Key Insights

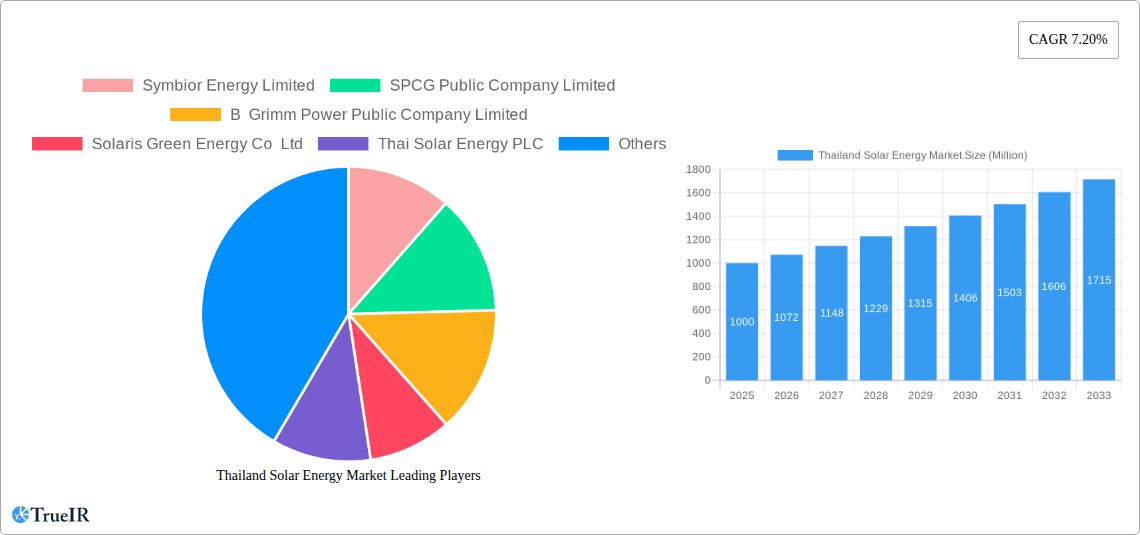

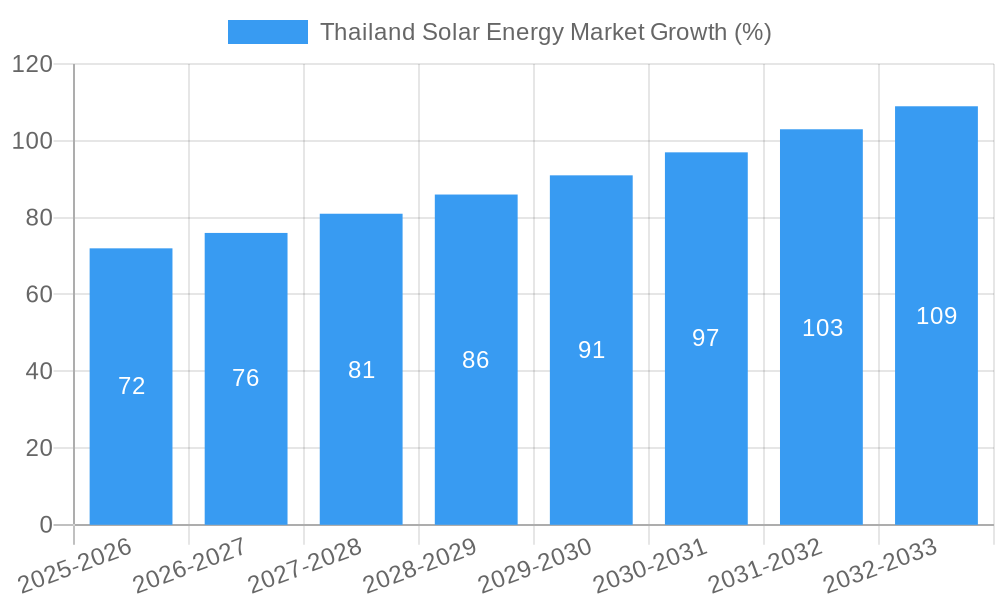

The Thailand solar energy market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR of 7.2% and a 2019-2024 historical period), is poised for robust growth over the forecast period (2025-2033). This expansion is driven by several factors, including the Thai government's commitment to renewable energy targets, increasing electricity demand, and declining solar PV technology costs. The solar PV segment currently dominates the market, benefiting from its established technology and scalability, while CSP (Concentrated Solar Power) is anticipated to witness gradual growth, particularly in large-scale projects. Key players like Symbior Energy Limited, SPCG Public Company Limited, and B Grimm Power Public Company Limited are actively shaping the market landscape through strategic investments and project developments. The market's growth trajectory, however, may face some constraints, including land availability for large-scale projects, regulatory hurdles, and grid integration challenges. Overcoming these challenges will be crucial to unlocking the full potential of Thailand's solar energy sector.

The forecast period (2025-2033) projects a significant increase in market value, driven by ongoing government support and technological advancements. This growth will likely see heightened competition among established players and new entrants. The market segmentation, particularly the dominance of solar PV, is expected to remain consistent, although the CSP segment is projected to experience a slow but steady increase as technology matures and large-scale projects gain traction. Continued focus on improving grid infrastructure and streamlining regulatory approvals will be pivotal in maximizing market growth and attracting further foreign investment in the sector.

Thailand Solar Energy Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Thailand solar energy market, offering invaluable insights for investors, industry professionals, and policymakers. Leveraging a comprehensive study period (2019-2033), with a base year of 2025 and a forecast period spanning 2025-2033, this report examines market structure, competitive dynamics, emerging trends, and future growth potential. Key segments, including Solar Photovoltaic (PV) and Concentrated Solar Power (CSP), are thoroughly explored, alongside crucial industry milestones and the impact of leading players. This data-rich report uses millions (M) for all value representations.

Thailand Solar Energy Market Market Structure & Competitive Landscape

The Thai solar energy market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2024. Key players, including Symbior Energy Limited, SPCG Public Company Limited, B Grimm Power Public Company Limited, Solaris Green Energy Co Ltd, Thai Solar Energy PLC, Black & Veatch Holding Company, Solartron PLC, Marubeni Corporation, and Energy Absolute PCL, dominate market share. Innovation is driven by government incentives promoting renewable energy, technological advancements in PV efficiency, and a growing demand for sustainable energy solutions.

Regulatory frameworks, including feed-in tariffs and net metering policies, significantly influence market dynamics. While hydropower and natural gas remain dominant, solar energy presents a compelling substitute, particularly in decentralized applications. End-user segments include residential, commercial, and industrial sectors, with the latter experiencing the most rapid growth. Mergers and acquisitions (M&A) activity has been moderate, with xx M USD in deals recorded between 2019 and 2024, primarily driven by strategic expansion and technology consolidation. The market is characterized by intense competition, with companies focusing on cost optimization, technology differentiation, and project development expertise.

Thailand Solar Energy Market Market Trends & Opportunities

The Thailand solar energy market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected between 2025 and 2033. Market size is estimated to reach xx Million USD in 2025, driven by increasing electricity demand, government support for renewable energy, and decreasing solar PV technology costs. Technological advancements such as bifacial solar panels and improved energy storage solutions are further enhancing market penetration. Consumer preferences are shifting towards sustainable and environmentally friendly energy solutions, creating a favorable environment for solar energy adoption. Competitive dynamics are marked by price competition, technological innovation, and strategic partnerships. Market penetration rates are expected to increase significantly, with xx% of the overall electricity generation projected to come from solar sources by 2033.

Dominant Markets & Segments in Thailand Solar Energy Market

The Solar Photovoltaic (PV) segment dominates the Thai solar energy market, accounting for over xx% of the total market share in 2024. Concentrated Solar Power (CSP) has a significantly smaller share, with xx% in 2024, although future growth is anticipated.

Key Growth Drivers for PV:

- Favorable government policies and incentives

- Decreasing PV technology costs

- Growing demand for clean energy solutions

- Increasing electricity prices

- Improved grid infrastructure

The dominance of PV stems from its lower initial investment cost compared to CSP, wider availability of technology, and established supply chains. While CSP offers higher efficiency in regions with abundant sunlight, its higher initial cost and technical complexity have limited its market penetration. However, advancements in CSP technology and supportive government initiatives could enhance its future adoption.

Thailand Solar Energy Market Product Analysis

Technological advancements are driving innovation in the Thai solar energy market. Higher-efficiency PV modules, improved energy storage solutions, and smart grid integration are enhancing the competitiveness of solar energy systems. Products are tailored to meet diverse end-user needs, encompassing residential rooftop systems, large-scale utility-scale projects, and industrial applications. Competitive advantages are built on cost efficiency, technological superiority, project execution expertise, and long-term operational support.

Key Drivers, Barriers & Challenges in Thailand Solar Energy Market

Key Drivers:

The Thai solar energy market is propelled by government initiatives promoting renewable energy integration, decreasing solar PV module costs, increasing electricity prices, and heightened environmental awareness among consumers. The country's abundant sunlight also contributes to the market's attractiveness.

Key Challenges:

Challenges include limited grid capacity in some regions, land availability constraints for large-scale projects, potential supply chain disruptions, and competition from other renewable energy sources. Regulatory complexities and bureaucratic hurdles can also delay project implementation. Quantifiable impacts include project delays (xx% of projects experience delays due to regulatory issues) and increased project costs (xx% cost increase due to supply chain uncertainties).

Growth Drivers in the Thailand Solar Energy Market Market

Government incentives, such as feed-in tariffs and tax credits, are significantly boosting solar energy adoption. Decreasing solar PV module costs enhance cost-competitiveness compared to fossil fuels. Technological advancements continue to improve efficiency and reduce operational costs, further bolstering market growth.

Challenges Impacting Thailand Solar Energy Market Growth

Regulatory uncertainties, intermittent electricity generation, and land acquisition challenges impede faster market expansion. Supply chain disruptions and a shortage of skilled labor can also create bottlenecks. Competition from established energy sources and the cost of integrating solar energy into the national grid remain significant challenges.

Key Players Shaping the Thailand Solar Energy Market Market

- Symbior Energy Limited

- SPCG Public Company Limited

- B Grimm Power Public Company Limited

- Solaris Green Energy Co Ltd

- Thai Solar Energy PLC

- Black & Veatch Holding Company

- Solartron PLC

- Marubeni Corporation

- Energy Absolute PCL

Significant Thailand Solar Energy Market Industry Milestones

- June 2023: National Power Supply Public Company Limited (NPS) completes the first phase of a 60 MW floating solar power plant, with a further 90 MW phase expected to be operational in Q1 2024. This demonstrates progress in utilizing unconventional locations for solar energy generation.

- March 2023: Falken Tires commences construction of a 22 MW solar panel installation at its Thai factory, showcasing significant private sector investment in renewable energy and on-site generation. Completion is expected within two years.

Future Outlook for Thailand Solar Energy Market Market

The Thailand solar energy market is poised for continued strong growth, driven by sustained government support, decreasing technology costs, and increasing demand for renewable energy. Strategic opportunities exist in large-scale solar power projects, rooftop solar installations, and energy storage solutions. The market's potential is substantial, with significant growth expected across all segments, leading to a more sustainable and diversified energy mix for Thailand.

Thailand Solar Energy Market Segmentation

-

1. Technology

- 1.1. Solar Photovoltaic (PV)

- 1.2. Concentrated Solar Power (CSP)

Thailand Solar Energy Market Segmentation By Geography

- 1. Thailand

Thailand Solar Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption

- 3.3. Market Restrains

- 3.3.1. 4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy

- 3.4. Market Trends

- 3.4.1. Solar Photovoltaic (PV) Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Solar Energy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Solar Photovoltaic (PV)

- 5.1.2. Concentrated Solar Power (CSP)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Symbior Energy Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SPCG Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B Grimm Power Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Solaris Green Energy Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thai Solar Energy PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Black & Veatch Holding Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Solartron PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Marubeni Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Energy Absolute PCL

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Symbior Energy Limited

List of Figures

- Figure 1: Thailand Solar Energy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Thailand Solar Energy Market Share (%) by Company 2024

List of Tables

- Table 1: Thailand Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Thailand Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 3: Thailand Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Thailand Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 5: Thailand Solar Energy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Thailand Solar Energy Market Volume gigawatt Forecast, by Region 2019 & 2032

- Table 7: Thailand Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Thailand Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

- Table 9: Thailand Solar Energy Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 10: Thailand Solar Energy Market Volume gigawatt Forecast, by Technology 2019 & 2032

- Table 11: Thailand Solar Energy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Thailand Solar Energy Market Volume gigawatt Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Solar Energy Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Thailand Solar Energy Market?

Key companies in the market include Symbior Energy Limited, SPCG Public Company Limited, B Grimm Power Public Company Limited, Solaris Green Energy Co Ltd, Thai Solar Energy PLC, Black & Veatch Holding Company, Solartron PLC, Marubeni Corporation, Energy Absolute PCL.

3. What are the main segments of the Thailand Solar Energy Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Policies and Increasing Adoption of Solar PV Systems4.; Soaring Electricity Prices Incentivized Installing Solar PV Systems for Self-Consumption.

6. What are the notable trends driving market growth?

Solar Photovoltaic (PV) Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Growth of Other Renewable Technologies Such as Wind and Bioenergy.

8. Can you provide examples of recent developments in the market?

June 2023: National Power Supply Public Company Limited (NPS) has completed the installation of the first phase of the 60 MW floating solar power plant on the well. The plant will start generating electricity in the fourth quarter of 2023. Also, the company is installing a 90 MW Floating Solar Farm Phase 2 which is expected to be completed and ready to generate electricity in the first quarter of next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Solar Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Solar Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Solar Energy Market?

To stay informed about further developments, trends, and reports in the Thailand Solar Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence