Key Insights

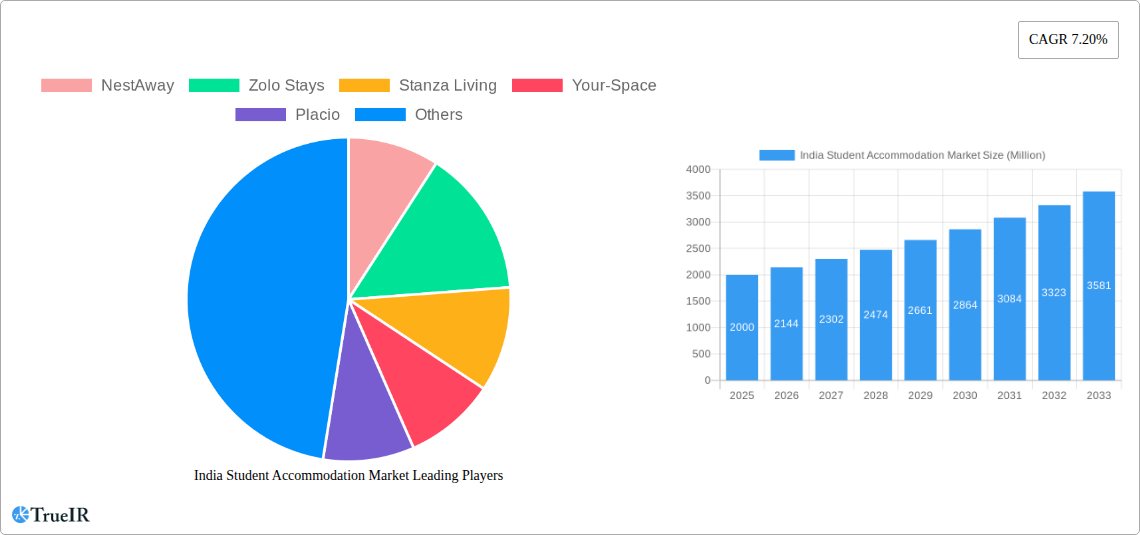

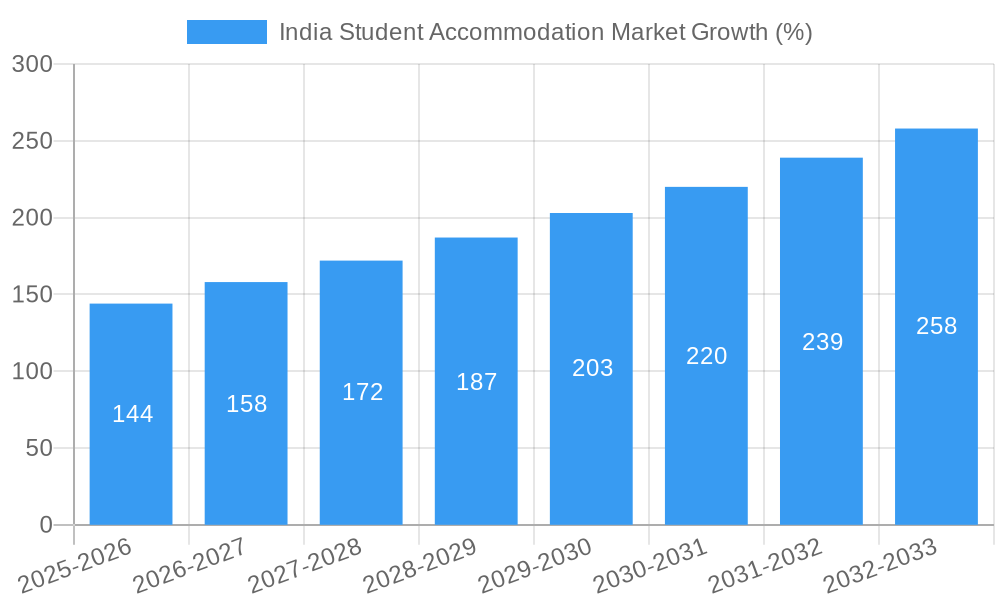

The Indian student accommodation market is experiencing robust growth, driven by increasing urbanization, rising student enrollment in higher education institutions, and a growing preference for convenient and well-equipped living spaces. The market, estimated at approximately ₹2000 million (₹2 Billion) in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.20% from 2025 to 2033, reaching a significant market value. This expansion is fueled by several factors: the burgeoning middle class, increasing disposable incomes among students and their families, and a shift towards a preference for managed accommodation that offers amenities beyond basic lodging. The segments demonstrating the strongest growth are PG (Paying Guest) accommodations and PBSA (Purpose-Built Student Accommodation), reflecting the diverse needs and budget considerations of the student population. Demand is particularly high in metropolitan areas like Delhi-NCR, Mumbai, Bangalore, and Chennai, driving regional variations in market performance. While increasing competition among operators presents a challenge, the overall market outlook remains positive, with significant opportunities for both established players and new entrants to capitalize on the expanding demand for modern and comfortable student housing solutions.

The growth is further facilitated by the evolving preferences of students. The increasing adoption of technology in property management and the rising demand for amenities like high-speed Wi-Fi, laundry services, and dedicated study spaces are reshaping the market landscape. Constraints include the availability of suitable land in prime locations, regulatory complexities related to property management, and the need for continuous improvement in infrastructure and service quality to maintain high occupancy rates. The market's segmentation by accommodation type (PG, PBSA, Studio Apartments, etc.) and service offerings reflects the diverse needs of students across different socioeconomic backgrounds. As the market matures, we anticipate an increased focus on sustainability, technological integration, and enhanced safety measures, further driving the demand for sophisticated student accommodation solutions in India.

India Student Accommodation Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning India student accommodation market, projecting significant growth from 2025 to 2033. Leveraging extensive research and data from 2019-2024 (historical period), this report offers crucial insights for investors, stakeholders, and industry players. The report utilizes a base year of 2025 and forecasts market trends until 2033, presenting a comprehensive overview of market size, segmentation, competitive landscape, and future growth potential, all presented in Millions.

India Student Accommodation Market Market Structure & Competitive Landscape

The Indian student accommodation market is experiencing rapid expansion, driven by a rising student population and increasing urbanization. Market concentration is currently moderate, with key players like NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom, OYO Life, and CoHo vying for market share. However, the market remains fragmented, with numerous smaller operators catering to niche segments. The market structure is characterized by both organized and unorganized players, with the organized sector experiencing faster growth.

Innovation is a significant driver, with companies investing in technology to enhance operational efficiency, improve customer experience (through features like Wi-Fi, laundry, utilities, and parking), and expand their reach. Regulatory impacts, particularly zoning regulations and building codes, influence the availability and cost of student housing. Product substitutes, such as shared apartments and homestays, pose competition, while the rising demand for purpose-built student accommodation (PBSA) is driving market evolution. End-user segmentation is primarily based on student demographics (age, course, budget) and location preferences.

M&A activity has been moderate in recent years. We estimate xx M&A transactions between 2019 and 2024, with a value of approximately xx Million. This trend is expected to continue, with larger players consolidating their market share through acquisitions. The market's competitive intensity is likely to increase as both domestic and international players further expand. The market concentration ratio (CR4) is estimated to be around xx% in 2025, indicating a moderately concentrated market with scope for further consolidation.

India Student Accommodation Market Market Trends & Opportunities

The India student accommodation market is experiencing robust growth, projected to reach xx Million by 2033, driven by a surging student population and increased preference for convenient, safe, and well-equipped accommodations. The CAGR is estimated to be xx% during the forecast period (2025-2033). This expansion is further fueled by several factors including rising disposable incomes, changing lifestyle preferences among students, technological advancements (online booking platforms, smart building technology), and increasing parental willingness to invest in quality student housing.

Technological shifts are profoundly impacting the market, enabling improved operational efficiency, enhanced customer experiences, and targeted marketing efforts. Consumer preferences are shifting towards modern, amenity-rich accommodations offering value-added services like Wi-Fi, laundry, and security, resulting in increased demand for PBSA and studio apartments. Competitive dynamics are characterized by intense rivalry among established players and the emergence of new entrants, leading to innovation and price competitiveness. Market penetration is relatively low in comparison to mature markets, offering significant growth opportunities. Demand for technologically advanced and flexible accommodations is particularly high in metropolitan areas like Mumbai, Delhi-NCR, Bangalore, and Chennai, driving higher growth in these regions.

Dominant Markets & Segments in India Student Accommodation Market

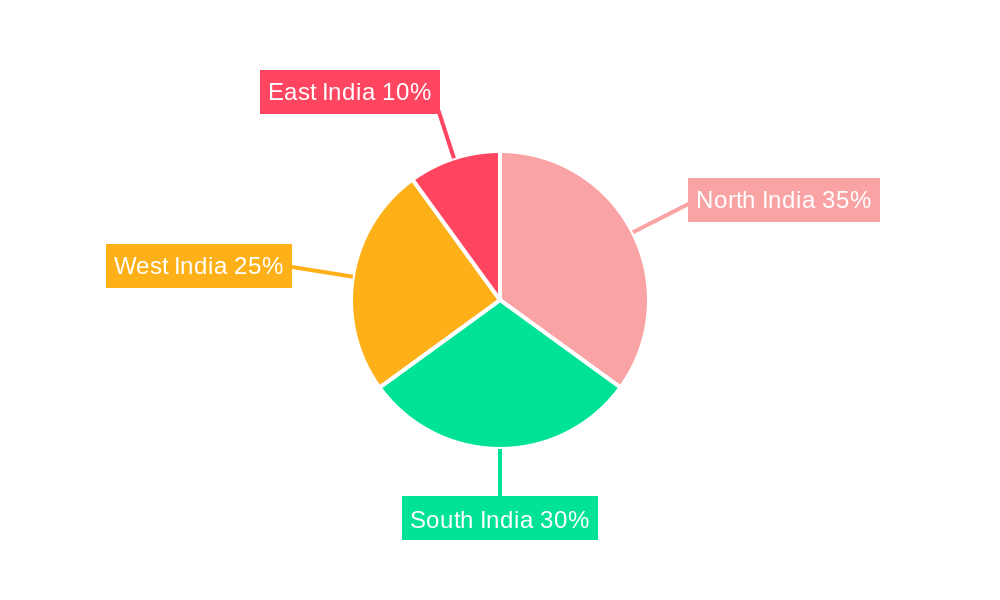

The dominant market segment is currently PG (Paying Guest) accommodations owing to their affordability and wide availability. However, the PBSA segment is experiencing the fastest growth, driven by the rising demand for modern and well-equipped accommodations. Metropolitan areas like Mumbai, Delhi-NCR, Bangalore, and Chennai dominate the market, accounting for xx% of the total market size in 2025.

Key Growth Drivers:

- Rapid Urbanization: Increasing migration to urban centers for education.

- Rising Disposable Incomes: Higher affordability for improved accommodation.

- Government Initiatives: Policies promoting quality student housing.

- Technological Advancements: Online booking platforms and smart building technologies.

Market Dominance Analysis:

The preference for specific service types varies significantly based on location and student demographics. While Wi-Fi is almost universally desired, the demand for other services like dishwashers and parking varies significantly based on location and affordability. The dominance of PG accommodations in tier-2 cities contrasts with the increasing preference for Studio Apartments and PBSA in metropolitan areas. The on-campus housing market varies widely between universities and is not consistently a dominant segment.

India Student Accommodation Market Product Analysis

Product innovation in the student accommodation market is focused on enhancing convenience, safety, and community engagement. This includes smart building technologies, integrated booking platforms, and value-added services. Key competitive advantages include location, amenities, pricing, and the quality of service provided. Technological advancements such as mobile apps for booking, payment, and maintenance requests, coupled with innovative security and access systems, drive market differentiation. The market fit for technologically advanced and customizable accommodations is demonstrably strong in urban centers, whilst more basic accommodation remains prevalent in other areas.

Key Drivers, Barriers & Challenges in India Student Accommodation Market

Key Drivers:

The increasing student population, rising disposable incomes, and a preference for convenient and modern accommodations are driving the market. Government initiatives supporting affordable housing and the growing adoption of technology are further boosting growth.

Key Barriers and Challenges:

The market faces challenges such as regulatory complexities related to land use and building codes, which impede project development. Supply chain issues and land scarcity in urban areas also restrain growth. Intense competition and the need for significant capital investment are additional barriers. A conservative estimate suggests that regulatory hurdles delay projects by an average of xx months.

Growth Drivers in the India Student Accommodation Market Market

Technological advancements, like online booking platforms and smart building technologies, are significant growth catalysts. The rising disposable incomes of students and the increasing preference for convenient, safe and amenity-rich accommodations are crucial factors. Favorable government policies promoting affordable housing also contribute to market expansion.

Challenges Impacting India Student Accommodation Market Growth

Regulatory complexities, primarily concerning land use and building regulations, significantly hamper project development and expansion. Supply chain disruptions and land scarcity, particularly in urban centers, restrict the availability of suitable land for projects. Intense competition among established players and new entrants also pose a challenge. These factors collectively affect market expansion and operational efficiency.

Key Players Shaping the India Student Accommodation Market Market

- NestAway

- Zolo Stays

- Stanza Living

- Your-Space

- Placio

- StayAbode

- Weroom

- OYO Life

- CoHo

Significant India Student Accommodation Market Industry Milestones

- 2020: Increased focus on hygiene and sanitation post-pandemic.

- 2021: Several key players launched online booking platforms for enhanced customer experience.

- 2022: Significant investments from venture capitalists into the sector.

- 2023: Introduction of several innovative features like co-working spaces within student housing.

- 2024: Government policy promoting PBSA development.

Future Outlook for India Student Accommodation Market Market

The India student accommodation market is poised for substantial growth, driven by a young and expanding student population, rising disposable incomes, and a shift towards premium accommodations. Strategic opportunities exist in expanding into tier-2 and tier-3 cities, developing specialized accommodations for international students, and integrating advanced technologies for operational efficiency and enhanced customer experience. The market's potential is considerable, with ample room for expansion and innovation in the coming years.

India Student Accommodation Market Segmentation

-

1. Service Type

- 1.1. Wi-Fi

- 1.2. Laundry

- 1.3. Utilities

- 1.4. Dishwasher

- 1.5. Parking

-

2. Type

- 2.1. PG

- 2.2. PBSA

- 2.3. Studio Apartment

- 2.4. Live in On-Campus Housing

- 2.5. Live in Off-Campus Housing

India Student Accommodation Market Segmentation By Geography

- 1. India

India Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Education Sector; Rising Demand for Quality Accomodation

- 3.3. Market Restrains

- 3.3.1. Enrolment Fluctuations

- 3.4. Market Trends

- 3.4.1. Urbanization Helping to Grow the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Wi-Fi

- 5.1.2. Laundry

- 5.1.3. Utilities

- 5.1.4. Dishwasher

- 5.1.5. Parking

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. PG

- 5.2.2. PBSA

- 5.2.3. Studio Apartment

- 5.2.4. Live in On-Campus Housing

- 5.2.5. Live in Off-Campus Housing

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Student Accommodation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 NestAway

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Zolo Stays

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stanza Living

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Your-Space

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Placio

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 StayAbode

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Weroom**List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 OYO Life

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 CoHo

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 NestAway

List of Figures

- Figure 1: India Student Accommodation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Student Accommodation Market Share (%) by Company 2024

List of Tables

- Table 1: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Student Accommodation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Student Accommodation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Student Accommodation Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: India Student Accommodation Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: India Student Accommodation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Student Accommodation Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the India Student Accommodation Market?

Key companies in the market include NestAway, Zolo Stays, Stanza Living, Your-Space, Placio, StayAbode, Weroom**List Not Exhaustive, OYO Life, CoHo.

3. What are the main segments of the India Student Accommodation Market?

The market segments include Service Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growth of Education Sector; Rising Demand for Quality Accomodation.

6. What are the notable trends driving market growth?

Urbanization Helping to Grow the Market.

7. Are there any restraints impacting market growth?

Enrolment Fluctuations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Student Accommodation Market?

To stay informed about further developments, trends, and reports in the India Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence