Key Insights

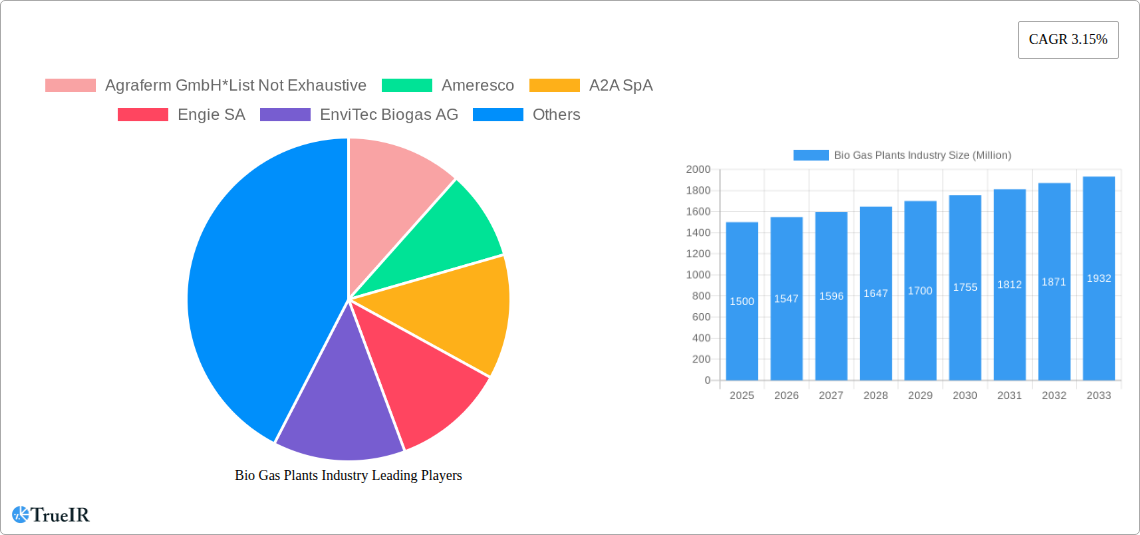

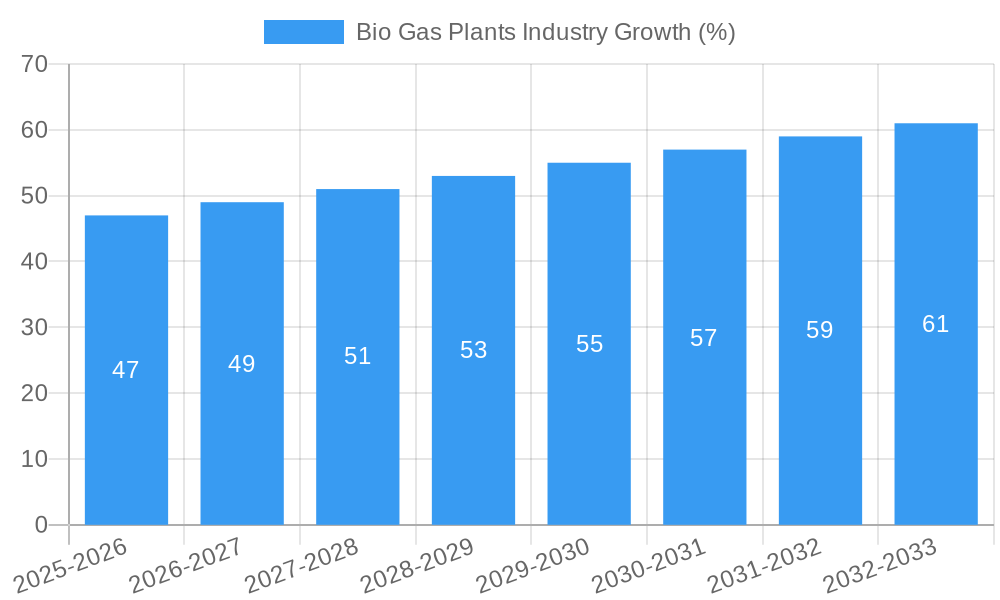

The biogas plant industry is experiencing steady growth, driven by increasing concerns about climate change and the need for renewable energy sources. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 3.15% and a known 2019-2024 historical period), is projected to expand significantly over the forecast period (2025-2033). This growth is fueled by several key factors. Government incentives and regulations promoting renewable energy adoption are creating a favorable investment environment. Furthermore, the increasing availability of sustainable feedstock, such as agricultural waste and organic municipal solid waste, is bolstering biogas production. Technological advancements in biogas plant design and operation are leading to improved efficiency and reduced costs, making the technology more accessible to a wider range of users. Different biogas plant types cater to diverse needs: small-scale digesters suitable for farms and rural communities, and medium-to-large-scale digesters for industrial applications and energy production. The key applications, electricity generation, biofuel production, and heat generation, further expand the market's reach and potential. Competition is relatively high, with both large multinational corporations and smaller specialized firms participating in the market.

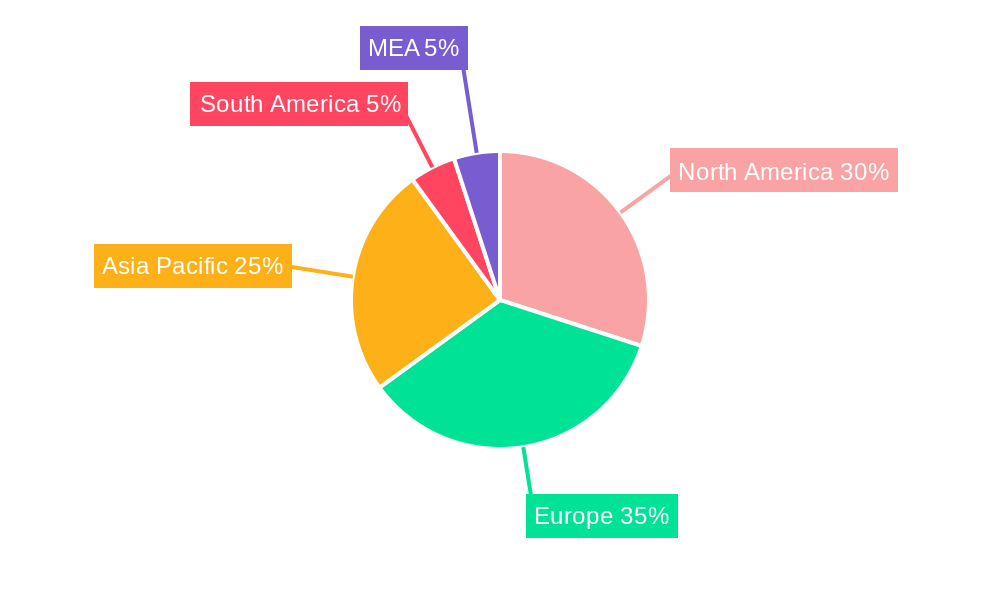

Despite the positive outlook, several challenges remain. The high initial investment costs associated with biogas plant construction can be a significant barrier to entry, particularly for small-scale operators. Furthermore, the variability in feedstock quality and availability can affect the consistency of biogas production. Regulatory hurdles and permitting processes in some regions also pose obstacles to market expansion. The geographical distribution of the market is expected to be uneven, with developed regions like North America and Europe likely maintaining a larger market share initially, while Asia-Pacific is expected to experience significant growth due to its large agricultural sector and increasing urbanization. Overcoming these challenges and leveraging technological improvements will be crucial for unlocking the full potential of the biogas plant industry.

Biogas Plants Industry Report: A Comprehensive Market Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the Biogas Plants industry, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data from 2019-2024 (historical period) and projecting to 2033 (forecast period), with a base year of 2025 and an estimated year of 2025, this report unveils the market's structure, trends, opportunities, and challenges. We delve into market segmentation, competitive dynamics, key players, and future growth projections, providing a holistic understanding of this rapidly evolving sector. The global market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx%.

Bio Gas Plants Industry Market Structure & Competitive Landscape

The Biogas Plants industry exhibits a moderately concentrated market structure, with several large players and a significant number of smaller, regional operators. The Herfindahl-Hirschman Index (HHI) for the industry is estimated to be xx, indicating a moderately concentrated market. Key innovation drivers include advancements in digester technology, improved biogas upgrading techniques, and the development of innovative applications for biogas. Regulatory frameworks, including feed-in tariffs and renewable energy mandates, significantly influence market growth and investment decisions. Product substitutes, such as natural gas and other renewable energy sources, pose some competitive pressure, although biogas benefits from its reduced carbon footprint and potential for local production. The industry is characterized by substantial end-user segmentation, encompassing electricity generation, biofuel production, and heat generation sectors. M&A activity in the sector has seen xx Million in transactions over the past five years, driven by consolidation efforts among industry players seeking to expand their market share and diversify their product portfolios. A noteworthy example is the xx Million acquisition of xx by xx in 2022, which significantly impacted market dynamics.

- Market Concentration: HHI of xx

- Innovation Drivers: Technological advancements, improved biogas upgrading

- Regulatory Impacts: Feed-in tariffs, renewable energy mandates

- Product Substitutes: Natural gas, other renewable energy sources

- End-User Segmentation: Electricity, biofuel, heat generation

- M&A Trends: xx Million in transactions over the past five years.

Bio Gas Plants Industry Market Trends & Opportunities

The Biogas Plants industry is experiencing substantial growth, driven by increasing demand for renewable energy, stricter environmental regulations, and the potential for carbon credit generation. The market size is projected to grow from xx Million in 2025 to xx Million by 2033, representing a CAGR of xx%. This growth is fueled by technological advancements leading to improved efficiency and cost-effectiveness of biogas plants. Consumer preferences are shifting towards environmentally friendly energy sources, boosting demand for biogas. Competitive dynamics are characterized by both cooperation and competition, with players engaging in strategic alliances to develop new projects and secure feedstock supplies. Market penetration rates are highest in Europe and North America but show significant potential in developing regions driven by government incentives and improving infrastructure. The industry has experienced significant shifts towards larger-scale projects to achieve economies of scale. The growing integration of biogas into existing energy infrastructure presents significant growth opportunities. Furthermore, the increasing adoption of digestate as a valuable fertilizer stream is expanding the industry's economic potential and overall attractiveness.

Dominant Markets & Segments in Bio Gas Plants Industry

Europe and North America currently dominate the Biogas Plants market, driven by favorable policies, mature infrastructure, and substantial investments in renewable energy. However, Asia-Pacific is expected to exhibit the fastest growth rate over the forecast period.

Leading Segments:

- Biogas Plant Type: Medium- to large-scale digesters are experiencing greater growth due to economies of scale, though small-scale digesters remain vital for localized applications.

- Application: Electricity generation currently holds the largest market share, followed by heat generation, with biofuel production demonstrating significant growth potential.

Key Growth Drivers:

- Europe: Strong government support for renewable energy, mature biogas infrastructure, and advancements in technology.

- North America: Increasing demand for renewable natural gas (RNG), supportive regulations, and incentives for biogas production.

- Asia-Pacific: Rapid economic growth, rising energy demand, government initiatives to promote renewable energy, and the availability of significant biomass resources.

Bio Gas Plants Industry Product Analysis

Technological advancements are driving innovation in biogas plant design and operation, focusing on improving efficiency, reducing costs, and expanding application potential. These include optimized digester designs, enhanced biogas upgrading technologies, and the integration of digital solutions for monitoring and control. The market offers a range of biogas plants tailored to different scales and applications, from small-scale systems for farms to large-scale industrial facilities. Key competitive advantages lie in efficiency, cost-effectiveness, scalability, and the ability to integrate with existing energy infrastructure.

Key Drivers, Barriers & Challenges in Bio Gas Plants Industry

Key Drivers:

- Rising demand for renewable energy: Driven by climate change concerns and government policies.

- Government incentives and regulations: Feed-in tariffs, renewable portfolio standards, and carbon pricing mechanisms.

- Technological advancements: Improving efficiency and reducing costs of biogas production.

- Growing availability of suitable feedstocks: Agricultural residues and organic waste streams.

Challenges:

- High initial investment costs: Limiting entry for small businesses.

- Fluctuations in feedstock availability and prices: Affecting project profitability.

- Regulatory complexities and permitting processes: Creating delays in project development.

- Competition from other renewable energy sources: Such as solar and wind power. The estimated cost of regulatory hurdles and permitting delays is xx Million annually.

Growth Drivers in the Bio Gas Plants Industry Market

The biogas plants industry is experiencing robust growth driven by increasing governmental support for renewable energy initiatives, technological advancements resulting in improved plant efficiency, and rising demand for sustainable energy solutions. Economies of scale realized with larger plants further contribute to this expansion.

Challenges Impacting Bio Gas Plants Industry Growth

Despite the promising outlook, challenges remain. High capital investment costs represent a significant hurdle, particularly for smaller players. Supply chain disruptions, particularly relating to specialized equipment and components, may impede growth. Navigating complex regulatory landscapes and permitting processes adds another layer of complexity, impacting project timelines and profitability.

Key Players Shaping the Bio Gas Plants Industry Market

- Agraferm GmbH

- Ameresco

- A2A SpA

- Engie SA

- EnviTec Biogas AG

- BTS Biogas SRL/GmbH

- Gasum Oy

- Air Liquide SA

- AB Holding SpA (Gruppo AB)

- FWE GmbH

- Scandinavian Biogas

Significant Bio Gas Plants Industry Industry Milestones

- August 2021: Greenlane Renewables Inc. secured USD 10.2 million in contracts for RNG projects in the US, showcasing the expanding RNG market segment.

Future Outlook for Bio Gas Plants Industry Market

The future of the biogas plants industry is bright, with considerable growth potential driven by increasing environmental awareness, supportive government policies, and technological innovation. Strategic opportunities lie in expanding into new geographical markets, developing innovative applications for biogas, and improving supply chain resilience. The market is poised for significant expansion as nations transition towards cleaner energy sources and seek to mitigate climate change. The potential for biogas to serve as a crucial component in a sustainable energy future is substantial.

Bio Gas Plants Industry Segmentation

-

1. Application

- 1.1. Electricity Generation

- 1.2. Biofuel

- 1.3. Heat Generation

-

2. Biogas Plant Type

- 2.1. Small-scale Digesters

- 2.2. Medium- to Large-scale Digesters

Bio Gas Plants Industry Segmentation By Geography

- 1. North America

- 2. Asia Pacific

- 3. Europe

- 4. South America

- 5. Middle East and Africa

Bio Gas Plants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.15% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in the Demand for Electricity4.; Rising Adoption of Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. 4.; New Sources of Distributed Electricity Generation

- 3.4. Market Trends

- 3.4.1. Small-scale Digesters Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electricity Generation

- 5.1.2. Biofuel

- 5.1.3. Heat Generation

- 5.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 5.2.1. Small-scale Digesters

- 5.2.2. Medium- to Large-scale Digesters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Asia Pacific

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electricity Generation

- 6.1.2. Biofuel

- 6.1.3. Heat Generation

- 6.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 6.2.1. Small-scale Digesters

- 6.2.2. Medium- to Large-scale Digesters

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Asia Pacific Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electricity Generation

- 7.1.2. Biofuel

- 7.1.3. Heat Generation

- 7.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 7.2.1. Small-scale Digesters

- 7.2.2. Medium- to Large-scale Digesters

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electricity Generation

- 8.1.2. Biofuel

- 8.1.3. Heat Generation

- 8.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 8.2.1. Small-scale Digesters

- 8.2.2. Medium- to Large-scale Digesters

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electricity Generation

- 9.1.2. Biofuel

- 9.1.3. Heat Generation

- 9.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 9.2.1. Small-scale Digesters

- 9.2.2. Medium- to Large-scale Digesters

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electricity Generation

- 10.1.2. Biofuel

- 10.1.3. Heat Generation

- 10.2. Market Analysis, Insights and Forecast - by Biogas Plant Type

- 10.2.1. Small-scale Digesters

- 10.2.2. Medium- to Large-scale Digesters

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Bio Gas Plants Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Agraferm GmbH*List Not Exhaustive

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Ameresco

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 A2A SpA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Engie SA

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 EnviTec Biogas AG

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 BTS Biogas SRL/GmbH

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Gasum Oy

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Air Liquide SA

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 AB Holding SpA (Gruppo AB)

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 FWE GmbH

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Scandinavian Biogas

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 Agraferm GmbH*List Not Exhaustive

List of Figures

- Figure 1: Global Bio Gas Plants Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Bio Gas Plants Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Bio Gas Plants Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Bio Gas Plants Industry Revenue (Million), by Biogas Plant Type 2024 & 2032

- Figure 17: North America Bio Gas Plants Industry Revenue Share (%), by Biogas Plant Type 2024 & 2032

- Figure 18: North America Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Bio Gas Plants Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Bio Gas Plants Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Bio Gas Plants Industry Revenue (Million), by Biogas Plant Type 2024 & 2032

- Figure 23: Asia Pacific Bio Gas Plants Industry Revenue Share (%), by Biogas Plant Type 2024 & 2032

- Figure 24: Asia Pacific Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Asia Pacific Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Bio Gas Plants Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Europe Bio Gas Plants Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe Bio Gas Plants Industry Revenue (Million), by Biogas Plant Type 2024 & 2032

- Figure 29: Europe Bio Gas Plants Industry Revenue Share (%), by Biogas Plant Type 2024 & 2032

- Figure 30: Europe Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: South America Bio Gas Plants Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: South America Bio Gas Plants Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: South America Bio Gas Plants Industry Revenue (Million), by Biogas Plant Type 2024 & 2032

- Figure 35: South America Bio Gas Plants Industry Revenue Share (%), by Biogas Plant Type 2024 & 2032

- Figure 36: South America Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: South America Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Bio Gas Plants Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Bio Gas Plants Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Bio Gas Plants Industry Revenue (Million), by Biogas Plant Type 2024 & 2032

- Figure 41: Middle East and Africa Bio Gas Plants Industry Revenue Share (%), by Biogas Plant Type 2024 & 2032

- Figure 42: Middle East and Africa Bio Gas Plants Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Bio Gas Plants Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Bio Gas Plants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 4: Global Bio Gas Plants Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Bio Gas Plants Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 52: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 55: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 57: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 58: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 60: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 61: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Bio Gas Plants Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 63: Global Bio Gas Plants Industry Revenue Million Forecast, by Biogas Plant Type 2019 & 2032

- Table 64: Global Bio Gas Plants Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio Gas Plants Industry?

The projected CAGR is approximately 3.15%.

2. Which companies are prominent players in the Bio Gas Plants Industry?

Key companies in the market include Agraferm GmbH*List Not Exhaustive, Ameresco, A2A SpA, Engie SA, EnviTec Biogas AG, BTS Biogas SRL/GmbH, Gasum Oy, Air Liquide SA, AB Holding SpA (Gruppo AB), FWE GmbH, Scandinavian Biogas.

3. What are the main segments of the Bio Gas Plants Industry?

The market segments include Application, Biogas Plant Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in the Demand for Electricity4.; Rising Adoption of Electric Vehicles.

6. What are the notable trends driving market growth?

Small-scale Digesters Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; New Sources of Distributed Electricity Generation.

8. Can you provide examples of recent developments in the market?

In August 2021, Greenlane Renewables Inc. announced that its wholly-owned subsidiary, Greenlane Biogas North America Ltd, signed a total of USD 10.2 million in contracts for renewable natural gas (RNG) projects in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio Gas Plants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio Gas Plants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio Gas Plants Industry?

To stay informed about further developments, trends, and reports in the Bio Gas Plants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence