beyond larger vehicles.

- April 2023: Dongfeng Motor Corporation's (DFM) commitment to parallel technical routes (PHREV, battery electric, and hydrogen energy) underscores a diversified approach and strengthens its position in the new energy vehicle market. The development of its Qingzhou technology brand (20kW to 300kW) demonstrates the scaling of technology for diverse commercial vehicle needs.

Future Outlook for Asia-Pacific Fuel Cell Vehicles Market Market

The Asia-Pacific fuel cell vehicle market is expected to experience substantial growth over the forecast period, fueled by continuous technological advancements, supportive government policies, and a growing awareness of environmental sustainability. Strategic partnerships and investments in hydrogen infrastructure will be key to unlocking the market's full potential. The market is expected to see increasing competition and innovation, leading to more cost-effective and efficient fuel cell vehicles. The expansion into new segments and applications will further contribute to market growth.

Asia-Pacific Fuel Cell Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

-

1.1. Commercial Vehicles

Asia-Pacific Fuel Cell Vehicles Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Fuel Cell Vehicles Market Regional Market Share

Geographic Coverage of Asia-Pacific Fuel Cell Vehicles Market

Asia-Pacific Fuel Cell Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Fuel Cell Vehicles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ballard Power Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mazda Motor Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nissan Motor Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dongfeng Motor Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Daihatsu Motor Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daimler AG (Mercedes-Benz AG)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hyundai Motor Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Honda Motor Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporatio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ballard Power Systems

List of Figures

- Figure 1: Asia-Pacific Fuel Cell Vehicles Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Fuel Cell Vehicles Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Fuel Cell Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Asia-Pacific Fuel Cell Vehicles Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Fuel Cell Vehicles Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Asia-Pacific Fuel Cell Vehicles Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Fuel Cell Vehicles Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Fuel Cell Vehicles Market?

The projected CAGR is approximately 3.4%.

2. Which companies are prominent players in the Asia-Pacific Fuel Cell Vehicles Market?

Key companies in the market include Ballard Power Systems, Mazda Motor Corporation, Nissan Motor Co Ltd, Dongfeng Motor Corporation, Daihatsu Motor Co Ltd, Daimler AG (Mercedes-Benz AG), Hyundai Motor Company, Honda Motor Co Ltd, Toyota Motor Corporatio.

3. What are the main segments of the Asia-Pacific Fuel Cell Vehicles Market?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4829.9 million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

July 2023: Honda's next-generation fuel cell system makes its Chinese debut.It is mainly applied to fuel cell electric vehicles, commercial vehicles, fixed power supply, and engineering machinery.May 2023: Japanese motorcycle makers to establish research body “HySE” for development of hydrogen small mobility engines.April 2023: DFM has launched its development in the new energy field in 2021. In terms of platform development, it has built three electrified platforms. In terms of technology innovation, it adheres to the parallel technical routes of PHREV, battery electric, and hydrogen energy. In terms of hydrogen power R&D, it has established the Qingzhou technology brand, covering power from 20kW to 300kW and meeting the needs of various passenger and commercial vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Fuel Cell Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Fuel Cell Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Fuel Cell Vehicles Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Fuel Cell Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence