Key Insights

The Italian online accommodation market, projected to reach €10.1 billion by 2024, is poised for significant expansion, with an anticipated Compound Annual Growth Rate (CAGR) of 6.8% between 2024 and 2033. This growth is propelled by the escalating adoption of Online Travel Agencies (OTAs) such as Booking.com, Expedia, and Airbnb, offering unparalleled choice and seamless booking experiences. Italy's robust tourism industry, renowned for its historical sites and cultural heritage, further stimulates demand for online accommodation. The increasing prevalence of mobile bookings and advanced search functionalities are key drivers. Potential market challenges include seasonal tourism fluctuations, economic instability, and intense competition, requiring continuous innovation and strategic agility from industry participants. The market is segmented across mobile and web platforms, with bookings channeled through both third-party OTAs and direct booking channels. Prominent players like Airbnb and Booking.com underscore the critical role of brand visibility and user experience in this competitive arena. Future expansion will likely leverage technological advancements, customized service offerings, and sustainable tourism practices to enhance customer acquisition and retention.

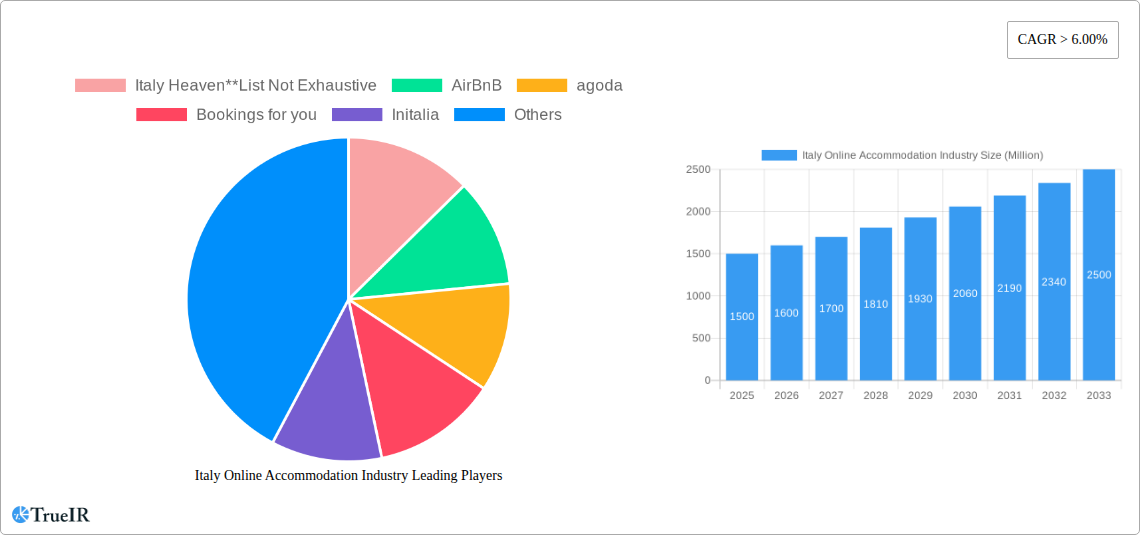

Italy Online Accommodation Industry Market Size (In Billion)

The competitive environment encompasses global leaders (Booking Holdings, Expedia, Airbnb) and niche providers serving specialized segments (Plum Guide, Italy Heaven). The success of these entities depends on their capacity to address a broad spectrum of traveler needs, from budget-friendly options to luxury experiences. The notable presence of local operators indicates opportunities for specialized services tailored to the Italian market. The ongoing trend towards personalized travel, the integration of immersive technologies like AR/VR for property showcasing, and the growing demand for sustainable accommodations are expected to shape the market's future trajectory. The forecast period (2024-2033) presents substantial opportunities for growth and innovation within this evolving sector.

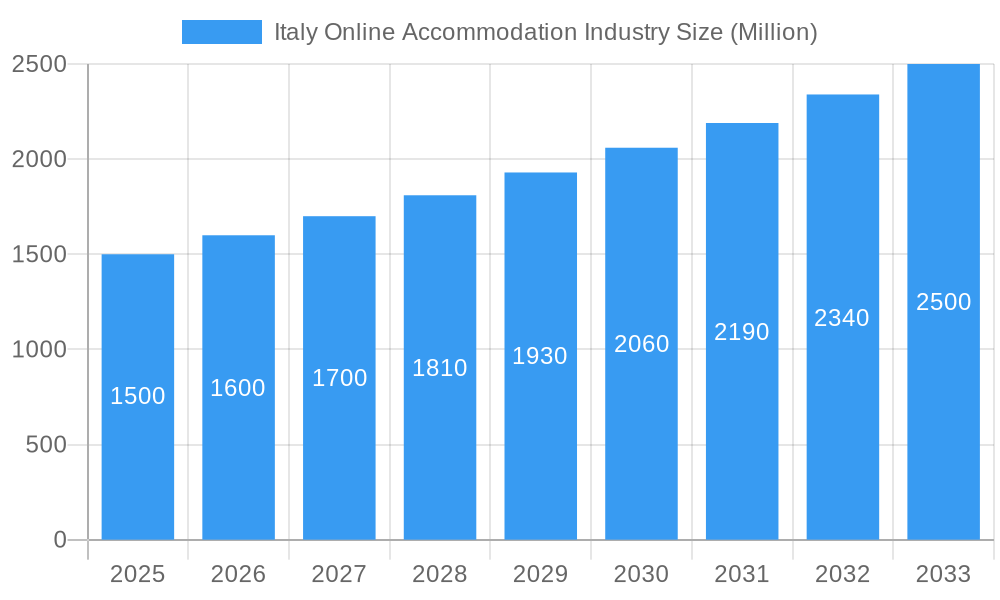

Italy Online Accommodation Industry Company Market Share

Italy Online Accommodation Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Italy online accommodation industry, covering market structure, competitive landscape, trends, opportunities, and future outlook from 2019 to 2033. Leveraging extensive data and insights, this report is essential for investors, businesses, and anyone seeking a comprehensive understanding of this rapidly evolving sector. The report utilizes a base year of 2025 and forecasts market performance through 2033, utilizing historical data from 2019-2024. The total market value is projected to reach xx Million by 2033.

Italy Online Accommodation Industry Market Structure & Competitive Landscape

The Italian online accommodation market is characterized by a high degree of competition, with both global giants and smaller, regional players vying for market share. Market concentration is moderate, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2025. However, the presence of dominant players like Booking Holdings and Expedia significantly influences market dynamics. The market is driven by innovation, with companies continually introducing new features and technologies to enhance user experience.

Key Players: The market is dominated by global players such as Booking Holdings, Expedia, and Airbnb, alongside regional players like Italy Heaven, agoda, Bookings for you, Initalia, TripAdvisor, and Plum guide, and Vrbo. This competitive landscape fosters innovation and efficiency.

Regulatory Impacts: Italian regulations concerning tourism and data privacy significantly influence the operation of online accommodation platforms. Compliance costs and evolving regulations present both challenges and opportunities.

Product Substitutes: The rise of alternative accommodation options, such as homestays and private rentals, presents both competitive pressure and expansion opportunities for online platforms.

End-User Segmentation: The market caters to a diverse range of travelers, from budget-conscious backpackers to luxury travelers, demanding tailored services and experiences.

M&A Trends: The industry has witnessed several mergers and acquisitions in recent years, leading to increased market consolidation and the emergence of larger, more integrated platforms. The total value of M&A activity in the period 2019-2024 is estimated at xx Million.

Italy Online Accommodation Industry Market Trends & Opportunities

The Italian online accommodation market is experiencing a dynamic period of expansion, propelled by a confluence of factors that are reshaping how travelers plan and book their stays. The market is projected to achieve a valuation of XX Million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This upward trajectory is significantly influenced by a rise in disposable incomes, a consistent influx of international and domestic tourists, and a clear shift in consumer behavior towards the convenience and efficiency of online booking platforms. Furthermore, rapid technological advancements, particularly in the realm of mobile booking applications and AI-driven personalization, are not only streamlining the booking process but also opening new avenues for innovation. The penetration of online accommodation bookings is anticipated to reach an impressive XX% by 2033. Travelers are increasingly seeking unique and authentic experiences, prompting industry players to emphasize customized itineraries, hyper-targeted advertising, and seamless digital interactions across all touchpoints.

Dominant Markets & Segments in Italy Online Accommodation Industry

The Italian online accommodation landscape is characterized by a rich tapestry of popular destinations and emerging hotspots, catering to diverse traveler preferences. Iconic cities such as Rome, Florence, and Milan continue to be primary drivers of online booking volume, attracting a steady stream of tourists seeking cultural immersion and urban experiences. Concurrently, there is a notable surge in online accommodation bookings in smaller cities and picturesque rural areas. This burgeoning interest signifies a broader trend towards experiential travel, with visitors increasingly valuing authentic local encounters and off-the-beaten-path discoveries.

Platform Type:

- Mobile Applications: The proliferation of smartphones and the demand for on-the-go convenience have cemented mobile booking as a dominant force. Dedicated mobile applications offer intuitive user interfaces, personalized recommendations, and seamless transaction capabilities, making them indispensable tools for modern travelers.

- Websites: Despite the rise of mobile, traditional websites remain a cornerstone of online accommodation bookings. They continue to provide comprehensive property details, extensive search functionalities, and detailed filtering options, appealing to users who prefer a more in-depth research experience.

Mode of Booking:

- Third-Party Online Portals (OTAs): Global leaders like Booking.com and Expedia offer an unparalleled breadth of accommodation choices and competitive pricing. While these platforms provide extensive reach and convenience, their commission-based models are a significant consideration for both providers and consumers.

- Direct/Captive Portals: Booking directly with hotels or individual property owners presents an attractive alternative. This approach can potentially lead to cost savings for travelers and foster greater loyalty between guests and providers. However, the selection might be more limited compared to the vast offerings of OTAs.

Key growth drivers fueling the expansion of this sector include:

- Enhanced Digital Infrastructure: The continuous expansion of high-speed internet access and widespread smartphone adoption across Italy creates a fertile ground for seamless online transactions and digital service delivery.

- Supportive Government Initiatives: Proactive government policies, investments in tourism infrastructure, and promotional campaigns are significantly bolstering the growth and accessibility of online accommodation bookings, encouraging both domestic and international tourism.

Italy Online Accommodation Industry Product Analysis

The Italian online accommodation industry features a diverse range of products and services, from budget-friendly hostels to luxury villas. Technological advancements are continuously improving the user experience. Integration of AI-powered recommendations, virtual tours, and personalized itineraries enhances customer satisfaction and drives bookings. The market demonstrates a strong fit for various technological improvements due to high demand for user-friendly platforms and personalized travel experiences.

Key Drivers, Barriers & Challenges in Italy Online Accommodation Industry

Key Drivers:

- Rising disposable incomes: Increased spending power enables more people to afford travel and online booking convenience.

- Growing tourism: Italy's rich culture and history consistently attract tourists, fueling demand for online accommodation.

- Technological advancements: User-friendly platforms and AI-powered features enhance the online booking experience.

Challenges and Restraints:

- Intense Competition: The market’s competitiveness forces businesses to maintain low prices and offer highly competitive services.

- Regulatory Hurdles: Compliance with data privacy regulations and tourism-related laws adds complexity for businesses. Estimated compliance costs in 2025 amount to xx Million.

- Supply Chain Disruptions: Global events and economic fluctuations can disrupt accommodation supply chains, influencing online bookings.

Growth Drivers in the Italy Online Accommodation Industry Market

The sustained expansion of the Italian online accommodation industry is fundamentally driven by a powerful combination of escalating tourist arrivals, the ongoing enhancement of digital infrastructure, and the accelerating adoption of mobile booking technologies. This growth is further amplified by robust government support for the tourism sector and generally favorable economic conditions, creating an environment ripe for continued development and innovation.

Challenges Impacting Italy Online Accommodation Industry Growth

The main challenges include intense competition, regulatory complexities, and the potential impact of economic downturns or global events on travel demand. Maintaining high levels of customer service in a competitive market is also a significant challenge.

Key Players Shaping the Italy Online Accommodation Industry Market

- Italy Heaven

- Airbnb

- agoda

- Bookings for you

- Initalia

- Trip advisor

- Booking Holdings

- Expedia

- Plum guide

- Vrbo

Significant Italy Online Accommodation Industry Industry Milestones

- June 01, 2021: Trip.com and TripAdvisor solidified their strategic alliance by integrating TripAdvisor Plus into their offerings, aiming to elevate the overall travel experience for customers.

- July 20, 2021: TripAdvisor forged valuable partnerships with prominent hotel technology providers, including SiteMinder, Roiback, Derbysoft, and WebHotelier. This collaboration was instrumental in broadening the participation of hotels within the TripAdvisor Plus ecosystem.

- September 13, 2021: In a move to enrich the travel journey, TripAdvisor announced a partnership with Audible, ensuring travelers have convenient access to a wide array of audio entertainment during their trips.

Future Outlook for Italy Online Accommodation Industry Market

The future of the Italian online accommodation market appears exceptionally promising, poised for sustained growth fueled by increasing tourism flows, relentless technological innovation, and strategic collaborations within the industry. A heightened focus on delivering personalized travel experiences and the leveraging of cutting-edge technologies will be paramount in shaping the market's evolution. This dynamic environment presents substantial opportunities for market expansion, strategic acquisitions, and further consolidation. The market is on track to maintain its growth trajectory, with projections indicating it will surpass XX Million by 2033.

Italy Online Accommodation Industry Segmentation

-

1. Platform type

- 1.1. Mobile Application

- 1.2. Website

-

2. Mode of Booking type

- 2.1. Third Party Online Portals

- 2.2. Direct/Captive portals

Italy Online Accommodation Industry Segmentation By Geography

- 1. Italy

Italy Online Accommodation Industry Regional Market Share

Geographic Coverage of Italy Online Accommodation Industry

Italy Online Accommodation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Long-Distances are Physically Demanding which in return Restraining the Market

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration has Huge Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Online Accommodation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 5.1.1. Mobile Application

- 5.1.2. Website

- 5.2. Market Analysis, Insights and Forecast - by Mode of Booking type

- 5.2.1. Third Party Online Portals

- 5.2.2. Direct/Captive portals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Platform type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Italy Heaven**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AirBnB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 agoda

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bookings for you

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Initalia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Trip advisor

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Booking Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Expedia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plum guide

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vrbo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Italy Heaven**List Not Exhaustive

List of Figures

- Figure 1: Italy Online Accommodation Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italy Online Accommodation Industry Share (%) by Company 2025

List of Tables

- Table 1: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 2: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 3: Italy Online Accommodation Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Italy Online Accommodation Industry Revenue billion Forecast, by Platform type 2020 & 2033

- Table 5: Italy Online Accommodation Industry Revenue billion Forecast, by Mode of Booking type 2020 & 2033

- Table 6: Italy Online Accommodation Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Online Accommodation Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Italy Online Accommodation Industry?

Key companies in the market include Italy Heaven**List Not Exhaustive, AirBnB, agoda, Bookings for you, Initalia, Trip advisor, Booking Holdings, Expedia, Plum guide, Vrbo.

3. What are the main segments of the Italy Online Accommodation Industry?

The market segments include Platform type, Mode of Booking type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends is Driving the Market; Cultural Exploration is Driving the Market.

6. What are the notable trends driving market growth?

Increasing Internet Penetration has Huge Impact on the Market.

7. Are there any restraints impacting market growth?

Long-Distances are Physically Demanding which in return Restraining the Market.

8. Can you provide examples of recent developments in the market?

On September 13, 2021. TripAdvisor partnered with Audible for the Ultimate Travel Audio Entertainment, it makes easy for traveller to listen their favourite audio playlists with them during their next trip with just a few taps on their mobile device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Online Accommodation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Online Accommodation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Online Accommodation Industry?

To stay informed about further developments, trends, and reports in the Italy Online Accommodation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence