Key Insights

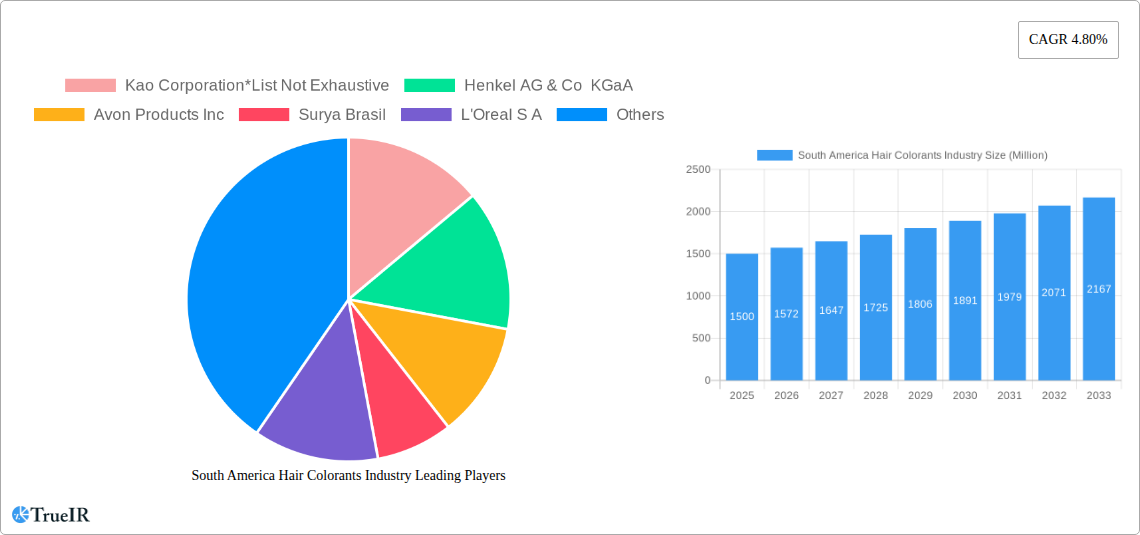

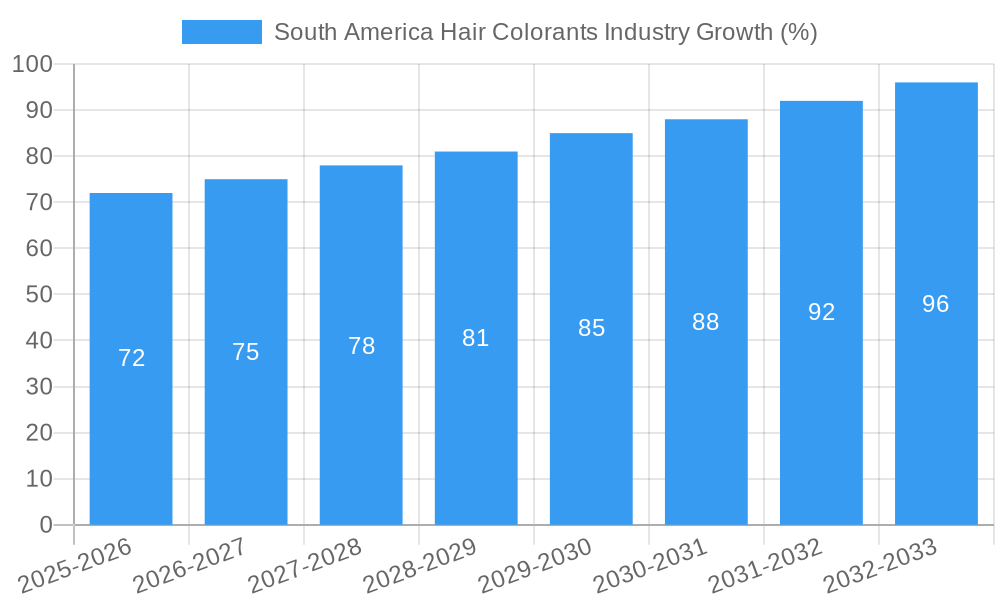

The South American hair colorants market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.80% from 2025 to 2033. This expansion is driven by several key factors. Firstly, a rising young adult population increasingly concerned with personal appearance and expressing individuality fuels demand for diverse hair color options. Secondly, the increasing penetration of e-commerce and the expanding presence of international brands offer greater accessibility to premium hair colorants. Furthermore, evolving consumer preferences towards natural and organic hair dyes are shaping the market, creating opportunities for brands offering such products. The market is segmented by product type (bleaches, highlighters, permanent, semi-permanent, and others) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist retailers, and online stores). Brazil and Argentina represent significant market shares, reflecting their substantial populations and relatively high disposable incomes. However, challenges exist, including economic volatility in some South American nations and the potential for counterfeit products impacting consumer trust.

The competitive landscape is characterized by a mix of multinational corporations such as L'Oréal S.A., Kao Corporation, and Henkel AG & Co. KGaA, alongside regional players and specialized brands catering to niche preferences. Successful companies are focusing on innovation, including developing eco-friendly formulations, expanding their product portfolios to cater to diverse hair types and textures, and strengthening their online presence to reach a wider customer base. Future growth will depend on companies effectively navigating economic uncertainties, addressing consumer demand for diverse and sustainable products, and adopting effective marketing strategies to build brand loyalty within this dynamic market. The expanding middle class and rising disposable incomes across South America particularly in urban areas will also contribute to growth.

South America Hair Colorants Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the South America hair colorants market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report dissects market trends, competitive landscapes, and future growth potential. The market size is estimated at XX Million in 2025 and is projected to reach XX Million by 2033, showcasing a robust CAGR of XX%.

South America Hair Colorants Industry Market Structure & Competitive Landscape

The South American hair colorants market exhibits a moderately concentrated structure, with key players like L'Oreal S.A, Kao Corporation, Henkel AG & Co KGaA, and Avon Products Inc holding significant market share. The industry's competitive landscape is shaped by factors such as innovation in product formulations (e.g., natural and organic colorants), stringent regulatory frameworks concerning chemical composition and safety, and the emergence of substitute products like henna. The market is segmented by product type (bleachers, highlighters, permanent, semi-permanent, others) and distribution channels (supermarkets/hypermarkets, convenience stores, specialist retailers, online stores, others).

- Market Concentration: The four largest players account for approximately XX% of the market share in 2025 (estimated). This indicates a moderately consolidated market.

- Innovation Drivers: Growing consumer demand for natural and organic hair colorants, as well as technologically advanced formulations offering better coverage and less damage, are key innovation drivers.

- Regulatory Impacts: Stringent regulations regarding the safety and labeling of chemical ingredients significantly influence product development and marketing strategies.

- Product Substitutes: The availability of natural alternatives like henna poses a competitive challenge to synthetic hair colorants.

- End-User Segmentation: The market caters to a diverse consumer base, including both men and women, with varying age groups and preferences influencing demand.

- M&A Trends: Over the historical period (2019-2024), there were approximately XX mergers and acquisitions, reflecting strategic efforts by major players to expand their market presence.

South America Hair Colorants Industry Market Trends & Opportunities

The South American hair colorants market is witnessing significant growth fueled by rising disposable incomes, increasing awareness of personal care, and the expanding influence of beauty trends and social media. Technological advancements, such as the development of ammonia-free and less damaging colorants, are reshaping consumer preferences. The market's competitive landscape is dynamic, with established players focusing on innovation, premiumization, and expanding distribution networks. The increasing penetration of e-commerce channels offers considerable opportunities for growth. The CAGR for the forecast period (2025-2033) is estimated at XX%, driven by factors such as increasing urbanization, evolving consumer lifestyles, and a growing focus on self-expression through hair styling. Market penetration rates for different product types vary significantly, with permanent colorants maintaining the highest market share due to long-lasting color retention. This contrasts with a growing preference for semi-permanent colorants, reflecting a shift towards less damaging products.

Dominant Markets & Segments in South America Hair Colorants Industry

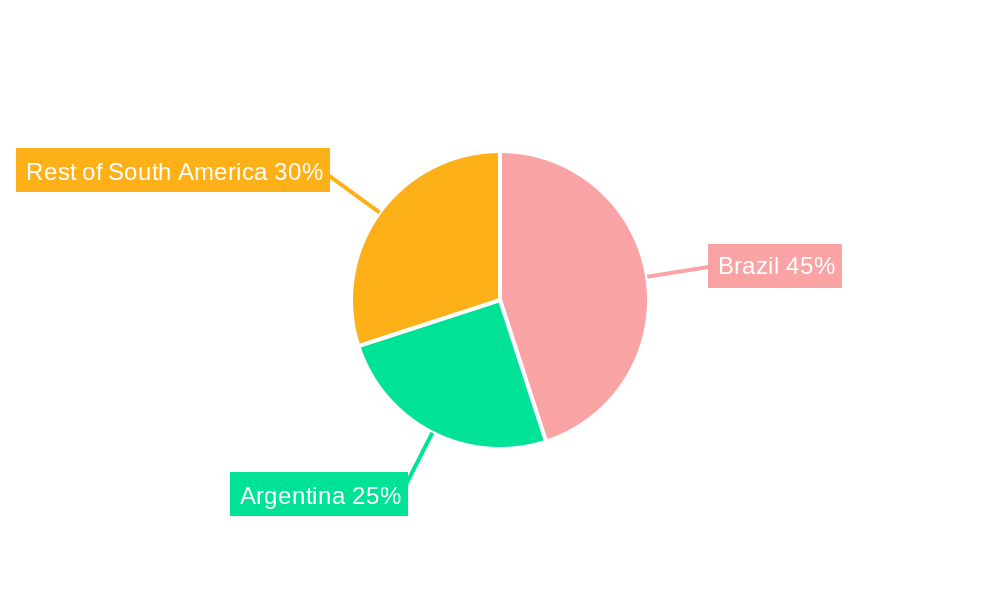

Brazil is the dominant market in South America for hair colorants, accounting for approximately XX% of the regional market value in 2025. This is attributed to factors such as a large population, high consumer spending on beauty products, and strong distribution networks. Argentina and Colombia also represent significant markets.

By Product Type:

- Permanent Colorants: This segment holds the largest market share due to its long-lasting color and widespread acceptance.

- Semi-Permanent Colorants: Witnessing rapid growth, driven by increasing demand for less damaging options.

- Bleachers and Highlighters: Show substantial growth potential given current trends in hair styling.

By Distribution Channel:

- Supermarkets/Hypermarkets: Remain the dominant distribution channel due to accessibility and wide product availability.

- Online Stores: Demonstrating significant growth, fueled by e-commerce expansion and convenience.

Key Growth Drivers:

- Rising Disposable Incomes: Increased purchasing power fuels demand for premium and diverse hair colorant products.

- Evolving Consumer Preferences: Growing preferences for natural ingredients and customizable color solutions drive product innovation.

- Expansion of E-commerce: Online retail channels boost accessibility and convenience for consumers.

South America Hair Colorants Industry Product Analysis

The South American hair colorants market showcases a range of products, from traditional permanent dyes to innovative ammonia-free and natural formulations. Technological advancements focus on minimizing damage to hair, providing vibrant and long-lasting color, and offering customized coloring solutions. The competitive advantage lies in offering a combination of high-quality performance, user-friendliness, and a focus on natural ingredients to cater to health-conscious consumers. The market shows a clear shift towards convenient, at-home coloring solutions, while professional salon services remain a significant segment for premium options and specialized treatments.

Key Drivers, Barriers & Challenges in South America Hair Colorants Industry

Key Drivers:

The South American hair colorants market is driven by increasing consumer spending on personal care, growing adoption of hair coloring among various age groups, and a rising preference for at-home hair-coloring solutions, leading to the expansion of this market. Favorable government policies supporting local manufacturing and innovation further fuel growth.

Challenges & Restraints:

Fluctuations in raw material prices and supply chain disruptions caused by various factors including political instability, pose challenges. Stricter regulatory guidelines concerning chemicals used in hair colorants add pressure on manufacturers to adapt their production processes. Intense competition from both domestic and international players also presents a notable hurdle, with pricing pressures and the need for continuous product innovation creating ongoing challenges.

Growth Drivers in the South America Hair Colorants Industry Market

Rising disposable incomes, expanding middle class, evolving beauty trends influenced by social media, and the increase in e-commerce penetration significantly contribute to the growth of the South American hair colorants market. The demand for natural, vegan, and organic products further fuels this expansion.

Challenges Impacting South America Hair Colorants Industry Growth

Regulatory hurdles related to the use of certain chemicals in hair colorants, price sensitivity among certain consumer segments, and the competitive pressure from both established and emerging players are significant challenges for the industry. Supply chain vulnerabilities and economic uncertainties also impact growth prospects.

Key Players Shaping the South America Hair Colorants Industry Market

- Kao Corporation

- Henkel AG & Co KGaA

- Avon Products Inc

- Surya Brasil

- L'Oreal S.A

- Hoyu Co Ltd

- Coferly

Significant South America Hair Colorants Industry Milestones

- 2020: L'Oreal launches a new range of ammonia-free hair colorants in Brazil.

- 2021: Kao Corporation invests in a new manufacturing facility in Colombia.

- 2022: Henkel AG & Co KGaA acquires a regional hair colorant brand in Argentina.

- 2023: Surya Brasil expands its distribution network to key cities across South America.

- 2024: Significant increase in the number of online stores selling hair colorants across South America.

Future Outlook for South America Hair Colorants Industry Market

The South American hair colorants market is poised for continued growth, driven by robust economic growth in several key countries, increasing consumer disposable income, and evolving consumer preferences. Strategic opportunities include focusing on product innovation, particularly in the natural and organic segment, expansion of e-commerce channels, and targeting specific demographic segments. The market shows strong potential for sustained growth, with further segmentation and customization of products tailored to specific consumer needs.

South America Hair Colorants Industry Segmentation

-

1. Product Type

- 1.1. Bleachers

- 1.2. Highlighters

- 1.3. Permanent Colorants

- 1.4. Semi-Permanent Colorants

- 1.5. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Stores

- 2.5. Others

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Hair Colorants Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Hair Colorants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure

- 3.3. Market Restrains

- 3.3.1. Prevalence of Counterfeit Goods

- 3.4. Market Trends

- 3.4.1. Brazil Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bleachers

- 5.1.2. Highlighters

- 5.1.3. Permanent Colorants

- 5.1.4. Semi-Permanent Colorants

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Stores

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Hair Colorants Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Kao Corporation*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Henkel AG & Co KGaA

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Avon Products Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Surya Brasil

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 L'Oreal S A

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Hoyu Co Ltd

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Coferly

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Kao Corporation*List Not Exhaustive

List of Figures

- Figure 1: South America Hair Colorants Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Hair Colorants Industry Share (%) by Company 2024

List of Tables

- Table 1: South America Hair Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Hair Colorants Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Hair Colorants Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Hair Colorants Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: South America Hair Colorants Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 9: South America Hair Colorants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: South America Hair Colorants Industry Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: South America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South America Hair Colorants Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Brazil South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Argentina South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of South America South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: South America Hair Colorants Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: South America Hair Colorants Industry Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 21: South America Hair Colorants Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 22: South America Hair Colorants Industry Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 23: South America Hair Colorants Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: South America Hair Colorants Industry Volume K Tons Forecast, by Geography 2019 & 2032

- Table 25: South America Hair Colorants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: South America Hair Colorants Industry Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: Brazil South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Brazil South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Argentina South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Argentina South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America South America Hair Colorants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America South America Hair Colorants Industry Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Hair Colorants Industry?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the South America Hair Colorants Industry?

Key companies in the market include Kao Corporation*List Not Exhaustive, Henkel AG & Co KGaA, Avon Products Inc, Surya Brasil, L'Oreal S A, Hoyu Co Ltd, Coferly.

3. What are the main segments of the South America Hair Colorants Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements and Aggressive Marketing; Inclination Toward Healthy Lifestyle And Athleisure.

6. What are the notable trends driving market growth?

Brazil Dominates the Market.

7. Are there any restraints impacting market growth?

Prevalence of Counterfeit Goods.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Hair Colorants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Hair Colorants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Hair Colorants Industry?

To stay informed about further developments, trends, and reports in the South America Hair Colorants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence