Key Insights

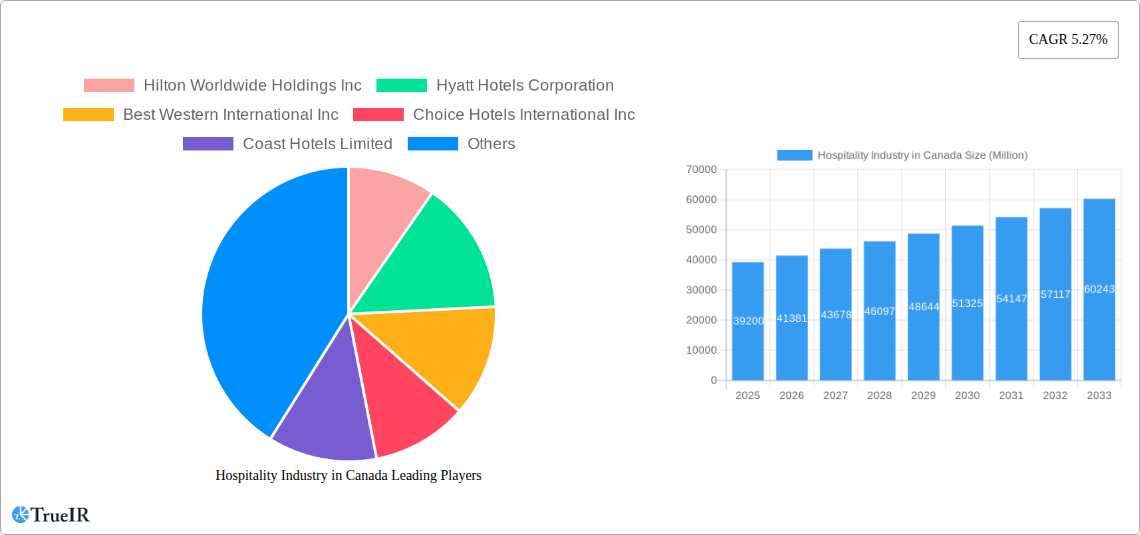

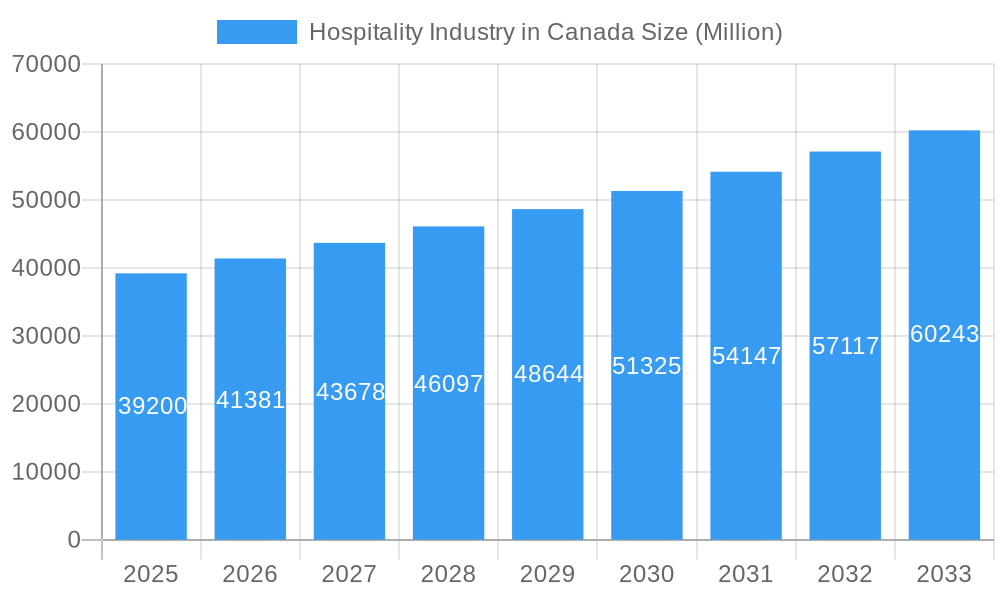

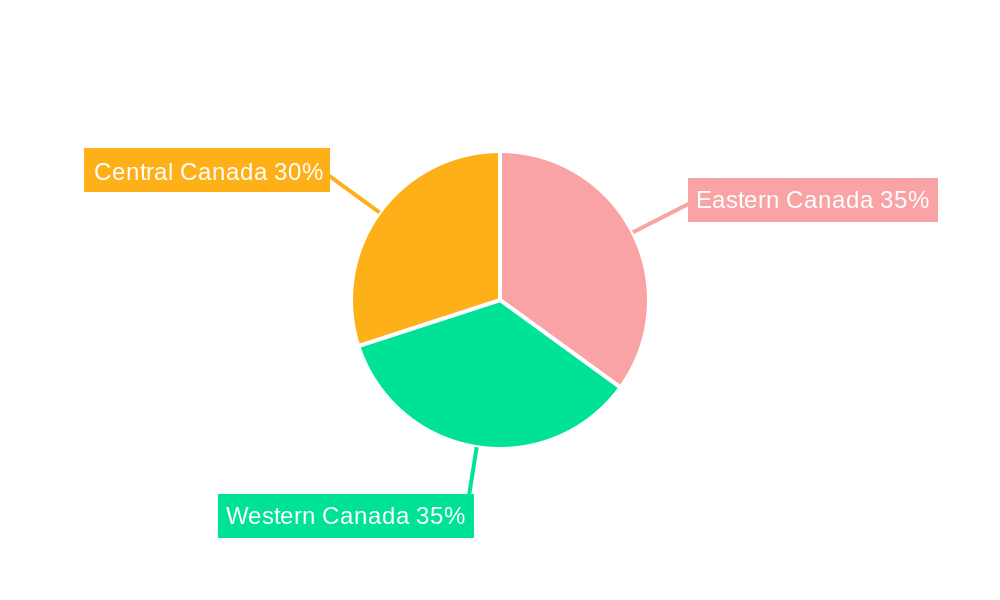

The Canadian hospitality industry, valued at $39.20 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.27% from 2025 to 2033. This expansion is fueled by several key drivers. Increased domestic and international tourism, driven by Canada's diverse landscapes and vibrant cities, is a significant contributor. Furthermore, growing business travel and the rise of experiential tourism, focusing on unique and immersive experiences, are boosting demand for diverse accommodation options. The industry's segmentation, encompassing chain hotels, independent hotels, service apartments, budget/economy, mid-scale, and luxury hotels, caters to a wide spectrum of traveler needs and budgets. While the industry faces challenges such as fluctuations in currency exchange rates and potential economic downturns that can affect travel spending, the overall outlook remains positive. The growing preference for sustainable and eco-friendly travel practices presents both a challenge and an opportunity for hotels to adapt their operations and attract environmentally conscious travelers. The geographical distribution of hotels across Eastern, Western, and Central Canada reflects regional tourism patterns, with key cities like Toronto, Montreal, Vancouver, and Calgary acting as major hospitality hubs.

Hospitality Industry in Canada Market Size (In Billion)

The competitive landscape is characterized by a mix of large international chains (Hilton, Marriott, Hyatt, IHG) and smaller independent hotels and boutique establishments. These companies are continuously innovating to enhance customer experience through technological advancements, personalized services, and loyalty programs. The ongoing expansion of airport infrastructure and improved transportation networks facilitates easier access to various regions within Canada, further stimulating tourism and contributing to the growth of the hospitality sector. The increasing use of online travel agencies (OTAs) and direct booking platforms is transforming the way consumers research and book accommodations, demanding agility and robust digital marketing strategies from hospitality businesses. The projected growth trajectory suggests significant opportunities for investment and expansion within the Canadian hospitality industry over the next decade.

Hospitality Industry in Canada Company Market Share

Canada's Hospitality Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Canadian hospitality market from 2019 to 2033, offering invaluable insights for investors, industry professionals, and strategic planners. We delve into market structure, competitive dynamics, emerging trends, and future growth potential, incorporating extensive quantitative and qualitative data. This in-depth analysis leverages key performance indicators (KPIs) and forecasts to illuminate the evolving landscape of the Canadian hospitality sector. The report covers a $XX Million market, projected to reach $XX Million by 2033, showcasing significant growth opportunities.

Hospitality Industry in Canada Market Structure & Competitive Landscape

The Canadian hospitality market exhibits a moderately concentrated structure, with a few dominant players and a significant number of smaller, independent hotels. Major players like Marriott International Inc, Hilton Worldwide Holdings Inc, and Hyatt Hotels Corporation control a substantial market share, but independent hotels and smaller chains also contribute significantly. This dynamic is further shaped by several factors:

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the Canadian hotel market is estimated at xx, indicating a moderately concentrated market. Larger chains benefit from economies of scale and brand recognition.

- Innovation Drivers: Technological advancements in revenue management systems, online booking platforms, and customer relationship management (CRM) software are driving innovation and efficiency. The rise of sustainable tourism and experiential travel also presents significant innovation opportunities.

- Regulatory Impacts: Provincial and federal regulations concerning taxation, licensing, and environmental standards significantly impact the operating costs and strategies of hospitality businesses.

- Product Substitutes: The rise of Airbnb and other alternative accommodations poses a competitive threat to traditional hotels, especially in the budget and mid-scale segments.

- End-User Segmentation: The market is segmented by traveler type (business, leisure, group), price sensitivity, and preferred accommodation type (hotel, resort, serviced apartment).

- M&A Trends: The past five years have seen xx M&A transactions in the Canadian hospitality sector, driven by consolidation and expansion strategies of major players.

Hospitality Industry in Canada Market Trends & Opportunities

The Canadian hospitality market is experiencing robust growth, driven by several key trends:

The market size experienced a CAGR of xx% between 2019 and 2024, reaching $XX Million in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), with the market expected to reach $XX Million by 2033. Several factors fuel this expansion:

- Increased Domestic and International Tourism: Canada's diverse attractions and welcoming environment attract millions of tourists annually. The recovery from the pandemic is driving further growth.

- Technological Advancements: Online travel agencies (OTAs) and booking platforms continue to shape consumer behavior, creating both opportunities and challenges for hoteliers.

- Evolving Consumer Preferences: Consumers increasingly prioritize unique experiences, personalized services, and sustainable tourism practices.

- Competitive Dynamics: The competitive landscape is dynamic, with the emergence of new brands and the expansion of existing players. Innovation in service offerings and value propositions is crucial for success.

- Market Penetration Rate: The hotel room occupancy rate is projected to increase from xx% in 2024 to xx% by 2033, reflecting increasing market penetration.

Dominant Markets & Segments in Hospitality Industry in Canada

The Canadian hospitality market demonstrates strong regional variations, with major urban centers experiencing higher demand and room rates. Ontario and British Columbia are leading markets due to significant tourism and business travel activity.

- By Type: Chain hotels dominate the market share in terms of revenue, benefiting from economies of scale and brand recognition, while independent hotels offer localized experiences and cater to niche segments.

- By Segment: The mid-scale and upper-mid-scale hotel segments represent the most significant revenue contributors, demonstrating strong growth. The luxury hotel segment also shows potential for future growth due to increasing high-net-worth individuals visiting the country. The budget/economy segment faces increased competition from alternative accommodations. Service apartments cater to extended-stay travelers and corporate clients and have been showcasing steady growth.

Key growth drivers vary across segments:

- Infrastructure Development: Investments in transportation infrastructure, including airports and roads, enhance accessibility and boost tourism.

- Government Policies: Tourism-friendly policies, visa facilitation, and promotional campaigns significantly support market growth.

- Economic Growth: A strong economy translates to increased business travel and disposable income for leisure travel.

Hospitality Industry in Canada Product Analysis

Product innovation in the Canadian hospitality sector focuses on enhancing customer experiences, improving operational efficiency, and implementing sustainable practices. This includes advancements in technology such as AI-powered chatbots for guest services, smart room technology, and data-driven revenue management systems. These innovations are enhancing guest satisfaction, streamlining operations, and offering a competitive edge. The market fit for these innovations is high, driven by increasing consumer demand for personalized and seamless experiences.

Key Drivers, Barriers & Challenges in Hospitality Industry in Canada

Key Drivers:

- Growing Tourism: Both domestic and international tourism fuels demand for accommodation.

- Economic Growth: A thriving economy stimulates business travel and leisure spending.

- Technological Advancements: Smart technologies improve efficiency and customer service.

- Government Initiatives: Support for tourism development creates favorable market conditions.

Challenges and Restraints:

- Labor Shortages: The industry faces significant challenges in recruiting and retaining qualified staff, impacting operational efficiency. This challenge has impacted businesses by xx%.

- Rising Operating Costs: Increases in energy prices, labor costs, and supplies impact profitability. This has increased operating costs by an estimated xx%.

- Intense Competition: The presence of both established chains and alternative accommodations creates intense competition. This competition has reduced profit margins by xx%.

Growth Drivers in the Hospitality Industry in Canada Market

The Canadian hospitality market benefits from several significant growth drivers: increasing tourism, particularly from international markets; sustained economic growth supporting both business and leisure travel; ongoing investments in tourism infrastructure; and government initiatives aimed at promoting tourism. These factors combined create a positive outlook for market expansion and development.

Challenges Impacting Hospitality Industry in Canada Growth

Challenges impacting growth include labor shortages, rising operating costs, intense competition from alternative accommodations, and regulatory complexities. These factors can hinder profitability and expansion plans, requiring businesses to adopt adaptive strategies and innovate to overcome these obstacles.

Key Players Shaping the Hospitality Industry in Canada Market

Significant Hospitality Industry in Canada Industry Milestones

- July 2023: Wyndham Hotels & Resorts announced the addition of 60 new hotels to its Echo Suites extended-stay brand, including its first Canadian locations, signifying expansion in a growing market segment.

- January 2024: APA Hotel Canada Inc., a subsidiary of Coast Hotels Limited, opened two new hotels in Dawson City, Yukon, demonstrating the ongoing expansion of hotel brands in less-saturated markets.

Future Outlook for Hospitality Industry in Canada Market

The Canadian hospitality market is poised for continued growth, driven by a positive outlook for tourism, economic expansion, and technological advancements. Strategic opportunities exist in focusing on sustainable tourism, enhancing guest experiences through technology, and catering to evolving consumer preferences. The market's potential for growth is significant, presenting attractive opportunities for both established players and new entrants.

Hospitality Industry in Canada Segmentation

-

1. Type

- 1.1. Chain Hotels

- 1.2. Independent Hotels

-

2. Segment

- 2.1. Service Apartments

- 2.2. Budget and Economy Hotels

- 2.3. Mid and Upper Mid-scale Hotels

- 2.4. Luxury Hotels

Hospitality Industry in Canada Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hospitality Industry in Canada Regional Market Share

Geographic Coverage of Hospitality Industry in Canada

Hospitality Industry in Canada REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Awareness among Hotels & Resorts to Implement Eco-Friendly Measures; Rising Mobile Reservations & Contactless Check-In/Out

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labour; Reputation Management is One of the Most Important Tasks in the Hospitality industry

- 3.4. Market Trends

- 3.4.1. The Increase in Tourist Arrivals and Hotel Occupancy also Results in an Increase in Spending

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chain Hotels

- 5.1.2. Independent Hotels

- 5.2. Market Analysis, Insights and Forecast - by Segment

- 5.2.1. Service Apartments

- 5.2.2. Budget and Economy Hotels

- 5.2.3. Mid and Upper Mid-scale Hotels

- 5.2.4. Luxury Hotels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Chain Hotels

- 6.1.2. Independent Hotels

- 6.2. Market Analysis, Insights and Forecast - by Segment

- 6.2.1. Service Apartments

- 6.2.2. Budget and Economy Hotels

- 6.2.3. Mid and Upper Mid-scale Hotels

- 6.2.4. Luxury Hotels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Chain Hotels

- 7.1.2. Independent Hotels

- 7.2. Market Analysis, Insights and Forecast - by Segment

- 7.2.1. Service Apartments

- 7.2.2. Budget and Economy Hotels

- 7.2.3. Mid and Upper Mid-scale Hotels

- 7.2.4. Luxury Hotels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Chain Hotels

- 8.1.2. Independent Hotels

- 8.2. Market Analysis, Insights and Forecast - by Segment

- 8.2.1. Service Apartments

- 8.2.2. Budget and Economy Hotels

- 8.2.3. Mid and Upper Mid-scale Hotels

- 8.2.4. Luxury Hotels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Chain Hotels

- 9.1.2. Independent Hotels

- 9.2. Market Analysis, Insights and Forecast - by Segment

- 9.2.1. Service Apartments

- 9.2.2. Budget and Economy Hotels

- 9.2.3. Mid and Upper Mid-scale Hotels

- 9.2.4. Luxury Hotels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Hospitality Industry in Canada Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Chain Hotels

- 10.1.2. Independent Hotels

- 10.2. Market Analysis, Insights and Forecast - by Segment

- 10.2.1. Service Apartments

- 10.2.2. Budget and Economy Hotels

- 10.2.3. Mid and Upper Mid-scale Hotels

- 10.2.4. Luxury Hotels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hilton Worldwide Holdings Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hyatt Hotels Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Best Western International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Choice Hotels International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Coast Hotels Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mariott International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wyndham Hotel Group LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Intercontinental Hotels Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Sandman Group**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Accor SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hilton Worldwide Holdings Inc

List of Figures

- Figure 1: Global Hospitality Industry in Canada Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 5: North America Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 6: North America Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 9: South America Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 11: South America Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 12: South America Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 17: Europe Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 18: Europe Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 23: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 24: Middle East & Africa Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Segment 2025 & 2033

- Figure 29: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Segment 2025 & 2033

- Figure 30: Asia Pacific Hospitality Industry in Canada Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Hospitality Industry in Canada Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 3: Global Hospitality Industry in Canada Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 6: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 12: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 18: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 30: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Hospitality Industry in Canada Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Hospitality Industry in Canada Revenue Million Forecast, by Segment 2020 & 2033

- Table 39: Global Hospitality Industry in Canada Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Hospitality Industry in Canada Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hospitality Industry in Canada?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the Hospitality Industry in Canada?

Key companies in the market include Hilton Worldwide Holdings Inc, Hyatt Hotels Corporation, Best Western International Inc, Choice Hotels International Inc, Coast Hotels Limited, Mariott International Inc, Wyndham Hotel Group LLC, Intercontinental Hotels Group, The Sandman Group**List Not Exhaustive, Accor SA.

3. What are the main segments of the Hospitality Industry in Canada?

The market segments include Type, Segment.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Awareness among Hotels & Resorts to Implement Eco-Friendly Measures; Rising Mobile Reservations & Contactless Check-In/Out.

6. What are the notable trends driving market growth?

The Increase in Tourist Arrivals and Hotel Occupancy also Results in an Increase in Spending.

7. Are there any restraints impacting market growth?

Lack of Skilled Labour; Reputation Management is One of the Most Important Tasks in the Hospitality industry.

8. Can you provide examples of recent developments in the market?

January 2024 - APA Hotel Canada Inc., a wholly owned subsidiary of Coast Hotels Limited, is one of the fastest-growing hotel brands in North America and one of the largest hotel brands in Canada. Coast Hotels announced the opening of two brand new franchise properties, Eldorado (a Coast Hotel) and Midnight Sun (a Coast Hotel), in the historic and vibrant downtown area of Dawson City, Yukon, Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hospitality Industry in Canada," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hospitality Industry in Canada report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hospitality Industry in Canada?

To stay informed about further developments, trends, and reports in the Hospitality Industry in Canada, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence