Key Insights

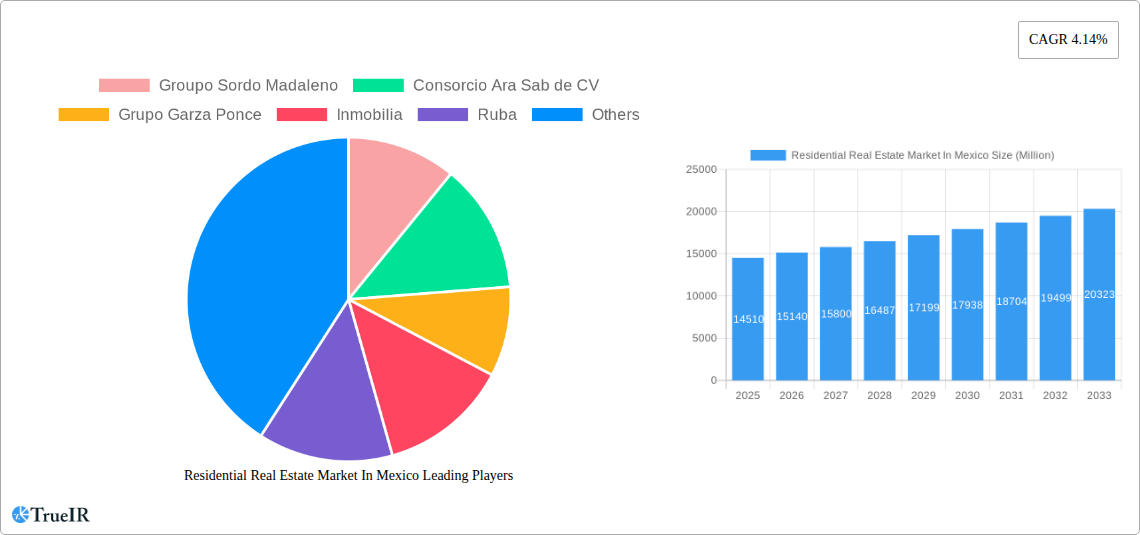

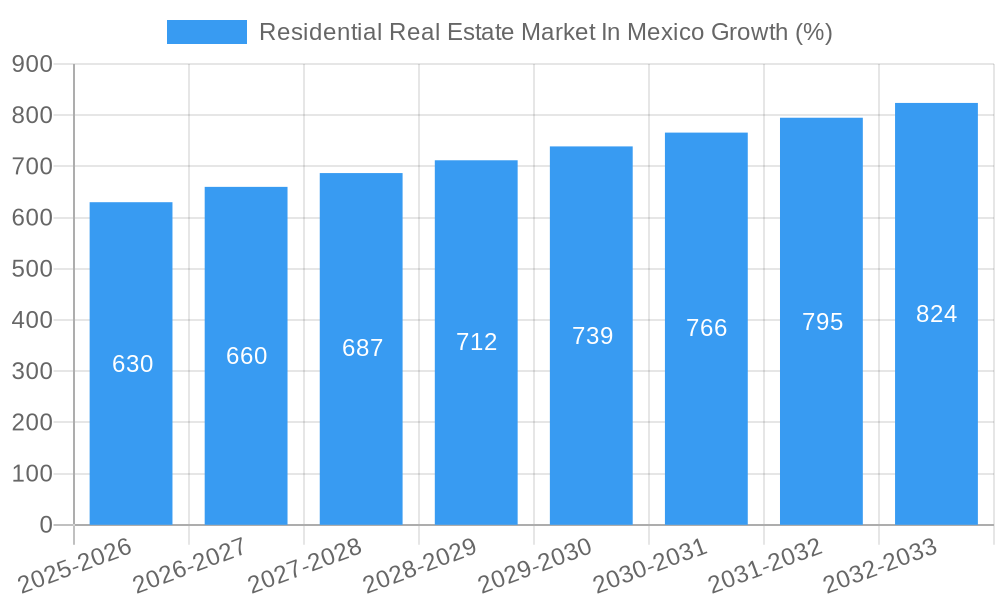

The Mexican residential real estate market, valued at $14.51 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.14% from 2025 to 2033. This growth is fueled by several key factors. A burgeoning middle class with increasing disposable income is driving demand for housing, particularly in urban centers. Government initiatives aimed at improving infrastructure and promoting affordable housing also contribute positively. Furthermore, Mexico's strategic geographic location and its growing economy attract both domestic and foreign investment in the real estate sector, further stimulating market expansion. The market is segmented primarily by property type, with apartments and condominiums representing a significant share, followed by landed houses and villas. Leading developers like Grupo Sordo Madaleno, Consorcio Ara Sab de CV, and Grupo Garza Ponce play a crucial role in shaping the market landscape, contributing to the construction of diverse housing options that cater to various income levels and preferences. While challenges such as fluctuating interest rates and regulatory hurdles exist, the overall outlook remains positive, driven by underlying economic fundamentals and consistent demand.

The long-term forecast indicates continued growth, albeit at a potentially moderated pace as the market matures. While the initial rapid expansion may slow slightly, the consistent demand and ongoing development projects suggest sustained growth throughout the forecast period. Specific market segments, such as luxury housing and developments in rapidly growing cities, are likely to experience more pronounced growth compared to others. Continuous monitoring of macroeconomic indicators, government policies, and shifts in consumer preferences will be essential to accurately forecasting future market performance. The competitive landscape is likely to remain dynamic, with existing players vying for market share and new entrants seeking opportunities in specific niches.

Residential Real Estate Market in Mexico: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the dynamic Residential Real Estate Market in Mexico, covering the period from 2019 to 2033. We delve into market structure, competitive landscapes, emerging trends, and future growth projections, offering valuable insights for investors, developers, and industry stakeholders. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and a forecast period spanning 2025-2033. Key market segments, including apartments and condominiums, and landed houses and villas, are analyzed in detail, along with influential players and recent significant industry milestones. Expect detailed quantitative and qualitative analysis, including market size, CAGR, and market penetration rates, providing a clear understanding of this thriving market.

Residential Real Estate Market In Mexico Market Structure & Competitive Landscape

The Mexican residential real estate market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Concentration ratios (e.g., CR4) are estimated at xx% for the overall market in 2024, indicating room for both consolidation and the emergence of niche players. Innovation is driven by technological advancements in property management, online platforms, and construction techniques. Regulatory impacts, including zoning laws and building codes, significantly influence development patterns and investment decisions. Substitutes, such as rental properties, exert varying degrees of pressure depending on location and economic conditions.

End-user segmentation is primarily based on income levels, lifestyle preferences, and family size. Mergers and acquisitions (M&A) activity has seen a moderate increase in recent years, with an estimated xx Million USD in transaction volume in 2024, driven primarily by consolidation within the apartment and condominium segments.

- Market Concentration: xx% CR4 in 2024, projected to reach xx% by 2033.

- Innovation Drivers: PropTech, sustainable construction, smart home technologies.

- Regulatory Impacts: Zoning laws, building codes, environmental regulations.

- Product Substitutes: Rental markets, co-living spaces.

- End-User Segmentation: Income-based, lifestyle-based, family-based.

- M&A Trends: xx Million USD transaction volume in 2024, driven by consolidation.

Residential Real Estate Market In Mexico Market Trends & Opportunities

The Mexican residential real estate market is experiencing robust growth, driven by factors such as urbanization, population increase, and rising disposable incomes. The market size is estimated at xx Million USD in 2024, exhibiting a CAGR of xx% during the historical period (2019-2024). This growth trajectory is expected to continue, with a projected CAGR of xx% during the forecast period (2025-2033), reaching an estimated market size of xx Million USD by 2033. Technological advancements, including the rise of PropTech platforms like Habi, are reshaping market dynamics, improving transparency, and enhancing efficiency. Consumer preferences are shifting towards sustainable and smart homes, creating opportunities for developers focusing on environmentally friendly and technologically advanced housing solutions. Intense competition necessitates innovative marketing strategies, competitive pricing, and superior customer service to gain market share.

Dominant Markets & Segments in Residential Real Estate Market In Mexico

The Mexico City metropolitan area consistently ranks as the dominant market segment, driven by strong population growth, economic activity, and significant infrastructure investments. However, other major cities are also exhibiting significant growth potential, including Guadalajara, Monterrey, and Cancun.

Within the residential segment, Apartments and Condominiums represent the largest share, fueled by demand from young professionals and urban dwellers. Landed Houses and Villas cater to a higher income segment and are more prevalent in suburban and rural areas. Growth is expected to be driven by:

- Apartments and Condominiums:

- Rising urbanization and migration to urban centers.

- Increased demand for affordable housing options in proximity to employment opportunities.

- Government initiatives to improve housing affordability.

- Landed Houses and Villas:

- Growing disposable income among higher-income households.

- Preference for larger living spaces and private outdoor areas.

- Development of luxury residential communities.

Residential Real Estate Market In Mexico Product Analysis

Product innovations are focused on energy efficiency, smart home integration, and sustainable building materials. This includes the adoption of renewable energy sources, smart thermostats, and eco-friendly construction techniques. The competitive advantage lies in offering superior quality, innovative designs, and technologically advanced features that appeal to discerning buyers. Market fit hinges on aligning product offerings with specific consumer preferences and price points, catering to diverse income levels and lifestyle choices.

Key Drivers, Barriers & Challenges in Residential Real Estate Market In Mexico

Key Drivers:

- Urbanization: The ongoing migration from rural to urban areas is driving demand for housing.

- Economic Growth: Rising disposable incomes are enabling increased housing affordability.

- Government Initiatives: Government programs supporting affordable housing are stimulating market growth.

Challenges:

- Regulatory Hurdles: Complex permitting processes and bureaucratic delays impede development.

- Supply Chain Issues: Disruptions in the supply chain impact construction costs and timelines.

- Competition: Intense competition among developers requires innovative strategies and effective marketing.

Growth Drivers in the Residential Real Estate Market In Mexico Market

The Mexican residential real estate market's growth is propelled by urbanization, economic growth, and government initiatives focused on affordable housing. Technological advancements in construction and property management further fuel growth. Improved infrastructure and increased foreign investment contribute to expanding the market's potential.

Challenges Impacting Residential Real Estate Market In Mexico Growth

Challenges include regulatory hurdles leading to project delays, supply chain disruptions affecting costs, and intense competition among developers. These factors, combined with economic fluctuations, can impede market growth if not strategically addressed.

Key Players Shaping the Residential Real Estate Market In Mexico Market

- Grupo Sordo Madaleno

- Consorcio Ara Sab de CV

- Grupo Garza Ponce

- Inmobilia

- Ruba

- Ideal Impulsora Del Desarrollo

- Grupo Jomer

- Groupo Lar

- Aleatica

- Grupo HIR

Significant Residential Real Estate Market In Mexico Industry Milestones

- June 2023: Habi secures USD 15 Million (potential USD 50 Million) from IDB Invest to boost expansion and improve secondary market liquidity.

- June 2023: Celaya Tequila partners with New Story to fund affordable housing in Jalisco, Mexico, demonstrating corporate social responsibility and impacting the affordable housing sector.

Future Outlook for Residential Real Estate Market In Mexico Market

The future of the Mexican residential real estate market remains positive. Continued urbanization, economic growth, and innovative technological solutions will drive significant expansion. Strategic investments in infrastructure and government support for affordable housing will further enhance market potential, with significant growth opportunities for developers and investors who can adapt to evolving consumer preferences and navigate the regulatory landscape effectively.

Residential Real Estate Market In Mexico Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

Residential Real Estate Market In Mexico Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Residential Real Estate Market In Mexico REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.14% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1 Demand for Residential Real Estate Witnessing Notable Surge

- 3.4.2 Primarily Driven by Young Homebuyers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Landed Houses and Villas

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Landed Houses and Villas

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Landed Houses and Villas

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Landed Houses and Villas

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Residential Real Estate Market In Mexico Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Landed Houses and Villas

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Groupo Sordo Madaleno

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Consorcio Ara Sab de CV

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Grupo Garza Ponce

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Inmobilia

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ruba

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ideal Impulsora Del Desarrollo**List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grupo Jomer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Groupo Lar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Aleatica

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Grupo HIR

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Groupo Sordo Madaleno

List of Figures

- Figure 1: Global Residential Real Estate Market In Mexico Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Mexico Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 3: Mexico Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 5: North America Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 9: South America Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 10: South America Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 13: Europe Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 14: Europe Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 17: Middle East & Africa Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 18: Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Residential Real Estate Market In Mexico Revenue (Million), by Type 2024 & 2032

- Figure 21: Asia Pacific Residential Real Estate Market In Mexico Revenue Share (%), by Type 2024 & 2032

- Figure 22: Asia Pacific Residential Real Estate Market In Mexico Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Residential Real Estate Market In Mexico Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Argentina Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United Kingdom Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: France Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Spain Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Russia Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Benelux Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Nordics Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Europe Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Turkey Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Israel Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: GCC Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: North Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: South Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East & Africa Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Residential Real Estate Market In Mexico Revenue Million Forecast, by Country 2019 & 2032

- Table 36: China Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: India Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Japan Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: South Korea Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: ASEAN Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Oceania Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Asia Pacific Residential Real Estate Market In Mexico Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Residential Real Estate Market In Mexico?

The projected CAGR is approximately 4.14%.

2. Which companies are prominent players in the Residential Real Estate Market In Mexico?

Key companies in the market include Groupo Sordo Madaleno, Consorcio Ara Sab de CV, Grupo Garza Ponce, Inmobilia, Ruba, Ideal Impulsora Del Desarrollo**List Not Exhaustive, Grupo Jomer, Groupo Lar, Aleatica, Grupo HIR.

3. What are the main segments of the Residential Real Estate Market In Mexico?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Demand for Residential Real Estate Witnessing Notable Surge. Primarily Driven by Young Homebuyers.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Habi, a prominent real estate technology platform, is set to receive a substantial financial boost of USD 15 million from IDB Invest. This funding, spread over four years, aims to fuel Habi's expansion plans in Mexico. While the structured loan has the potential to reach USD 50 million, its primary focus is to cater to Habi's working capital needs. IDB Invest's strategic move is not just about bolstering Habi's growth; it also aims to leverage technology to enhance liquidity and agility in Mexico's secondary real estate markets. By addressing the housing gap in Mexico, this funding initiative is poised to elevate market efficiency, bolster transparency, encourage local contractors for home renovations, and expand Habi's corridor network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Residential Real Estate Market In Mexico," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Residential Real Estate Market In Mexico report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Residential Real Estate Market In Mexico?

To stay informed about further developments, trends, and reports in the Residential Real Estate Market In Mexico, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence