Key Insights

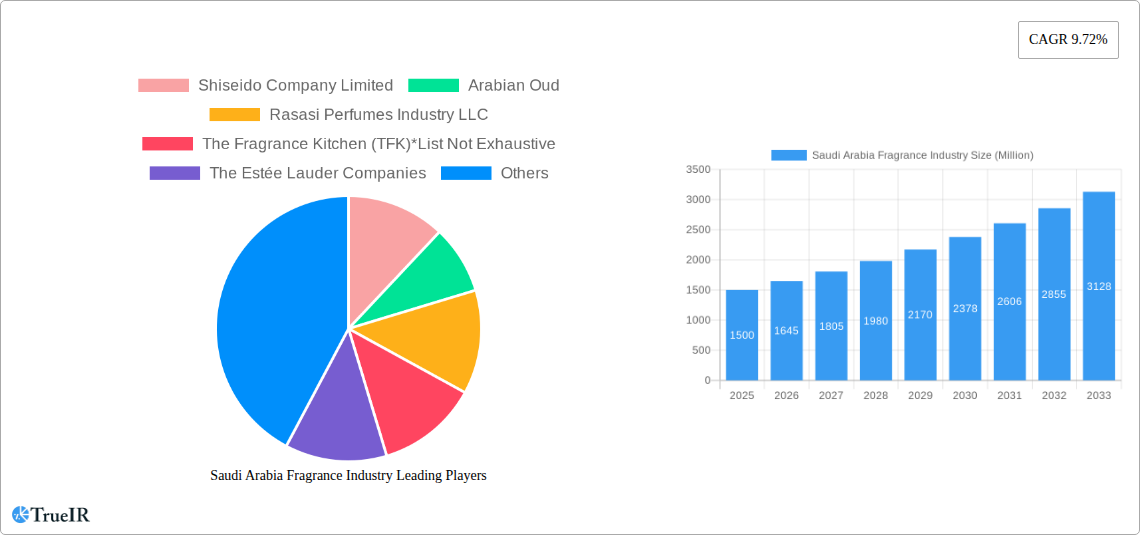

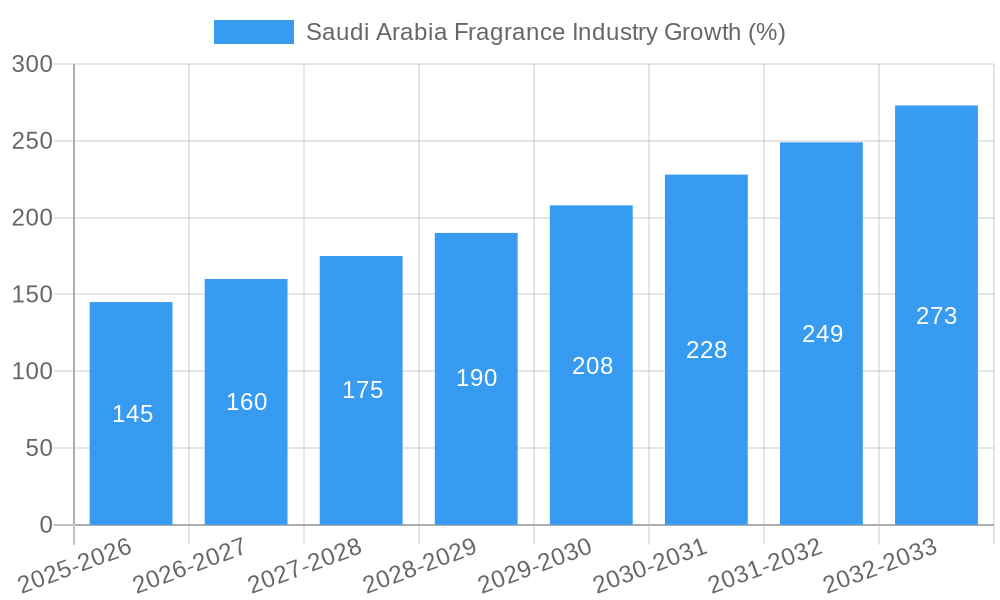

The Saudi Arabian fragrance market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.72% from 2025 to 2033. This expansion is fueled by several key drivers. The rising disposable incomes among Saudi Arabian consumers, particularly within the younger demographic, are driving increased spending on premium and luxury fragrances. A burgeoning tourism sector also contributes significantly, with visitors contributing to the market demand. Furthermore, the growing influence of social media and beauty influencers promotes the adoption of new fragrances and brands, impacting purchasing decisions. The market is segmented by product type (hair care, skin care, makeup, deodorants, fragrances), pricing category (mass, premium), and end-user (men, women, unisex). The premium segment is experiencing particularly strong growth, reflecting a shift towards higher-quality, niche fragrances. However, challenges remain. Fluctuations in oil prices can indirectly impact consumer spending, while potential economic slowdowns could moderate market expansion. Competition among established international brands and local players remains fierce, demanding innovative product development and effective marketing strategies to maintain market share.

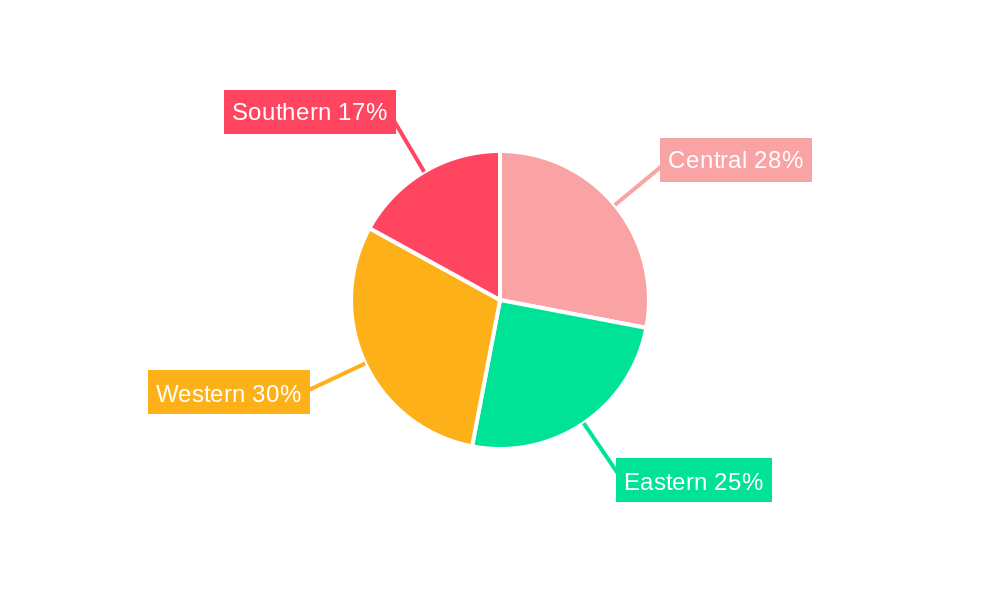

The competitive landscape features a mix of international giants like L'Oréal S.A., Unilever PLC, and Estée Lauder Companies, alongside prominent regional players such as Arabian Oud, Rasasi Perfumes, and Zohoor Alreef. These companies employ diverse strategies—from leveraging established brand recognition to focusing on regional cultural nuances—to cater to the diverse consumer base. Future growth will hinge on the ability of companies to adapt to evolving consumer preferences, embracing sustainable practices, and capitalizing on the increasing digitalization of the retail sector. Regional variations within Saudi Arabia—with potential differences in demand across Central, Eastern, Western, and Southern regions—also present opportunities for targeted marketing and distribution strategies. A deeper understanding of these regional nuances will be crucial for success in this dynamic market.

Saudi Arabia Fragrance Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Saudi Arabia fragrance industry, encompassing market size, segmentation, competitive landscape, and future growth projections. Leveraging extensive research and data analysis, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Saudi Arabia Fragrance Industry Market Structure & Competitive Landscape

The Saudi Arabian fragrance market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) estimated at xx in 2024. Key players such as Shiseido Company Limited, Arabian Oud, Rasasi Perfumes Industry LLC, The Fragrance Kitchen (TFK), The Estée Lauder Companies, Unilever PLC, Zohoor Alreef, L'Oréal S A, Revlon Inc, and The Procter & Gamble Company hold significant market share. Innovation, particularly in scent technology and sustainable packaging, is a major driver. Regulatory changes regarding ingredient labeling and safety standards significantly impact market dynamics. Fragrances face competition from other personal care products, including deodorants, skincare, and hair care. The end-user segmentation is primarily divided into men, women, and unisex categories. The M&A activity in the period 2019-2024 has involved xx deals, with a total value of approximately $xx Million, primarily driven by consolidation among smaller players. Further consolidation is expected in the forecast period.

Saudi Arabia Fragrance Industry Market Trends & Opportunities

The Saudi Arabian fragrance market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. This expansion is fueled by several key factors, including increasing disposable incomes, a burgeoning young population with high spending power, and a growing awareness of personal grooming and self-expression. Technological advancements such as AI-powered fragrance creation and personalized scent recommendations are shaping consumer experiences. Premium segment fragrances are enjoying higher growth rates driven by higher discretionary spending. Consumer preferences are shifting towards natural and organic ingredients, and sustainable practices, creating opportunities for brands emphasizing these aspects. Competitive dynamics remain intense, with established players and new entrants vying for market share through innovative product launches and targeted marketing strategies. Market penetration rates for premium fragrances are expected to increase from xx% in 2024 to xx% by 2033, while mass fragrances retain a significant share. The market size in 2025 is estimated to be $xx Million, expanding to $xx Million by 2033.

Dominant Markets & Segments in Saudi Arabia Fragrance Industry

The Premium segment within the Fragrances type demonstrates the most significant growth. Key growth drivers in this segment include:

- Rising Disposable Incomes: Increased affluence allows consumers to spend more on luxury and premium products.

- Westernization of Lifestyle: The adoption of Western trends in personal care and grooming drives demand for premium fragrances.

- Emphasis on Self-Expression: Premium fragrances are seen as a way to express individuality and status.

- E-commerce Growth: The rising popularity of online retail channels expands access to premium products.

- Luxury Retail Expansion: The growth of luxury malls and department stores provides prime retail space.

The major cities, such as Riyadh, Jeddah, and Dammam, dominate the market due to their large population base and higher concentration of affluent consumers.

Saudi Arabia Fragrance Industry Product Analysis

Product innovation is heavily concentrated on creating unique, long-lasting scents with natural and sustainable ingredients. Technology integration is driving personalization and customization, creating opportunities for products catering to diverse needs and preferences. Competitive advantages are derived through unique fragrance formulations, superior packaging, strong branding, and effective marketing strategies. Advancements in fragrance delivery technologies and sustainable packaging contribute to market fit and attract eco-conscious consumers.

Key Drivers, Barriers & Challenges in Saudi Arabia Fragrance Industry

Key Drivers:

Rising disposable incomes, increasing consumer awareness of personal care, and technological innovations like AI-powered scent creation drive market growth. Government initiatives supporting local businesses and foreign investments also contribute positively.

Challenges:

Stringent regulatory requirements regarding ingredient safety and labeling pose a significant barrier for manufacturers. Supply chain disruptions and price volatility of raw materials impact production costs and profitability. Intense competition and increasing consumer demand for natural and sustainable products create challenges for companies lacking in these areas. The estimated cost of regulatory compliance adds an additional $xx Million annually to operational expenses.

Growth Drivers in the Saudi Arabia Fragrance Industry Market

The key drivers are rising disposable incomes, increasing urbanization, a young and fashion-conscious population, and the expanding influence of social media in shaping consumer preferences. Government initiatives to promote local manufacturing and tourism indirectly benefit the industry.

Challenges Impacting Saudi Arabia Fragrance Industry Growth

Key challenges include the volatility of raw material prices, the stringent regulatory landscape impacting formulation and labeling, and the rising demand for natural and sustainable alternatives. Competition from international brands and counterfeiting also pose significant threats.

Key Players Shaping the Saudi Arabia Fragrance Industry Market

- Shiseido Company Limited

- Arabian Oud

- Rasasi Perfumes Industry LLC

- The Fragrance Kitchen (TFK)

- The Estée Lauder Companies

- Unilever PLC

- Zohoor Alreef

- L'Oréal S A

- Revlon Inc

- The Procter & Gamble Company

Significant Saudi Arabia Fragrance Industry Industry Milestones

- December 2021: Arabian Oud launched Oud07, a new fragrance targeting both men and women, expanding its product line and distribution channels.

- January 2023: L'Oréal Groupe showcased HAPTA, a computerized makeup applicator for users with limited mobility, and L'Oréal Brow Magic, an at-home electronic eyebrow applicator, demonstrating technological advancements in beauty application.

- January 2023: The Estée Lauder Companies launched a Voice-Enabled Makeup Assistant (VMA), an AI-powered tool assisting visually impaired makeup users, showcasing innovation in accessibility.

Future Outlook for Saudi Arabia Fragrance Industry Market

The Saudi Arabia fragrance industry is poised for continued growth, driven by sustained economic development, a rising middle class with increased purchasing power, and a strong focus on technological advancement within the beauty sector. Strategic opportunities exist for brands focusing on personalization, sustainability, and leveraging digital channels for marketing and sales. The market presents significant potential for both established players and new entrants focusing on innovation and consumer preferences.

Saudi Arabia Fragrance Industry Segmentation

-

1. Type

- 1.1. Hair Care

- 1.2. Skin Care

- 1.3. Make-up Products

- 1.4. Deodorants

- 1.5. Fragrances

-

2. Category

- 2.1. Mass

- 2.2. Premium

-

3. End-User

- 3.1. Men

- 3.2. Women

- 3.3. Unsex

Saudi Arabia Fragrance Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Fragrance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.72% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription

- 3.3. Market Restrains

- 3.3.1. High Cost of Rented Apparel Maintenance

- 3.4. Market Trends

- 3.4.1. Rising Number of Active Social Media Users

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hair Care

- 5.1.2. Skin Care

- 5.1.3. Make-up Products

- 5.1.4. Deodorants

- 5.1.5. Fragrances

- 5.2. Market Analysis, Insights and Forecast - by Category

- 5.2.1. Mass

- 5.2.2. Premium

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Men

- 5.3.2. Women

- 5.3.3. Unsex

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Central Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2019-2031

- 8. Western Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2019-2031

- 9. Southern Saudi Arabia Fragrance Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Shiseido Company Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Arabian Oud

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Rasasi Perfumes Industry LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Fragrance Kitchen (TFK)*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 The Estée Lauder Companies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Unilever PLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Zohoor Alreef

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 L'Oréal S A

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Revlon Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 The Procter & Gamble Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Shiseido Company Limited

List of Figures

- Figure 1: Saudi Arabia Fragrance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Fragrance Industry Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Saudi Arabia Fragrance Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Central Saudi Arabia Fragrance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Eastern Saudi Arabia Fragrance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Western Saudi Arabia Fragrance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Saudi Arabia Fragrance Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Category 2019 & 2032

- Table 13: Saudi Arabia Fragrance Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 14: Saudi Arabia Fragrance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Fragrance Industry?

The projected CAGR is approximately 9.72%.

2. Which companies are prominent players in the Saudi Arabia Fragrance Industry?

Key companies in the market include Shiseido Company Limited, Arabian Oud, Rasasi Perfumes Industry LLC, The Fragrance Kitchen (TFK)*List Not Exhaustive, The Estée Lauder Companies, Unilever PLC, Zohoor Alreef, L'Oréal S A, Revlon Inc, The Procter & Gamble Company.

3. What are the main segments of the Saudi Arabia Fragrance Industry?

The market segments include Type, Category, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Sustainable Fashion Trend; Strategic Expansion With Respect To E-commerce Subscription.

6. What are the notable trends driving market growth?

Rising Number of Active Social Media Users.

7. Are there any restraints impacting market growth?

High Cost of Rented Apparel Maintenance.

8. Can you provide examples of recent developments in the market?

Jan 2023: At CES 2023, the L'Oréal Groupe revealed two new technological prototypes that open up new avenues for the expression of beauty. The first portable, ultra-precise computerized makeup applicator, called HAPTA, was created to improve the demands of those with restricted hand and arm mobility in terms of aesthetics. The first at-home electronic eyebrow makeup applicator, L'Oréal Brow Magic, was intended to give users custom brows in a matter of seconds.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Fragrance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Fragrance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Fragrance Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Fragrance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence