Key Insights

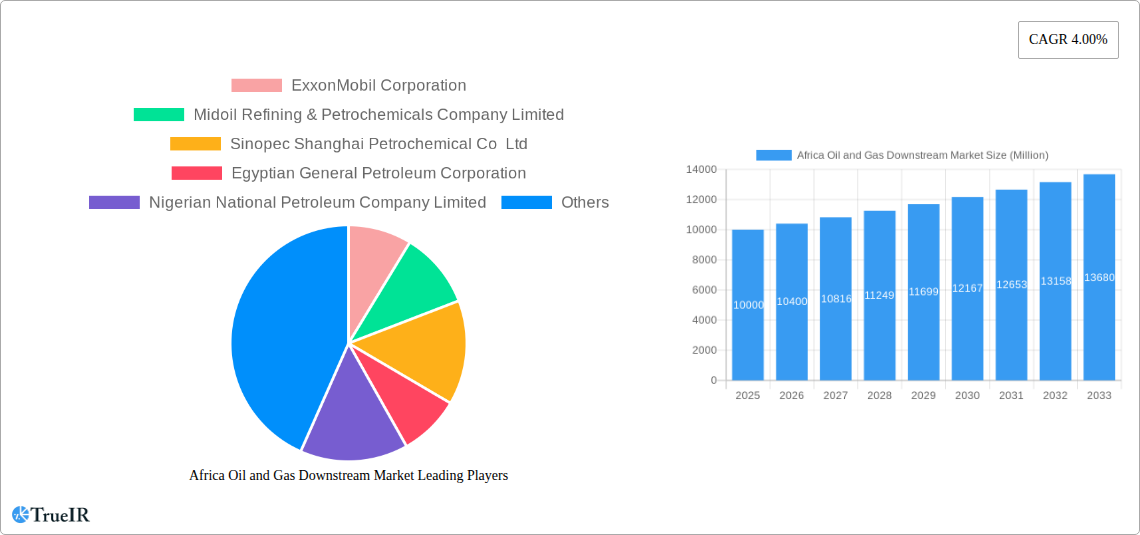

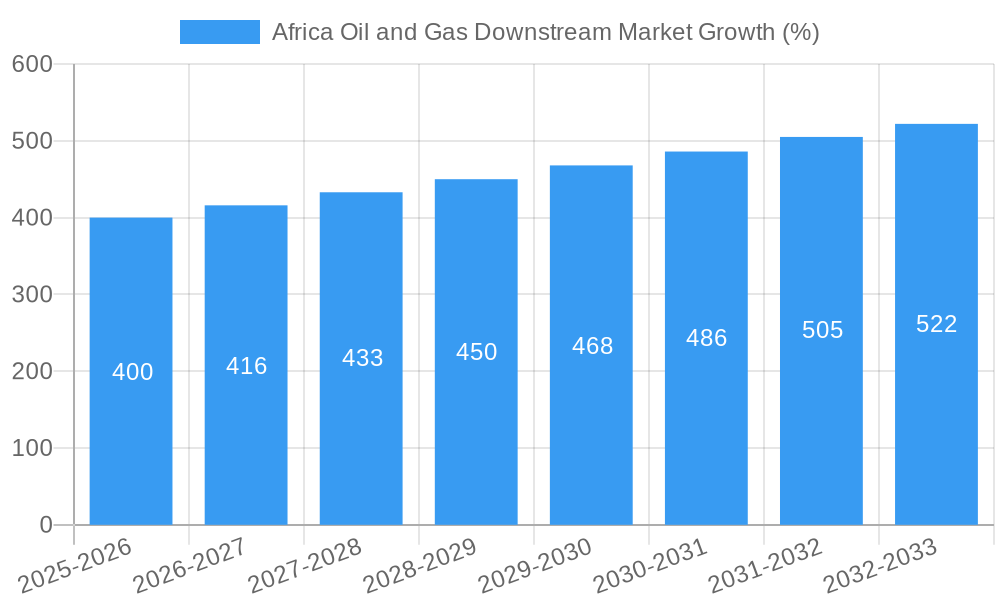

The African Oil and Gas Downstream Market, currently valued at approximately $XX million (estimated based on provided CAGR and market trends), is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.00% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing urbanization and industrialization across the continent fuel demand for gasoline, diesel, and jet fuel. Secondly, the burgeoning population in many African nations contributes to a rising energy consumption profile. Thirdly, government initiatives focused on infrastructure development and energy security are fostering investment in refining and petrochemical capacities. The market is segmented by sector (Refinery and Petrochemical) and product type (Gasoline, Diesel, Jet Fuel, LPG, Petrochemicals), with significant variations in demand across regions. Key players such as ExxonMobil Corporation, Midoil Refining & Petrochemicals Company Limited, Sinopec Shanghai Petrochemical Co Ltd, Egyptian General Petroleum Corporation, and Nigerian National Petroleum Company Limited are shaping market dynamics through expansion projects and strategic partnerships. However, challenges persist, including infrastructural limitations, geopolitical instability in certain regions, and price volatility in the global oil market, which act as restraints to market growth.

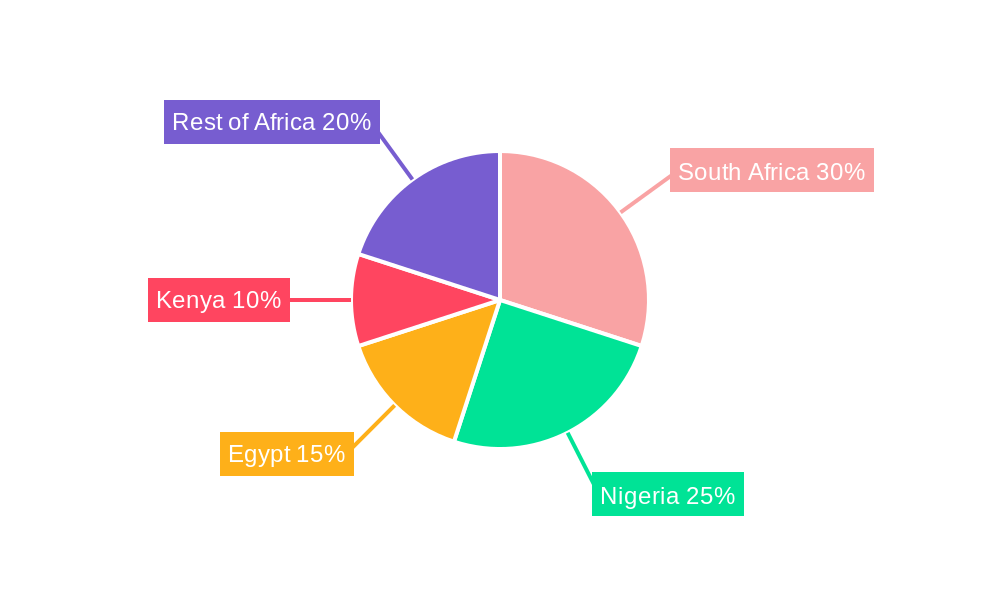

The forecast period (2025-2033) is expected to witness a notable shift in market share across different African nations. Countries like South Africa, with its relatively advanced infrastructure, will likely maintain a dominant position. However, countries like Kenya, Uganda, and Tanzania are poised for significant growth due to ongoing investments in their downstream sectors. The consistent expansion of the petrochemical segment is particularly noteworthy, driven by increasing demand for plastics and other petrochemical-based products within the burgeoning manufacturing and construction sectors across the continent. Future market growth will depend heavily on continuous investment in refining capacity, successful diversification efforts by key players, and the overall stability of the political and economic landscape across various African nations. Careful management of environmental concerns and sustainability initiatives will also play a critical role in shaping the long-term trajectory of this market.

This comprehensive report provides a detailed analysis of the dynamic Africa Oil & Gas Downstream Market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future growth potential. The report leverages extensive data and expert analysis to illuminate opportunities and challenges within the refining, petrochemical, and fuel sectors across the African continent.

Africa Oil and Gas Downstream Market Market Structure & Competitive Landscape

The Africa oil and gas downstream market exhibits a complex structure influenced by varying levels of market concentration across different segments and countries. While some nations feature dominant state-owned enterprises (SOEs), others demonstrate a more fragmented landscape with a mix of multinational corporations and private players. The market concentration ratio (CR4) for the refinery sector is estimated at 60% in 2025, indicating moderate concentration, while the petrochemical sector exhibits a lower CR4 of 40%, signifying greater fragmentation.

Innovation Drivers: Technological advancements in refining processes (e.g., improved catalysts, process optimization), the expansion of petrochemical production, and the increasing adoption of cleaner fuels drive innovation.

Regulatory Impacts: Varying regulatory frameworks across African nations significantly impact market dynamics. Some countries have robust regulatory bodies, while others lack clear guidelines, leading to inconsistencies and challenges.

Product Substitutes: Biofuels and renewable energy sources present emerging substitutes, albeit with limited penetration currently. However, their growth potential could influence the future market share of traditional fuels.

End-User Segmentation: The market serves diverse end-users including transportation, power generation, industrial processes, and household consumption. Transportation represents the largest segment, with a projected 70% share in 2025.

M&A Trends: Mergers and acquisitions (M&A) activity within the African downstream oil and gas sector has been moderate in recent years, with a total M&A volume of approximately $xx Million in 2024. However, increased investment and privatization efforts could stimulate future M&A activity. This includes both horizontal and vertical integrations across the value chain.

Africa Oil and Gas Downstream Market Market Trends & Opportunities

The African oil and gas downstream market is poised for significant growth, driven by a combination of factors including rising energy demand, expanding populations, and infrastructure development. The market size is projected to reach $xx Million by 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing urbanization, industrialization, and rising vehicle ownership, particularly in sub-Saharan Africa.

Technological advancements, such as the adoption of more efficient refining technologies and the integration of digital solutions, are transforming the industry. Consumer preferences are shifting towards cleaner fuels and higher-quality products, driving demand for upgraded refineries and improved product offerings. The competitive landscape is evolving, with both domestic and international players vying for market share, leading to increased investment in infrastructure and capacity expansion.

Market penetration rates vary across different product segments. Gasoline retains a significant market share, while the penetration of LPG and other alternative fuels is gradually increasing. The growth of the petrochemical sector is particularly promising, fueled by the increasing demand for plastics and other petrochemical-based products. The entry of new players and technological advancements are also expected to further shape the market's competitive dynamics.

Dominant Markets & Segments in Africa Oil and Gas Downstream Market

The dominant markets within the African oil and gas downstream sector are concentrated in North Africa (Egypt, Algeria, Morocco) and Southern Africa (South Africa, Nigeria). Nigeria and Egypt, in particular, exhibit high demand for refined products due to their sizeable populations and economies.

Key Growth Drivers:

- Expanding Infrastructure: Ongoing investments in refining capacity, pipelines, and storage facilities contribute to market growth.

- Government Policies: Supportive regulatory frameworks and investment incentives encourage market expansion.

- Rising Energy Demand: A surge in electricity consumption and industrial activities fuels demand for energy.

- Increased Vehicle Ownership: A rise in personal and commercial vehicles fuels gasoline and diesel demand.

Market Dominance Analysis: Nigeria's large population and significant refining capacity contribute to its dominance in the gasoline and diesel segments. The country’s ongoing investments in refining infrastructure further solidify this position. Egypt's established refining sector and strong economic growth underpin its dominance in the LPG and petrochemical segments. South Africa's diversified economy and established petrochemical industry also represent key market hubs.

Refinery Sector:

- Nigeria accounts for a large portion of the total refining capacity.

- South Africa holds a significant market share, driven by its established infrastructure.

- Egypt's refineries play a vital role in meeting domestic and regional demand.

Petrochemical Sector:

- South Africa and Egypt dominate the petrochemical market due to their substantial production capacity and well-established downstream industries.

- Investments in new petrochemical plants in several countries are expected to increase the overall production capacity across the continent.

Product Segmentation:

- Gasoline and diesel maintain the largest market share owing to the growing transportation sector.

- LPG's market share is increasing due to its use in households and industries.

- Jet fuel demand is driven by the growth in air travel, especially within Africa.

Africa Oil and Gas Downstream Market Product Analysis

Technological advancements are driving product innovation in the African oil and gas downstream market. The focus on cleaner fuels (e.g., low-sulfur diesel) and improved fuel efficiency is particularly pronounced. This is coupled with the development of more advanced petrochemical products that cater to diverse applications in packaging, construction, and other industries. These advancements enhance the products' competitive advantage through improved performance, reduced environmental impact, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Africa Oil and Gas Downstream Market

Key Drivers:

Rising energy demand driven by population growth, urbanization, and industrialization are primary catalysts for market expansion. Supportive government policies and investment in infrastructure also contribute to the growth trajectory. Moreover, technological advancements in refining and petrochemical production improve efficiency and product quality, leading to sustained market expansion.

Challenges and Restraints:

Significant challenges include infrastructure limitations that constrain refining capacity and distribution networks. Regulatory uncertainties and inconsistencies across countries complicate investment decisions and hinder efficient operations. Furthermore, intense competition from international players and price volatility pose a significant threat to profitability and sustained growth. The combined impact of these factors can potentially impede the market's overall development. For instance, inadequate pipeline infrastructure can lead to increased transportation costs, limiting the growth of certain segments.

Growth Drivers in the Africa Oil and Gas Downstream Market Market

Significant growth drivers include expanding populations fueling increased energy demand, substantial investments in refinery capacity expansion, and favorable government policies aimed at promoting energy security. Technological advancements in refinery technologies and the adoption of cleaner fuels are also propelling market growth.

Challenges Impacting Africa Oil and Gas Downstream Market Growth

Key challenges include limited refining capacity in some regions, resulting in reliance on imports and increased costs; inadequate infrastructure, leading to logistical bottlenecks and supply chain disruptions; regulatory inconsistencies across different countries, complicating investment decisions and hindering market development; and intense competition from international companies, putting pressure on local players. These factors collectively pose significant obstacles to the market's growth trajectory.

Key Players Shaping the Africa Oil and Gas Downstream Market Market

- ExxonMobil Corporation

- Midoil Refining & Petrochemicals Company Limited

- Sinopec Shanghai Petrochemical Co Ltd

- Egyptian General Petroleum Corporation

- Nigerian National Petroleum Company Limited

Significant Africa Oil and Gas Downstream Market Industry Milestones

- October 2022: The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) announced that the Dangote Refinery project is 97% complete. This signifies a major step towards enhancing Nigeria's refining capacity and reducing its reliance on imports.

- March 2022: South Africa's Parliament recommended the construction of a mega fuel refinery, highlighting the country's focus on energy security and reducing its vulnerability to global oil price fluctuations.

Future Outlook for Africa Oil and Gas Downstream Market Market

The African oil and gas downstream market is projected to experience robust growth in the coming years, driven by a confluence of factors. Increased energy demand, ongoing infrastructure development, and supportive government policies will act as significant growth catalysts. Strategic investments in refining capacity, coupled with technological advancements towards cleaner fuels, will further shape the market's trajectory, creating considerable opportunities for both domestic and international players. The market's potential for further expansion remains considerable.

Africa Oil and Gas Downstream Market Segmentation

-

1. Sector

- 1.1. Refinery Sector

- 1.2. Petrochemical Sector

-

2. Geography

- 2.1. Nigeria

- 2.2. Egypt

- 2.3. South Africa

- 2.4. Others

Africa Oil and Gas Downstream Market Segmentation By Geography

- 1. Nigeria

- 2. Egypt

- 3. South Africa

- 4. Others

Africa Oil and Gas Downstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Adoption of Alternative Clean Energy

- 3.4. Market Trends

- 3.4.1. Refining Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Refinery Sector

- 5.1.2. Petrochemical Sector

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Egypt

- 5.2.3. South Africa

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Egypt

- 5.3.3. South Africa

- 5.3.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Nigeria Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Refinery Sector

- 6.1.2. Petrochemical Sector

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Egypt

- 6.2.3. South Africa

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. Egypt Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Refinery Sector

- 7.1.2. Petrochemical Sector

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Egypt

- 7.2.3. South Africa

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. South Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Refinery Sector

- 8.1.2. Petrochemical Sector

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Egypt

- 8.2.3. South Africa

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Others Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Refinery Sector

- 9.1.2. Petrochemical Sector

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Egypt

- 9.2.3. South Africa

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. South Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Africa Oil and Gas Downstream Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ExxonMobil Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Midoil Refining & Petrochemicals Company Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sinopec Shanghai Petrochemical Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Egyptian General Petroleum Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Nigerian National Petroleum Company Limited

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.1 ExxonMobil Corporation

List of Figures

- Figure 1: Africa Oil and Gas Downstream Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Oil and Gas Downstream Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 5: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 7: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: South Africa Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Sudan Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Uganda Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Kenya Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Africa Oil and Gas Downstream Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Africa Oil and Gas Downstream Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 24: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 25: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 27: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 29: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 30: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 31: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 33: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 36: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 37: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 39: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 41: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 42: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Sector 2019 & 2032

- Table 43: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 45: Africa Oil and Gas Downstream Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Africa Oil and Gas Downstream Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Oil and Gas Downstream Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Africa Oil and Gas Downstream Market?

Key companies in the market include ExxonMobil Corporation, Midoil Refining & Petrochemicals Company Limited, Sinopec Shanghai Petrochemical Co Ltd, Egyptian General Petroleum Corporation, Nigerian National Petroleum Company Limited.

3. What are the main segments of the Africa Oil and Gas Downstream Market?

The market segments include Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Favorable Government Initiatives4.; Increasing Adoption of Solar Energy.

6. What are the notable trends driving market growth?

Refining Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Adoption of Alternative Clean Energy.

8. Can you provide examples of recent developments in the market?

In October 2022, The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) announced that the Dangote Refinery project is 97% completed. Dangote Oil Refinery is a 650,000 barrels per day (BPD) integrated refinery project under construction in the Lekki Free Trade Zone, Lagos. It is expected to be Africa's biggest oil refinery and the world's most extensive single-train facility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Oil and Gas Downstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Oil and Gas Downstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Oil and Gas Downstream Market?

To stay informed about further developments, trends, and reports in the Africa Oil and Gas Downstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence