Key Insights

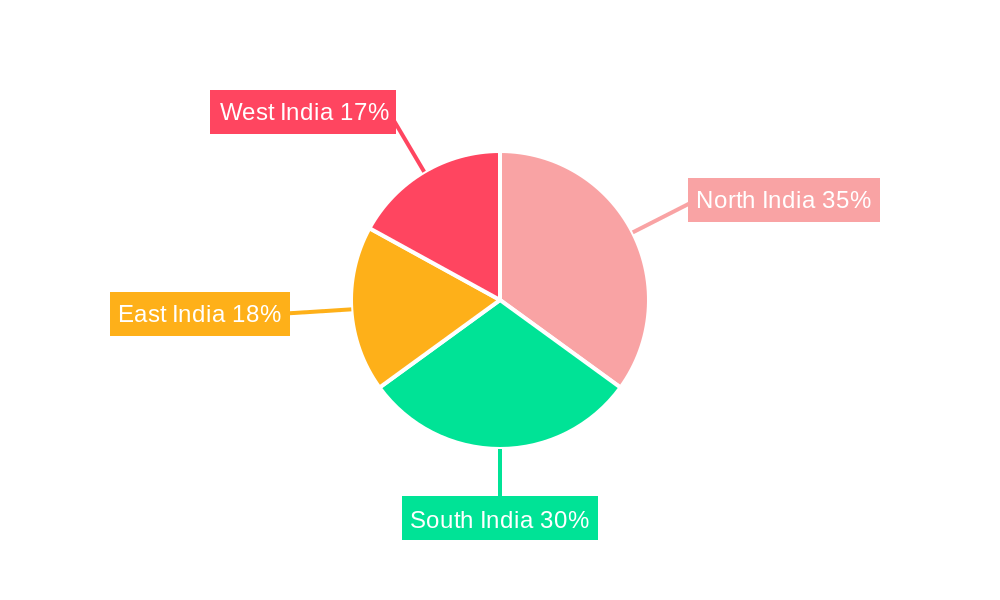

The India MICE (Meetings, Incentives, Conferences, Exhibitions) tourism sector is poised for significant expansion. Driven by India's robust economic growth and its emergence as a global business nexus, the industry is projected to achieve a Compound Annual Growth Rate (CAGR) of 5.2%. This upward trajectory is further supported by rising disposable incomes, a growing appetite for experiential travel, and government efforts to enhance infrastructure and simplify visa regulations. While localized infrastructure and seasonal factors present challenges, the overall outlook remains highly positive. The MICE industry's diverse segments—meetings, incentives, conferences, and exhibitions—offer multifaceted growth opportunities. A competitive yet dynamic market is characterized by established entities and specialized agencies, with North and South India leading in market share due to existing infrastructure and business concentration. Significant growth potential also exists in East and West India as economic development progresses.

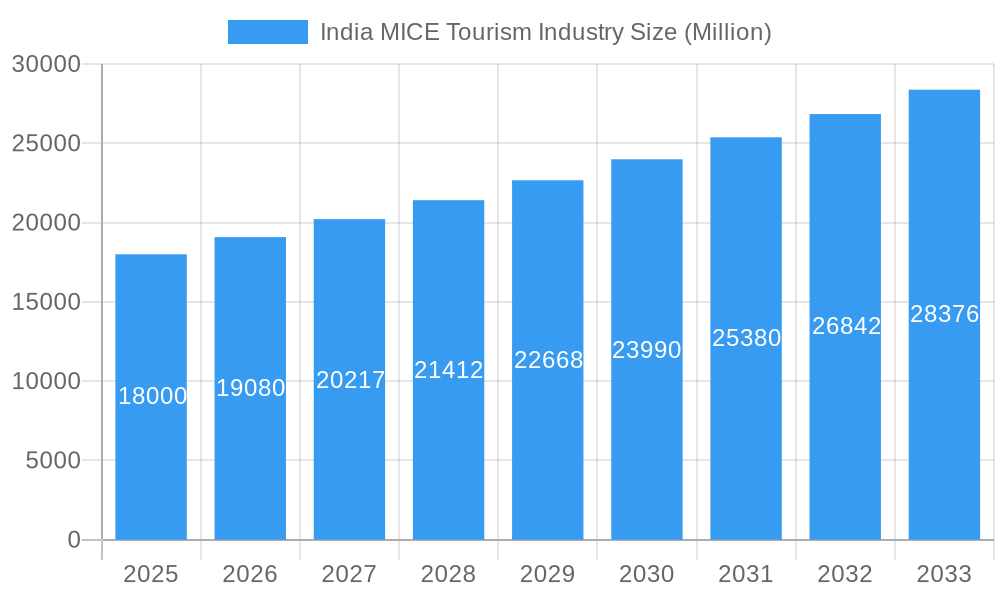

India MICE Tourism Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained MICE tourism growth in India. Expect market consolidation as larger players potentially acquire smaller ones. Innovations in event technology and sustainable practices will be critical for competitive advantage. Personalized experiences and niche market targeting will differentiate service providers. Industry growth is intrinsically tied to economic performance and infrastructure development. Strategic investments in infrastructure, especially in less-developed regions, will unlock greater potential. Continued focus on attracting international events will enhance the industry's global standing. The India MICE tourism market size in 2024 is estimated at 110.3 billion.

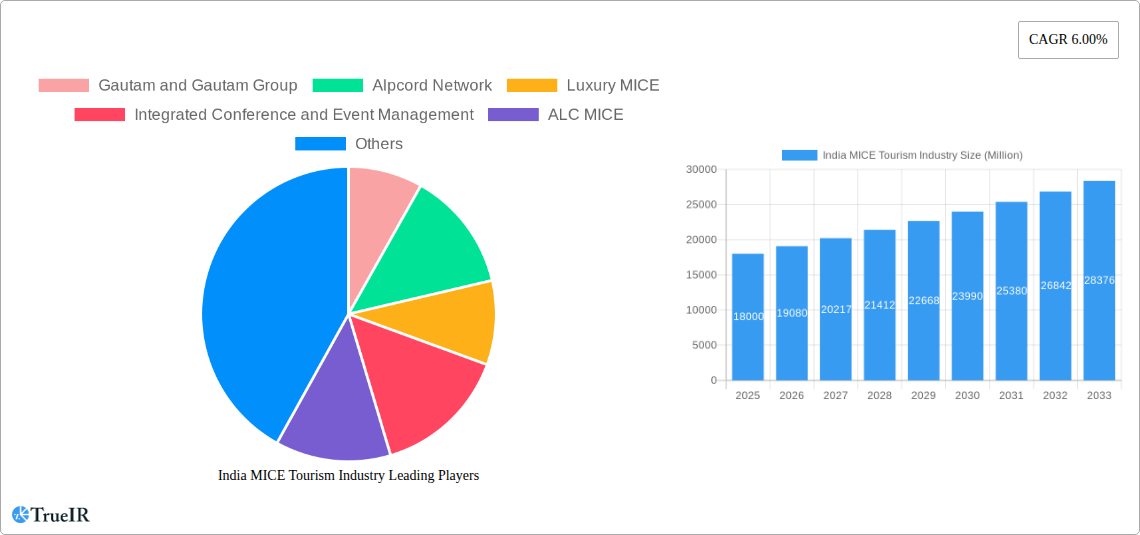

India MICE Tourism Industry Company Market Share

This comprehensive report analyzes the India MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism industry, examining market size, trends, competitive dynamics, and future projections. Leveraging extensive data analysis, it provides actionable intelligence for stakeholders. With a base year of 2024 and a forecast period of 2025-2033, this report is an indispensable resource for businesses, investors, and policymakers navigating India's dynamic MICE tourism landscape. The estimated market size for 2024 is 110.3 billion.

India MICE Tourism Industry Market Structure & Competitive Landscape

The Indian MICE tourism market is characterized by a moderately fragmented structure, with a few large players and a multitude of smaller companies vying for market share. The concentration ratio (CR4) is estimated at xx%, indicating a moderately competitive landscape. Innovation is driven primarily by technological advancements in event management software, virtual and hybrid event platforms, and personalized customer experiences.

Regulatory changes, including visa policies and infrastructure development initiatives, significantly impact market dynamics. Product substitutes, such as virtual conferences and online meetings, are posing a challenge, yet the demand for in-person events remains strong, especially for networking and relationship building. End-user segmentation includes corporate clients, associations, government agencies, and educational institutions, each with specific needs and preferences.

M&A activity in the sector is moderate, with approximately xx deals recorded in the historical period (2019-2024). These mergers and acquisitions are largely driven by the consolidation of smaller companies into larger event management groups. The increasing demand for comprehensive solutions and specialized services is driving the consolidation of market players.

India MICE Tourism Industry Market Trends & Opportunities

The Indian MICE tourism market exhibits substantial growth potential, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fuelled by several factors, including the rapid expansion of the Indian economy, a rise in corporate events, and increasing government support for tourism development. Technological advancements such as AI-powered event management tools and virtual reality experiences are transforming the industry, offering enhanced personalization and engagement.

Consumer preferences are shifting towards more sustainable and experiential MICE events, reflecting a growing global awareness of environmental and social responsibility. Market penetration rates are increasing, especially in tier-2 and tier-3 cities, due to improved infrastructure and connectivity. Competitive dynamics are intense, with companies focusing on innovation, value-added services, and strategic partnerships to gain a competitive edge. The market is witnessing a growing trend towards specialization, with event management companies focusing on niche sectors such as medical conferences, technology summits, and luxury travel events. The overall market size is projected to reach XX Million by 2033.

Dominant Markets & Segments in India MICE Tourism Industry

The Indian MICE tourism market is geographically diverse, with major cities such as Mumbai, Delhi, Bangalore, and Hyderabad emerging as prominent hubs. However, government initiatives are actively promoting MICE tourism in other regions, including Agra, Udaipur, Pune, Thiruvananthapuram, Varanasi, and Bhubaneswar.

- Key Growth Drivers:

- Improved infrastructure, including convention centers, airports, and hotels.

- Supportive government policies and incentives to attract MICE events.

- Growing business activity and economic development.

- Increasing number of international and domestic business travelers.

- Development of advanced event technology.

The "Meetings" segment currently holds the largest market share, driven by the increasing number of corporate meetings and conferences. The "Incentives" segment is also experiencing strong growth due to the growing practice of rewarding employees with memorable travel experiences. The "Conferences" segment remains significant due to India's burgeoning educational and scientific research landscape. The "Exhibitions" segment shows considerable potential due to an increase in trade shows and industry events.

India MICE Tourism Industry Product Analysis

Product innovation in the Indian MICE tourism industry focuses on technological advancements to enhance event efficiency, engagement, and sustainability. This includes incorporating virtual reality (VR) and augmented reality (AR) experiences, AI-driven event management platforms, and personalized mobile apps. The competitive advantage lies in delivering integrated, customized solutions that meet the specific needs of each client, enhancing customer satisfaction and loyalty. The adoption of sustainable practices in event organization is becoming a significant differentiator.

Key Drivers, Barriers & Challenges in India MICE Tourism Industry

Key Drivers:

- Economic Growth: India's robust economic growth is creating more opportunities for corporate events and business travel.

- Technological Advancements: The adoption of technology like AI and VR is transforming the event planning and management industry.

- Government Initiatives: Government promotion of MICE tourism, as evidenced by initiatives such as designating certain cities as MICE hubs, is boosting the sector.

Challenges:

- Infrastructure Gaps: Some regions still lack adequate infrastructure to support large-scale MICE events.

- Competition: Increased competition within the industry necessitates innovation and differentiation.

- Regulatory Hurdles: Navigating complex regulations can pose challenges for event organizers. This can lead to increased costs and delays, potentially reducing the attractiveness of India as a MICE destination. The quantified impact on this aspect is difficult to assess accurately without specific data, but it can be estimated to cause a xx% reduction in potential events.

Growth Drivers in the India MICE Tourism Industry Market

The Indian MICE industry's growth is fueled by rising disposable incomes, increased business travel, and government support for infrastructure development in key tourism destinations. Technological advancements, like virtual and hybrid event platforms, further enhance efficiency and reach. Government initiatives, such as designating Bangalore as a MICE hub, directly stimulate sector growth.

Challenges Impacting India MICE Tourism Industry Growth

Challenges include infrastructure limitations in certain regions, stringent regulations, and fierce competition. The lack of skilled professionals and the rising cost of organizing events can hinder sector growth. Moreover, seasonality and inconsistent tourism policies can affect the industry's overall progress. These factors may reduce the potential growth by approximately xx% annually.

Key Players Shaping the India MICE Tourism Industry Market

- Gautam and Gautam Group

- Alpcord Network

- Luxury MICE

- Integrated Conference and Event Management

- ALC MICE

- ITL World

- India MICE

- Travel XS MICE & More Services

- Dee Catalyst Pvt Ltd

- Plan IT! India

Significant India MICE Tourism Industry Industry Milestones

- June 2021: The Ministry of Tourism identified six cities (Agra, Udaipur, Pune, Thiruvananthapuram, Varanasi, and Bhubaneswar) for MICE development, boosting year-round tourism.

- March 2022: The Chief Minister of Karnataka announced Bangalore's upgrade to a national MICE hub, leveraging its IT infrastructure and connectivity. This has significantly boosted investor interest in the region.

Future Outlook for India MICE Tourism Industry Market

The Indian MICE tourism market is poised for continued growth, driven by rising disposable incomes, infrastructural improvements, and government support. Strategic investments in technology and sustainable practices will be crucial. The focus on niche markets and innovative event formats will present considerable opportunities for market players, potentially creating a XX Million market by 2033.

India MICE Tourism Industry Segmentation

-

1. Event

- 1.1. Meeting

- 1.2. Incentives

- 1.3. Conference

- 1.4. Exhibitions

India MICE Tourism Industry Segmentation By Geography

- 1. India

India MICE Tourism Industry Regional Market Share

Geographic Coverage of India MICE Tourism Industry

India MICE Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing Popularity of Museums

- 3.2.2 Historical Sites

- 3.2.3 Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions

- 3.4. Market Trends

- 3.4.1. Then Number of Meeting and Conventions in India is Increasing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India MICE Tourism Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Event

- 5.1.1. Meeting

- 5.1.2. Incentives

- 5.1.3. Conference

- 5.1.4. Exhibitions

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Event

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gautam and Gautam Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alpcord Network

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Luxury MICE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Integrated Conference and Event Management

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALC MICE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ITL World

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 India MICE**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Travel XS MICE & More Services

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dee Catalyst Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Plan IT! India

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Gautam and Gautam Group

List of Figures

- Figure 1: India MICE Tourism Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India MICE Tourism Industry Share (%) by Company 2025

List of Tables

- Table 1: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 2: India MICE Tourism Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India MICE Tourism Industry Revenue billion Forecast, by Event 2020 & 2033

- Table 4: India MICE Tourism Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India MICE Tourism Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the India MICE Tourism Industry?

Key companies in the market include Gautam and Gautam Group, Alpcord Network, Luxury MICE, Integrated Conference and Event Management, ALC MICE, ITL World, India MICE**List Not Exhaustive, Travel XS MICE & More Services, Dee Catalyst Pvt Ltd, Plan IT! India.

3. What are the main segments of the India MICE Tourism Industry?

The market segments include Event.

4. Can you provide details about the market size?

The market size is estimated to be USD 110.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Museums. Historical Sites. Zoos and Park is driving the Market Growth; Digitalized Experiences is Driving the Market.

6. What are the notable trends driving market growth?

Then Number of Meeting and Conventions in India is Increasing.

7. Are there any restraints impacting market growth?

Distinct institutional cultures and values; Adapting to the changes in technology is tough for the Institutions.

8. Can you provide examples of recent developments in the market?

In March 2022, Presenting the budget for 2022/23, the Chief Minister of the State announced the up-gradation of Bangalore into a Meeting, Incentive, Conferences, and Exhibitions (MICE) hub of the country by leveraging the city's advantages as a business capital, IT Capital as well as its developed infrastructure in technology, transport, and air connectivity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India MICE Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India MICE Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India MICE Tourism Industry?

To stay informed about further developments, trends, and reports in the India MICE Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence