Key Insights

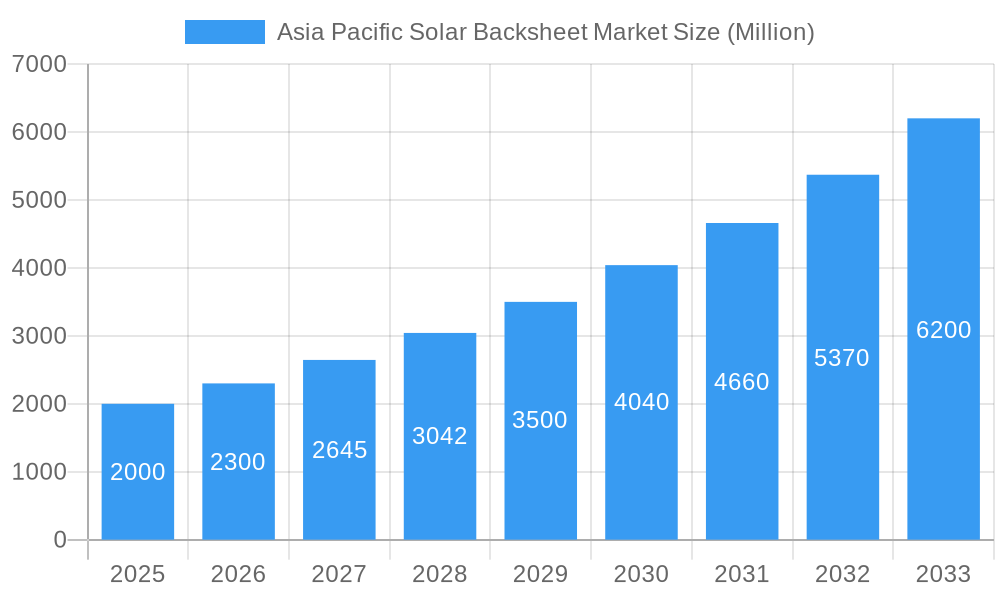

The Asia Pacific solar backsheet market is projected to grow at a CAGR of 7.2%. With an estimated market size of $1.8 billion in the base year of 2024, the market is set to expand significantly by 2033. This growth is propelled by robust government initiatives promoting renewable energy, decreasing solar panel costs, and heightened environmental consciousness. Key trends include the demand for highly durable, weather-resistant backsheets, especially for extreme climates, and specialized solutions for the rising adoption of bifacial solar panels. Challenges such as raw material price volatility and supply chain vulnerabilities persist, yet the market outlook remains optimistic. The market is segmented by material into fluoropolymer and non-fluoropolymer backsheets, addressing diverse performance and cost requirements. Leading players including Arkema SA, Toray Industries Inc, and DuPont de Nemours Inc are driving innovation and market share expansion. China, Japan, India, and South Korea are pivotal growth contributors due to substantial solar energy installations.

Asia Pacific Solar Backsheet Market Market Size (In Billion)

The competitive environment features both global corporations and regional manufacturers. Key strategies include material science innovation, supply chain optimization through partnerships, and geographic expansion. The escalating demand for solar energy positions the Asia Pacific solar backsheet market for sustained expansion. Advancements in technology and governmental support will fuel innovation and market growth. The increasing need for tailored solutions for specific climatic conditions and solar panel designs offers significant opportunities for market players.

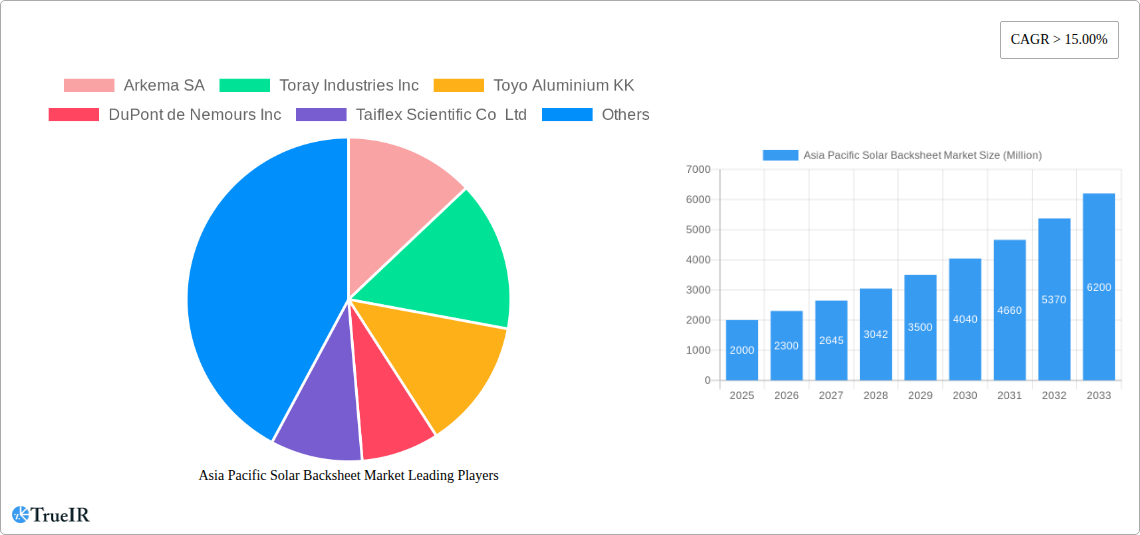

Asia Pacific Solar Backsheet Market Company Market Share

Asia Pacific Solar Backsheet Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific solar backsheet market, offering valuable insights for stakeholders across the solar energy value chain. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market size, growth drivers, competitive dynamics, and future outlook. It leverages extensive market research and data analysis to deliver actionable intelligence for informed decision-making.

Asia Pacific Solar Backsheet Market Structure & Competitive Landscape

The Asia Pacific solar backsheet market is characterized by a moderately concentrated landscape, with key players like Arkema SA, Toray Industries Inc, Toyo Aluminium KK, DuPont de Nemours Inc, Taiflex Scientific Co Ltd, Brij Encapsulants, 3M Co, ZTT International Limited, Hanwha Group, and Hangzhou First Applied Material Co Ltd vying for market share. However, the market also accommodates several smaller regional players, resulting in a dynamic competitive environment.

The market's structure is influenced by several factors:

- Innovation Drivers: Continuous advancements in material science, particularly in fluoropolymer and non-fluoropolymer backsheet technologies, are driving market growth. Innovations focus on improved durability, efficiency, and cost-effectiveness.

- Regulatory Impacts: Government policies and incentives promoting renewable energy adoption, such as India's Performance-Linked Incentive (PLI) scheme, significantly impact market growth and investment. These schemes create favorable conditions for backsheet manufacturers.

- Product Substitutes: While backsheets are crucial for solar panel performance, limited viable substitutes exist, reinforcing their market importance. However, ongoing research into alternative encapsulating materials could present future challenges.

- End-User Segmentation: The market caters to various segments, including residential, commercial, and utility-scale solar installations. The growth of each segment influences overall market demand and product development strategies. The residential and commercial segments are expected to see significant growth in the coming years.

- M&A Trends: Consolidation through mergers and acquisitions (M&A) could reshape the market landscape in the coming years. While precise M&A volume data for this specific market isn't readily available (xx Million USD), the broader trend towards consolidation within the solar industry suggests potential future activity within the backsheet sector. The increased demand for solar energy is likely to fuel M&A activity among companies seeking scale and diversification.

Asia Pacific Solar Backsheet Market Market Trends & Opportunities

The Asia Pacific solar backsheet market is experiencing robust growth, fueled by the region's rapidly expanding solar energy sector. Market size is projected to reach xx Million USD by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is driven by several key factors:

- Technological advancements in backsheet materials are leading to improved performance, durability, and cost-efficiency. This enhances the overall value proposition of solar panels, boosting adoption rates.

- Increasing consumer preference for renewable energy sources and environmental sustainability is fueling demand for solar energy installations, driving up backsheet demand.

- Favorable government policies and financial incentives are significantly accelerating the adoption of solar energy across the region, creating a large addressable market.

- Intensifying competition among backsheet manufacturers leads to innovation and price reductions, making solar panels more affordable and accessible.

Market penetration rates are increasing steadily, driven by declining solar energy costs and improved efficiency of solar panels, reflecting increased affordability and wider accessibility for consumers and businesses.

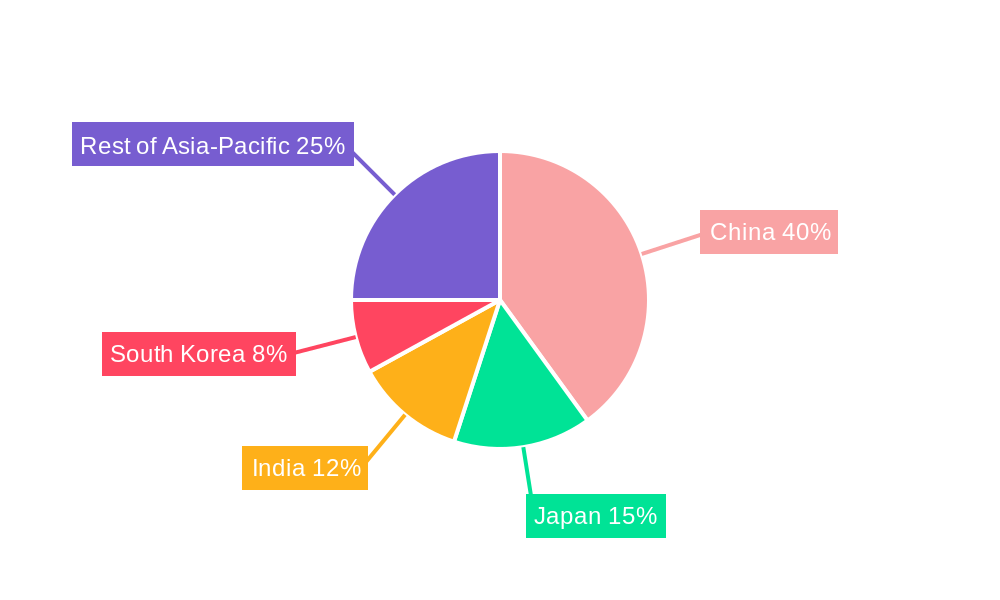

Dominant Markets & Segments in Asia Pacific Solar Backsheet Market

Within the Asia Pacific region, China and India are emerging as dominant markets for solar backsheets, driven by their substantial investments in renewable energy infrastructure and supportive government policies. Japan and Australia also present significant market opportunities.

- Key Growth Drivers in China: Large-scale solar power projects, robust domestic manufacturing capabilities, and supportive government regulations drive market growth.

- Key Growth Drivers in India: Government initiatives such as the PLI scheme, expanding solar capacity targets, and growing residential and commercial solar installations are key drivers.

- Key Growth Drivers in Japan and Australia: High solar irradiance levels, supportive policy frameworks, and increasing consumer adoption propel market growth in these countries.

Segment Analysis:

The fluoropolymer segment holds a larger market share compared to the non-fluoropolymer segment due to its superior performance characteristics, such as enhanced durability and resistance to harsh environmental conditions. However, the non-fluoropolymer segment is witnessing rapid growth due to its cost-effectiveness, presenting a strong competitive dynamic. The market share of fluoropolymers is estimated to be around xx% in 2025, while non-fluoropolymers account for xx%.

Asia Pacific Solar Backsheet Market Product Analysis

The market offers a range of backsheet products with varying features and functionalities catering to different applications and customer needs. Recent technological advancements focus on enhancing material properties (e.g., improved UV resistance, higher temperature tolerance) to extend the operational lifespan of solar panels and optimize their overall performance. This has led to the development of backsheets with superior weather resistance, enhanced light reflection, and improved mechanical strength. The successful market fit of these products hinges on optimizing the balance between performance, durability, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Asia Pacific Solar Backsheet Market

Key Drivers: The growth of the solar energy sector is the primary driver, fueled by increasing energy demand, rising awareness of climate change, government policies promoting renewable energy, and decreasing solar panel costs. Technological innovation in backsheet materials is also crucial.

Key Challenges: Competition from other materials, price fluctuations in raw materials, and the potential for supply chain disruptions remain significant challenges. Regulatory changes and complex approval processes can also create hurdles for market entry and expansion. Estimated impact of these challenges is a xx% reduction in projected growth in 2026.

Growth Drivers in the Asia Pacific Solar Backsheet Market Market

Government initiatives promoting renewable energy adoption, such as India's PLI scheme, are key drivers. Technological advancements resulting in more efficient and durable backsheets also stimulate growth. Furthermore, decreasing solar panel costs and increasing consumer demand for renewable energy contribute significantly.

Challenges Impacting Asia Pacific Solar Backsheet Market Growth

Supply chain disruptions, particularly with raw materials, pose significant challenges. Price volatility of raw materials and stringent regulatory requirements can impact profitability and market expansion. Strong competition among established and emerging players necessitates continuous innovation and cost optimization.

Key Players Shaping the Asia Pacific Solar Backsheet Market Market

- Arkema SA

- Toray Industries Inc

- Toyo Aluminium KK

- DuPont de Nemours Inc

- Taiflex Scientific Co Ltd

- Brij Encapsulants

- 3M Co

- ZTT International Limited

- Hanwha Group

- Hangzhou First Applied Material Co Ltd

Significant Asia Pacific Solar Backsheet Market Industry Milestones

- September 2022: The Indian government's approval of the second tranche of the PLI scheme for solar PV module manufacturing is expected to attract USD 11.35 Billion in investment and boost the backsheet market significantly. This will create an estimated 65 GW per annum of new manufacturing capacity.

- September 2022: Sharp's launch of the NU-JC410B solar panel featuring a white backsheet highlights the ongoing innovation in solar panel design and increased demand for specific backsheet types.

Future Outlook for Asia Pacific Solar Backsheet Market Market

The Asia Pacific solar backsheet market is poised for continued robust growth, driven by sustained expansion of the solar energy sector, technological innovation, and supportive government policies. Strategic opportunities exist for companies focusing on cost-effective, high-performance backsheet solutions, particularly those addressing sustainability concerns and enhancing panel durability. The market's potential is immense, with significant growth projected throughout the forecast period.

Asia Pacific Solar Backsheet Market Segmentation

-

1. Type

- 1.1. Fluoropolymer

- 1.2. Non-fluoropolymer

-

2. Geography

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. South Korea

- 2.5. Rest of Asia-Pacific

Asia Pacific Solar Backsheet Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Solar Backsheet Market Regional Market Share

Geographic Coverage of Asia Pacific Solar Backsheet Market

Asia Pacific Solar Backsheet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel

- 3.3. Market Restrains

- 3.3.1. 4.; The High Costs of Renewable Aviation Fuel

- 3.4. Market Trends

- 3.4.1. Fluoropolymer is Expected to Become a Significant Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fluoropolymer

- 5.1.2. Non-fluoropolymer

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fluoropolymer

- 6.1.2. Non-fluoropolymer

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. India

- 6.2.3. Japan

- 6.2.4. South Korea

- 6.2.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fluoropolymer

- 7.1.2. Non-fluoropolymer

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. India

- 7.2.3. Japan

- 7.2.4. South Korea

- 7.2.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fluoropolymer

- 8.1.2. Non-fluoropolymer

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fluoropolymer

- 9.1.2. Non-fluoropolymer

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. India

- 9.2.3. Japan

- 9.2.4. South Korea

- 9.2.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Solar Backsheet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fluoropolymer

- 10.1.2. Non-fluoropolymer

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. India

- 10.2.3. Japan

- 10.2.4. South Korea

- 10.2.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arkema SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toray Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toyo Aluminium KK

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DuPont de Nemours Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Taiflex Scientific Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Brij Encapsulants*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 3M Co

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ZTT International Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hanwha Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hangzhou First Applied Material Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arkema SA

List of Figures

- Figure 1: Asia Pacific Solar Backsheet Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Solar Backsheet Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Asia Pacific Solar Backsheet Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Solar Backsheet Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Asia Pacific Solar Backsheet Market?

Key companies in the market include Arkema SA, Toray Industries Inc, Toyo Aluminium KK, DuPont de Nemours Inc, Taiflex Scientific Co Ltd, Brij Encapsulants*List Not Exhaustive, 3M Co, ZTT International Limited, Hanwha Group, Hangzhou First Applied Material Co Ltd.

3. What are the main segments of the Asia Pacific Solar Backsheet Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Government Regulations for Greenhouse Gas Emissions 4.; Encouraging Production and Consumption of Renewable Aviation Fuel.

6. What are the notable trends driving market growth?

Fluoropolymer is Expected to Become a Significant Segment.

7. Are there any restraints impacting market growth?

4.; The High Costs of Renewable Aviation Fuel.

8. Can you provide examples of recent developments in the market?

September 2022: The government of India approved the second tranche of the performance-linked incentive (PLI) scheme to boost the manufacturing of solar photovoltaic (PV) modules in India. This scheme is expected to attract direct investment of approximately USD 11.35 billion and create manufacturing capacity for various materials, including EVA, solar glass, backsheet, etc. According to the government, the second tranche of the PLI scheme is expected to manufacture 65 GW per annum of fully integrated and partially integrated solar PV modules in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Solar Backsheet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Solar Backsheet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Solar Backsheet Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Solar Backsheet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence