Key Insights

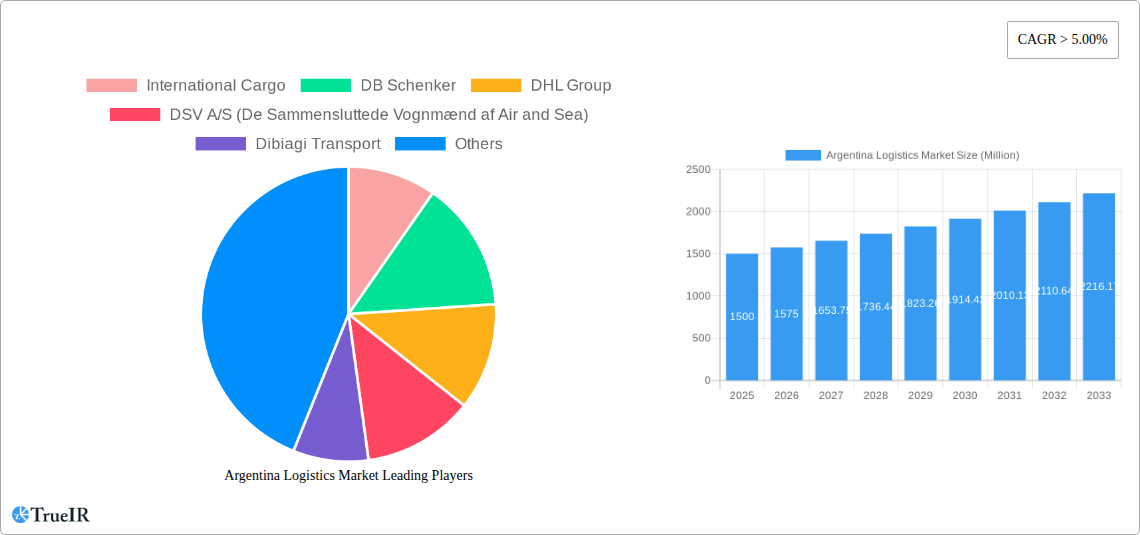

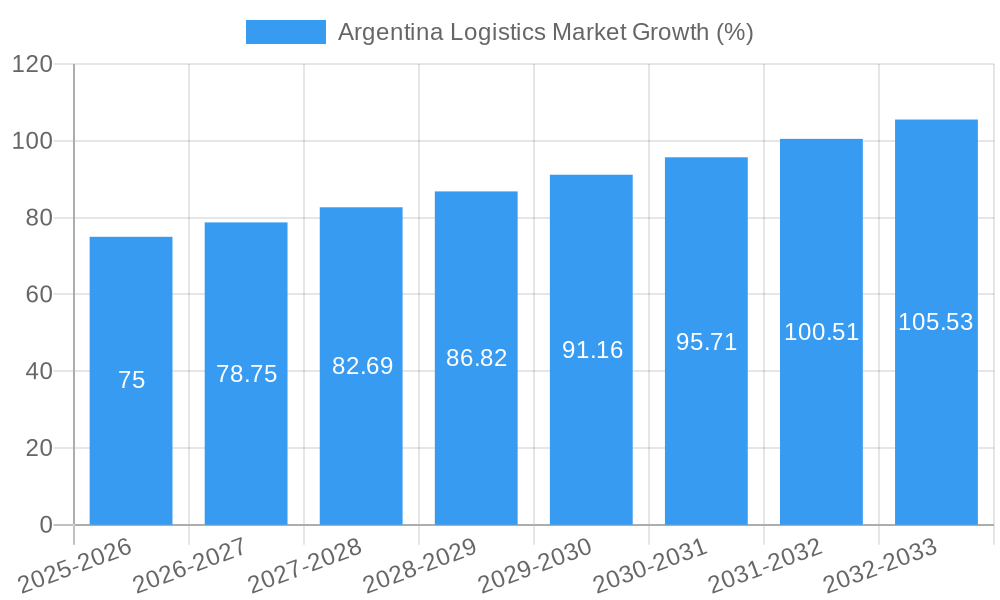

The Argentina logistics market, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a 5% CAGR from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for efficient and reliable transportation and warehousing solutions across diverse sectors, including agriculture (particularly for export-oriented produce), construction (supporting infrastructure development), and manufacturing (facilitating both domestic and international trade), fuels market expansion. Secondly, the growth of e-commerce and the consequent rise in express parcel delivery are significantly contributing to the market's upward trajectory. Furthermore, Argentina's strategic geographical location, facilitating trade with both neighboring countries and global markets, acts as a significant catalyst for growth. The market is segmented by end-user industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others) and logistics function (Courier, Express, and Parcel (CEP), Temperature Controlled, Other Services). While challenges such as infrastructure limitations and economic volatility exist, the overall positive trajectory indicates considerable opportunities for logistics providers. Companies like International Cargo, DB Schenker, DHL Group, and others are well-positioned to capitalize on this expanding market. The temperature-controlled segment, critical for the transportation of perishable goods, is expected to show particularly strong growth given Argentina’s agricultural exports.

The continued expansion of the Argentine economy, coupled with investments in infrastructure improvements, is anticipated to further boost the logistics sector. The adoption of advanced technologies like real-time tracking and supply chain management software will also play a crucial role in enhancing efficiency and driving market growth. However, navigating regulatory hurdles and ensuring a stable business environment will be key for companies seeking long-term success. The competition among established international players and local firms will likely intensify as the market continues to grow, creating a dynamic and competitive landscape. Focus on sustainability and environmentally friendly logistics solutions will also become increasingly important in the coming years.

Argentina Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report offers a detailed analysis of the Argentina logistics market, providing invaluable insights for stakeholders seeking to navigate this rapidly evolving landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report leverages extensive data and expert analysis to deliver a comprehensive overview of market size, trends, opportunities, and challenges. The report covers key segments, including end-user industries and logistics functions, focusing on major players such as International Cargo, DB Schenker, DHL Group, and Kuehne + Nagel. The projected market value is expected to reach xx Million by 2033, presenting significant growth opportunities for investors and industry participants.

Argentina Logistics Market Market Structure & Competitive Landscape

The Argentina logistics market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller, specialized firms. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive market. Key drivers of innovation include the adoption of advanced technologies such as AI, blockchain, and IoT, pushing for enhanced efficiency and traceability. Regulatory impacts, including customs procedures and infrastructure development initiatives, significantly influence market dynamics. Product substitutes, such as e-commerce platforms offering direct delivery, pose a challenge to traditional logistics providers. The end-user segmentation is diverse, with significant contributions from sectors like agriculture, manufacturing, and wholesale & retail trade.

M&A activity has been relatively modest in recent years, with a total transaction value of approximately xx Million between 2019 and 2024. However, increasing consolidation is anticipated, driven by the need to enhance operational efficiency and expand geographical reach.

- Concentration Ratio (CR4): xx% (2024)

- M&A Volume (2019-2024): xx Million

- Key Regulatory Factors: Customs regulations, infrastructure investments, transport policies.

- Innovation Drivers: AI-powered route optimization, blockchain for supply chain transparency, IoT for real-time asset tracking.

Argentina Logistics Market Market Trends & Opportunities

The Argentina logistics market is characterized by robust growth, driven by expanding e-commerce, increasing cross-border trade, and rising demand for efficient supply chain solutions. The market size, valued at xx Million in 2024, is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth reflects the increasing adoption of technology-driven logistics solutions, a shift in consumer preferences towards faster delivery, and the burgeoning need for specialized logistics services. The market penetration rate of advanced logistics technologies is currently at xx% and is expected to increase to xx% by 2033. Competitive dynamics are marked by both cooperation and competition, with players focusing on partnerships to enhance service offerings and expanding their market share through strategic acquisitions.

Dominant Markets & Segments in Argentina Logistics Market

The Wholesale and Retail Trade sector is currently the dominant end-user industry, contributing xx% to the total market value in 2024, followed by the Manufacturing sector with xx%. The Courier, Express, and Parcel (CEP) segment dominates the logistics function category, accounting for the largest share of the market.

- Key Growth Drivers for Wholesale & Retail Trade: Expansion of e-commerce, growing consumer demand for faster delivery, increasing urbanization.

- Key Growth Drivers for Manufacturing: Rising industrial production, increased exports, need for efficient supply chain management.

- Key Growth Drivers for CEP: E-commerce boom, increasing demand for same-day and next-day delivery, technological advancements in tracking and delivery.

- Key Growth Drivers for Temperature Controlled: Growing demand for perishable goods, rising awareness of food safety and hygiene.

Regional Dominance: The Buenos Aires metropolitan area currently represents the largest market share due to its high population density and economic activity, but other regions are showing significant potential for growth, with substantial infrastructure investments in major ports and airports driving increased efficiency and trade.

Argentina Logistics Market Product Analysis

Product innovation in the Argentina logistics market is primarily focused on enhancing efficiency, transparency, and sustainability. Technological advancements, such as real-time tracking systems, automated warehousing, and route optimization software, are improving delivery times, reducing costs, and enhancing supply chain visibility. The market is witnessing a growing demand for specialized services, including temperature-controlled transportation and value-added services like packaging and labeling. The competitive advantage is shifting towards companies that can integrate technology effectively, offer flexible and customized solutions, and ensure supply chain resilience.

Key Drivers, Barriers & Challenges in Argentina Logistics Market

Key Drivers:

- E-commerce growth: The exponential rise of online shopping fuels the demand for efficient delivery and logistics solutions.

- Infrastructure improvements: Investments in ports, airports, and roadways enhance connectivity and facilitate smoother freight movement.

- Technological advancements: The adoption of AI, IoT, and blockchain improves supply chain visibility and efficiency.

Challenges:

- Inflation and economic volatility: Fluctuations in the Argentine peso negatively impact transportation costs and investment decisions.

- Infrastructure limitations: While improvements are underway, existing infrastructure deficiencies in some regions continue to pose a challenge.

- Bureaucracy and regulatory hurdles: Complex customs procedures and administrative processes can create bottlenecks in supply chains.

- Competition: Intense competition among logistics providers necessitates continuous innovation and cost optimization. Quantifiable impacts are evident in reduced profit margins and increased pressure to enhance service offerings.

Growth Drivers in the Argentina Logistics Market Market

Growth is fueled by expanding e-commerce, infrastructure improvements (especially in port and airport facilities), and the adoption of technologically advanced solutions that enhance efficiency and traceability across the supply chain. Government initiatives aimed at improving logistics infrastructure and streamlining regulations are additional catalysts.

Challenges Impacting Argentina Logistics Market Growth

Inflation, currency volatility, and infrastructure limitations in certain regions pose significant headwinds. Furthermore, bureaucratic hurdles and regulatory complexities add to operational costs and delays, impacting supply chain efficiency. Intense competition among logistics providers further complicates the growth trajectory.

Key Players Shaping the Argentina Logistics Market Market

- DB Schenker

- DHL Group

- DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- Dibiagi Transport

- Transporte Frios Del Nort

- Kuehne + Nagel

- TASA Logística

- Agunsa Logistics

- Americold

- TIBA Group

- Ocasa

- Tefasa

- International Cargo

Significant Argentina Logistics Market Industry Milestones

- October 2023: Kuehne+Nagel launched three new charter connections between the Americas, Europe, and Asia, enhancing its global reach and capacity for key industries like healthcare and perishables.

- November 2023: DB Schenker and American Airlines Cargo implemented an API connection, streamlining airfreight booking and improving digitalization in the sector.

- January 2024: Kuehne + Nagel introduced its Book & Claim insetting solution for electric vehicles, demonstrating a commitment to sustainable logistics and decarbonization efforts.

Future Outlook for Argentina Logistics Market Market

The Argentina logistics market is poised for continued growth, driven by ongoing e-commerce expansion, infrastructure development, and technological advancements. Strategic opportunities exist for companies that can leverage technology to enhance efficiency, offer specialized services, and adapt to the evolving needs of the market. The potential for market expansion is significant, particularly in regions with underserved logistics infrastructure.

Argentina Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Argentina Logistics Market Segmentation By Geography

- 1. Argentina

Argentina Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Operations

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Argentina Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Argentina

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 International Cargo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DSV A/S (De Sammensluttede Vognmænd af Air and Sea)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dibiagi Transport

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Transporte Frios Del Nort

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kuehne + Nagel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TASA Logística

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Agunsa Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Americold

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TIBA Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Ocasa

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Tefasa

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 International Cargo

List of Figures

- Figure 1: Argentina Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Argentina Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Argentina Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Argentina Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Argentina Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Argentina Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Argentina Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Argentina Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 7: Argentina Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 8: Argentina Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Argentina Logistics Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Argentina Logistics Market?

Key companies in the market include International Cargo, DB Schenker, DHL Group, DSV A/S (De Sammensluttede Vognmænd af Air and Sea), Dibiagi Transport, Transporte Frios Del Nort, Kuehne + Nagel, TASA Logística, Agunsa Logistics, Americold, TIBA Group, Ocasa, Tefasa.

3. What are the main segments of the Argentina Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase demand of Petrochemical is driving the market4.; Increase in Investments is driving the market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; High Cost of Operations.

8. Can you provide examples of recent developments in the market?

January 2024: Kuehne + Nagel has announced its Book & Claim insetting solution for electric vehicles, to improve its decarbonization solutions. Developing Book & Claim insetting solutions for road freight was a strategic priority for Kuehne + Nagel. Customers who use Kuehne + Nagel's road transport services can now claim the carbon reductions of electric trucks when it is not possible to physically move their goods on these vehicles.November 2023: DB Schenker, in partnership with American Airlines Cargo, announces an advancement in airfreight operations. The introduction of an API (Application Programming Interface) connection, introduced on November 14th, 2023, marks the next step in digitalizing and streamlining airfreight booking processes.October 2023: Kuehne+Nagel has introduced three new charter connections between the Americas, Europe, and Asia. It has begun its operations with its own freighter, the B747-8 “Inspire”, from October 23, 2023. It has conducted two additional weekly routings from Atlanta and Chicago to Amsterdam and from there to Taipei. This flight will serve key industries such as healthcare, perishables and semiconductors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Argentina Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Argentina Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Argentina Logistics Market?

To stay informed about further developments, trends, and reports in the Argentina Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence