Key Insights

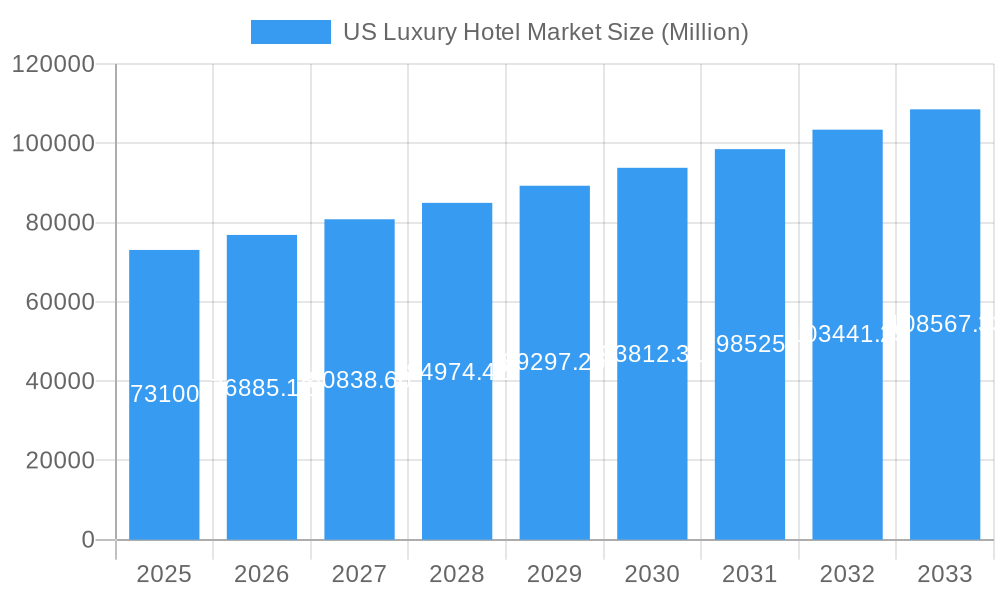

The US luxury hotel market, valued at $73.10 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.12% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing affluence of high-net-worth individuals and a rising preference for experiential travel are significantly contributing to market growth. Furthermore, the ongoing expansion of the tourism sector, particularly in popular US destinations like New York City, California, and Florida, creates a higher demand for premium accommodations. The rise of boutique and themed hotels, catering to specific interests and preferences, also contributes to market segmentation and expansion. The market is segmented by service type (business hotels, airport hotels, suite hotels, resorts, other service hotels) and theme (heritage, contemporary, modern, others), allowing for targeted marketing and specialized services. While economic downturns could potentially act as a restraint, the resilience of the luxury travel sector suggests that the market will continue to grow, albeit possibly at a moderated pace during economic uncertainty. Specific geographic regions within the US, such as the Northeast and West Coast, are anticipated to exhibit stronger growth due to their established tourism infrastructure and concentration of affluent populations.

US Luxury Hotel Market Market Size (In Billion)

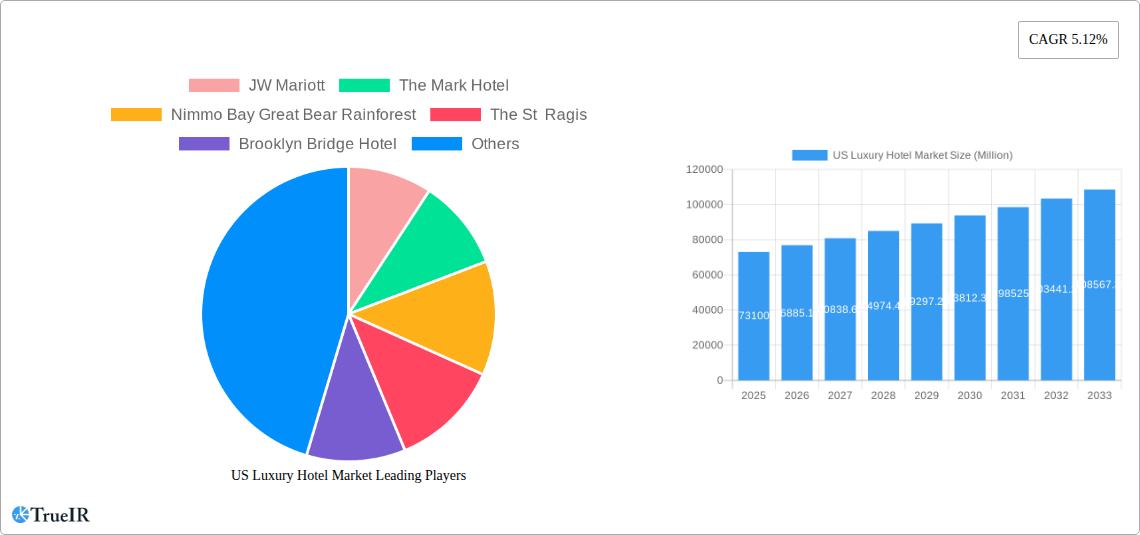

The competitive landscape is characterized by a mix of established international luxury hotel chains like JW Marriott and Hyatt, and smaller, independent boutique hotels like The Mark Hotel and Mayflower Inn and Spa. These hotels compete based on factors such as location, service quality, amenities, brand reputation, and unique thematic offerings. The ongoing competition pushes innovation in the sector, leading to the development of unique and luxurious experiences, further enhancing the overall market appeal. The forecast period (2025-2033) is expected to see continued growth, driven by factors like technological advancements in hospitality (e.g., personalized service through technology), a focus on sustainability and eco-friendly practices, and the enduring appeal of luxurious travel experiences. The market's segmentation ensures diverse opportunities for various players to cater to the nuanced demands of the luxury travel segment.

US Luxury Hotel Market Company Market Share

US Luxury Hotel Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the US luxury hotel market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. With a focus on market trends, competitive dynamics, and future growth potential, this report is an essential resource for navigating the complexities of this lucrative sector. The study period spans 2019-2033, with 2025 serving as the base and estimated year.

US Luxury Hotel Market Structure & Competitive Landscape

The US luxury hotel market is characterized by a moderately concentrated structure, with a few major players commanding significant market share. However, the landscape is dynamic, influenced by continuous innovation, evolving regulatory environments, and the emergence of substitute experiences (e.g., luxury vacation rentals). The market is segmented by service type (business hotels, airport hotels, suite hotels, resorts, other service hotels) and theme (heritage, contemporary, modern, others). Mergers and acquisitions (M&A) activity is a notable feature, reshaping the competitive landscape. For example, the 20-year partnership between Marriott and MGM Resorts, announced in January 2024, significantly increased Marriott's footprint and market power. The estimated M&A volume in the luxury hotel sector during 2019-2024 reached approximately $xx Million. Concentration ratios, calculated using the Herfindahl-Hirschman Index (HHI), indicate a moderately concentrated market, with an estimated HHI of xx in 2024. Further analysis reveals that innovation, particularly in technology and service offerings, is a key driver of differentiation and competitive advantage. Regulatory changes, including zoning laws and environmental regulations, significantly impact market operations and expansion strategies.

US Luxury Hotel Market Market Trends & Opportunities

The US luxury hotel market is experiencing robust growth, driven by rising disposable incomes, a growing preference for experiential travel, and increasing demand for personalized services. The market size is projected to reach $xx Million in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is further propelled by technological advancements such as enhanced booking platforms, personalized guest experiences through AI-powered services, and innovative loyalty programs. Consumer preferences are shifting towards unique and sustainable luxury experiences, demanding high levels of personalization and seamless integration of technology. These trends are reshaping the competitive dynamics, pushing companies to adapt quickly to meet evolving demands. The market penetration rate of luxury hotels in major US cities is estimated to be xx% in 2025, with significant growth potential in secondary markets.

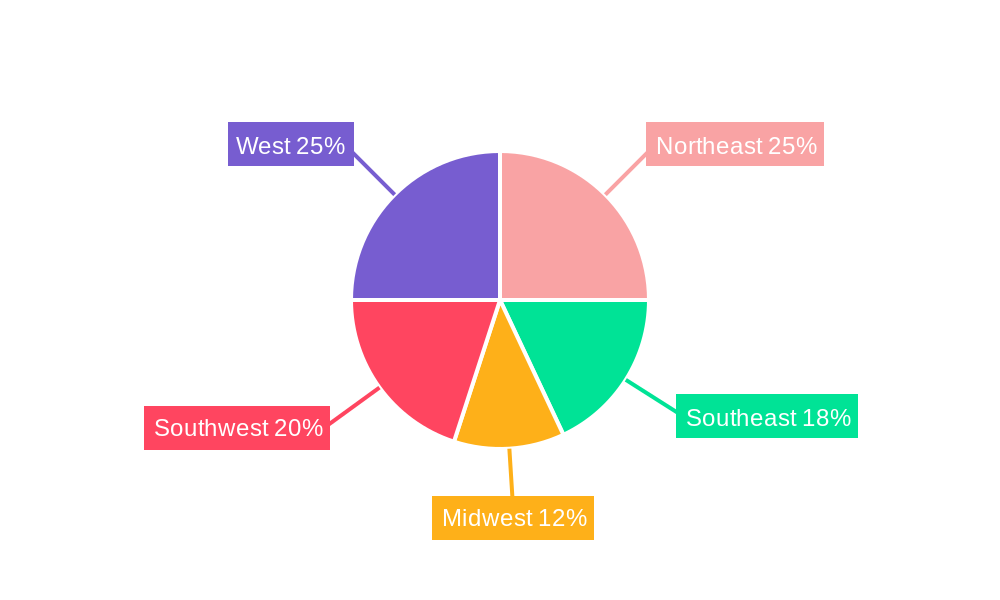

Dominant Markets & Segments in US Luxury Hotel Market

The US luxury hotel market exhibits regional variations in growth and dominance. Key growth drivers include favorable economic conditions, supportive tourism policies, and robust infrastructure development.

- By Service Type: Resorts consistently demonstrate strong growth, propelled by increasing demand for leisure travel and unique experiences. Business hotels maintain a significant market share, driven by corporate travel and MICE (Meetings, Incentives, Conferences, and Exhibitions) events.

- By Theme: Contemporary and Modern themed hotels show the highest growth, reflecting consumer preferences for stylish and innovative designs. However, Heritage properties also attract a substantial customer base, capitalizing on their historical significance and unique charm.

- Leading Regions: California, New York, and Florida are the dominant markets, benefiting from strong tourism infrastructure, established luxury brands, and a high concentration of high-net-worth individuals.

US Luxury Hotel Market Product Analysis

Luxury hotels constantly strive for innovation to enhance guest experiences and maintain a competitive edge. Technological advancements in areas such as smart room technology, personalized concierge services, and advanced booking systems are key differentiators. These innovations aim to enhance convenience, personalize service, and provide unique luxury experiences, aligning closely with evolving consumer preferences. The market fit of these innovations is high due to the increased willingness of luxury travelers to pay a premium for advanced amenities and seamless experiences.

Key Drivers, Barriers & Challenges in US Luxury Hotel Market

Key Drivers:

- Increasing disposable incomes and a preference for experiential travel.

- Technological advancements enhancing guest experience and operational efficiency.

- Government initiatives promoting tourism and infrastructure development.

Challenges and Restraints:

- Economic downturns significantly impact luxury travel spending.

- Intense competition among established and emerging luxury hotel brands.

- Supply chain disruptions and inflationary pressures affect operational costs. The impact is estimated at a xx% increase in operational expenses in 2024.

Growth Drivers in the US Luxury Hotel Market

The primary growth drivers are increasing disposable incomes, particularly among high-net-worth individuals, fueling demand for luxury travel and accommodation. Technological advancements, including personalized services and smart hotel technologies, enhance the overall guest experience. Furthermore, supportive government policies that encourage tourism and infrastructure development in key tourist locations also contribute significantly to market growth.

Challenges Impacting US Luxury Hotel Market Growth

Significant challenges include economic volatility which impacts consumer spending on luxury travel, intense competition, and rising operational costs due to inflation and supply chain disruptions. Stringent regulations regarding environmental sustainability and labor practices also add to operational complexity and costs.

Key Players Shaping the US Luxury Hotel Market

- JW Marriott

- The Mark Hotel

- Nimmo Bay Great Bear Rainforest

- The St. Regis

- Brooklyn Bridge Hotel

- Rencho Valnecia Resort

- Mayflower Inn and Spa

- Long Beach Lodge Resort

- Hyatt Group

- Cavallo Point

Significant US Luxury Hotel Market Industry Milestones

- June 2023: Hyatt Corporation merges its World of Hyatt loyalty program with Dream Hotels, The Chatwal, The Time New York, and Unscripted properties, expanding its reach and offerings.

- January 2024: Marriott and MGM Resorts enter a 20-year partnership, integrating 17 MGM properties into the Marriott brand and expanding distribution channels.

Future Outlook for US Luxury Hotel Market

The US luxury hotel market is poised for continued growth, driven by sustained economic expansion, evolving consumer preferences, and ongoing technological advancements. Strategic opportunities exist in personalized service offerings, sustainable luxury initiatives, and strategic partnerships. The market's potential is significant, particularly in emerging luxury travel destinations and untapped niche segments. The market is expected to witness a CAGR of xx% between 2025 and 2033, reaching a market size of $xx Million by 2033.

US Luxury Hotel Market Segmentation

-

1. Service Type

- 1.1. Business Hotels

- 1.2. Airport Hotels

- 1.3. Suite Hotel

- 1.4. Resorts

- 1.5. Other Service Types

-

2. Theme

- 2.1. Heritage

- 2.2. Contemporary

- 2.3. Modern

- 2.4. Other Themes

US Luxury Hotel Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Luxury Hotel Market Regional Market Share

Geographic Coverage of US Luxury Hotel Market

US Luxury Hotel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Trend of Availing Luxurious Lifestyle While Travelling

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences; Rising Operational Costs

- 3.4. Market Trends

- 3.4.1. Tourism Growth in United States is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Hotels

- 5.1.2. Airport Hotels

- 5.1.3. Suite Hotel

- 5.1.4. Resorts

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Theme

- 5.2.1. Heritage

- 5.2.2. Contemporary

- 5.2.3. Modern

- 5.2.4. Other Themes

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Hotels

- 6.1.2. Airport Hotels

- 6.1.3. Suite Hotel

- 6.1.4. Resorts

- 6.1.5. Other Service Types

- 6.2. Market Analysis, Insights and Forecast - by Theme

- 6.2.1. Heritage

- 6.2.2. Contemporary

- 6.2.3. Modern

- 6.2.4. Other Themes

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Hotels

- 7.1.2. Airport Hotels

- 7.1.3. Suite Hotel

- 7.1.4. Resorts

- 7.1.5. Other Service Types

- 7.2. Market Analysis, Insights and Forecast - by Theme

- 7.2.1. Heritage

- 7.2.2. Contemporary

- 7.2.3. Modern

- 7.2.4. Other Themes

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Hotels

- 8.1.2. Airport Hotels

- 8.1.3. Suite Hotel

- 8.1.4. Resorts

- 8.1.5. Other Service Types

- 8.2. Market Analysis, Insights and Forecast - by Theme

- 8.2.1. Heritage

- 8.2.2. Contemporary

- 8.2.3. Modern

- 8.2.4. Other Themes

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Hotels

- 9.1.2. Airport Hotels

- 9.1.3. Suite Hotel

- 9.1.4. Resorts

- 9.1.5. Other Service Types

- 9.2. Market Analysis, Insights and Forecast - by Theme

- 9.2.1. Heritage

- 9.2.2. Contemporary

- 9.2.3. Modern

- 9.2.4. Other Themes

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific US Luxury Hotel Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Hotels

- 10.1.2. Airport Hotels

- 10.1.3. Suite Hotel

- 10.1.4. Resorts

- 10.1.5. Other Service Types

- 10.2. Market Analysis, Insights and Forecast - by Theme

- 10.2.1. Heritage

- 10.2.2. Contemporary

- 10.2.3. Modern

- 10.2.4. Other Themes

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 JW Mariott

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Mark Hotel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nimmo Bay Great Bear Rainforest

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The St Ragis

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Brooklyn Bridge Hotel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rencho Valnecia Resort

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mayflower Inn and Spa

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Long Beach Lodge Resort

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hyatt Group**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cavallo Point

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 JW Mariott

List of Figures

- Figure 1: Global US Luxury Hotel Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 5: North America US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 6: North America US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 9: South America US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: South America US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 11: South America US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 12: South America US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Europe US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Europe US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 17: Europe US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 18: Europe US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 23: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 24: Middle East & Africa US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Luxury Hotel Market Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Asia Pacific US Luxury Hotel Market Revenue (Million), by Theme 2025 & 2033

- Figure 29: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Theme 2025 & 2033

- Figure 30: Asia Pacific US Luxury Hotel Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Luxury Hotel Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 3: Global US Luxury Hotel Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 6: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 12: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 18: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 29: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 30: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Luxury Hotel Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global US Luxury Hotel Market Revenue Million Forecast, by Theme 2020 & 2033

- Table 39: Global US Luxury Hotel Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Luxury Hotel Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Luxury Hotel Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the US Luxury Hotel Market?

Key companies in the market include JW Mariott, The Mark Hotel, Nimmo Bay Great Bear Rainforest, The St Ragis, Brooklyn Bridge Hotel, Rencho Valnecia Resort, Mayflower Inn and Spa, Long Beach Lodge Resort, Hyatt Group**List Not Exhaustive, Cavallo Point.

3. What are the main segments of the US Luxury Hotel Market?

The market segments include Service Type, Theme.

4. Can you provide details about the market size?

The market size is estimated to be USD 73.10 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Trend of Availing Luxurious Lifestyle While Travelling.

6. What are the notable trends driving market growth?

Tourism Growth in United States is Driving the Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences; Rising Operational Costs.

8. Can you provide examples of recent developments in the market?

In January 2024, A 20-year partnership has been established between Marriott and MGM Resorts. The Marriott brand now includes 17 MGM properties in the US, including those in Las Vegas. As per the agreement, MGM's and Marriott's sales channels can be used to make property reservations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Luxury Hotel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Luxury Hotel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Luxury Hotel Market?

To stay informed about further developments, trends, and reports in the US Luxury Hotel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence